Macro Theme:

Key dates ahead:

- 12/24 1/2 day (Xmas Eve)

- 12/25 Market Closed

- 12/31 OPEX Q-end

12/20: We think vols indicate oversold conditions into a massive put-clearing OPEX. For this reason we are looking to removing short, and looking for defined risk ways to play for a bounce into end of year.

If 6k is recovered by Friday, 12/27, then we think the SPX can move into the JPM collar strike at 6,055 by 12/31 expiration.

Below 5,950 we flip back to a risk-off stance.

Key SG levels for the SPX are:

- Support: 5,950, 5,900

- Resistance: 6,000, 6,050

- As of 12/20:

- We are looking for ways to express upside into year end via call spreads (least aggressive), selling put spreads, or combos (most aggressive). Naked calls are not advised due to high IV’s.

Founder’s Note:

Merry Christmas 🎄 & Happy Hanukkah 🕎

Futures are up 15bps into today’s shortened session.

Resistance: 6,000, 6,050

Support: 5,950, 5,900

We remain risk on until/unless the SPX is >=5,950. Below 5,950 we now flip to a short stance.

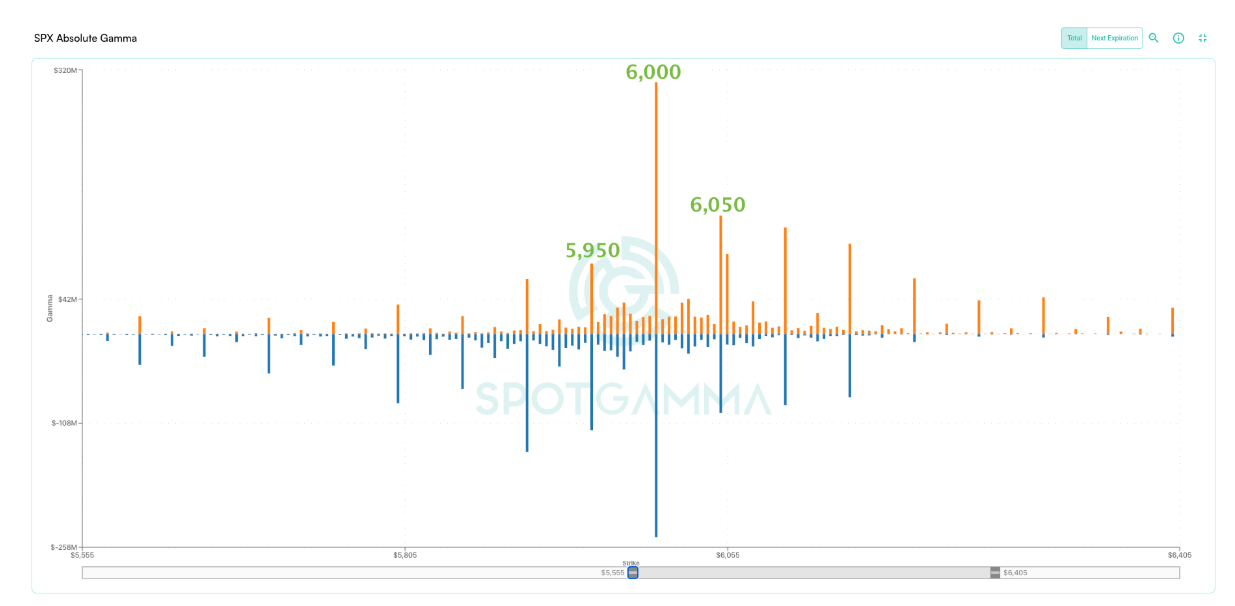

The SPX is now just ~30bps from the big 6,000 strike, which holds the most

absolute gamma

on the board. The upcoming holiday sessions are likely to tip the price scales into that level, due to the decay of put positions from last weeks decline.

We remain of the opinion that if we can close above >=6,000 today, that odds of visiting the 6,055 JPM pin into 12/31 increases sharply. If we fail to cross 6,000, it becomes something of a race against time.

In an attempt to illustrate this, we plotted the estimated gamma of the 12/31, 6,055 strike over the next 7 days. Disclaimer: This imagine is just a quick illustration of a single strike, we’ve not properly calibrated many aspects of this pricing model.

As you can see, if we are above 6k into 12/31 the gamma increases sharply into the 6,055 strike. However, if the SPX is <6,000 into Friday, the gamma of that 6,055 strike all but disappears.

Adding to the intrigue, TRACE shows that there is a small pocket of negative gamma strikes (non 0DTE, red box) at 6,000, which suggests SPX could get a small boost through that area. Those negative dealer strikes are within the context of a map that is increasingly positive in gamma >=6,000 (darker purple), which suggests market support (via positive gamma) increases into 6,050 just as gamma increases in the map, above.

On the bearish side of things, there is now a clear indication that SPX could break sharply lower if we breach 5,950 to the downside. We see this via negative gamma (red) in the TRACE map.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6038.57 | $5974 | $594 | $21503 | $522 | $2237 | $221 |

| SG Gamma Index™: |

| -0.132 | -0.218 |

|

|

|

|

| SG Implied 1-Day Move: | 0.67% | 0.67% | 0.67% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6014.57 | $5950 | $594 | $21270 | $521 | $2320 | $232 |

| Absolute Gamma Strike: | $6064.57 | $6000 | $600 | $21275 | $520 | $2250 | $220 |

| Call Wall: | $6119.57 | $6055 | $600 | $21275 | $535 | $2250 | $240 |

| Put Wall: | $5964.57 | $5900 | $590 | $20800 | $505 | $2220 | $210 |

| Zero Gamma Level: | $6003.57 | $5939 | $593 | $21128 | $522 | $2335 | $231 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.982 | 0.813 | 1.37 | 0.857 | 0.523 | 0.490 |

| Gamma Notional (MM): | $6.902M | ‑$409.483M | $9.968M | ‑$138.049M | ‑$56.029M | ‑$848.65M |

| 25 Delta Risk Reversal: | -0.049 | -0.024 | -0.054 | -0.03 | -0.03 | -0.006 |

| Call Volume: | 523.002K | 1.499M | 8.969K | 777.77K | 15.047K | 425.946K |

| Put Volume: | 835.869K | 1.979M | 8.768K | 835.437K | 30.779K | 527.412K |

| Call Open Interest: | 6.178M | 5.698M | 58.981K | 2.857M | 253.787K | 3.663M |

| Put Open Interest: | 11.79M | 10.751M | 68.821K | 5.272M | 370.577K | 6.569M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6050, 6100, 5900] |

| SPY Levels: [600, 590, 595, 605] |

| NDX Levels: [21275, 21500, 22000, 21000] |

| QQQ Levels: [520, 525, 510, 500] |

| SPX Combos: [(6249,93.39), (6225,70.90), (6201,97.04), (6177,84.53), (6147,93.54), (6129,69.54), (6123,80.63), (6100,94.92), (6088,83.63), (6076,92.58), (6058,99.04), (6052,95.52), (6040,69.35), (6034,75.12), (6028,92.85), (6022,84.98), (6016,83.02), (5998,98.63), (5986,71.65), (5950,91.37), (5938,71.38), (5932,81.76), (5926,95.72), (5920,77.68), (5914,80.49), (5902,98.68), (5884,84.15), (5878,81.37), (5873,90.50), (5867,82.09), (5849,95.36), (5825,91.80), (5801,95.63), (5777,84.29), (5747,90.10), (5723,82.48), (5699,89.82)] |

| SPY Combos: [587.96, 603.32, 577.91, 582.64] |

| NDX Combos: [21267, 21998, 20966, 20772] |

| QQQ Combos: [518.28, 509.98, 504.79, 500.12] |

0 comentarios