Macro Theme:

Key dates ahead:

- 2/7: NFP

- 2/12: CPI

- 2/21: OPEX

- 2/26: NVDA ER

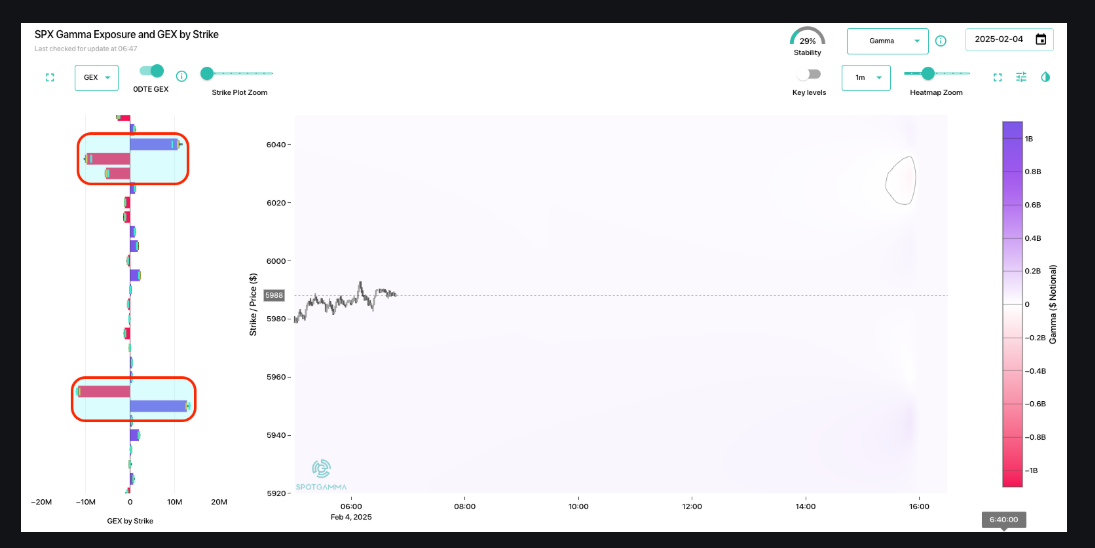

We flip to risk-off as SPX traded <6,000.

The 6k price level remains a sensitive spot for SPX, as major declines can occur from this “simmering” but not “ovepriced” vol position.

Key SG levels for the SPX are:

- Resistance: 6,020, 6,050, 6,100

- Support: 6,000, 5,950, 5,900, 5,800

Founder’s Note:

Futures are flat.

Resistance: 6,020, 6,050, 6,100

Support: 6,000, 5,950

TLDR: Gamma is flat, and IV remains elevated. Options positioning remains poised to push price today, with 6,050 and 5,950 today’s key zones. Lack of negative headlines likely leads to positive drift higher, as IVs should naturally contract. However, one bad headline could easily push SPX back to the 5,950 level. For this reason we recommend playing upside with fixed-risk call/call spread positions.

Captain Condor is back, with ~3k contracts at the 6,035 x 6,040 call spread by 5,955 x 5,059 put spread. These positions are much smaller than recent condor size, which has been often >12k contracts and as much as 30k. Muddling things are additional, similarly sized 0DTE positions layered around these respective spreads.

Therefore, while the Captain’s position is small, the other layered positions combine to provide prime SPX price target areas – particularly if any possible tariff headline(s) come across the wires.

We had some discussion in yesterday’s Q&A about ways to play various moves, particularly higher prices. In particular, META game up as the stock is at all time highs with low IV & skew. That skew has slid a bit higher with overnight calcs, but as you can see the equity index site remains fairly low-ranked both in terms of IV & skew. This suggests that hedging/playing upside via SPY/QQQ calls (and plot-adjacent names) is reasonable.

Additionally we noted that GLD (bottom, green box), while it has an average IV, it has a low skew rank into the face of ATH’s. From a first principle, low skew suggests that the move in GLD is not overbought as it is with China (top, red box).

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6019.63 | $5994 | $597 | $21297 | $518 | $2258 | $223 |

| SG Gamma Index™: |

| -0.853 | -0.336 |

|

|

|

|

| SG Implied 1-Day Move: | 0.64% | 0.64% | 0.64% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6050.63 | $6025 | $600 | $21440 | $520 | $2280 | $226 |

| Absolute Gamma Strike: | $6025.63 | $6000 | $600 | $21450 | $510 | $2300 | $220 |

| Call Wall: | $6225.63 | $6200 | $620 | $21450 | $535 | $2285 | $235 |

| Put Wall: | $5925.63 | $5900 | $590 | $21000 | $510 | $2200 | $220 |

| Zero Gamma Level: | $6029.63 | $6004 | $601 | $21084 | $525 | $2304 | $234 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.889 | 0.701 | 1.122 | 0.681 | 0.660 | 0.458 |

| Gamma Notional (MM): | ‑$331.881M | ‑$993.173M | $2.133M | ‑$462.589M | ‑$33.45M | ‑$935.74M |

| 25 Delta Risk Reversal: | -0.049 | -0.028 | -0.055 | 0.00 | -0.039 | -0.019 |

| Call Volume: | 539.715K | 1.845M | 8.361K | 788.762K | 13.348K | 296.635K |

| Put Volume: | 937.107K | 2.807M | 10.186K | 996.495K | 28.571K | 987.056K |

| Call Open Interest: | 6.457M | 5.433M | 61.826K | 2.538M | 233.11K | 2.918M |

| Put Open Interest: | 11.984M | 11.754M | 72.372K | 4.60M | 393.652K | 6.80M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6100, 6050, 5950] |

| SPY Levels: [600, 590, 595, 605] |

| NDX Levels: [21450, 21000, 21400, 22000] |

| QQQ Levels: [510, 520, 500, 515] |

| SPX Combos: [(6276,71.23), (6252,94.35), (6222,85.36), (6216,81.05), (6198,97.72), (6174,85.50), (6168,78.97), (6162,95.01), (6150,94.32), (6126,87.24), (6120,78.50), (6108,71.57), (6102,95.94), (6096,71.69), (6072,87.32), (6049,81.96), (6043,74.18), (6001,92.80), (5977,87.54), (5971,84.55), (5959,73.47), (5953,96.60), (5947,79.38), (5935,73.65), (5929,89.04), (5923,91.29), (5917,87.06), (5911,81.44), (5899,96.12), (5893,76.37), (5875,75.97), (5869,80.84), (5863,70.94), (5851,93.48), (5833,69.29), (5827,85.78), (5815,81.66), (5803,96.00), (5773,74.67), (5767,69.73), (5749,88.93), (5725,69.92), (5719,77.04), (5701,92.57)] |

| SPY Combos: [617.47, 627.7, 614.46, 607.84] |

| NDX Combos: [21447, 20957, 20552, 22000] |

| QQQ Combos: [521.77, 509.76, 534.82, 499.83] |

0 comentarios