Macro Theme:

Key dates ahead:

- 1/8: Jobless claims, FOMC Mins

- 1/9: Market Closed: President Carter

- 1/10: NFP

- 1/14: PPI

- 1/15: CPI

- 1/17: OPEX

- 1/20: Inauguration

- 1/31: FOMC

As of 1/8: 5,800 is now major support. Any rally that fails to close >6k should be seen as a short cover rally, and subject to quick reversals.

6,050 – 6,100 is likely major resistance into 1/17 OPEX.

Key SG levels for the SPX are:

- Support: 5,870, 5800

- Resistance: 5,940, 6,000, 6,050

Founder’s Note:

Futures are 15bps lower ahead of 8:30 AM ET Jobless Claims and 2PM FOMC Mins. Eyes are also on the 30y bond auction at 1PM.

The US10Y has shifted to a new high of 4.71%, presenting a headwind for equities. With rates higher, focus will turn to the upcoming data points today, and Friday with NFP.

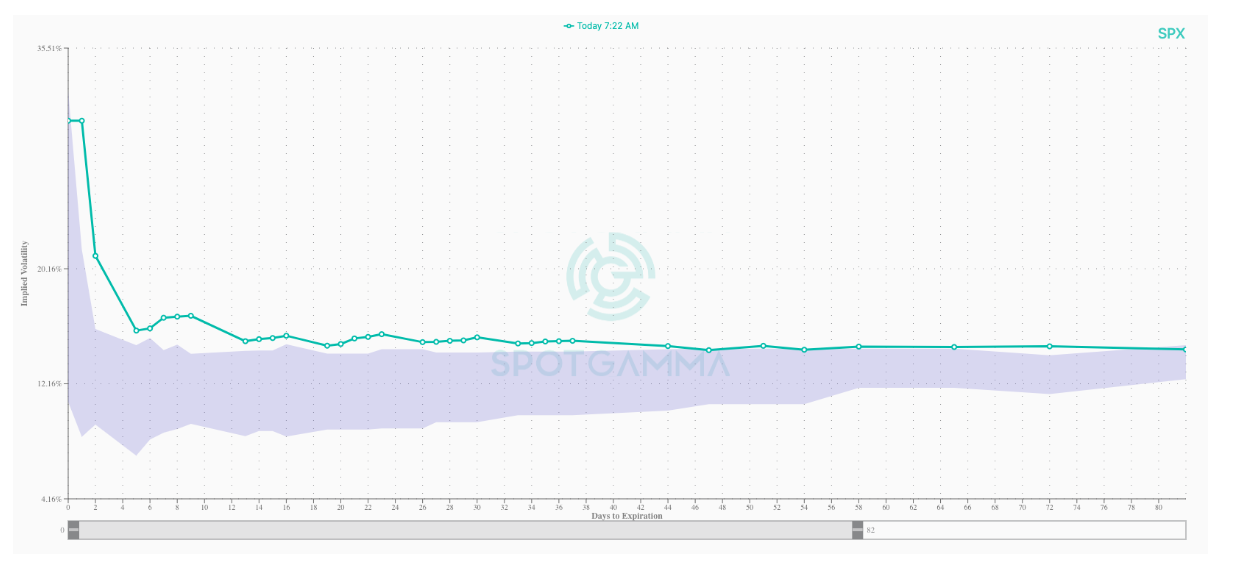

For all intents and purposes we find ourselves in a negative gamma position while the SPX is <5,900, and we so are risk-off if/when SPX trades <5,900. The assumption is that moves lower in the market will be met with higher levels of implied vol, which compounds downside hedging pressure.

Backing the notion of data-dependence, we see that short dated SPX vols are a elevated at +30%, and the 0DTE straddle is a “warm” $44/75bps (ref 5,890). That’s not exactly panic, which suggests that the equity market has not yet hit any type of stretched downside. That’s not to say things have to spill lower, but we are saying equities are no where near oversold. 5,800 is the major next level.

Negative gamma, as a first order principle, equates to high volatility. Volatility works both ways, and so we have to respect “good data” today generating a bounce. Any bounce in equities should be seen in the context of a short cover rally, and subject to fading unless we can close >6,000.

This is precisely what we warned of on Monday & yesterday AM wherein the equity bid found 0 followthrough.

So what is offering some “local” positive gamma (blue on our TRACE map)?

Look no further than Captain Condor, who yesterday had on a ~12k contract condor and has now doubled that position to a massive 30k contracts at the 5940/5,945 call spread x 5,870/5,865 put spread. There are some arguments around if this is a single entity or not, but regardless its clear that there is some “doubling down” after the condor trade was blown up yesterday. As a rough estimate the condor trade itself lost +$3mm yesterday for this entity/entities, and so this doubling down looks to recoup that. We understand that this group may dynamically hedge this position, too, and so actually loses are unknown – but the doubling down suggests that there was indeed a loss.

|

|

/ES |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$5952.97 |

$5909 |

$588 |

$21173 |

$515 |

$2249 |

$222 |

|

SG Gamma Index™: |

|

-2.16 |

-0.515 |

|

|

|

|

|

SG Implied 1-Day Move: |

0.60% |

0.60% |

0.60% |

|

|

|

|

|

SG Implied 5-Day Move: |

1.95% |

1.95% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

After open |

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

After open |

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$5983.97 |

$5940 |

$590 |

$21270 |

$515 |

$2245 |

$229 |

|

Absolute Gamma Strike: |

$6043.97 |

$6000 |

$585 |

$21275 |

$520 |

$2250 |

$220 |

|

Call Wall: |

$5988.97 |

$5945 |

$615 |

$21275 |

$530 |

$2250 |

$240 |

|

Put Wall: |

$5913.97 |

$5870 |

$585 |

$20800 |

$500 |

$2150 |

$220 |

|

Zero Gamma Level: |

$5962.97 |

$5919 |

$592 |

$21119 |

$518 |

$2313 |

$232 |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

0.759 |

0.600 |

1.017 |

0.730 |

0.622 |

0.464 |

|

Gamma Notional (MM): |

‑$667.255M |

‑$1.449B |

$793.226K |

‑$405.491M |

‑$31.939M |

‑$961.043M |

|

25 Delta Risk Reversal: |

-0.046 |

-0.026 |

-0.053 |

-0.032 |

-0.034 |

-0.013 |

|

Call Volume: |

732.935K |

1.933M |

11.799K |

1.018M |

10.942K |

312.646K |

|

Put Volume: |

1.206M |

2.283M |

11.506K |

1.229M |

21.969K |

657.16K |

|

Call Open Interest: |

6.545M |

5.639M |

59.721K |

3.004M |

236.042K |

3.405M |

|

Put Open Interest: |

12.274M |

12.619M |

71.534K |

5.079M |

375.228K |

6.92M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [6000, 5950, 5900, 6050] |

|

SPY Levels: [585, 590, 600, 595] |

|

NDX Levels: [21275, 21000, 21500, 21400] |

|

QQQ Levels: [520, 500, 510, 515] |

|

SPX Combos: [(6199,94.47), (6175,74.47), (6163,89.18), (6151,87.29), (6128,78.46), (6098,90.78), (6074,86.34), (6051,81.86), (6039,70.56), (6027,86.72), (6021,85.64), (5998,81.60), (5968,73.66), (5950,98.74), (5944,99.52), (5939,82.80), (5927,88.93), (5921,89.09), (5915,71.55), (5903,72.17), (5897,99.19), (5891,87.60), (5879,89.13), (5874,96.48), (5868,99.97), (5862,90.32), (5850,97.37), (5844,77.54), (5838,76.11), (5832,93.59), (5826,89.61), (5820,92.15), (5814,83.98), (5803,99.15), (5791,76.37), (5785,70.58), (5773,93.81), (5767,76.17), (5749,94.02), (5726,81.11), (5720,76.65), (5702,96.96), (5673,87.36), (5649,88.97), (5625,75.43), (5619,74.24)] |

|

SPY Combos: [587.66, 591.83, 592.42, 578.13] |

|

NDX Combos: [21279, 20961, 20559, 21173] |

|

QQQ Combos: [529.77, 535.01, 517.7, 519.8] |

0 comentarios