Macro Theme:

Key dates ahead:

- 3/12: CPI

- 3/18: VIX expiration (Tuesday)

- 3/19: FOMC

- 3/21: OPEX

- 3/31: Q-End OPEX

- 4/2: Tariff Deadline

3/11: Having now seen some capitulation into 3/11 and SPX 5,565, we are looking for a short term oversold bounce into the ±5,750 area. Call credit spreads & call 1×2’s are our preferred way to play a market recovery.

3/10: A lot of things now seem to be lining up at the end of the month to be a material low in markets, as very large expirations (VIX: 3/18, OPEX 3/21, Q End EXP 3/31) may line up with concrete tariff announcements (4/2). Further, the price area of 5,500 comes into view as major long term support as its the last downside pocket of large put open interest, which includes the JPM Collar Strike.

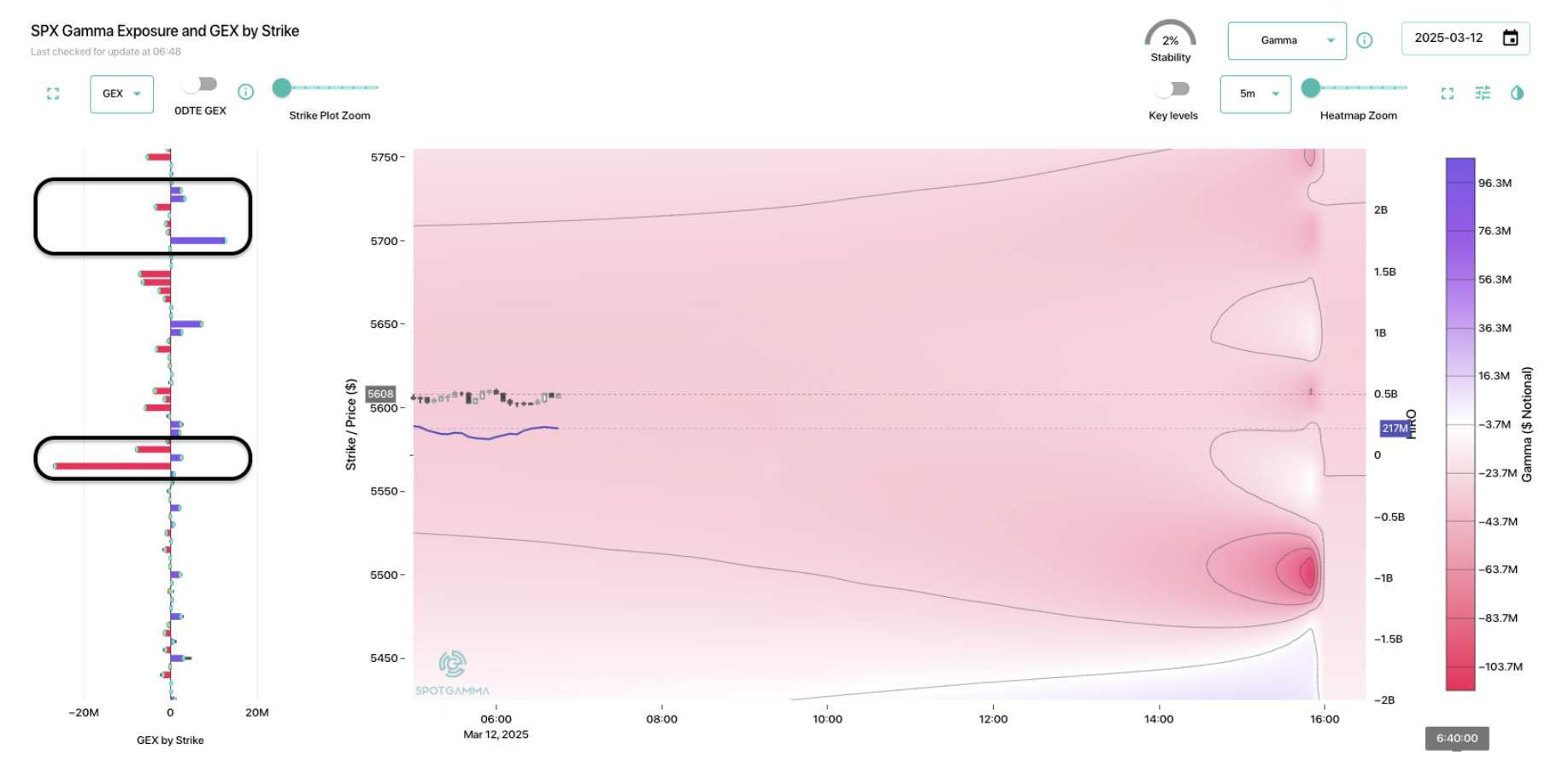

Key SG levels for the SPX are:

- Resistance: 5,700, 5,800

- Support: 5,600, 5,565, 5500

Founder’s Note:

Futures are 65bps higher ahead of 8:30AM ET CPI.

Equities are priced to move today, with the 0DTE straddle a hot $72 or 120bps (ref 5,610, IV 47%). That does not seem all that rich given the large ~100 handle swings we’ve been experiencing in the SPX.

The big resistance area is setting up at 5,700 (with no major level before then), based on some positive gamma nodes near that strike.

To the downside, we continue to note the large 5,565 JPM put which should add to negative gamma below. Our data continues to suggest the market seems a short bottom in this 5,500-5,565 range into April 2 (we have no view past that date).

SPX 5-day RV is 22%, 1-month is 17.7%. This informs us that a “fair value” for the VIX is ~24 (VIX 26 this AM). We have to add in a bit of vol premium due to CPI, too, and so we currently see “not much” risk premium in this market, particularly with FOMC next week.

This lack of vol premium is likely true unless you think there is going to be a material decline in realized volatility going forward. Given the BIG negative gamma prevalent in the market, and major expirations not until Tuesday (which starts to clear the negative gamma), we think vol should hold some premium.

What’s clear from perusing the socials is that traders are looking to short this volatility, with this trade apparently awakened by the VIX hitting 30. That short vol trade could look OK on the day, particularly if CPI is a dud.

Somewhat aligning with this view, we saw a large 3/18 exp 20 x 25 VIX call spread closed yesterday (+100k). The VIX complex is also seeing some “relief” with dealers now seemingly long >VIX 30 calls. This is a signal that downside is running out of juice.

However, as we have been stating, there is no stability in this market, and so a feel-good equity rally/vol decline could quickly revert with one tweet. Therefore if you want to play the short vol trade, we recommend doing so with VIX/VOL ETN (UVXY VXX) puts/put spreads rather than the much riskier VIX/VIX ETN short calls.

We prefer the way to play this market with equity structures like put and/or call 1×2’s (or broken wing flies for capped risk), which you can strike to have light long/short delta and short vega. This could allow to profit “two ways” if the SPX moves to your long strike, and vol contracts. Obviously there is risk in this trade if vol spikes, particularly if you are in put 1x2s, which you can cap with a much deeper OTM position.

credit: TastyTrade

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5578.55 | $5572 | $556 | $19376 | $471 | $2023 | $200 |

| SG Gamma Index™: |

| -3.68 | -0.745 |

|

|

|

|

| SG Implied 1-Day Move: | 0.75% | 0.75% | 0.75% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5946.55 | $5940 | $595 | $20510 | $480 | $2150 | $220 |

| Absolute Gamma Strike: | $5006.55 | $5000 | $550 | $20000 | $480 | $2000 | $200 |

| Call Wall: | $6506.55 | $6500 | $650 | $21500 | $483 | $2210 | $240 |

| Put Wall: | $5506.55 | $5500 | $550 | $19000 | $470 | $2000 | $195 |

| Zero Gamma Level: | $5889.55 | $5883 | $585 | $20069 | $496 | $2193 | $221 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.527 | 0.388 | 0.606 | 0.588 | 0.440 | 0.297 |

| Gamma Notional (MM): | ‑$1.399B | ‑$2.777B | ‑$10.384M | ‑$706.131M | ‑$69.02M | ‑$1.702B |

| 25 Delta Risk Reversal: | -0.074 | -0.067 | -0.068 | -0.067 | -0.057 | -0.05 |

| Call Volume: | 919.202K | 2.424M | 11.611K | 1.303M | 14.902K | 466.12K |

| Put Volume: | 1.39M | 3.462M | 9.503K | 1.188M | 29.66K | 989.76K |

| Call Open Interest: | 7.556M | 7.374M | 76.76K | 3.748M | 296.181K | 3.994M |

| Put Open Interest: | 13.135M | 12.51M | 77.949K | 5.238M | 461.156K | 8.444M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 6000, 5500, 5600] |

| SPY Levels: [550, 560, 570, 565] |

| NDX Levels: [20000, 19000, 19500, 21500] |

| QQQ Levels: [480, 490, 500, 470] |

| SPX Combos: [(5812,71.78), (5801,88.35), (5773,68.93), (5750,87.03), (5723,83.69), (5711,68.99), (5700,97.07), (5672,90.89), (5661,78.13), (5650,96.54), (5622,87.72), (5611,85.09), (5600,97.87), (5589,68.17), (5578,88.43), (5566,89.59), (5561,82.89), (5550,94.92), (5539,68.38), (5527,88.75), (5522,74.47), (5511,88.67), (5500,98.95), (5477,89.16), (5461,90.06), (5449,92.15), (5427,75.83), (5410,85.46), (5399,96.80), (5377,71.48), (5360,76.75), (5349,89.27), (5327,71.28), (5310,84.65), (5299,93.12)] |

| SPY Combos: [549.37, 558.9, 568.99, 563.94] |

| NDX Combos: [19299, 19726, 18893, 18486] |

| QQQ Combos: [464.69, 477.93, 466.11, 479.35] |

0 comentarios