Macro Theme:

Key dates ahead:

- 2/12: CPI + Powell Testimony

- 2/21: OPEX

- 2/26: NVDA ER

On 2/11 we recommended buying SPX ~1-month calls as a way to hedge a right tail move. Our data suggests calls are cheap (ex: 3/13 exp 25 delta call = 10.6% IV ref 6,200).

We flip to risk-off/short delta if SPX trades <6,000.

6,100 – 6,120 is a major band of resistance into 2/12 CPI.

Key SG levels for the SPX are:

- Resistance: 6,100, 6,120

- Support: 6,025, 6,000

Founder’s Note:

Futures are flat ahead of 8:30 AM ET CPI + Powell testimony 10AM.

Resistance: 6,100

Support: 6,025, 6,000

A break <6k is “risk off”, and we’d look for a quick test of 5,950.

While the investing world focuses on how important this print is, options pricing suggests a relative lack of enthusiasm. The 0DTE straddle is a pretty average $38/62bps (ref 6,065, IV 23.5%). This pricing is interesting given that major overhead resistance is 6,100 (+35 handles), and support is in the 6,025-6,000 area (-40 handles). Given this ($38 straddle vs 40 handles to support/resistance) it seems like the CPI move is fairly valued.

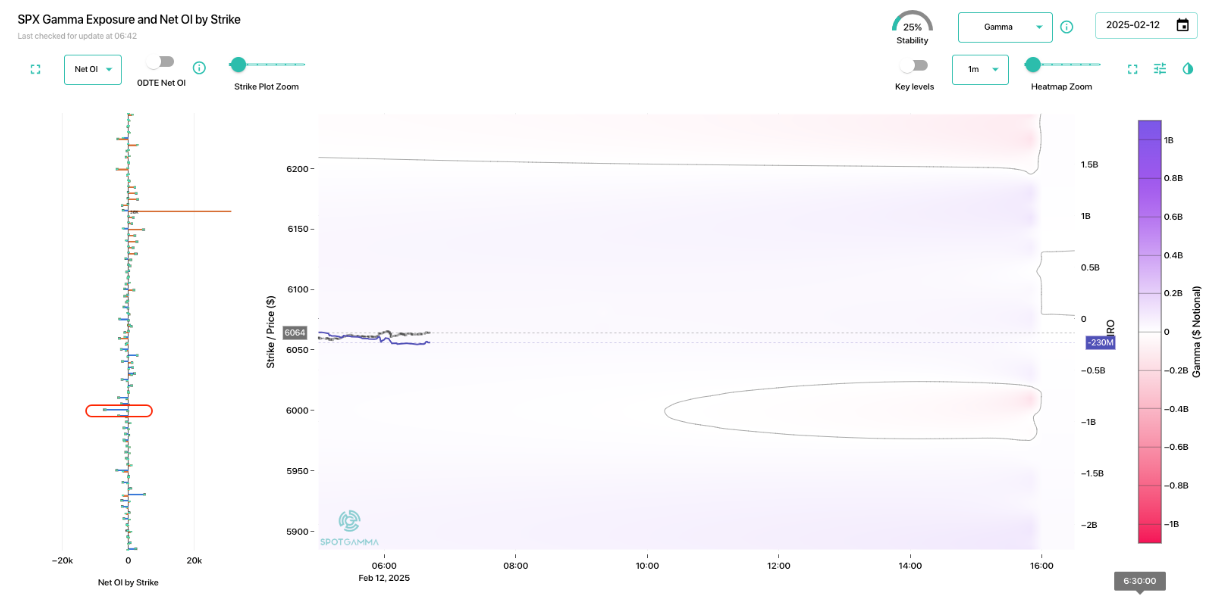

Overall we see that SPX gamma is quite flat (allowing for price movement), as depicted in the very light shade of blue in the TRACE map. We also highlight a fairly chunky long 7k 0DTE put position (dealer short) at 6k. If the CPI is a hot tail that could activate this put, which can accelerate downside. Also note that the massive short upside strike (dealer long) at 6,165 (orange bar) is the JPM call for 3/31 OPEX – and while that is not (yet) a “pinning” area (March OPEX is too far), it is a strike that will get a lot of attention if the market rallies.

Zooming out, we’ve been framing SPX vol into this event as rather low, and we’re looking for CPI to spark a move outside of the 6,000-6,100 box that has contained the SPX since January OPEX. Quite frankly we do not have an edge on which direction price will break.

We have, however, been making the case that vol is, at worst, fairly valued, and maybe even cheap. For this reason we yesterday recommended buying 1-month SPX calls to hedge a move higher/right tail. A similar case can be made to own downside puts, given the SPX IV Rank is 15% (ranks are in EquityHub, see yesterday’s note).

Shown below is the SPX vol premium (1-month implied vol – 1-month realized vol), and as you can see the premium is both flat, and near its lowest levels of the past year. (We note the premium went negative after the August ’24 VIX spike as IV collapsed from massive highs). This suggests that for IV to contract further we’d really have to have the market stall out which would allow realized vol to drop. 1-month realized vol is 13%, and it could contract to ~10%, which would likely render our long vol idea wrong. Plus, given a cadre of catalysts over the next few weeks (tariffs, OPEX, NVDA ER) we suspect SPX will continue to move/jump.

The lack of vol is also appearing in single stocks, despite heavy price action.

Consider TSLA, which is down 30% this month and -50% from Dec highs. You can see that the ATM vol (red) has been declining as the stock reversed, which suggests that a heavy long call contingent is getting burned (call buying generated stock up, vol up post election).

We’d imagine that if traders were recently buying puts vol would increase as the stock declined, but its been “stock down, vol down”.

That being said, yesterday saw some big long dated put buying (via

HIRO

) as TSLA options had the highest volume of any single stock (as per Tape), and we now see a lot of put positions now at $300 (major support level).

Buying puts with the stock down 30% in a month feels like “shorting in the hole”, but the vol action speaks to our larger point: options traders do not seem to be positioning for longer term, more convex downside. Since Trump has taken office we have consistently felt one tariff headline away from a protracted downside move, but bears have not taken the bait. This has us on watch for the idea of one last upside move, as markets that don’t drop with bad news might rip on good news – and one could argue major single stocks have some room to rally. This takes us back to expressing this view with “cheap” (& fixed risk) upside SPX calls.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6092.95 | $6068 | $605 | $21693 | $527 | $2275 | $225 |

| SG Gamma Index™: |

| 0.618 | -0.177 |

|

|

|

|

| SG Implied 1-Day Move: | 0.59% | 0.59% | 0.59% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6084.95 | $6060 | $603 | $21440 | $527 | $2280 | $227 |

| Absolute Gamma Strike: | $6024.95 | $6000 | $600 | $21450 | $530 | $2300 | $220 |

| Call Wall: | $6224.95 | $6200 | $610 | $21450 | $530 | $2285 | $235 |

| Put Wall: | $5924.95 | $5900 | $600 | $21000 | $510 | $2200 | $220 |

| Zero Gamma Level: | $6057.95 | $6033 | $604 | $21315 | $527 | $2304 | $230 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.076 | 0.846 | 1.42 | 0.830 | 0.787 | 0.552 |

| Gamma Notional (MM): | $246.208M | ‑$245.10M | $10.004M | ‑$164.191M | ‑$21.256M | ‑$728.211M |

| 25 Delta Risk Reversal: | -0.041 | -0.023 | -0.048 | -0.029 | -0.029 | -0.009 |

| Call Volume: | 342.715K | 876.029K | 6.402K | 521.071K | 8.682K | 263.215K |

| Put Volume: | 695.365K | 1.471M | 8.623K | 728.492K | 20.073K | 467.048K |

| Call Open Interest: | 6.747M | 5.53M | 63.033K | 2.566M | 246.77K | 3.125M |

| Put Open Interest: | 12.528M | 12.315M | 74.481K | 4.758M | 398.873K | 7.091M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6100, 6150, 6050] |

| SPY Levels: [600, 605, 595, 610] |

| NDX Levels: [21450, 22000, 21400, 21500] |

| QQQ Levels: [530, 520, 525, 510] |

| SPX Combos: [(6348,86.44), (6323,71.08), (6299,97.06), (6275,76.34), (6269,68.53), (6251,95.66), (6226,86.48), (6214,85.00), (6202,99.23), (6178,96.16), (6172,75.51), (6166,98.09), (6160,87.56), (6153,72.77), (6147,99.40), (6141,82.00), (6135,83.42), (6129,89.00), (6123,93.12), (6117,97.25), (6111,92.77), (6105,84.74), (6099,98.46), (6093,94.55), (6075,84.23), (6044,79.68), (6032,79.05), (6026,82.45), (6014,90.68), (6008,86.87), (6002,96.25), (5996,76.66), (5990,71.23), (5977,91.27), (5965,86.67), (5947,93.86), (5929,77.75), (5923,86.31), (5917,79.74), (5899,96.56), (5874,75.02), (5868,72.91), (5850,87.93), (5826,79.30), (5814,73.91), (5801,93.30), (5777,82.92)] |

| SPY Combos: [608.48, 618.16, 613.32, 610.9] |

| NDX Combos: [21455, 21780, 21976, 20956] |

| QQQ Combos: [521.84, 535.07, 539.84, 510.2] |

0 comentarios