Macro Theme:

Key dates ahead:

- 12/24 1/2 day (Xmas Eve)

- 12/25 Market Closed

- 12/31 OPEX Q-end

12/20: We think vols indicate oversold conditions into a massive put-clearing OPEX. For this reason we are looking to removing short, and looking for defined risk ways to play for a bounce into end of year.

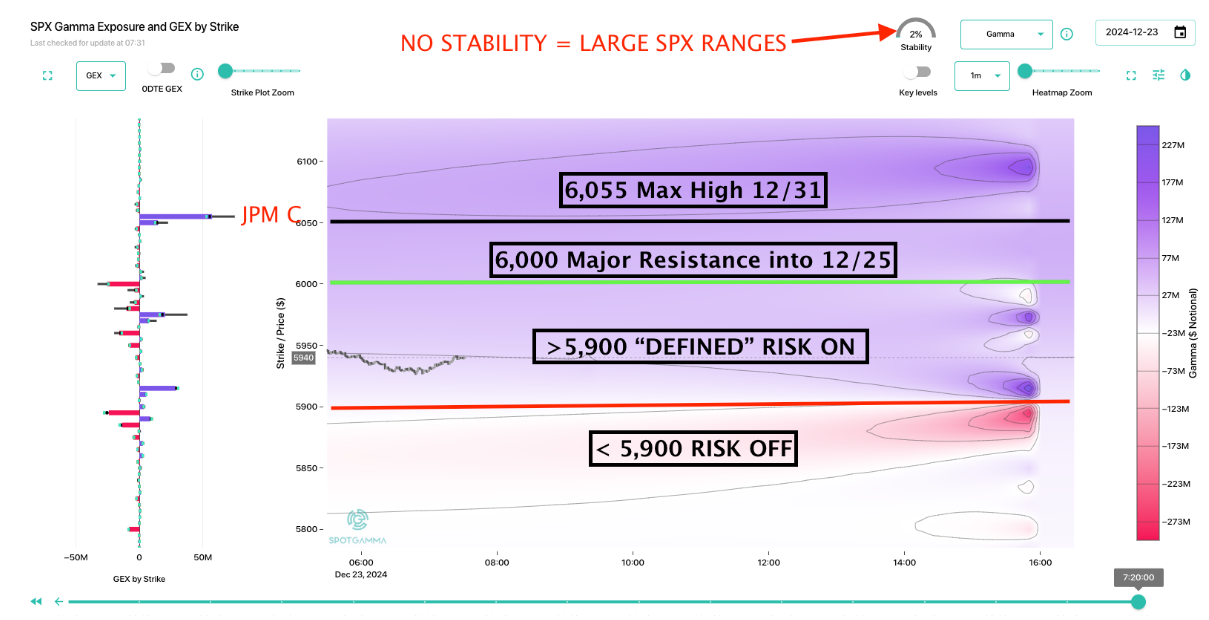

From 12/19: The SPX has to recover 6k before Monday 12/23 in order for stability to re-enter the market. Until/unless that happens we remain concerned that 12/18 volatility was just an “amuse-bouche”, and not a one-off episode.

If 6k is recovered, then the JPM pin at 6,055 into 12/31 is back on.

Key SG levels for the SPX are:

- Support: 5,900

- Resistance: 6,000

- As of 12/20:

- We are looking for ways to express upside into year end via call spreads (least aggressive), selling put spreads, or combos (most aggressive). Naked calls are not advised due to high IV’s.

Founder’s Note:

ES futures are flat, NQ futures are +30bps.

Resistance: 5,970, 6,000

Support: 5,900, 5,850

There was no major risk-off event over the weekend, and so we think volatility is likely to come for sale into tomorrows 1/2 day and the Wed Christmas holiday. This, the “vanna flow” (decreasing vol leading dealers to buy stock), should lift equities. As a result we are looking for “defined risk” structures to play upside. This includes call spreads, call flies, etc. We opt for spreads vs single leg positions due to possible IV/vol decay. Additionally, because stability is low we will be careful to size down positions to avoid getting a quick stop-out due to jumpy moves.

With that, we watch 6,000 as the big resistance line into tomorrow. If that is achieved, then the JPM Collar (6,055) is likely a pin into 12/31 exp.

A break <5,900 thrusts the SPX back into a negative gamma stance, which signals significant risk.

OPEX served to remove about 1/3 of total absolute (i.e. un-netted) gamma, with 6,000 still the largest strike on the board. As you can see, below 6k put positions (blue) are larger than call positions (orange) which is what we typically see after recent market declines. This informs us that there is some put-fuel to drive equities, which is why the vanna lift could be substantial enough to drive us into the 6k strike.

For the downside, puts are expensive enough now to not be terribly enticing, and the threat of downside doesn’t appear to be imminent (i.e. tomorrow). +50% of SPX flow is 0DTE, so “no threat today” is gravy.

In regards to the possible vol drop, you can see below how elevated SPX term structure is, with IV’s near 14%. In the realm of SPX IV’s this is not terribly high, but based on recent past (and upcoming holidays) its rich (gray cone = 30 day range). Again, we’d anticipate these IV’s dropping lower (into the cone), which would provide a tail wind for stocks.

Not only do these holidays make it tough to carry relative expensive vol, this chart from GS informs us of very strong year end seasonality. This all presents a pretty strong “flows over fundamentals” window for the final week of 2024.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5997.49 | $5930 | $590 | $21289 | $518 | $2242 | $222 |

| SG Gamma Index™: |

| -1.208 | -0.374 |

|

|

|

|

| SG Implied 1-Day Move: | 0.72% | 0.72% | 0.72% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6037.49 | $5970 | $598 | $21270 | $520 | $2340 | $231 |

| Absolute Gamma Strike: | $6067.49 | $6000 | $600 | $21275 | $520 | $2250 | $220 |

| Call Wall: | $6122.49 | $6055 | $605 | $21275 | $535 | $2500 | $240 |

| Put Wall: | $5967.49 | $5900 | $590 | $20800 | $505 | $2220 | $220 |

| Zero Gamma Level: | $6008.49 | $5941 | $594 | $21076 | $521 | $2340 | $232 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.836 | 0.667 | 1.126 | 0.806 | 0.515 | 0.508 |

| Gamma Notional (MM): | ‑$483.182M | ‑$1.109B | $2.154M | ‑$300.822M | ‑$53.958M | ‑$772.655M |

| 25 Delta Risk Reversal: | -0.058 | -0.037 | -0.059 | -0.045 | -0.045 | -0.019 |

| Call Volume: | 853.919K | 2.137M | 20.532K | 997.759K | 25.384K | 587.352K |

| Put Volume: | 1.496M | 2.378M | 14.019K | 1.318M | 36.294K | 785.012K |

| Call Open Interest: | 6.10M | 5.656M | 59.479K | 2.834M | 248.857K | 3.621M |

| Put Open Interest: | 11.686M | 10.039M | 68.58K | 5.24M | 365.32K | 6.528M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 5900, 6050, 6100] |

| SPY Levels: [600, 590, 595, 605] |

| NDX Levels: [21275, 21000, 21500, 22000] |

| QQQ Levels: [520, 510, 500, 515] |

| SPX Combos: [(6198,96.21), (6174,73.16), (6150,89.99), (6127,75.90), (6121,71.47), (6103,93.32), (6073,87.47), (6055,97.28), (6049,91.93), (6026,69.57), (6020,84.42), (6002,87.92), (5978,71.64), (5949,89.15), (5925,86.99), (5919,91.13), (5913,90.15), (5901,98.54), (5895,88.00), (5889,84.88), (5883,85.51), (5877,91.58), (5872,86.75), (5860,73.59), (5848,96.77), (5824,92.66), (5812,78.00), (5800,96.98), (5777,77.55), (5771,78.03), (5753,90.93), (5723,86.98), (5700,92.37), (5652,87.67)] |

| SPY Combos: [579.67, 589.64, 569.71, 584.36] |

| NDX Combos: [21268, 20927, 20714, 20523] |

| QQQ Combos: [499.77, 504.91, 510.06, 511.6] |

0 comentarios