Macro Theme:

Key dates ahead:

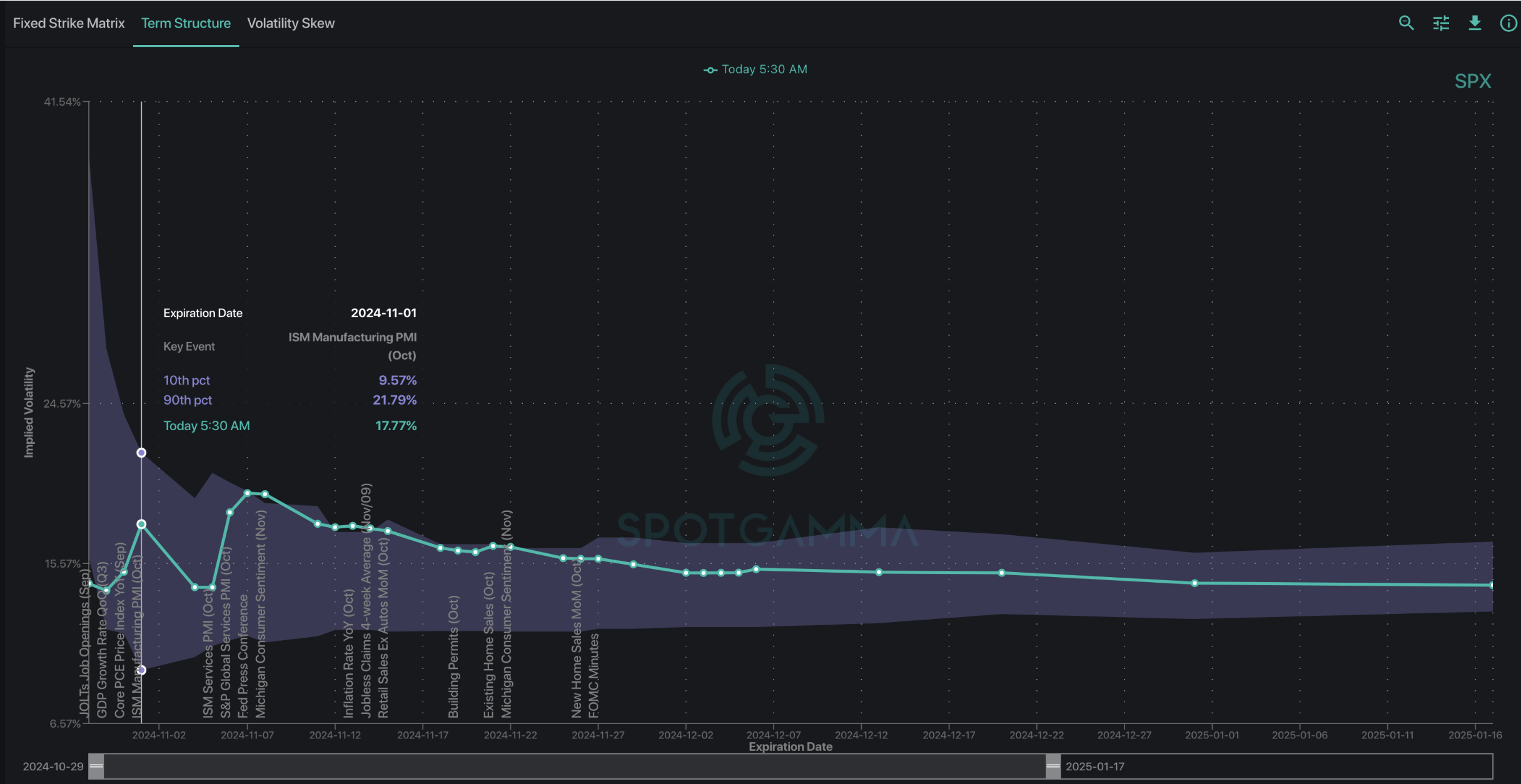

- 11/1 PMI

- 11/6 Election

- 11/7 FOMC

We remain long of equities while SPX >5,800, and neutral <5,800. Currently we do note see a material negative gamma SPX position until <5,700, suggesting a lack of strong “risk off” positioning. This prevents us from looking to go short <5,800 until/unless those negative gamma dynamics change.

5,900 remains a strong Call Wall resistance point above.

Jan NVDA and/or QQQ calls are our preferred way to hedge the election/FOMC right tail, as call skews are statistically cheap, and the coupling of higher equity prices with call demand could lead to a sharp increase in call values.

Key SG levels for the SPX are:

- Support: 5,820, 5,800

- Resistance: 5,850, 5860, 5,900

- As of 10/16/24:

- Long while >5,800

- Risk-off on a break <5,800

QQQ:

- Support: 490, 485

- Resistance: 500

IWM:

- Support: 220, 218

- Resistance: 225

Founder’s Note:

Futures are flat, with eyes on earnings from AMD & GOOGL, tonight.

Like the last several weeks, we start off today in a positive gamma stance, with a

pivot

at 5,835/5,830 (large positive gamma strikes). Support is at 5,820 then 5,800. Resistance is at 5,850.

There is just very little happening in equities, as the mildly positive gamma regime remains in control. That positive gamma is keeping the SPX locked in the 5,800-5,850 range – a range that has been in play for 2 weeks.

Traders are now starting to bid up IV in front of Friday’s 11/1 PMI print, as its the last major data point before FOMC. This infers that the 5,800-5,850 range may continue to dominate in through Friday.

While broad equity markets churn, Bitcoin is threatening all time highs near 74k, which we broadly take as a positive signal for risk assets.

What’s also threatening highs are yields, with the 10Y at 4.3%. That’s +70bps from the Sep FOMC rate cut…

Higher rates & rising assets seem at odds with each other, but we’ll leave deciphering these dynamics to macro pundits.

Overall, it highlights the unusual pre-election/FOMC environment we’re in.

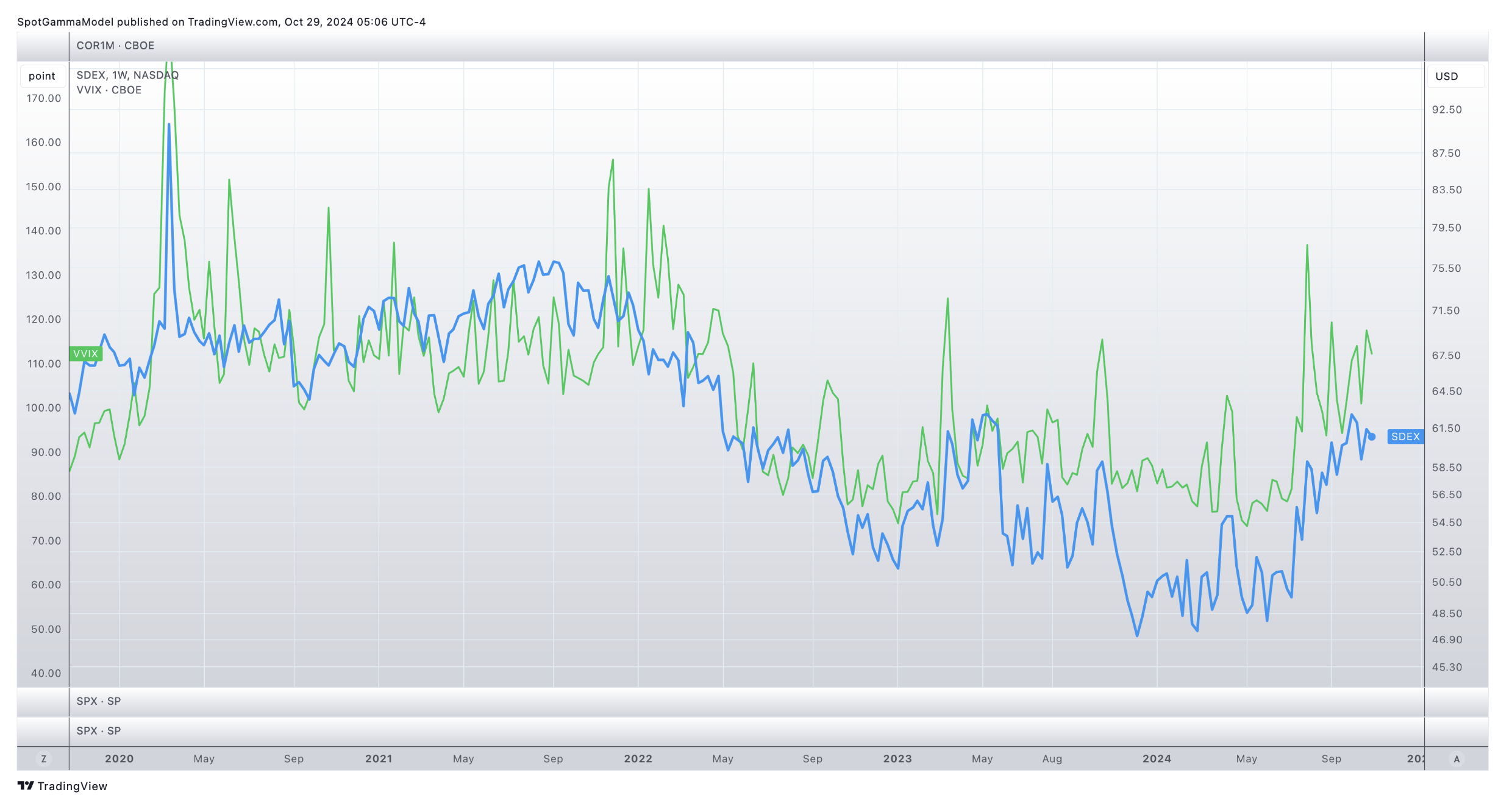

In the face of higher yields, equities are at all time highs, while equity traders are hedged for downside. This hedging is seen in the VVIX & SDEX. Both of these indexes reflect that traders are bidding up tail protection ahead of these large events.

These key events, now just 1 week out, should lead to a resolution to the prevailing range. Our default view remains that election & FOMC passing leads to a contraction in IV, which lifts equity markets. That being said, it does seem that next week likely serves as a key turning point, with little to spark moves until (at best) Friday (PMI).

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5859.27 | $5823 | $580 | $20351 | $495 | $2244 | $222 |

| SG Gamma Index™: |

| 0.446 | -0.159 |

|

|

|

|

| SG Implied 1-Day Move: | 0.63% | 0.63% | 0.63% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5856.27 | $5820 | $581 | $20290 | $496 | $2225 | $221 |

| Absolute Gamma Strike: | $5886.27 | $5850 | $580 | $20300 | $500 | $2250 | $220 |

| Call Wall: | $6036.27 | $6000 | $590 | $20300 | $497 | $2280 | $230 |

| Put Wall: | $5836.27 | $5800 | $570 | $18500 | $460 | $2000 | $210 |

| Zero Gamma Level: | $5825.27 | $5789 | $579 | $20147 | $494 | $2238 | $224 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.062 | 0.845 | 1.361 | 0.936 | 0.966 | 0.863 |

| Gamma Notional (MM): | $27.86M | ‑$489.085M | $6.888M | ‑$78.701M | ‑$4.995M | ‑$139.265M |

| 25 Delta Risk Reversal: | -0.057 | -0.035 | -0.066 | -0.04 | 0.00 | -0.012 |

| Call Volume: | 350.649K | 964.952K | 6.298K | 602.49K | 13.705K | 256.456K |

| Put Volume: | 688.938K | 1.75M | 7.995K | 809.077K | 17.629K | 511.668K |

| Call Open Interest: | 6.727M | 5.486M | 59.346K | 3.046M | 295.965K | 3.66M |

| Put Open Interest: | 13.198M | 13.996M | 80.492K | 5.835M | 495.367K | 7.323M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5850, 5800, 5900, 6000] |

| SPY Levels: [580, 585, 570, 575] |

| NDX Levels: [20300, 20500, 20400, 20000] |

| QQQ Levels: [500, 497, 490, 480] |

| SPX Combos: [(6097,95.65), (6074,81.11), (6056,90.09), (6051,92.65), (6027,78.89), (5998,99.23), (5975,90.16), (5969,74.61), (5957,78.12), (5952,96.38), (5940,85.18), (5928,69.39), (5923,96.25), (5917,88.18), (5905,72.37), (5899,98.86), (5893,76.96), (5888,91.97), (5882,79.96), (5876,94.01), (5870,87.45), (5864,91.81), (5858,84.09), (5853,98.33), (5847,77.84), (5841,77.00), (5835,92.82), (5818,95.08), (5812,72.46), (5806,73.26), (5800,92.88), (5794,82.01), (5789,70.49), (5783,84.74), (5765,77.18), (5754,76.20), (5748,95.05), (5736,75.28), (5725,83.06), (5713,85.53), (5701,91.76), (5672,74.28), (5649,85.23), (5626,74.42), (5614,78.84), (5602,91.51), (5573,73.37), (5550,84.01)] |

| SPY Combos: [598.12, 588.28, 583.07, 573.22] |

| NDX Combos: [20412, 20534, 20290, 20962] |

| QQQ Combos: [500.21, 493.77, 510.12, 479.91] |

0 comentarios