Macro Theme:

Key dates ahead:

- 1/14: PPI

- 1/15: CPI

- 1/17: OPEX

- 1/20: MLK (market closed) + Inauguration

- 1/29: FOMC

6,050 – 6,100 is likely major resistance into 1/17 OPEX.

Friday 1/10: This is a high risk environment, wherein a small trigger could elicit a tail move. Accordingly we will be risk-off/short delta on a break <5,900.

Per our update on 1/13: A break <5,750 marks positioning that could produce a tail move.

Key SG levels for the SPX are:

- Support: 5,770, 5,700

- Resistance: 5,800, 5,900

Founder’s Note:

ES futures are -70bps, NQ -100bps.

Yields are higher, with the US 10Y tagging 4.8% this AM.

All eyes are on PPI tomorrow & CPI Wednesday.

Support: 5,775, 5,750, 5,700

Resistance: 5,800, 5,900

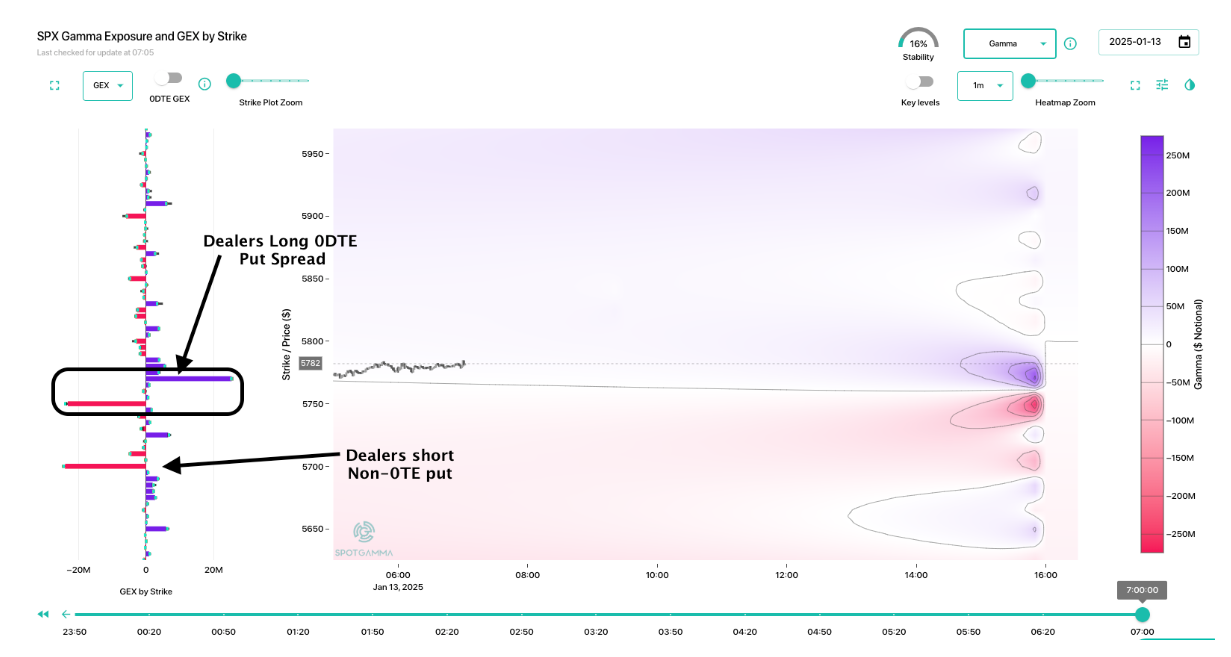

Equity futures are weak this AM, with VIX >20. We see a large, supportive 0DTE put spread (dealer long/positive gamma) at 5,770 x 5,750. Below that rests a large longer dated puts at 5,700 (dealer short put/negative gamma).

The reality is that this selling has been rather controlled, and the data implies that should the SPX break <5,750 then volatility may move substantially higher (i.e. things might get “pukey”).

A recovery above 5,800 signals a “dead cat bounce” is in play, and we see no major resistance until 5,900. Given the big data prints tomorrow/Wednesday, we think all moves must be actively traded/adjusted (day trades/roll positions, etc).

On the vol topic, we see that SPX term structure reflects higher vols around upcoming PPI/CPI, which may be the last major data points until 1/29 FOMC. However, even though futures are lower this AM we see 0DTE IV’s as rather muted. The ATM straddle is just $42/70bps (ref 5,780 IV 28.6%) – thats what futures are down overnight (where is the vol premium?)!

Consider Fridays 0DTE straddle into NFP was 90bps, and the SPX is implied to open -2.5% since the NFP.

If equities do continue to move lower, the obvious first place for a market low is into Friday’s OPEX, which is followed by Monday’s MLK observance & inauguration (market closed). That day off can stall out vol, however the ultimate “all clear” may not come until 1/29 FOMC. Around this period is when tech earnings pick up in earnest, too.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5865.87 | $5827 | $580 | $20847 | $507 | $2189 | $216 |

| SG Gamma Index™: |

| -2.662 | -0.714 |

|

|

|

|

| SG Implied 1-Day Move: | 0.64% | 0.64% | 0.64% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5963.87 | $5925 | $590 | $21100 | $510 | $2240 | $229 |

| Absolute Gamma Strike: | $6038.87 | $6000 | $585 | $21275 | $500 | $2250 | $220 |

| Call Wall: | $6238.87 | $6200 | $600 | $21275 | $530 | $2250 | $240 |

| Put Wall: | $5838.87 | $5800 | $575 | $20800 | $500 | $2000 | $210 |

| Zero Gamma Level: | $5963.87 | $5925 | $592 | $20794 | $514 | $2302 | $233 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.671 | 0.479 | 0.992 | 0.659 | 0.559 | 0.369 |

| Gamma Notional (MM): | ‑$904.198M | ‑$2.247B | ‑$481.074K | ‑$534.904M | ‑$43.676M | ‑$1.303B |

| 25 Delta Risk Reversal: | -0.049 | 0.00 | -0.052 | -0.037 | -0.04 | -0.023 |

| Call Volume: | 640.262K | 2.023M | 10.503K | 919.748K | 30.599K | 419.011K |

| Put Volume: | 1.19M | 2.592M | 14.221K | 1.102M | 74.348K | 1.168M |

| Call Open Interest: | 6.582M | 5.802M | 60.042K | 2.967M | 239.503K | 3.48M |

| Put Open Interest: | 12.294M | 12.764M | 71.145K | 5.001M | 385.978K | 7.252M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 5900, 5800, 5000] |

| SPY Levels: [585, 580, 590, 575] |

| NDX Levels: [21275, 21000, 20500, 20800] |

| QQQ Levels: [500, 510, 520, 515] |

| SPX Combos: [(6101,84.80), (6078,72.71), (6048,77.35), (6025,73.74), (6019,69.86), (5926,77.68), (5903,96.03), (5874,84.11), (5868,73.20), (5850,94.28), (5833,82.18), (5827,87.42), (5821,92.76), (5810,83.05), (5804,80.80), (5798,99.29), (5792,82.80), (5786,79.40), (5780,86.31), (5775,97.33), (5769,90.14), (5763,78.63), (5757,78.01), (5751,98.08), (5745,69.11), (5740,81.36), (5734,72.72), (5722,96.42), (5710,80.85), (5699,98.78), (5687,70.88), (5676,81.35), (5670,84.52), (5652,93.76), (5623,91.17), (5600,92.91), (5576,70.88), (5565,79.31), (5547,85.90)] |

| SPY Combos: [587.72, 577.7, 582.42, 567.68] |

| NDX Combos: [21285, 20556, 20764, 20139] |

| QQQ Combos: [517.33, 510.12, 499.81, 504.96] |

0 comentarios