Macro Theme:

Key dates ahead:

- 10/31 CORE PCE

- 11/1 PMI

- 11/6 Election

- 11/7 FOMC

We remain long of equities while SPX >5,800, and neutral <5,800. Currently we do note see a material negative gamma SPX position until <5,700, suggesting a lack of strong “risk off” positioning. This prevents us from looking to go short <5,800 until/unless those negative gamma dynamics change.

5,850 is pre-election resistance.

Jan NVDA and/or QQQ calls are our preferred way to hedge the election/FOMC right tail, as call skews are statistically cheap, and the coupling of higher equity prices with call demand could lead to a sharp increase in call values.

Key SG levels for the SPX are:

- Support: 5,700

- Resistance: 5,790, 5,800, 5,820

- As of 10/16/24:

- Long while >5,800

- Risk-off on a break <5,800

QQQ:

- Support: 490, 480

- Resistance: 494, 500

IWM:

- Support: 220, 218

- Resistance: 225

Founder’s Note:

Equity futures are 75 – 100 bps lower from poor megacap earnings, as both META & MSFT are off -3.5%.

Initial Jobless Claims & CORE PCE are at 8:30 AM ET.

This early move has the indicative SPX price near 5,775, which is obviously below the 5,800 – 5,850 range that has dominated trading the last two weeks.

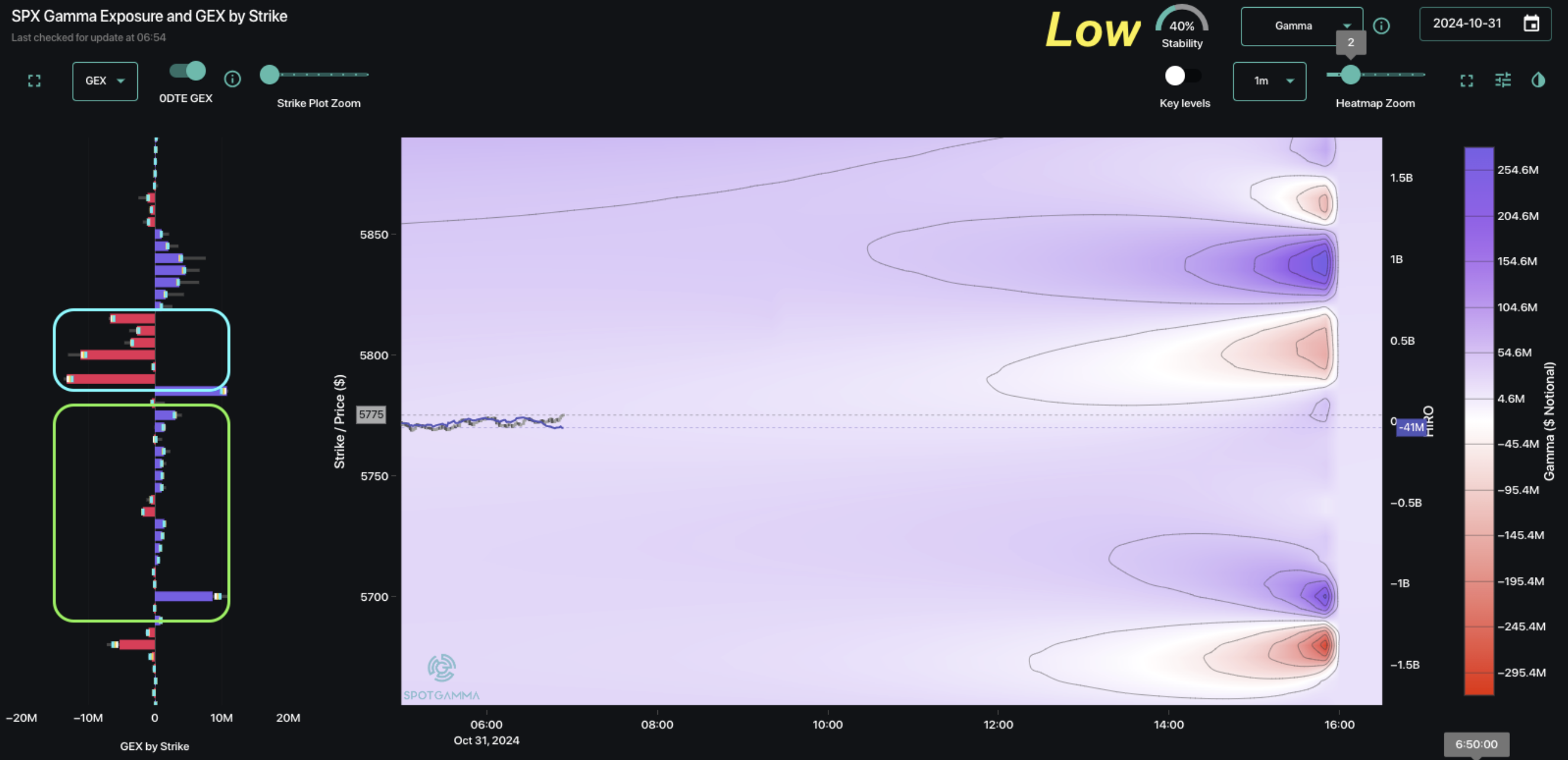

Using TRACE to set the stage, we can see that gamma remains mildly positive, but the Stability metric is a low 40%. This infers a fair amount of market movement today vs tight ranges from prior sessions.

Second, we see small, but net positive gamma strikes from 5,775 down to 5,700 (green box, note how small those strikes are). This is true both for 0DTE positions (shown here), and for all expirations, and it suggests that traders have shorted puts <5,775. This adds to dealers having mildly positive gamma all the way through 5,700. If there is pause for concern in this setup, its that if a tail is printed in today’s AM data, we do not see any large, material support level until 5,700. A few new chunky puts could toss us into a negative gamma stance.

Lastly, we see a pocked of negative gamma strikes >5,790 (blue box). These negative gamma positions appear to be dealers short (traders long) 0DTE puts from 5,790 to 5,815. If these puts are closed, it could bring a pop to S&P prices, which coincides with a move back into 5,800.

If the zone <5,790 was reflecting dealers short puts, resulting in a red negative gamma map, then we would be bracing for further downside. However, for the moment, the positioning does not reflect options as a major driver for downside price action. Things could obviously change with a negative reaction to jobless claims & PCE, but typically these economic events pass without much impact. This could lead to a small implied volatility contraction, which could give a small bump to stocks.

Even as we are not terribly concerned about equities here, implied vols are getting a bit jumpy, as seen with the VIX at 21. Below is our Fixed Strike Matrix, showing the change in IV from yesterday’s close to this morning. For expirations from today to next Friday, vols are +1.5% higher, which is material.

Here we have 1-month SPX skew, and as you can see the current IV’s (teal line) are at 90-day highs (teal shaded cone). What we think is happening here is month-end (today) and some fairly important data points (jobless claims, PCE today, Non-Farms tomorrow) are colliding with the elevated vols for elections & FOMC next week. Overall this is reflecting traders not necessarily bearish, but bracing for the litany of data coming our way.

Further, we’d imagine that if the data today & tomorrow is in line, then we’d see short dated “pre-election options sellers jump in to provide some market stability (you know how they all love that weekend theta!)

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5847.87 | $5813 | $579 | $20387 | $496 | $2233 | $221 |

| SG Gamma Index™: |

| 0.165 | -0.237 |

|

|

|

|

| SG Implied 1-Day Move: | 0.62% | 0.62% | 0.62% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | $5844.42 | $5809.55 | $579.18 |

|

|

|

|

| SG Implied 1-Day Move Low: | $5772.82 | $5737.95 | $572.04 |

|

|

|

|

| SG Volatility Trigger™: | $5854.87 | $5820 | $581 | $20290 | $496 | $2230 | $222 |

| Absolute Gamma Strike: | $5884.87 | $5850 | $580 | $20300 | $500 | $2250 | $220 |

| Call Wall: | $6034.87 | $6000 | $590 | $20300 | $500 | $2280 | $230 |

| Put Wall: | $5734.87 | $5700 | $570 | $18500 | $465 | $2000 | $210 |

| Zero Gamma Level: | $5814.87 | $5780 | $583 | $20183 | $495 | $2244 | $223 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.022 | 0.777 | 1.343 | 0.878 | 0.920 | 0.777 |

| Gamma Notional (MM): | ‑$72.191M | ‑$687.79M | $5.70M | ‑$163.427M | ‑$11.97M | ‑$328.142M |

| 25 Delta Risk Reversal: | -0.056 | -0.033 | -0.062 | -0.039 | -0.028 | -0.006 |

| Call Volume: | 449.639K | 1.188M | 6.049K | 627.589K | 8.46K | 281.121K |

| Put Volume: | 828.982K | 1.438M | 8.882K | 1.246M | 14.404K | 340.33K |

| Call Open Interest: | 6.839M | 5.645M | 60.597K | 3.096M | 301.653K | 3.674M |

| Put Open Interest: | 13.40M | 14.307M | 83.535K | 5.968M | 502.413K | 7.409M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5850, 5800, 6000, 5900] |

| SPY Levels: [580, 585, 575, 570] |

| NDX Levels: [20300, 20500, 20400, 21000] |

| QQQ Levels: [500, 490, 495, 480] |

| SPX Combos: [(6099,95.23), (6075,81.53), (6058,90.56), (6052,92.91), (6023,74.89), (6017,79.89), (6000,99.24), (5976,89.14), (5959,71.38), (5947,96.34), (5942,84.80), (5924,91.98), (5918,69.76), (5913,92.42), (5907,70.55), (5901,98.12), (5895,71.84), (5889,83.33), (5883,72.55), (5878,93.12), (5872,79.67), (5866,90.27), (5860,80.32), (5854,78.35), (5849,94.10), (5843,87.27), (5837,94.66), (5819,69.90), (5814,85.70), (5808,81.54), (5802,88.20), (5796,81.18), (5790,84.85), (5785,82.53), (5779,72.34), (5767,82.38), (5761,85.52), (5756,69.73), (5750,91.23), (5744,69.20), (5732,85.10), (5726,85.31), (5715,85.77), (5697,94.89), (5674,69.14), (5663,71.08), (5651,87.88), (5628,80.58), (5616,78.55), (5599,90.50), (5575,75.79), (5552,86.25)] |

| SPY Combos: [598.57, 588.69, 593.34, 608.46] |

| NDX Combos: [20306, 20530, 20938, 19919] |

| QQQ Combos: [501.64, 499.64, 494.14, 500.14] |

0 comentarios