Macro Theme:

Key dates ahead:

- 4/29: Bessent, JOLTS

- 4/30: PCE, Earnings: META, MSFT

- 5/1: ISM

- 5/2: NFP

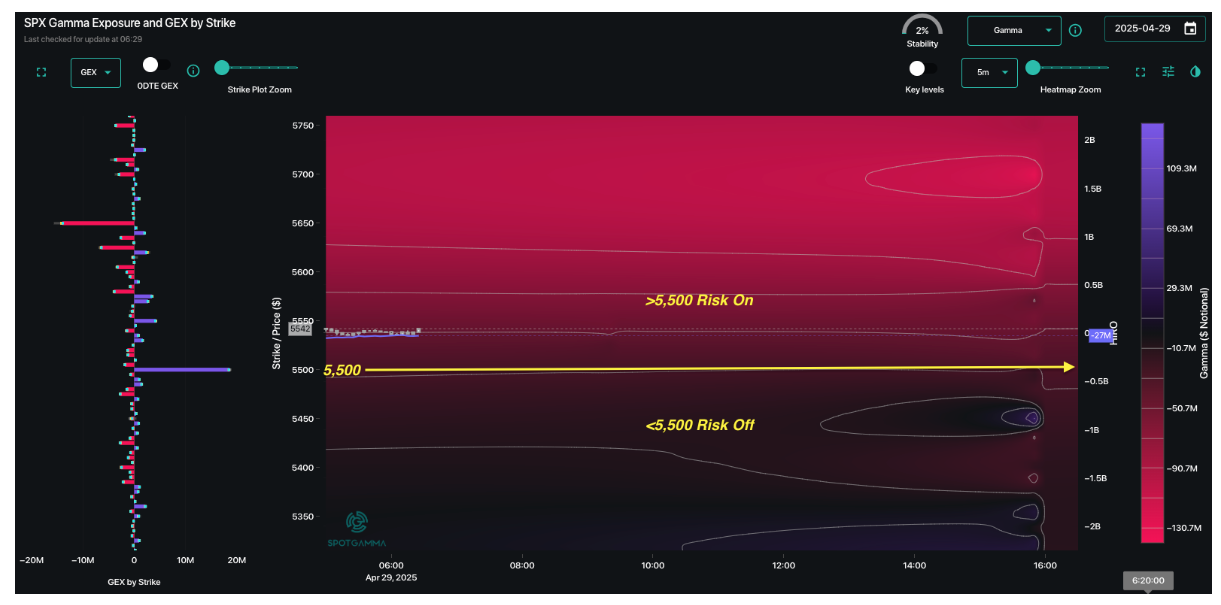

4/29: Based on the formation of light positive gamma >5,500, we look to be net long of stocks while SPX holds that level. We recommend short dated (May exp) calls or call spreads. This does not invalidate the view of owning longer dated put hedges (per 4/25 update).

4/25: <=25 delta 1-month S&P500 puts/put spreads make sense on a risk/reward basis given ATM IV in SPX is ~25%, which is at or below short term realized vol. This is not a call for a market decline, as much as we see the potential for that outcome, and the price to play it seems reasonable. This is true particularly given next weeks earnings and macro prints.

Key SG levels for the SPX are:

- Resistance: 5,700 (no clear resistance level >5,500)

- Support: 5,500 (no clear support level <5,500)

Founder’s Note:

Futures are flat overnight. Last night we saw earnings from the likes of: KO, PFE, UPS, PYPL and GM – they are all flat to higher.

Treasury Secretary Scott Bessent & Karoline Leavitt press briefing at 8:30AM ET (some speculate trade deal announcement). JOLTS data is out at 10AM EST.

Key support remains at 5,500. That level was broken to the downside yesterday, and met with 0DTE put sellers. We are now starting to see some positive gamma form >= 5,500, which infers some additional support/price stability >5,500. As such, we feel compelled to carry short dated (1-2 week) upside exposure while the SPX maintains that level. What has us most on watch are the large short call positions >=5,600, which could accelerate upside.

This short term upside potential does not change our view that there is value in owning longer dated (>=1-month) put options/long vol positions as we have been suggesting over the past several days.

While TRACE uses our latest in proprietary dealer positioning, we couldn’t help but notice our original model (which assumes calls are all dealer long, puts are all dealer short) shows that 5,500 is also the transition period between mainly call positions (positive gamma bars), and net put positions (negative gamma) <5,500. Historically this would be seen as the “negative

gamma flip

point”, which is the transition from a “risk on” environment >5,500, and “risk off” <5,500. For the last 4-6 weeks we’ve been in an environment dominated by put positions, and so this transition would mark the possibility of returning to a more normalized trading environment >5,500.

In a way, its a make-or-break moment for stocks as the bull fuel from put-destruction has been used up, and long call buyers (vs “short put covering”) need to take the baton. Ultimately we have to respect the idea that a shift up into 5,600 would likely mark a rally that sticks into May OPEX.

While the above statements do seem to take a bullish tone, we ultimately are trying to find the most profitable path to a set of outcomes. No one doubts the potential for a nasty headline and sharp market drawdown – and we have stated and continue to believe the value of owning puts at these prices makes sense. For example, one hot data print from PCE/ISM/NFP could throw a big wrench in the bulls plans.

At the same time, the data above, combined with flat to positive earnings reactions, and a potential for a “signed deal” does present short term upside risk. In some ways this is quite tricky, but the “keep it simple” formula appears to be “maintain long while SPX >5,500”.

Finally, in last nights note we commented on some large SPY/QQQ put options, which appear to be a roll from near term June options out to September. This came along with some fresh long call VIX exposure that all serves to add some SPX downside hedging fuel. This is in contrast to recent positioning, which was more of less wiped clear through the recent stock market rally.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5550.26 | $5525 | $550 | $19432 | $472 | $1957 | $194 |

| SG Gamma Index™: |

| -0.517 | -0.132 |

|

|

|

|

| SG Implied 1-Day Move: | 0.80% | 0.80% | 0.80% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5525.26 | $5500 | $547 | $18180 | $467 | $1950 | $195 |

| Absolute Gamma Strike: | $5025.26 | $5000 | $550 | $18200 | $470 | $2000 | $190 |

| Call Wall: | $5625.26 | $5600 | $560 | $18200 | $485 | $1865 | $196 |

| Put Wall: | $5225.26 | $5200 | $535 | $19000 | $450 | $1850 | $190 |

| Zero Gamma Level: | $5559.26 | $5534 | $554 | $18808 | $468 | $1982 | $214 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.917 | 0.821 | 1.372 | 1.003 | 0.863 | 0.475 |

| Gamma Notional (MM): | ‑$157.995M | ‑$323.507M | $6.215M | $56.296M | ‑$12.263M | ‑$835.205M |

| 25 Delta Risk Reversal: | -0.066 | 0.00 | -0.032 | -0.056 | -0.067 | -0.049 |

| Call Volume: | 428.885K | 1.401M | 5.889K | 722.669K | 10.71K | 253.84K |

| Put Volume: | 759.116K | 2.144M | 6.54K | 1.145M | 20.716K | 707.688K |

| Call Open Interest: | 7.797M | 6.835M | 67.86K | 3.867M | 292.674K | 3.706M |

| Put Open Interest: | 12.667M | 10.91M | 63.917K | 5.567M | 430.775K | 7.708M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 6000, 5500, 5700] |

| SPY Levels: [550, 540, 545, 560] |

| NDX Levels: [18200, 20000, 19500, 19000] |

| QQQ Levels: [470, 450, 480, 460] |

| SPX Combos: [(5796,80.32), (5696,76.94), (5647,86.14), (5625,82.00), (5619,80.28), (5597,90.62), (5575,78.95), (5448,81.79), (5415,76.00), (5398,92.00), (5365,76.43), (5348,83.99), (5315,72.41), (5310,78.17), (5299,88.62)] |

| SPY Combos: [537.98, 528.06, 558.35, 533.02] |

| NDX Combos: [18519, 19957, 18927, 20152] |

| QQQ Combos: [484.85, 449.88, 465, 459.8] |

0 comentarios