Macro Theme:

Key dates ahead:

- 3/3 ISM Manufacturing PMI

- 3/5 ISM Services PMI

- 3/7 NFP/Powell

Risk On: >6,000

Risk Off: <5,975

Key SG levels for the SPX are:

- Resistance: 6,000

- Support: 5,964, 5,900

Founder’s Note:

Futures are 50bps higher, boosted by crypto FOMO (BTC +8%).

TLDR: Heavy resistance at 6k, with a soft-market underbelly. We are suspicious of this rally until/unless 6k is recovered, and are are risk off on a break <5,975 and we low to negative gamma down to 5,800.

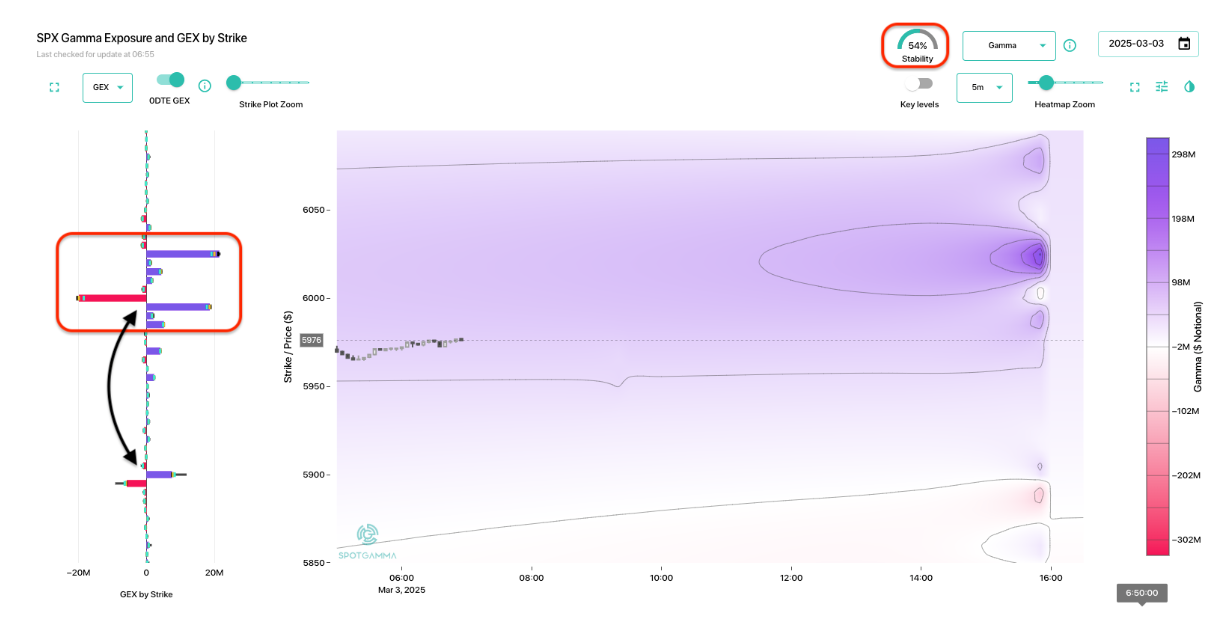

The overnight move higher places the SPX back within ear-shot of 6,000 resistance. At that strike we see the invocation of positive gamma (red box, left), which should reduce volatility (thus the higher TRACE stability readings, top right).

We also see our friend*, Captain Condor, back at it with a ~4k contract 0DTE SPX condor at:

- 5,995 x 6,000 call spread (adds to that 6k resistance)

- 5,900 x 5,895 put spread

Marked below with the black arrow.

Our concern here lies with the aforementioned “soft underbelly”. Friday’s 2 hour, +100 handle SPX move was the combination of negative dealer gamma, and massive positive deltas (see Sunday Note). That is very unstable stuff, and typically something you only see during bear market rallies.

The movement higher is also a lot of volatility, and so we see fixed strike SPX vols higher this morning than vs Friday night (shown by the green matrix, below). Yes, there is a bit of a Monday effect to IV’s (elevating them), but we will be watching them closely into the open. If vols decline then its a signal of “belief” in this rally, particularly if the SPX can regain 6k. At the same time, this bounce could have simply removed a bit of Friday’s oversold condition (ex: VIX +22), and given bears another shot.

We should note that Trump’s “Crypto Strategic Reserve” tweet has spiked cryptos, with retail fan favories like MSTR (+13%) ripping. Seeing how

HIRO

reacts to these fresh highs will also likely be a key indicator. By default we assume there will be some call selling/negative

HIRO

readings after the open, but lets see…

We will end here with our key concern: the liqudity hole beneath.

If we zoom out on TRACE we can see that SPX gamma <5,950 is flat to negative, which suggests lack of support/slippery downside price action if this rally gives way.

*We don’t now who Captain Condor is, but we’re open to new friends.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5964.36 | $5954 | $594 | $20884 | $508 | $2163 | $214 |

| SG Gamma Index™: |

| -2.216 | -0.537 |

|

|

|

|

| SG Implied 1-Day Move: | 0.64% | 0.64% | 0.64% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6010.36 | $6000 | $595 | $21100 | $520 | $2210 | $220 |

| Absolute Gamma Strike: | $6010.36 | $6000 | $600 | $21950 | $500 | $2300 | $215 |

| Call Wall: | $6210.36 | $6200 | $620 | $21950 | $540 | $2235 | $219 |

| Put Wall: | $5810.36 | $5800 | $580 | $20000 | $500 | $2100 | $215 |

| Zero Gamma Level: | $5974.36 | $5964 | $597 | $20988 | $518 | $2240 | $231 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.750 | 0.556 | 0.708 | 0.546 | 0.518 | 0.341 |

| Gamma Notional (MM): | ‑$352.126M | ‑$889.045M | ‑$4.198M | ‑$506.193M | ‑$52.483M | ‑$1.316B |

| 25 Delta Risk Reversal: | -0.058 | -0.053 | -0.067 | -0.053 | -0.045 | -0.038 |

| Call Volume: | 644.87K | 1.991M | 10.335K | 1.078M | 18.378K | 408.945K |

| Put Volume: | 1.145M | 2.666M | 14.297K | 1.388M | 39.239K | 877.95K |

| Call Open Interest: | 6.735M | 5.615M | 66.302K | 2.819M | 261.394K | 3.192M |

| Put Open Interest: | 12.366M | 11.125M | 81.553K | 4.698M | 428.278K | 7.303M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 5900, 6100, 5000] |

| SPY Levels: [600, 590, 580, 585] |

| NDX Levels: [21950, 21000, 22000, 21400] |

| QQQ Levels: [500, 510, 515, 490] |

| SPX Combos: [(6222,69.73), (6199,94.66), (6175,77.99), (6163,93.19), (6151,87.77), (6097,89.80), (5972,77.44), (5925,76.80), (5913,90.43), (5901,97.92), (5895,83.75), (5877,89.76), (5871,86.53), (5865,88.92), (5847,96.11), (5841,75.70), (5824,90.00), (5818,69.76), (5812,94.16), (5800,98.49), (5782,73.71), (5776,87.62), (5764,84.60), (5752,96.17), (5722,88.78), (5710,85.86), (5698,96.02), (5675,87.09), (5663,81.91)] |

| SPY Combos: [578.6, 589.14, 583.87, 568.66] |

| NDX Combos: [20133, 20550, 20341, 20968] |

| QQQ Combos: [499.83, 489.82, 479.82, 509.84] |

0 comentarios