Macro Theme:

Key dates ahead:

- 12/12 PPI/Jobs

- 12/18 FOMC

- 12/20 OPEX

- 12/31 OPEX Q-end

Our primary risk metric signals being long of equities while SPX >6,000 with an upside target 6,100. <6,000 we flip to risk-off. Through to 12/20 OPEX we plan to operate in “buy the dip mode” until/unless <6,000.

(12/12 Post) Into year end, we are operating from this playbook:

- SPX is unlikely to break over 6,110 before 12/18. We may elect some <=6DDTE collar some positions as a result.

- Select single stocks may have some more “juice to squeeze” this week, but we anticipate a consolidation phase into 12/18

- Assuming the SPX is within 1% of 6,055 after 12/20 OPEX, we think SPX pins 6,055 into 12/31 Exp

- January sets up to potentially weak & our prime time to look for an equity correction, with 1/17 OPEX of note.

Key SG levels for the SPX are:

- Support: 6,050, 6,000

- Resistance: 6,100, 6,112

- As of 12/06:

- Long equities if >6,000

- Short equities if SPX <6,000

QQQ:

- Support: 525, 520

- Resistance: 530, 535

IWM:

- Support: 238, 235

- Resistance: 240, 245

Founder’s Note:

Futures are off ~20bps, with PPI & Jobs data on deck this AM.

Resistance: 6,100, 6,110 (SPY 610)

Support: 6,070, 6,060, 6,050, 6,000

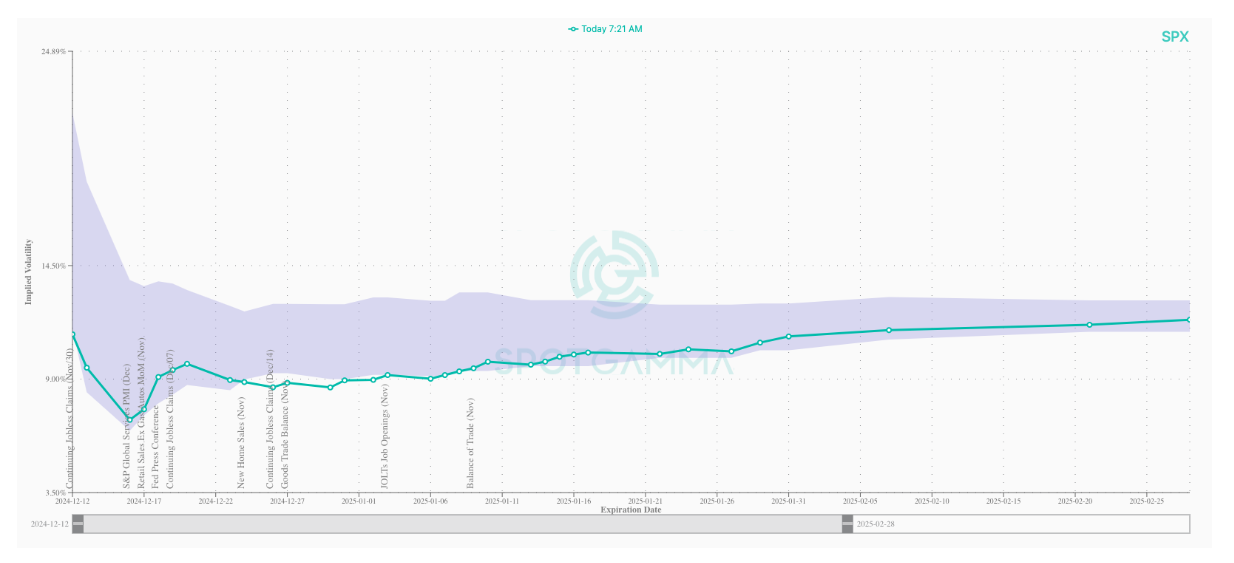

SPX vol is mildly perturbed ahead of this data release, however we anticipate that, much like with CPI, it passes as a non-event, leading to a contraction in event vol and a final move back toward 6,100.

The

Call Wall,

our prime resistance level, remains at 6,100 which leads us to anticipate no further upside at this time. As we are approaching the weekend, and FOMC/OPEX is next week, we think there is a good chance that the SPX essentially pins this general 6,055 – 6,100 range into 12/18 (FOMC). Framing this another way: we see little value in being long of S&P500 over the next week, as we expect volatility to be non-existent, with fairly large resistance at 6,100 & 6,110 (SPY 610). The Nasdaq does seem to have more available upside, with resistance at 530 & 535 (Call Wall) for QQQ.

We wanted to zoom out a bit here, and talk about the potential

pivots

for equities. Animal spirits are clearly raging as bulls cheer major gains. Usually this ends poorly.

This brings us to a critical point, and one that separates luck from skill: being positioned for a market correction.

As we have said on several webinars, this Dec OPEX is likely to be the largest options expiration on record, and our prime view of this impact is that we look for pinning into OPEX, and expect “volatility expansion”/unpinning after OPEX. We would normally regard that unpinning as a potential turning point south for equities (due to extreme rallies into OPEX), but in this case, we are dealing with year end (bullish flows, holidays), and the JPM collar trade expiring on 12/31.

But in the big picture, we can’t help but see the last 2 weeks of this year as a major intersection of time & price: massive expirations, FOMC, year end – all converging. This time/price convergence is also meeting extreme bullishness, and volatility at lower bounds.

Further, when we look at the most bullish “stock up, vol up” stocks, their really elevated IV’s have to contend with not only big expirations, but dreaded time decay (nothing zaps IV-energy like a series of holidays).

With that, we are operating from this playbook:

- SPX is unlikely to break over 6,110 before 12/18. We may elect some <=6DDTE collar some positions as a result.

- Select single stocks may have some more “juice to squeeze” this week, but we anticipate a consolidation phase into 12/18

- Assuming the SPX is within 1% of 6,055 after 12/20 OPEX, we think SPX pins 6,055 into 12/31 Exp

- January sets up to potentially weak & our prime time to look for an equity correction, with 1/17 OPEX of note.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6093.52 | $6084 | $607 | $21763 | $529 | $2394 | $237 |

| SG Gamma Index™: |

| 2.807 | 0.454 |

|

|

|

|

| SG Implied 1-Day Move: | 0.51% | 0.51% | 0.51% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6079.52 | $6070 | $604 | $21340 | $529 | $2405 | $238 |

| Absolute Gamma Strike: | $6109.52 | $6100 | $610 | $22000 | $530 | $2400 | $240 |

| Call Wall: | $6109.52 | $6100 | $610 | $22000 | $535 | $2500 | $240 |

| Put Wall: | $6069.52 | $6060 | $600 | $20800 | $465 | $2300 | $230 |

| Zero Gamma Level: | $6057.52 | $6048 | $601 | $21064 | $525 | $2406 | $237 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.317 | 1.416 | 2.048 | 1.30 | 0.959 | 1.022 |

| Gamma Notional (MM): | $795.091M | $1.622B | $22.245M | $520.01M | ‑$13.153M | $10.128M |

| 25 Delta Risk Reversal: | -0.028 | -0.02 | -0.03 | -0.013 | -0.006 | -0.004 |

| Call Volume: | 510.832K | 1.213M | 11.262K | 846.558K | 20.884K | 440.094K |

| Put Volume: | 776.467K | 1.344M | 14.827K | 1.282M | 16.812K | 528.097K |

| Call Open Interest: | 7.962M | 6.406M | 72.343K | 3.687M | 338.565K | 4.119M |

| Put Open Interest: | 14.432M | 12.596M | 100.416K | 6.845M | 554.326K | 8.382M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6100, 6000, 6050, 6150] |

| SPY Levels: [610, 605, 608, 600] |

| NDX Levels: [22000, 21000, 21800, 21400] |

| QQQ Levels: [530, 525, 520, 510] |

| SPX Combos: [(6352,91.60), (6297,97.84), (6273,79.25), (6261,74.92), (6248,98.91), (6224,89.50), (6212,88.60), (6200,99.79), (6188,88.14), (6182,83.73), (6175,94.74), (6169,89.62), (6157,99.05), (6151,99.74), (6145,86.57), (6139,93.50), (6133,97.72), (6127,99.12), (6121,96.93), (6115,92.64), (6109,99.61), (6102,99.99), (6096,96.31), (6090,98.04), (6066,90.97), (6060,93.36), (6054,96.51), (6048,73.39), (6042,84.99), (6036,73.35), (6029,86.77), (6011,84.57), (5987,72.35), (5975,84.82), (5956,77.01), (5950,88.41), (5932,69.79), (5926,77.32), (5902,87.62), (5853,82.93), (5823,68.74), (5798,88.02)] |

| SPY Combos: [609.5, 604.68, 619.15, 614.32] |

| NDX Combos: [21982, 21764, 22003, 22177] |

| QQQ Combos: [529.92, 525.23, 498.69, 514.82] |

0 comentarios