Macro Theme:

Key dates ahead:

- 12/20 OPEX

- 12/31 OPEX Q-end

- 12/24 1/2 day (Xmas Eve)

- 12/25 Market Closed

12/20: We think vols indicate oversold conditions into a massive put-clearing OPEX. For this reason we are looking to removing short, and looking for defined risk ways to play for a bounce into end of year.

From 12/19: The SPX has to recover 6k before Monday 12/23 in order for stability to re-enter the market. Until/unless that happens we remain concerned that 12/18 volatility was just an “amuse-bouche”, and not a one-off episode.

If 6k is recovered, then the JPM pin at 6,055 into 12/31 is back on.

Key SG levels for the SPX are:

- Support: 5,800 (Put Wall), 5,700

- Resistance: 5,900

- As of 12/19:

- Tactically long equities if >5,900 – meaning “in for a trade” not a long term hold

- Short equities if SPX <5,900

- As of 12/20:

- We are looking for ways to express upside into year end via call spreads (least aggressive), selling put spreads, or combos (most aggressive). Naked calls are not advised due to high IV’s.

Founder’s Note:

Futures are down 80 (ES) – 130 (NQ) bps ahead of today’s massive expiration.

Resistance: 5,850, 5,900

Support: 5800 (

Put Wall

), 5,700

TLDR: We are looking for ways to express upside into year end. This is due to oversold conditions (i.e. very elevated IV’s) and the removal of large put positions with today’s OPEX.

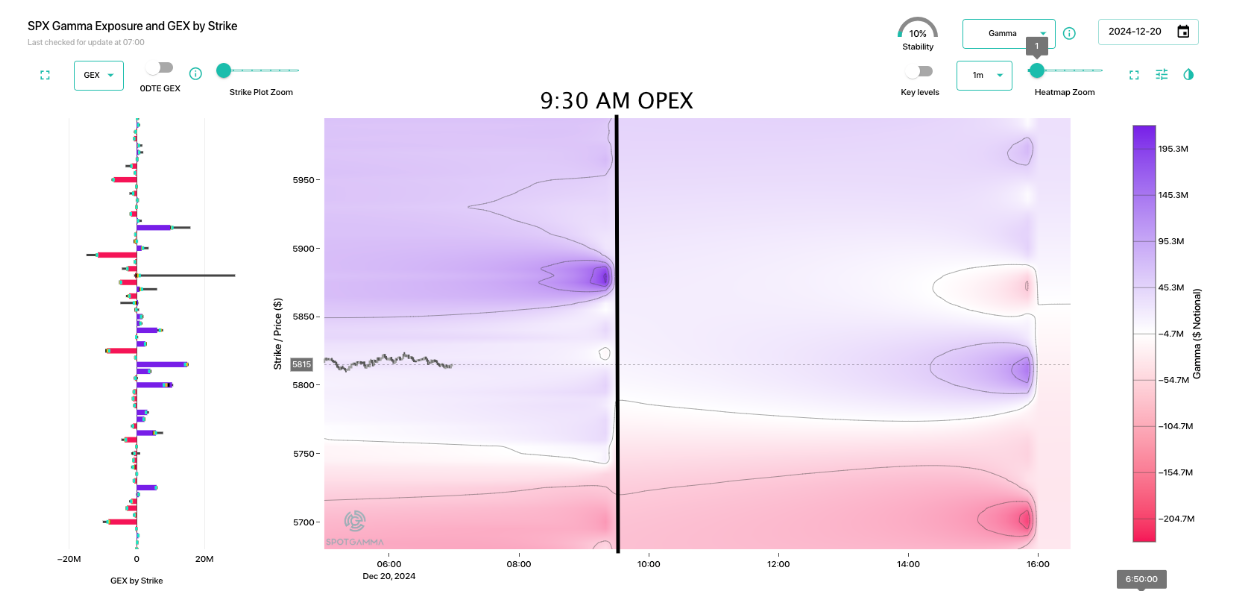

For SPX, this AM’s OPEX serves to remove positive gamma, which clears the way for further volatility. You can see this in the color changes from pre & post 9:30AM ET OPEX.

For single stocks, SPX PM, and all ETF’s, the 4PM OPEX is very large. 2 days ago there was a tremendous skew towards call values vs puts expiring of +10:1 (delta notional terms). As of last night that figure was 2:1 (below), and based on some pre-market levels, that is likely closer to 50/50.

While its clear that the major downside trigger was macro/rates (ZB, US Bond Futs, below), we believe that options positioning has exacerbated equity volatility. The options market had very low index vol, and select single stocks were extremely frothy. Further, there was massive

call delta’

s built up (likely the largest size ever) into Wednesday’s FOMC, and those have all now burned.

The biggest options names are the Mag 7’s and nearly every one of those had very high call skews (+90% rank), suggesting traders were long calls & dealers short. If dealers were short calls, they may have had long stock on as a hedge, and so as the market tumbled they likely had stock to sell.

Add to this a traders having to go from covering short volatility at lows and entering into into long vol positions which likely exacerbated stock movement.

At this point, vols have gotten rich. This is a deterrent to buying puts which should help to relieve some pressure. That being said, we aren’t at extremes. Just consider today’s 1-month SPX skew (teal) vs the skew from the close of August 5th (gray). To get to extremes we’d argue that you need some type of liquidation trigger, a la the yen carry trade margin call.

Additionally, there is a 1/2 session on Tuesday & Wed close for Christmas, then New Years is closed next week. So the Holiday Decay is thick which means if you are long short dated puts you need some big movement, and soon, to maintain put values in the face of holiday momentum-stalling.

Finally, per the US Govt shutdown:

From Barrons:

During the last shutdown under Trump–the longest in U.S. history between Dec.21, 2018 and Jan. 25, 2019–the S&P 500 jumped 10.3%, according to Dow Jones Market Data. In fact, the index has climbed throughout the last four shutdowns going back to 1995 under President Bill Clinton.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5934.16 | $5867 | $586 | $21110 | $514 | $2221 | $219 |

| SG Gamma Index™: |

| -2.638 | -0.403 |

|

|

|

|

| SG Implied 1-Day Move: | 0.66% | 0.66% | 0.66% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6062.16 | $5995 | $602 | $21330 | $521 | $2340 | $232 |

| Absolute Gamma Strike: | $5967.16 | $5900 | $590 | $21000 | $520 | $2250 | $220 |

| Call Wall: | $6267.16 | $6200 | $610 | $21400 | $535 | $2500 | $240 |

| Put Wall: | $5867.16 | $5800 | $580 | $21010 | $500 | $2220 | $220 |

| Zero Gamma Level: | $6033.16 | $5966 | $593 | $21216 | $521 | $2353 | $231 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.791 | 0.678 | 0.963 | 0.750 | 0.526 | 0.384 |

| Gamma Notional (MM): | ‑$1.095B | ‑$1.717B | ‑$4.35M | ‑$632.259M | ‑$133.854M | ‑$1.409B |

| 25 Delta Risk Reversal: | -0.075 | -0.066 | -0.078 | -0.059 | -0.056 | -0.033 |

| Call Volume: | 848.313K | 2.539M | 15.722K | 982.725K | 34.66K | 612.213K |

| Put Volume: | 1.778M | 2.745M | 12.947K | 1.331M | 79.927K | 1.592M |

| Call Open Interest: | 8.577M | 6.373M | 74.574K | 3.896M | 383.739K | 4.262M |

| Put Open Interest: | 15.516M | 13.218M | 107.416K | 7.264M | 603.867K | 8.578M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5900, 6000, 5850, 5800] |

| SPY Levels: [590, 600, 595, 585] |

| NDX Levels: [21000, 21400, 21100, 21500] |

| QQQ Levels: [520, 510, 500, 515] |

| SPX Combos: [(6149,84.92), (6125,74.18), (6108,71.39), (6102,90.93), (6055,95.34), (6049,69.81), (5984,69.91), (5973,87.68), (5949,88.83), (5937,77.02), (5926,82.10), (5920,73.08), (5914,80.41), (5908,79.63), (5902,97.68), (5896,84.55), (5891,78.32), (5873,88.94), (5867,91.80), (5855,82.71), (5849,95.87), (5838,87.04), (5832,82.63), (5826,88.94), (5820,71.61), (5814,81.83), (5808,89.57), (5803,98.51), (5797,72.42), (5773,84.77), (5767,76.98), (5756,76.20), (5750,94.26), (5726,83.98), (5703,96.69), (5673,76.84), (5650,89.80), (5627,79.80), (5603,73.08), (5597,90.78)] |

| SPY Combos: [589.21, 579.24, 583.93, 573.97] |

| NDX Combos: [20519, 20731, 20942, 21005] |

| QQQ Combos: [498.39, 499.94, 505.11, 514.92] |

0 comentarios