Macro Theme:

Key dates ahead:

- 4/17: Jobs + OPEX

4/14: Fixed risk short volatility trades make sense to us this week, as realized volatility should come in, which allows implied volatility to come in. Further, Thursday’s OPEX adds supportive flows due to put decay.

4/11: We are still looking to put positions on with respect to the 4/10 and 4/7 updates. Further, per our Friday AM note, we see a pickup in positive dealer gamma from ~4,500-4,800 and from 5,450 to 5,850. These are indeed wide ranges, but the gamma in aggregate speaks to wide support and resistance zones.

4/10: Post tariff-pause, we look to sell put flies or ratio puts in the index and/or select single stocks. We will wait for bouts of weakness to initiate these positions, focusing on ~1-2 months to expiration. This trade expression stems from the fact that we do not see strong directional conviction in the data, as traders digest tariff updates, and focus shifts to China.

(4/11)The below trade is “back on” as volatility remains at highs:

4/7: Into record high IV/VIX levels, we are looking at ways to play volatility contraction over the next 1-2 weeks via +2 month call spreads and/or flies, with a possible rally “resistance free” into the 5,400 zone. Such a rally could setup a shorting opportunity as downside pressure relatively subsides. To the downside, there are some large dealer positive gamma positions at 4,800, but that strike stands against the unwinding of massive global/cross asset flows which could overwhelm local options hedging. So – we tread lightly when trying to call price bottoms.

Key SG levels for the SPX are:

- Resistance: 5,500

- Support: 5,400, 5,300

Founder’s Note:

Futures are up 1.4% after Trump paused tariffs on certain electronics.

This move higher is shocking the VIX lower (explainer here). The truth is that fixed strike vol is having a more mild reaction, and we note it is off ~1 vol pt vs Friday. The overall takeaway from this is that vols are off those seen at the edge of the abyss (last Mon – Wed) and now trending towards lower lows. True to Friday AM’s note, implied vols are going to start to come in much more sharply when realized volatility starts to deflate – and we think that process is now underway.

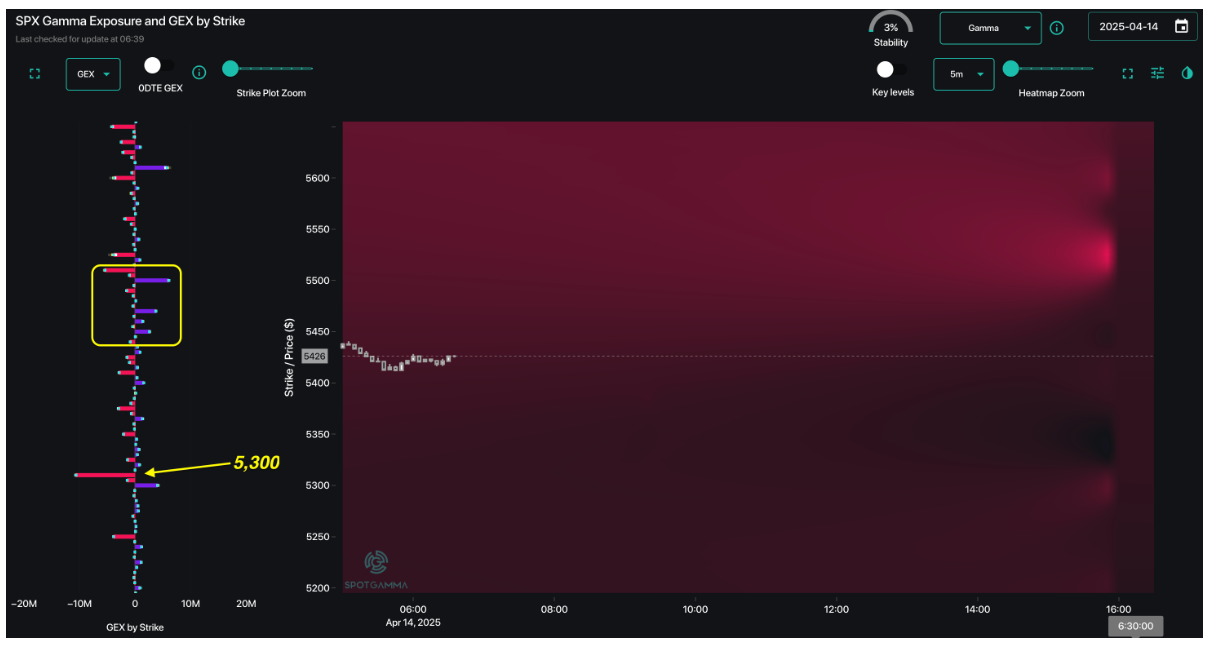

When we look at TRACE, we see that the map is still in a negative gamma stance (red map), but there is a pocket of positive gamma strikes from 5,450-5,500. We think that the 0DTE crew piles in to short calls in this region, making it a pocket of positive gamma resistance. 5,500 is an area that may generates strong resistance for the rest of this week, too. To confirm this, we will today be closely watching positive gamma at this level for signs of building.

We also are watching for traders to start selling short dated puts, which should add local areas of positive gamma support. The effect of this should be that realized volatility starts to come in. To be clear, we aren’t looking for 25-50 bps daily ranges, but the forces that were driving 3-5% daily moves may be behind us (at least temporarily). That being said, we currently see support at 5,400, and currently nothing else until 5,300. We anticipate that to change as 0DTE traders step in, but if no positive gamma forms in the 5,300-5,400 zone – then we won’t look for support.

This stability should also bring better liquidity into the market, which further stabilizes price action. The trading takeaway here is that it now may be a great time to look into shorting volatility via VIX puts and other fixed risk volatility ETN shorts (please don’t short naked calls in vol products like VIX/UVXY/VXX).

There is one other force for support this week: OPEX.

OPEX is currently, unsurprisingly, put heavy (Index

put delta

blue bars, vs calls in orange). Further, OPEX is on Thursday 4/17 this week due to Friday being closed for Good Friday. Additionally, VIX expiration is on Wednesday the 16th. This adds a lot of charm/short vol pressure (VIX option decay) to the market for this week, as options with high IV decay at a much higher relative rate.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5396.79 | $5363 | $533 | $18690 | $454 | $1860 | $184 |

| SG Gamma Index™: |

| -1.964 | -0.391 |

|

|

|

|

| SG Implied 1-Day Move: | 0.96% | 0.96% | 0.96% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5748.79 | $5715 | $565 | $18510 | $470 | $1900 | $220 |

| Absolute Gamma Strike: | $5033.79 | $5000 | $550 | $19600 | $450 | $2000 | $190 |

| Call Wall: | $6033.79 | $6000 | $580 | $19600 | $500 | $1935 | $230 |

| Put Wall: | $5233.79 | $5200 | $525 | $18500 | $464 | $1800 | $190 |

| Zero Gamma Level: | $5696.79 | $5663 | $557 | $18503 | $463 | $1971 | $203 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.679 | 0.540 | 1.09 | 0.744 | 0.647 | 0.318 |

| Gamma Notional (MM): | ‑$712.525M | ‑$1.42B | $1.525M | ‑$290.192M | ‑$28.92M | ‑$1.271B |

| 25 Delta Risk Reversal: | -0.134 | 0.00 | -0.131 | -0.116 | -0.123 | -0.108 |

| Call Volume: | 551.537K | 1.806M | 5.291K | 1.013M | 13.891K | 490.475K |

| Put Volume: | 924.432K | 2.457M | 6.08K | 953.00K | 19.099K | 882.981K |

| Call Open Interest: | 7.787M | 7.57M | 69.815K | 4.128M | 318.189K | 4.122M |

| Put Open Interest: | 12.917M | 12.325M | 67.209K | 5.627M | 427.834K | 8.313M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 6000, 5500, 5700] |

| SPY Levels: [550, 540, 525, 530] |

| NDX Levels: [19600, 19500, 19000, 20000] |

| QQQ Levels: [450, 470, 460, 480] |

| SPX Combos: [(5503,80.13), (5455,70.28), (5401,86.72), (5379,72.42), (5353,80.83), (5326,81.39), (5310,75.85), (5304,88.40), (5272,75.82), (5251,79.95), (5224,73.57), (5202,94.36), (5154,80.81), (5101,89.36)] |

| SPY Combos: [517.89, 507.92, 527.86, 537.83] |

| NDX Combos: [19606, 18522, 19120, 18316] |

| QQQ Combos: [425.21, 464.92, 430.12, 450.2] |

0 comentarios