Macro Theme:

Key dates ahead:

- 4/24: Durable Goods, Jobless Claims, Earnings: INTC, GOOGL, AAL, PG, FCX

- 4/30: Earnings: META, MSFT

- 5/1: ISM

- 5/2: NFP

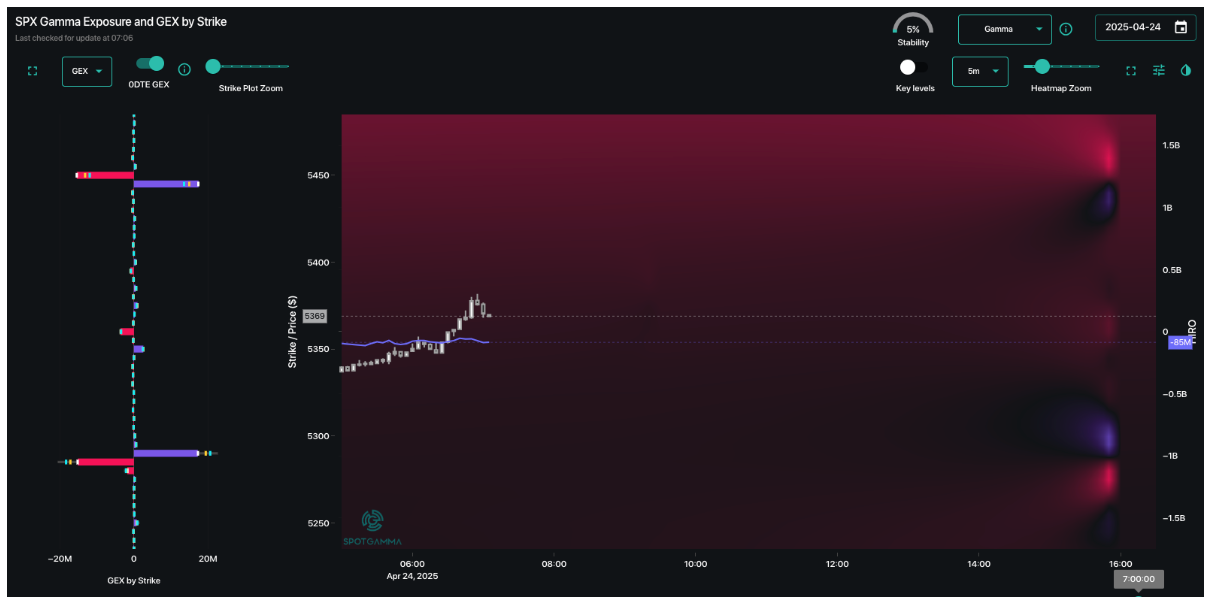

4/24 Update: The upside ~5,450 range was tested on 4/23, and rejected. We are now shifting max resistance to >=5,500, as that is where larger positive gamma strikes are now appearing.

With the SPX back near 5,300, we do not have strong conviction. Into SPX rallies near 5,500, we would look to re-engage in short call strategies. To the downside, first support is at 5,000, with more material support at 4,800. Into those downside zones we would look to initiate short put strategies. Additionally, with earnings picking up into the end of April, we will be looking closely for single stock trades.

4/17: With the SPX near 5,300, we do not have strong conviction. Into SPX rallies >=5,400, we would look to re-engage in short call strategies. To the downside, first support is at 5,000, with more material support at 4,800. Into those downside zones we would look to initiate short put strategies. Additionally, with earnings picking up into the end of April, we will be looking closely for single stock trades. ✅

4/23: ES futures were up +2.5% pushing the SPX into our target resistance zone of 5,400 – 5,500. As such, we will be looking to sell <=20 delta calls in the 4-6 week tenor (this is in accordance with our 4/17 update). Update: Calls were sold on 4/23 ✅

Key SG levels for the SPX are:

- Resistance: 5,500

- Support: 5,000, 4,800

Founder’s Note:

Futures are flat, with little material news overnight.

Today the market waits for 8:30AM ET Jobless Claims, then PM earnings from GOOGL.

TLDR: Having sold calls yesterday into the top of the risk range, there are no obvious trades here, until/unless we test 5,500 (we have shifted key resistance higher) to the upside, or <=5k to the downside. Index vols are also “fairly valued” given the high realized vol. In single stock/ETF space think call spreads on IBIT & MSTR are interesting as call IV is shifting higher – we want to play a potential “gamma squeeze”. Lastly we are eyeing TSLA puts for potential exposure to downside (even as an SPY/QQQ proxy), as post-earnings vol may be relatively cheap.

Additionally, we see Captain Condor back, with a very wide condor:

~10k 0DTE condors

- 5445 x 5450 call spread

- 5290 x 5285 put spread

It looks like the Condor was sold for somewhere near $1.70. Overall we think these are fair areas for support and resistance on the day. More critically, the area between these spreads is the “no mans land” that has provided fluid price action for the last several weeks – and that shouldn’t change today.

Our key resistance area has shifted from >=5,400 to >=5,500 because we now see positive gamma rolling higher on the last major market high (yesterday, 4/23).

While there certainly was a lot of volatility yesterday, it was not all that unusual relative to recent weeks. Its just “the new normal”, as the market continues to wait on actual data to inform opinions (Trumps tweets yesterday was again a head fake). Today offers a bit more of this data with Jobs & GOOGL, with SPX term structure sill flagging next weeks ISM/NFP as key.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5315.39 | $5287 | $535 | $18276 | $454 | $1890 | $190 |

| SG Gamma Index™: |

| -1.334 | -0.285 |

|

|

|

|

| SG Implied 1-Day Move: | 1.02% | 1.02% | 1.02% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5428.39 | $5400 | $545 | $18190 | $455 | $1900 | $220 |

| Absolute Gamma Strike: | $5028.39 | $5000 | $550 | $18200 | $450 | $2000 | $190 |

| Call Wall: | $5473.39 | $5445 | $580 | $18200 | $485 | $1865 | $230 |

| Put Wall: | $5228.39 | $5200 | $525 | $17500 | $430 | $1800 | $190 |

| Zero Gamma Level: | $5528.39 | $5500 | $546 | $18367 | $460 | $1958 | $209 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.773 | 0.630 | 1.101 | 0.734 | 0.821 | 0.417 |

| Gamma Notional (MM): | ‑$747.039M | ‑$888.701M | ‑$1.642M | ‑$276.509M | ‑$24.636M | ‑$921.567M |

| 25 Delta Risk Reversal: | -0.077 | -0.056 | -0.076 | -0.054 | -0.065 | -0.045 |

| Call Volume: | 606.742K | 2.246M | 7.252K | 1.005M | 24.841K | 363.178K |

| Put Volume: | 863.289K | 3.131M | 9.268K | 1.213M | 34.467K | 1.272M |

| Call Open Interest: | 7.679M | 6.93M | 69.265K | 3.829M | 304.113K | 3.609M |

| Put Open Interest: | 12.265M | 10.752M | 66.106K | 5.444M | 431.308K | 7.46M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 6000, 5500, 5400] |

| SPY Levels: [550, 540, 525, 530] |

| NDX Levels: [18200, 19000, 19500, 20000] |

| QQQ Levels: [450, 460, 470, 440] |

| SPX Combos: [(5362,70.14), (5357,79.53), (5314,79.90), (5267,76.35), (5224,81.24), (5214,90.73), (5203,92.32), (5187,78.20), (5166,82.92), (5134,76.81), (5119,94.70), (5066,82.64), (5039,69.48)] |

| SPY Combos: [518.29, 508.8, 528.3, 513.54] |

| NDX Combos: [17819, 18094, 17692, 17491] |

| QQQ Combos: [442.7, 429.81, 424.92, 440.04] |

0 comentarios