Macro Theme:

Key dates ahead:

- 1/14: PPI

- 1/15: CPI

- 1/17: OPEX

- 1/20: MLK (market closed) + Inauguration

- 1/29: FOMC

6,050 – 6,100 is likely major resistance into 1/17 OPEX.

1/14: We believe traders are under-pricing volatility, as both SPX & NDX trade at a discount to realized volatility. This means that an event trigger could lead to move movement than the market expects.

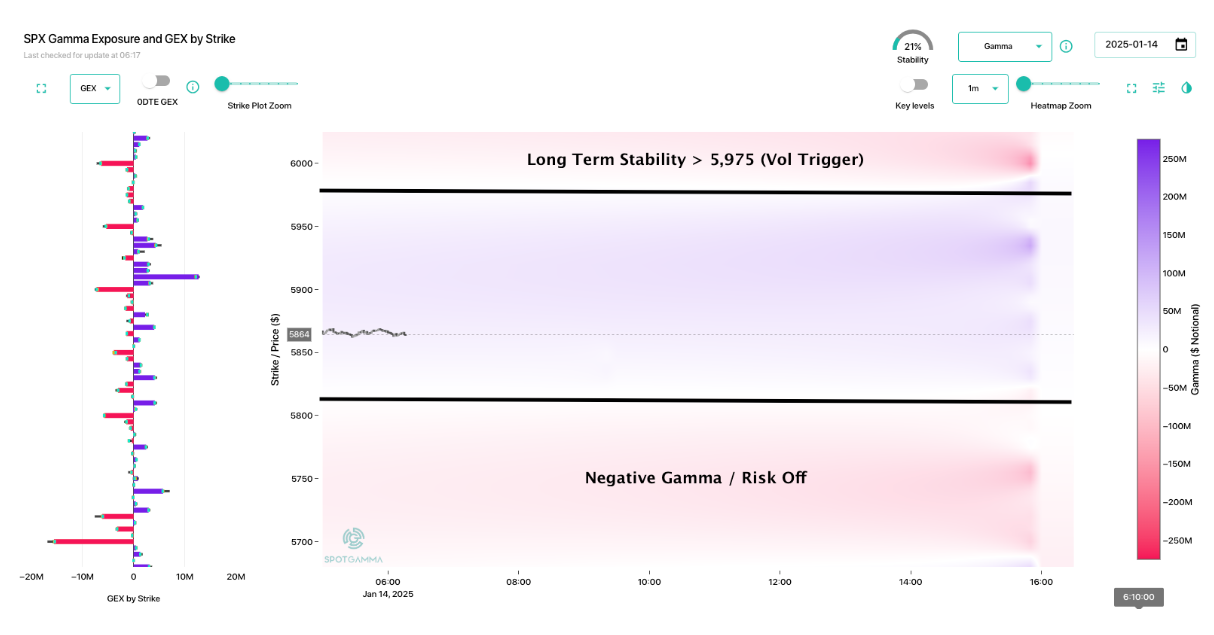

Market rallies are subject to quick & violent reversals until/unless 5,950 (vol trigger) is recovered.

We are risk off (short delta+long vol) if SPX <5,800.

Key SG levels for the SPX are:

- Support: 5,800, 5,740, 5,700

- Resistance: 5,910, 5,950

Founder’s Note:

Futures are +50bps ahead of 8:30 AM PPI.

Ahead of PPI today’s 0DTE straddle is a luke-warm $43/73bps (ref 5,865 IV 26.6%).

Resistance: 5,910, 5,950

Support: 5,800, 5,740

Rallies are likely not stable until/unless 5,975 is recovered

Risk Off/Short <5,800 due to large puts into 5,700

There is not a clear reason for the overnight market rally, but it happens into a space of negative gamma which can exacerbate movement. This means recent gains are subject to violent reversals, as we’ve seen several times over the last few weeks.

Accordingly, we could rally/sell off of PPI (today), and then sell/rally off of CPI (tomorrow), with >1% swings easily achievable.

In yesterday’s Note & Q&A we discussed the laggy implied volatility, which seems to be trading at a discount. The CBOE just put out a piece highlighting the same point, with the key column in red. This shows that implied vol is trading below realized for the SPX & Nasdaq. We broadly think this is incorrect, as we are in a negative gamma regime with plenty of catalysts in the coming days.

This stance is obvious to have if equities spill lower, as IV/VIX would surely spike. However, in the short term, we think its true (i.e. volatility is more elevated than mkt forecasts) to the upside too – at least until/unless SPX 6,000 is recaptured.

To boot, there was an interesting note from Nomura showing that historically realized vol tends to contract into earnings season, as focus shifts to single stocks (top chart). However, that is not true of January earnings season(s) (second chart), wherein realized vol tends to expand into earnings season.

This supports the the idea of betting on continued, elevated market movement vs vol contraction.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5875.34 | $5836 | $581 | $20784 | $505 | $2194 | $217 |

| SG Gamma Index™: |

| -2.399 | -0.671 |

|

|

|

|

| SG Implied 1-Day Move: | 0.67% | 0.67% | 0.67% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5939.34 | $5900 | $590 | $21100 | $510 | $2210 | $229 |

| Absolute Gamma Strike: | $6039.34 | $6000 | $580 | $21275 | $500 | $2250 | $220 |

| Call Wall: | $6239.34 | $6200 | $600 | $21275 | $530 | $2250 | $240 |

| Put Wall: | $5739.34 | $5700 | $575 | $20800 | $500 | $2000 | $210 |

| Zero Gamma Level: | $5929.34 | $5890 | $593 | $20732 | $512 | $2290 | $232 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.703 | 0.501 | 0.971 | 0.652 | 0.572 | 0.401 |

| Gamma Notional (MM): | ‑$700.714M | ‑$1.901B | $985.768K | ‑$479.11M | ‑$39.828M | ‑$1.237B |

| 25 Delta Risk Reversal: | -0.046 | 0.00 | -0.043 | -0.029 | -0.038 | -0.017 |

| Call Volume: | 530.365K | 1.557M | 9.316K | 883.174K | 14.331K | 450.605K |

| Put Volume: | 932.817K | 2.093M | 13.245K | 1.016M | 26.162K | 814.57K |

| Call Open Interest: | 6.712M | 5.926M | 61.39K | 3.048M | 244.642K | 3.604M |

| Put Open Interest: | 12.43M | 12.936M | 73.09K | 5.058M | 394.449K | 7.383M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 5900, 5800, 5950] |

| SPY Levels: [580, 585, 590, 575] |

| NDX Levels: [21275, 21000, 20500, 20800] |

| QQQ Levels: [500, 510, 505, 520] |

| SPX Combos: [(6122,71.01), (6099,84.35), (6052,82.17), (6023,70.55), (6017,73.83), (5924,81.33), (5912,73.28), (5900,94.76), (5871,70.97), (5848,94.33), (5825,83.63), (5819,90.62), (5813,80.91), (5801,99.09), (5790,79.82), (5778,94.15), (5772,94.74), (5760,82.77), (5749,97.27), (5743,94.80), (5731,77.89), (5725,87.38), (5719,92.27), (5708,85.37), (5702,99.03), (5690,68.57), (5679,75.32), (5673,93.67), (5649,92.99), (5638,71.38), (5626,81.78), (5620,83.77), (5603,93.71), (5574,70.05), (5568,86.95), (5550,86.23)] |

| SPY Combos: [577.61, 567.74, 572.96, 575.29] |

| NDX Combos: [21284, 20556, 20140, 20348] |

| QQQ Combos: [517.87, 500.12, 505.19, 489.97] |

0 comentarios