Macro Theme:

Key dates ahead:

- 3/6 Jobless Claims

- 3/7 NFP/Powell

- 3/18 VIX expiration (Tuesday)

- 3/21: OPEX

- 4/2: Tariff Deadline

3/4: We see signs of a “capitulatory” downside move waiting in the wings. As such, we do not want to be short puts/short vol. Dip buyers likely want to express that view instead with call spreads.

Key SG levels for the SPX are:

- Resistance: 5,800, 5,880, 5,900

- Support: 5,775, 5,749, 5,700, 5,651

Founder’s Note:

Futures are 1% lower ahead of 8:30 AM Jobs data.

Like a broken record, major +1% gains to yesterday’s 5,850 close were just evaporated. TRACE reflects low Stability (indicating another volatile session), and the Captain is back with a very large 19k Condor. This is the 4th round of this trade, after this trader(s) lost on Monday, sized up & lost on Tuesday, then sized up yesterday, and lost.

Today is ~19k of the:

call spread: 5,900 x 5,905

put spread: 5,775 x 5,770

On Tuesday AM the market dropped ~80 handles to tag the put spread of this condor. Yesterday the market pinned to the call spread of this condor. Today, with bigger size on deck, the overnight futures drop is already on the put spread.

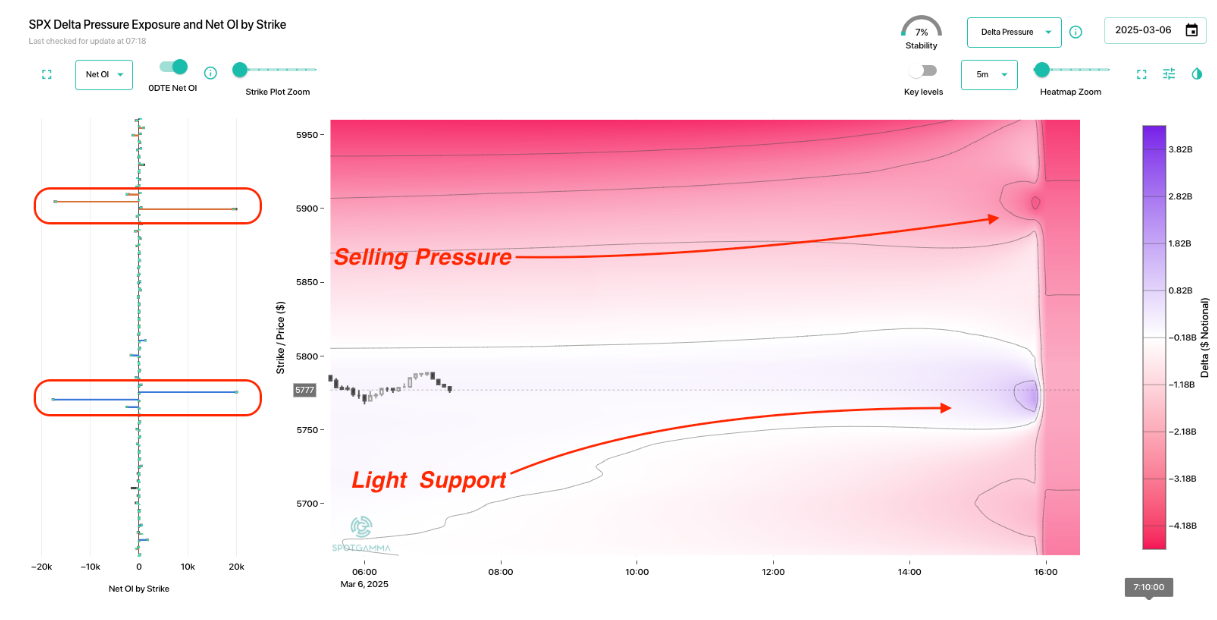

Today is a bit different in that the delta pressure this AM shows some buying support below and selling pressure above. Yesterday it was the opposite, suggesting dealers might be buying into strength and selling weakness.

Today’s implied support (blue on TRACE) is being provided by large dealer long puts (traders short puts) at 5,725 & 5,680. We also note the heavily watched 200 day SPX MA is around 5,725.

What is interesting about this market is that the surprise came when the equity market held those +1% afternoon gains into the close, rather than giving them up at the close. Given there is so much short dated flow chasing price into negative gamma voids, we’d expect price to continue to be transient/unstable.

A big part of this instability, as we covered in detail yesterday, is that high levels of both realized & implied volatility are likely to be sticky until there is a concrete trade deal, vs the headline-based 0DTE swings which are so prevalent. This dynamic makes shorting puts/vol for anything more than a swing trade seem rather dangerous. A concrete deal is needed for that longer dated IV to release lower, providing a more lasting supply of vanna.

Shown here is the Fixed Strike SPX matrix comparing SPX IV from Tuesday night (SPX closed ~5,775) vs this AM (SPX is back to 5,775). As you can see there is a very mild IV 1/3 vol pt contraction over this period for expirations out past this week. This contraction may simply be because the SOTU passed without major incident on Tuesday night (releasing event vol).

Once we get some type of tangible rate/tariff update we would expect to see vols much more meaningfully contract, which should provide a more lasting equity tailwind.

Obviously if this all instead goes full “Trade War”, then downside would get very capitulatory.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5849.85 | $5842 | $583 | $20628 | $502 | $2100 | $208 |

| SG Gamma Index™: |

| -2.322 | -0.584 |

|

|

|

|

| SG Implied 1-Day Move: | 0.67% | 0.67% | 0.67% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5887.85 | $5880 | $591 | $21030 | $510 | $2150 | $220 |

| Absolute Gamma Strike: | $6007.85 | $6000 | $600 | $21950 | $500 | $2100 | $215 |

| Call Wall: | $5912.85 | $5905 | $610 | $21950 | $535 | $2235 | $240 |

| Put Wall: | $5807.85 | $5800 | $580 | $19000 | $490 | $2100 | $215 |

| Zero Gamma Level: | $5948.85 | $5941 | $595 | $20731 | $512 | $2225 | $229 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.736 | 0.524 | 0.825 | 0.689 | 0.486 | 0.325 |

| Gamma Notional (MM): | ‑$798.202M | ‑$1.867B | ‑$5.105M | ‑$465.632M | ‑$67.448M | ‑$1.613B |

| 25 Delta Risk Reversal: | -0.066 | -0.058 | -0.072 | -0.055 | -0.051 | -0.043 |

| Call Volume: | 557.851K | 2.16M | 8.655K | 1.124M | 19.067K | 448.613K |

| Put Volume: | 883.59K | 2.653M | 9.123K | 1.012M | 28.101K | 961.99K |

| Call Open Interest: | 7.079M | 6.176M | 71.16K | 3.149M | 280.192K | 3.631M |

| Put Open Interest: | 12.697M | 11.869M | 83.406K | 4.94M | 450.429K | 7.873M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 5900, 5000, 5800] |

| SPY Levels: [600, 580, 590, 575] |

| NDX Levels: [21950, 21000, 22000, 21400] |

| QQQ Levels: [500, 510, 515, 490] |

| SPX Combos: [(6100,88.27), (6047,72.66), (5907,94.33), (5901,88.46), (5878,81.65), (5872,74.53), (5860,77.63), (5848,86.59), (5843,72.24), (5825,85.13), (5813,87.53), (5808,78.29), (5802,98.33), (5790,68.98), (5778,69.30), (5773,99.30), (5761,90.77), (5749,95.66), (5743,76.29), (5737,68.78), (5732,70.13), (5726,86.47), (5720,77.09), (5714,88.18), (5708,69.65), (5702,98.45), (5691,68.82), (5679,68.17), (5673,89.84), (5662,88.49), (5650,96.53), (5632,71.80), (5626,84.73), (5609,84.51), (5597,95.46), (5574,77.39), (5562,89.64)] |

| SPY Combos: [568.8, 579.19, 564.19, 574] |

| NDX Combos: [20133, 19721, 20546, 19927] |

| QQQ Combos: [490.06, 480.15, 499.97, 485.1] |

0 comentarios