Macro Theme:

Key dates ahead:

- 6/5 Jobless Claims

- 6/6 NFP

- 6/11 CPI

6/4: In line with the update from 5/27 – As the SPX has held >=5,900 we continue to favor upside equity plays, which syncs with looking for vol contraction into June monthly OPEX (6/20). We will operate from this position until/unless the SPX breaks <5,900. Under 5,900 we would expect negative gamma to increase, which could align with volatility spiking.

5/27: Our prime position here is maintaining rolling short dated tail positions, near the 5,750-5,700 zone, as the market consistently shows jump risk (ex: 20Y auction day and Friday 5/23). To the upside, if the SPX gets back >5,925 we would look to play June Exp call spreads/call flies into 6,000-6,100.

5,900 is the key pivot level due into 6/30 (5,905 JPM call).

Key SG levels for the SPX are:

- Resistance: 5,975, 6,000, 6,025 (We see a long term top in the 5,900 – 6k area)

- Pivot: 5,900

- Support: 5,775

Founder’s Note:

Futures are flat – indicating the SPX is stuck on 6,000, with the main event being AAPL WWDC…so… yeah, nothing really going on.

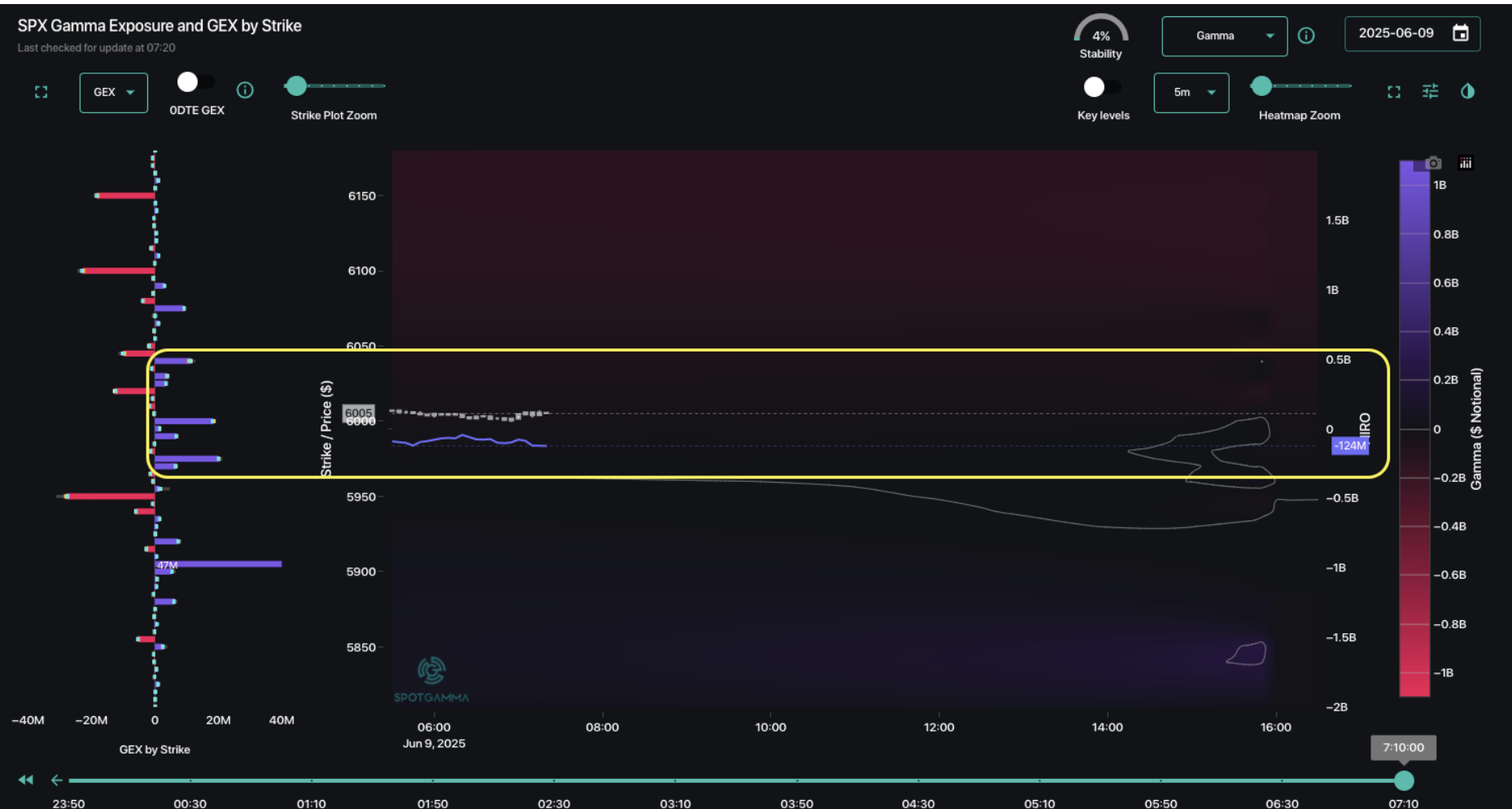

Given the lack of data today, we’d expect 0DTE options sellers to come out and supply positive gamma, which should keep a fairly tight trading range on the SPX. You can see that the current positions around 6k are fairly small but numerous – but that is again likely to fill in with 0DTE short gamma (& dealer long gamma) after market open. This all amounts to our view that we should continue to play mean reversion in this market (selling rips into 6,050 & buying dips <6k ), with looking to single stocks for larger directional plays.

A break <6,000 on concrete news (i.e. bad trade news, etc) would likely lead to a quick test of 5,900.

If you read financial news you will hear a lot about the all important Wednesday 9/11 CPI, but the SPX options market does not seem to care. Yes, those IV’s at 17% are elevated vs longer dated IV’s in the 13%’s, but this is not currently being priced lower than Friday’s NFP – and certainly lower than recent CPI’s. Should the CPI pass as benign we’d look for equity markets to slide higher. with 6,050 & 6,100 (

Call Wall

) the strikes that are building OI above. Hot CPI has 5,900 in play – which could line up some interesting 9/11 exp put fly’s.

Stepping to the more interesting single stock side – we were a bit tongue and cheek about the AAPL WWDC stock, mainly because AAPL has just not been interesting. Into the WWDC, we see short dated IV’s are a bit warm – but far from IV’s of an earnings report. What is interesting is that there is a noticeable call skew as you can see in the Compass, below (X = Call Skew %’ile). Compass anchors to ~1-month options, and we’d guess that shorted dated options are showing even higher call skews which suggests to us that selling calls/call spreads/call flies may be warranted into WWDC.

Next, on TSLA, if you missed our Friday note we commented how vol got wrecked on Friday, which zaps the rich premium that came in on Thursday’s Trump/Musk…thing. That signals to us that the trade shorting heavily-skewed puts has been largely milked, and we think that if you continue to hold short puts now you are taking a more fundamental view on TSLA & its price – vs a view that traders emotions + excessive flows had pushed IV to extremes. We’ve got no opinion on car sales – nor do we know if Trump/Musk will start a “round 2”.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6007.05 | $6000 | $599 | $21761 | $529 | $2132 | $211 |

| SG Gamma Index™: |

| 1.568 | 0.079 |

|

|

|

|

| SG Implied 1-Day Move: | 1.00% | 1.00% | 1.00% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | $6073.46 | $6066.41 | $605.79 |

|

|

|

|

| SG Implied 1-Day Move Low: | $5953.33 | $5946.29 | $593.79 |

|

|

|

|

| SG Volatility Trigger™: | $5982.05 | $5975 | $595 | $21240 | $524 | $2080 | $208 |

| Absolute Gamma Strike: | $6007.05 | $6000 | $600 | $21325 | $520 | $2100 | $215 |

| Call Wall: | $6107.05 | $6100 | $600 | $21325 | $540 | $2200 | $215 |

| Put Wall: | $5957.05 | $5950 | $550 | $19500 | $470 | $2000 | $200 |

| Zero Gamma Level: | $5927.05 | $5920 | $593 | $20904 | $521 | $2111 | $213 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.195 | 1.10 | 1.67 | 1.252 | 1.097 | 0.803 |

| Gamma Notional (MM): | $557.899M | $483.85M | $13.342M | $342.855M | $14.881M | ‑$166.662M |

| 25 Delta Risk Reversal: | -0.04 | -0.037 | -0.046 | 0.00 | 0.00 | -0.023 |

| Call Volume: | 437.601K | 1.528M | 7.522K | 577.198K | 15.116K | 352.509K |

| Put Volume: | 902.067K | 3.005M | 7.692K | 879.726K | 31.468K | 497.236K |

| Call Open Interest: | 8.426M | 6.164M | 69.938K | 3.775M | 297.247K | 3.993M |

| Put Open Interest: | 13.26M | 11.84M | 81.534K | 5.242M | 459.738K | 8.582M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 5900, 6100, 5950] |

| SPY Levels: [600, 595, 590, 580] |

| NDX Levels: [21325, 21500, 22000, 21900] |

| QQQ Levels: [520, 530, 510, 540] |

| SPX Combos: [(6252,93.07), (6228,69.49), (6210,74.52), (6198,98.34), (6174,82.66), (6156,74.39), (6150,97.01), (6126,84.62), (6108,88.95), (6102,99.48), (6090,80.80), (6078,97.40), (6072,74.20), (6060,92.96), (6048,99.11), (6042,88.10), (6036,83.22), (6030,83.38), (6024,82.49), (6018,94.09), (6012,70.12), (6006,91.17), (6000,98.06), (5976,84.47), (5958,85.24), (5952,89.65), (5904,92.40), (5898,74.48), (5874,68.86), (5868,71.99), (5850,78.29), (5802,86.78), (5778,74.76), (5748,84.80)] |

| SPY Combos: [609.06, 598.98, 604.32, 619.14] |

| NDX Combos: [21327, 22175, 21979, 22001] |

| QQQ Combos: [519.54, 517.97, 540.01, 520.07] |

0 comentarios