Macro Theme:

Key dates ahead:

- 12/4 ISM Servives PMI, Powell

- 12/5 Jobless Claims

- 12/6 NFP

- 12/11 CPI

Our primary risk signals signal long of equities while SPX >6,000 with an upside target of 6,050, then 6,100. We are neutral 5,900-6,000& <5,900 we flip to risk-off.

11/28: We prefer IWM/DIA to SPX/QQQ due to higher anticipated volatility into year end, but we still use SPX 6,000 as our equity risk on/off barometer.

11/22: Should there be a significant geopolitical escalation, we are on watch for an increase in put buying, and negative dealer gamma. That could invoke higher downside volatility on a break <5,900. In this scenario, we see 5,500 as major long term support.

Key SG levels for the SPX are:

- Support: 6,000, 5,950

- Resistance: 6,050, 6,077, 6,100

- As of 11/22:

- Long equities if >6,000

- Short equities if SPX <5,900

QQQ:

- Support: 510, 505, 500

- Resistance: 520

IWM:

- Support: 240, 235

- Resistance: 245

Founder’s Note:

Futures are flat to start, with a JOLTS data point at 10AM ET.

Resistance: 6,050, 6,077, 6,100

Support: 6,000

As per recent notes, we continue to maintain a bullish stance while the SPX is >6,000. Further, if the SPX can get >6,050 then positive gamma should materially increase which suggests more relative stability in equities.

Vol continues to contract, as evidenced by the 13.3 VIX (5-month low). As gamma builds, daily ranges should further contract, which decreases realized vol. Lower realized vol serves to contract implied vol. At that point we’ll like need a big OPEX to dislodge these positive gamma positions, which frees up the market to move.

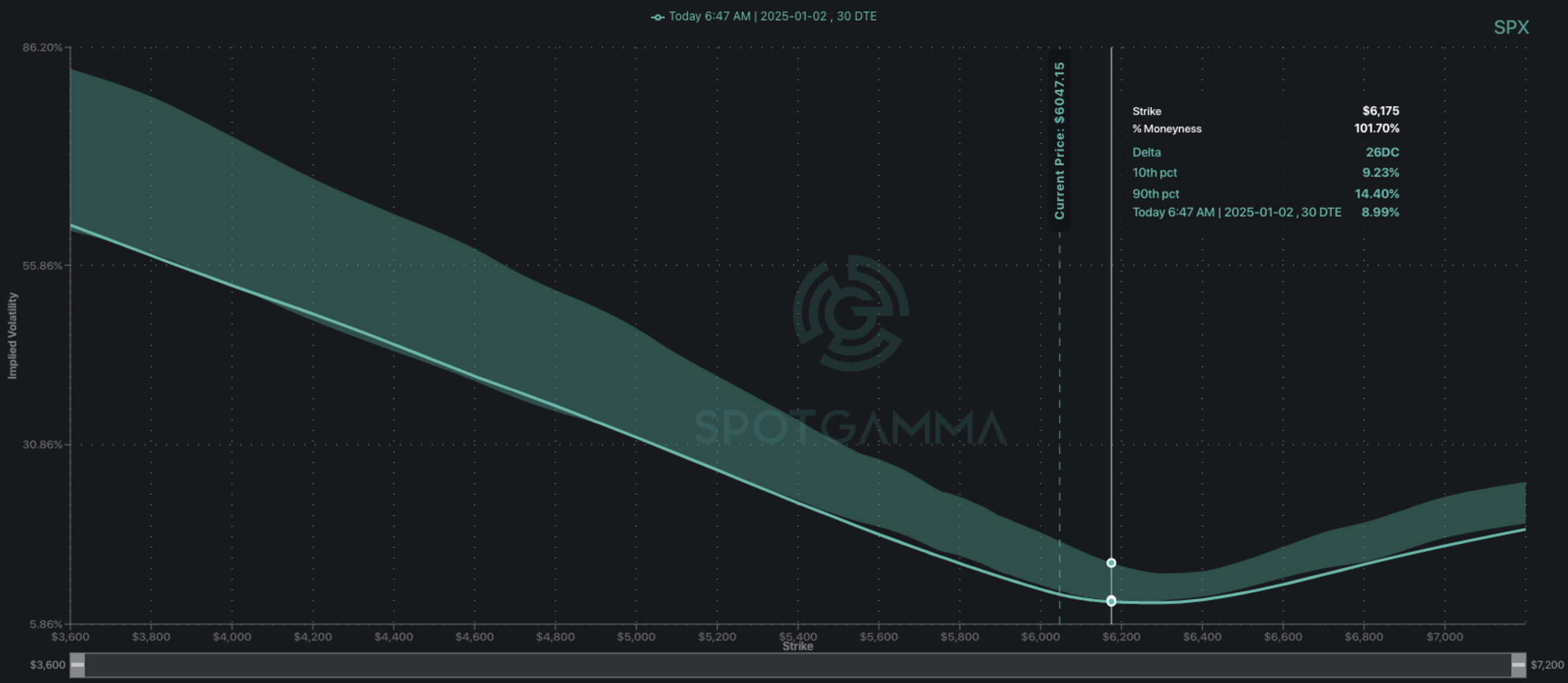

Some talk on FinTwit is around the low call implied vols for SPX which we discussed on Friday, and syncs with our Q&A discussion from yesterday AM about low single stock vols. Take for example the 1-month skew, below, which shows ~25 delta SPX calls (6,100 strike) trading <10% IV (quite low), which backs out to a ~45% chance of going in-the-money. That 6,100 level is <1% away from current SPX prices – which certainly seems achievable by year end (+1% in 30 days = ~12.8% IV).

While you may or may not agree with the idea of higher SPX prices into year end, its hard to argue against these low call IV’s being cheap ways to express that upside.

In that Friday AM note, we made the argument that the positive gamma buildup in SPX could reinforce a low volatility grind, and therefore traders may want to express upside in products with more volatility potential. A standout for that view seems is AAPL, which has a very low IV rank of just 5% (vs 1% (!!) for SPY). For AAPL, the 1-month ~25 delta call has an IV of 16.5% (shown below) – again this seems objectively cheap.

The difference between long a high beta name like AAPL vs SPX is that the big positive gamma flows, like systematic call overwriting (ex: JPM collar at 6,050), don’t exist in AAPL (at least in the same size as SPX), and so its more free to move. On this point we think AAPL has room to 250, and above that positions seem to wane.

What about downside? We came across this Reuters article citing high SKEW Index readings as a signal that investors are “clinging to crash protection”.

We’re going to broadly push back against this idea, due to the fact that these “indexified” measures of volatility are inherently flawed. For example, the CBOE SKEW index is up from 140 to 170 over the past month, but the SPX is +3% over that same time frame. As the SPX rises, it slides down the vol skew, meaning what was the lower IV out-of-the-money call, becomes the at-the-money call IV (watch this comprehensive breakdown for more on this idea).

Therefore, the higher SKEW readings are a function of not higher IV’s, but a higher “slope” of the put-wing, which is largely the result of the rapidly rising SPX market.

Under the hood, when we compare 11/18 1-month SKEW (gray) vs today (teal), and you can see that the vol surface is really sinking. That doesn’t scream “put buyers”.

Zooming out, we want to flag the massive December expiration on 12/20. You can see the relative size of these DEC positions across major indicies, below. These positions should reinforce the bulls positions into 12/20 as gamma naturally increases into OPEX, increasing pinning/”volatility restricting” flows. This suggests that mid to late Dec could be a turning point for markets.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6061.78 | $6047 | $603 | $21164 | $515 | $2434 | $241 |

| SG Gamma Index™: |

| 2.865 | 0.230 |

|

|

|

|

| SG Implied 1-Day Move: | 0.60% | 0.60% | 0.60% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6004.78 | $5990 | $603 | $20470 | $514 | $2440 | $239 |

| Absolute Gamma Strike: | $6014.78 | $6000 | $605 | $21000 | $510 | $2400 | $240 |

| Call Wall: | $6114.78 | $6100 | $605 | $20475 | $520 | $2500 | $250 |

| Put Wall: | $5814.78 | $5800 | $602 | $18500 | $465 | $2320 | $225 |

| Zero Gamma Level: | $5981.78 | $5967 | $598 | $20484 | $510 | $2410 | $239 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.398 | 1.246 | 1.794 | 1.072 | 1.126 | 1.064 |

| Gamma Notional (MM): | $908.70M | $985.376M | $18.817M | $209.039M | $5.152M | $97.927M |

| 25 Delta Risk Reversal: | -0.028 | -0.022 | -0.033 | -0.017 | -0.015 | -0.015 |

| Call Volume: | 421.299K | 1.197M | 10.115K | 816.451K | 14.913K | 317.754K |

| Put Volume: | 912.109K | 1.757M | 16.262K | 1.011M | 24.043K | 281.815K |

| Call Open Interest: | 7.419M | 5.995M | 67.881K | 3.331M | 321.30K | 3.827M |

| Put Open Interest: | 13.486M | 11.854M | 91.037K | 6.08M | 533.455K | 8.07M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6050, 6100, 5900] |

| SPY Levels: [605, 600, 610, 603] |

| NDX Levels: [21000, 20475, 21200, 21500] |

| QQQ Levels: [510, 515, 500, 520] |

| SPX Combos: [(6301,97.28), (6277,69.99), (6253,98.01), (6223,86.98), (6210,80.27), (6198,99.52), (6192,71.43), (6174,90.91), (6168,72.58), (6162,94.76), (6150,98.86), (6138,78.46), (6132,83.36), (6126,95.10), (6120,89.49), (6114,95.04), (6108,94.82), (6102,99.95), (6096,79.23), (6089,95.91), (6083,94.77), (6077,99.65), (6071,99.00), (6065,93.71), (6059,98.75), (6053,98.51), (6047,99.41), (6029,87.47), (6011,79.95), (5999,93.41), (5993,86.32), (5962,77.72), (5950,79.61), (5932,73.39), (5848,78.61), (5799,87.24), (5751,77.00)] |

| SPY Combos: [609.18, 604.96, 604.36, 619.42] |

| NDX Combos: [21355, 20466, 21397, 21270] |

| QQQ Combos: [498.53, 519.93, 514.84, 510.25] |

0 comentarios