Macro Theme:

Key dates ahead:

- 4/30: Earnings: META, MSFT

- 5/1: ISM

- 5/2: NFP

4/25: <=25 delta 1-month S&P500 puts/put spreads make sense on a risk/reward basis given ATM IV in SPX is ~25%, which is at or below short term realized vol. This is not a call for a market decline, as much as we see the potential for that outcome, and the price to play it seems reasonable. This is true particularly given next weeks earnings and macro prints.

Per the last few weeks: To the downside, first support is at 5,000, with more material support at 4,800. Into those downside zones we would look to initiate short put strategies. Additionally, with earnings picking up into the end of April, we will be looking closely for single stock trades.

On 4/24 we marked upside resistance at >=5,500, we are now seeing call skew lift, and no material positive gamma >=5,500. Given that, we will not look to short additional calls into future rallies until/unless positive upside gamma appears.

4/24 Update: The upside ~5,450 range was tested on 4/23, and rejected. We are now shifting max resistance to >=5,500, as that is where larger positive gamma strikes are now appearing.

With the SPX back near 5,300, we do not have strong conviction. Into SPX rallies near 5,500, we would look to re-engage in short call strategies. To the downside, first support is at 5,000, with more material support at 4,800. Into those downside zones we would look to initiate short put strategies. Additionally, with earnings picking up into the end of April, we will be looking closely for single stock trades. (Incorporated/updated into 4/25 note)

Key SG levels for the SPX are:

- Resistance: 5,500

- Support: 5,000, 4,800

Founder’s Note:

Futures are -10bps after yesterday’s strong rally.

GOOGL +5% after earnings to 167

All the chatter yesterday was “Is the selling really over???”

Its not hard to understand why nearly all investors are bearish given the US political stance of imposing tariffs and informing us that the US economy may hit a “speed bump”. Put all that macro aside for a moment…

From an options perspective, for the US equity rally to lose steam we need to see options-induced resistance (gamma) and/or signs that options prices are shifting towards a bearish tone (vol/skew).

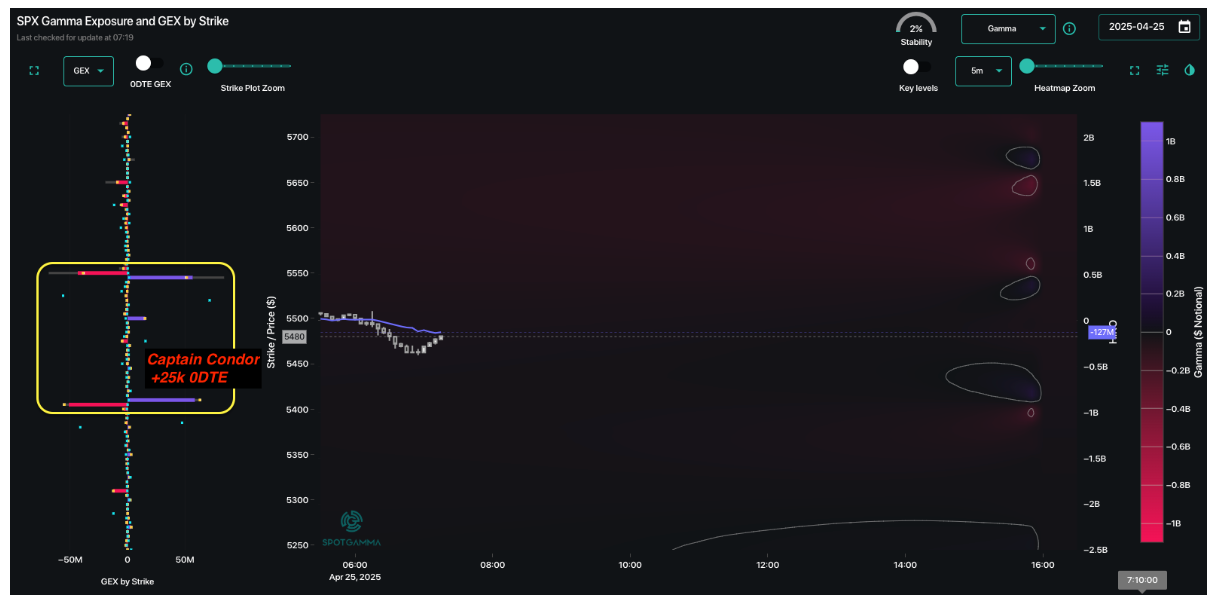

Looking at the SPX gamma landscape via TRACE we see the massive +25k Captain Condor at 5,545 above & 5410 below (see last nights note on CC) – but thats 0DTE. Outside of that is, quite frankly, nothing.

Our thesis has been dealer positive gamma would fill in on sharp market rallies, and this morning we just don’t see that. There is also little to the downside, until we get to 4,800 wherein large positive gamma puts still exist. Through this lens, past today’s big condor strikes (which we look to play as targets for today) there is no real edge to extract from this positioning.

If you look at SPY gamma positioning, its quite large, and very negative. As you can see from the SGOI curve below, peak negative gamma is at 545, and that negative gamma pressure tails off into SPY 475 to the downside, and not until ~600 to the upside. Thats not bullish or bearish – it is conducive to fluid price action through to and above what we’ve called “no mans land”: the 500->580 range.

What about vol?

Starting with skew, we’ve compared 1-month skew from last week (gray) to today (teal). Last week was the most recent time the SPX neared the 5,500 area (into VIX exp/OPEX).

What is interesting is the put skew has declined at exactly the area wherein we mark large dealer positive gamma (~4800), and we now see a small lift to call skew >=5,600, which reads like a relative call bid.

This is a bullish development, signaling the repricing of upside vs downside.

But here is where things hit a snag…

>=1week ATM IV for the SPX is ~25%, with the VIX at 27, and SPX 5-10 day realized vol in the 25% area. This tells us that implied vols are too cheap, because IV/VIX at 25-27 is simply matching the amount of movement the SPX has been experiencing. This doesn’t account for any unknown related to a policy tweet, upcoming data points (earnings, NFP, ISM, etc). In order to justify lower IV in the future, you would generally need to see a removal of the known unknown (tariffs).

Its possible the market is sniffing out some deals, and that is leading to the decline in volatility. But the risk with this low IV is that if a bad tweet or headline fires across the wires, then IV’s have to “untwist” as call IV would decline and put IV rises. This downside would occur into the SPX flat/SPY negative gamma construct, which would allow/provide a sharp downside move (3-5%).

So, whats the trade?

We do not want to be short stock/delta here, because there quite frankly is no reason to be. If anything the strong equity options flow last night, combined with the call skew bid is a win for bulls.

That being said we think buying ~1-month puts and or put spreads makes a ton of sense given the lower prices, and the SPX rally into what has been a strong resistance zone (5,450) and the cheapening vol. This is a “great risk reward” trade as opposed to “the market has to crash from here” type view.

If you want to play further price upside, we can’t fault that, but you have to be weary of the fact that call skew will likely contract into further rallies. Given that, we recommend call spreads vs long calls. To be clear, we remain short of +1 month OTM calls from Wednesday’s big market rally. If/when traders start selling puts into near-the-money SPX prices (i.e. supplying positive gamma), then we would start to add long stock/delta to our portfolio.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5402.88 | $5375 | $546 | $18693 | $467 | $1919 | $194 |

| SG Gamma Index™: |

| -0.574 | -0.125 |

|

|

|

|

| SG Implied 1-Day Move: | 0.98% | 0.98% | 0.98% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5437.88 | $5410 | $546 | $18190 | $464 | $1860 | $220 |

| Absolute Gamma Strike: | $5027.88 | $5000 | $550 | $18200 | $470 | $2000 | $190 |

| Call Wall: | $5572.88 | $5545 | $560 | $18200 | $485 | $1865 | $196 |

| Put Wall: | $5437.88 | $5410 | $525 | $19000 | $450 | $1850 | $190 |

| Zero Gamma Level: | $5535.88 | $5508 | $549 | $18506 | $466 | $1958 | $213 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.906 | 0.834 | 1.344 | 0.931 | 0.927 | 0.485 |

| Gamma Notional (MM): | ‑$671.897M | ‑$284.824M | $797.029K | ‑$6.485M | ‑$18.731M | ‑$812.494M |

| 25 Delta Risk Reversal: | -0.079 | -0.056 | -0.076 | -0.054 | -0.063 | -0.045 |

| Call Volume: | 507.155K | 1.835M | 9.47K | 931.097K | 18.909K | 307.286K |

| Put Volume: | 876.826K | 2.334M | 5.853K | 1.28M | 27.522K | 687.024K |

| Call Open Interest: | 7.782M | 7.052M | 68.909K | 3.919M | 299.081K | 3.699M |

| Put Open Interest: | 12.542M | 11.002M | 64.993K | 5.705M | 428.594K | 7.595M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 6000, 5500, 5700] |

| SPY Levels: [550, 540, 545, 560] |

| NDX Levels: [18200, 19500, 20000, 19000] |

| QQQ Levels: [470, 460, 450, 480] |

| SPX Combos: [(5591,70.36), (5489,81.91), (5440,96.70), (5435,96.95), (5322,68.59), (5306,95.92), (5301,94.78), (5295,87.95), (5263,68.90), (5247,78.13), (5204,81.07), (5198,87.56), (5161,72.69), (5145,80.44)] |

| SPY Combos: [518.25, 526.81, 527.88, 523.07] |

| NDX Combos: [18002, 19404, 19086, 19591] |

| QQQ Combos: [442.99, 449.81, 439.81, 434.81] |

0 comentarios