Macro Theme:

Key dates ahead:

- 2/26: NVDA ER

- 2/27: GDP

- 2/28: PCE

On 2/11 we recommended buying SPX ~1-month calls as a way to hedge a right tail move. Our data suggests calls are cheap (ex: 3/13 exp 25 delta call = 10.6% IV ref 6,200).

Update (2/20): We flip to risk-off/short delta if SPX trades <6,100.

Key SG levels for the SPX are:

- Resistance: 6,050, 6,069, 6,100

- Support: 6,025, 6,000, 5,953, 5,900

Founder’s Note:

Futures are +50bps, with no major data points today.

Resistance: 6,050, 6,069, 6,100

Support: 6,020, 6,000, 5,953, 5,900

“Liquidity Holes”

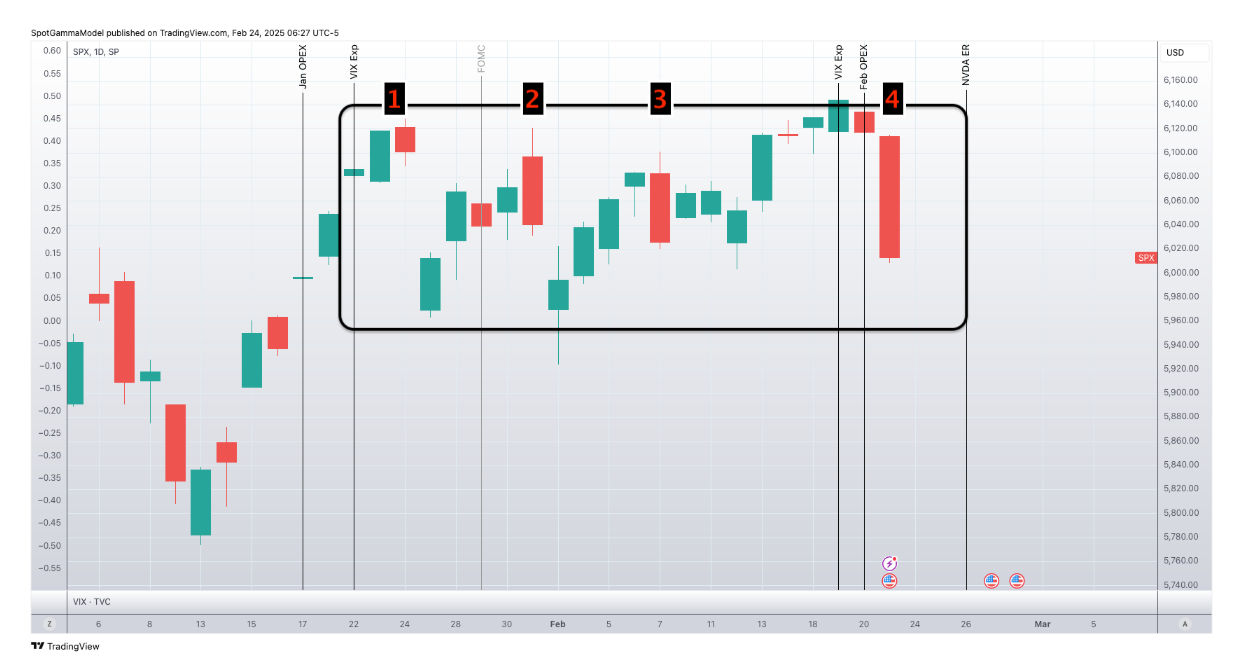

Friday was 4th Friday out of the last 5 that saw a nasty, bid-less rejection from the ~6,100 level, with the SPX finding support at 5,950-6,000.

Some may want to blame the most recent Friday selling to an OPEX “window of weakness”, however SpotGamma’s view was that we did not see much gamma expiring on 2/21. As we covered on Friday’s PM note, once SPX lost our risk-off 6,100 level, the flows went negative in a hot & heavy way with heavy single stock negative

HIRO/

deltas.

This type of jump risk traders have had to deal with “on the regular”, and a prime reason we have been focused on long calls (fixed risk) as the way to express upside: because 4 times now it seemed an equity breakout was imminent, only to give way – violently.

The jumps have also been a reason that we’ve recently recommended longer dated (3-6 month) put spreads. We’ve laid out these dynamics several times over the last 1-2 weeks, with a full breakdown video here.

Friday’s move seemed to reinforce these downside themes, and we are growing increasingly concerned that we’re on the precipices of a downside “August ’24” move that sticks (vs immediately bouncing). On that point AM’s dead-cat bounce doesn’t feel all that stable…but we’ll need a catalyst which likely doesn’t come until later this week.

While futures are rebounding this AM, focus is on NVDA earnings Wed 2/26, a slew of econ data on 2/27, and PCE on 2/28. This data is perturbing the SPX term structure, with SPX IV’s now 1/2-1 vol pt higher today than vs Friday. It will likely be tough to crush any vol premium before these events, which removes vanna as a driver of long equity flows.

Recently, the main flow generating negative deltas has been call selling, as shown below in the depressed 1-month SPY call skew (red box). Call selling is distinctly different from put buying due to the hedging obligations they foist onto dealers: call values go to zero as stocks move lower (reducing the need for dealers to short), while puts increase in value if markets drop (resulting in heavier shorting).

Puts are holding an elevated skew as traders are owning some tail risk protection, but that is against a backdrop of low volatility premium (i.e. there is a put skew but relative vols are low w/VIX ~17).

We think those trader long tail puts are largely down in the <5,500 SPX level, which don’t start to wake up in value (and dealer hedging obligations) unless we get a major 3-5% drawdown from here (i.e. ~5,900) and/or VIX >20. There is also the big VIX vega that is invoked if VIX moves into 25.

Should the SPX lose 5,950 we’ll be assuming crash positions as we think these downside hedges would “catch” and be a major driver of downside.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6037.95 | $6013 | $600 | $21614 | $526 | $2195 | $217 |

| SG Gamma Index™: |

| -2.254 | -0.432 |

|

|

|

|

| SG Implied 1-Day Move: | 0.60% | 0.60% | 0.60% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6074.95 | $6050 | $603 | $21940 | $530 | $2210 | $226 |

| Absolute Gamma Strike: | $6024.95 | $6000 | $600 | $21950 | $530 | $2300 | $215 |

| Call Wall: | $6224.95 | $6200 | $620 | $21950 | $550 | $2235 | $235 |

| Put Wall: | $5924.95 | $5900 | $595 | $21920 | $520 | $2100 | $215 |

| Zero Gamma Level: | $6093.95 | $6069 | $603 | $21722 | $529 | $2274 | $232 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.756 | 0.643 | 0.802 | 0.648 | 0.581 | 0.334 |

| Gamma Notional (MM): | ‑$765.80M | ‑$1.25B | ‑$7.405M | ‑$517.986M | ‑$55.879M | ‑$1.385B |

| 25 Delta Risk Reversal: | -0.057 | 0.00 | -0.065 | -0.049 | -0.046 | -0.041 |

| Call Volume: | 654.75K | 2.212M | 25.401K | 1.026M | 45.194K | 497.177K |

| Put Volume: | 1.343M | 3.353M | 19.647K | 1.22M | 78.754K | 1.479M |

| Call Open Interest: | 6.404M | 5.428M | 64.483K | 2.534M | 248.486K | 2.792M |

| Put Open Interest: | 12.143M | 11.038M | 74.964K | 4.612M | 409.395K | 6.76M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6100, 6050, 6150] |

| SPY Levels: [600, 595, 605, 590] |

| NDX Levels: [21950, 22000, 21400, 21900] |

| QQQ Levels: [530, 520, 525, 510] |

| SPX Combos: [(6302,94.42), (6278,74.86), (6248,94.93), (6224,78.86), (6212,83.32), (6200,97.96), (6188,72.13), (6175,88.63), (6163,96.15), (6157,74.93), (6151,94.52), (6127,79.78), (6115,76.23), (6097,91.34), (6085,70.47), (6055,74.55), (6049,90.28), (6043,71.77), (6037,81.01), (6031,81.77), (6025,86.02), (6019,77.82), (6013,90.04), (6007,91.70), (6001,98.62), (5995,93.18), (5989,89.29), (5983,86.74), (5977,97.75), (5971,86.43), (5965,97.04), (5959,91.12), (5953,98.73), (5941,80.07), (5935,74.91), (5923,91.28), (5911,90.00), (5899,98.41), (5893,72.36), (5875,84.25), (5869,75.75), (5863,85.72), (5851,92.98), (5827,81.19), (5815,78.81), (5803,96.24), (5773,80.56), (5761,78.50), (5749,89.32), (5724,73.12)] |

| SPY Combos: [618.33, 613.44, 615.27, 615.88] |

| NDX Combos: [21960, 21355, 20944, 21571] |

| QQQ Combos: [539.88, 545.25, 550.08, 520] |

0 comentarios