Macro Theme:

Key dates ahead:

- 6/11 CPI

- 6/18 FOMC + VIX Expiration

- 6/19 Juneteenth – Market Closed

- 6/20 OPEX

- 6/30 Quarterly OPEX

June OPEX Playbook:

June VIX/Equity expirations fall just as SPX realized vol is getting squeezed to the floor (5-day is 8%), and the SPX is nearing all time highs. As per usual, when we get a strongly trending market into expirations we look for markets to mean revert after expiration as the flow dynamics shift – and this case is generally no different – except this time we have the very large 5,905 JPM call that expires at the end of June (6/30). That could be a support buffer/target for SPX prices post-OPEX. Given that the scenario could be something like: CPI is benign, SPX rallies to 6,100 into next week, and then contracts to 5,900 by 6/30. If CPI on 6/11 is hot, that 5,900 level could come into play this week, which is why we will be looking to head into tomorrows print with a low risk/high reward “lotto” put spread/put fly in the 5,900 area – and we will couple that will 1-2 DTE 6,100 call spreads/flies.

6/9: Last week we used 5,900 as our bull/bear pivot, and that is now adjusted to 6,000 with the market likely well supported through this week. Next week’s FOMC/huge OPEX likely shifts many positions, and may allow volatility to expand.

6/4: In line with the update from 5/27 – As the SPX has held >=5,900 we continue to favor upside equity plays, which syncs with looking for vol contraction into June monthly OPEX (6/20). We will operate from this position until/unless the SPX breaks <5,900. Under 5,900 we would expect negative gamma to increase, which could align with volatility spiking. ✅

5/27: Our prime position here is maintaining rolling short dated tail positions, near the 5,750-5,700 zone, as the market consistently shows jump risk (ex: 20Y auction day and Friday 5/23). To the upside, if the SPX gets back >5,925 we would look to play June Exp call spreads/call flies into 6,000-6,100.

Key SG levels for the SPX are:

- Resistance: 6,025, 6,050, 6,100 (We see a long term top in the 5,900 – 6k area)

- Pivot: 6,000 (bearish <, bullish >)

- Support: 5,975, 5,905 (6/30 Exp JPM Call)

Founder’s Note:

Futures are up 15bps, but they did trade lower from 6,035 to 5,990 overnight before recovering/reverting to 6,015 (SPY600).

TLDR: Key levels are unchanged from recent days: the

pivot

is 6,000 – and we remain bullish while the SPX is above that level. First support is 5,975, then 5,900. Resistance is at 6,050. We continue to look for volatility to remain subdued today, with mean reversion plays back into the 6,000-6,025 area. This 6,000-6,025 “box” likely shifts tomorrow after CPI.

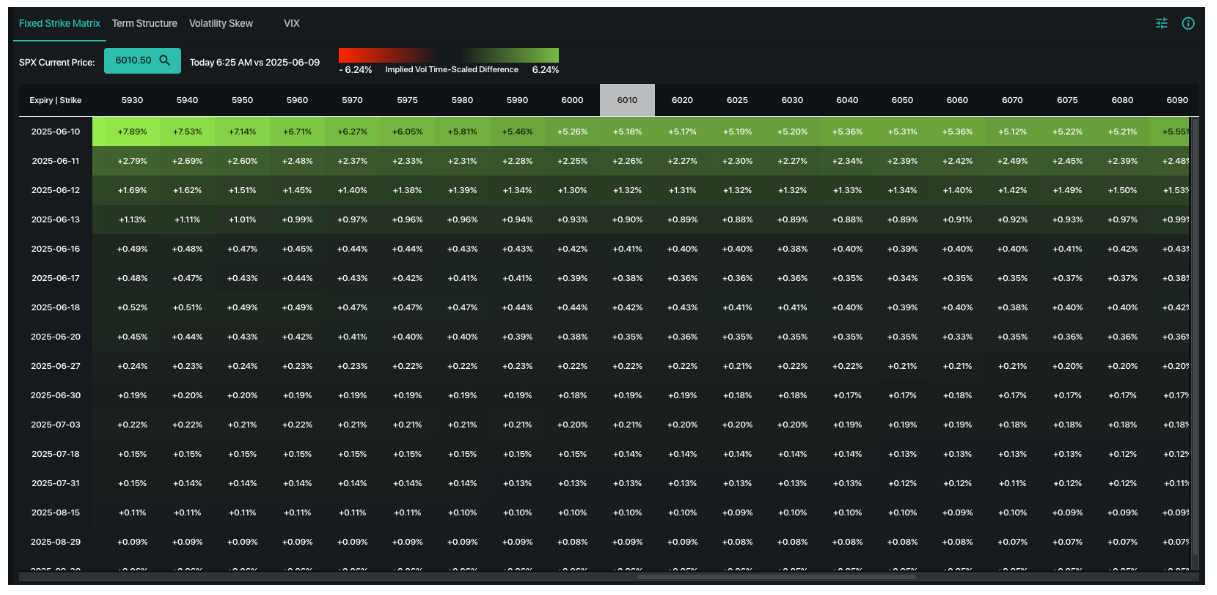

In last nights notes we flagged implied vol which crept higher during yesterday’s flat session. We see that vol remains elevated overnight, with no major news on the docket for today. This is happening in the face of a realized vol collapse, wherein 5-day SPX realized is 8%, and 1-month is 15%. For today we don’t think these dynamics matter as 0DTE players are likely to come out and sell 0DTE options which supplies positive gamma to dealers. For tomorrow, and CPI, if the CPI is good vol is sold. If its bad, we may well visit 5,900 in short order.

Away from the seemingly dull index flows, we are eyeing breakouts in SLV & BTC – both of which are at major highs. Calls skews are warming up there, a signal that things are “getting squeezy”. We consider these to be speculative setups & therefore play them with calls/call spreads for defined risk/reward. Below is the change in 1-month skew for SLV from last week (gray) vs today (teal), and you can see that the call skew is bid. Some may think “time to sell calls”, but the IV rank remains rather subdued (45%) and we think the risk here is that this could ignite higher as the crowd comes in – remember GLD hit +90% IV rank during its highs a few weeks ago. In complete transparency we were flagging IBIT/BTC in a similar situation last week, but BTC did then consolidate from this similar position – but it is now back at those highs.

Finally – in last nights webinar we talked about the upcoming transition period with a HUGE June OPEX on the 20th, which falls just after VIX Exp & FOMC on 6/18. These expirations fall just as SPX realized vol is getting squeezed to the floor (5-day is 8%), and the SPX is nearing all time highs. As per usual, when we get a strongly trending market into expirations we look for markets to mean revert after expiration as the flow dynamics shift – and this case is generally no different – except this time we have the very large 5,905 JPM call that expires at the end of June (6/30). That could be a support buffer/target for SPX prices post-OPEX. Given that the scenario could be something like: CPI is benign, SPX rallies to 6,100 into next week, and then contracts to 5,900 by 6/30. If CPI is hot, that 5,900 level could come into play this week, which is why we will be looking to head into tomorrows print with a low risk/high reward “lotto” put spread/put fly in the 5,900 area – and we will couple that will 1-2 DTE 6,100 call spreads/flies.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6006.25 | $6000 | $599 | $21761 | $530 | $2132 | $213 |

| SG Gamma Index™: |

| 1.93 | 0.152 |

|

|

|

|

| SG Implied 1-Day Move: | 0.61% | 0.61% | 0.61% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6001.25 | $5995 | $596 | $21240 | $529 | $2080 | $209 |

| Absolute Gamma Strike: | $6006.25 | $6000 | $600 | $21325 | $520 | $2100 | $215 |

| Call Wall: | $6106.25 | $6100 | $600 | $21325 | $540 | $2200 | $215 |

| Put Wall: | $5981.25 | $5975 | $590 | $21400 | $470 | $2000 | $200 |

| Zero Gamma Level: | $5926.25 | $5920 | $594 | $21382 | $521 | $2111 | $213 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.243 | 1.192 | 1.563 | 1.359 | 1.157 | 0.937 |

| Gamma Notional (MM): | $547.231M | $597.396M | $10.283M | $452.302M | $6.325M | ‑$22.946M |

| 25 Delta Risk Reversal: | -0.04 | 0.00 | -0.045 | 0.00 | 0.00 | -0.019 |

| Call Volume: | 366.27K | 1.19M | 6.267K | 553.042K | 35.206K | 288.526K |

| Put Volume: | 567.115K | 1.202M | 8.434K | 613.214K | 46.059K | 465.735K |

| Call Open Interest: | 8.473M | 6.268M | 70.602K | 3.876M | 301.007K | 4.039M |

| Put Open Interest: | 13.315M | 11.953M | 85.248K | 5.278M | 462.905K | 8.68M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 5900, 6100, 5950] |

| SPY Levels: [600, 595, 590, 605] |

| NDX Levels: [21325, 21500, 22000, 21900] |

| QQQ Levels: [520, 530, 540, 535] |

| SPX Combos: [(6294,94.80), (6246,93.65), (6204,76.13), (6198,98.42), (6168,88.05), (6156,82.01), (6144,97.68), (6126,69.07), (6120,84.24), (6108,78.47), (6102,86.24), (6096,99.62), (6084,83.64), (6078,89.72), (6072,96.12), (6066,84.65), (6060,69.02), (6054,94.43), (6048,99.43), (6042,76.14), (6036,86.83), (6030,78.44), (6024,87.91), (6018,94.79), (6012,73.72), (6006,92.70), (5994,98.42), (5970,87.42), (5946,86.95), (5928,71.79), (5898,88.80), (5868,79.93), (5844,69.70), (5796,86.63), (5748,82.72)] |

| SPY Combos: [609.33, 603.93, 618.91, 599.14] |

| NDX Combos: [21305, 22154, 21936, 21979] |

| QQQ Combos: [519.32, 539.99, 535.22, 535.75] |

0 comentarios