Macro Theme:

Key dates ahead:

- 6/18 FOMC + VIX Expiration

- 6/19 Juneteenth – Market Closed

- 6/20 OPEX

- 6/30 Quarterly OPEX

June OPEX Playbook:

Update 6/16: 5,900 is likely support in through 6/30 even with a negative FOMC reaction. Given that, we are now giving edge to the SPX rallying into 6,100 for Friday with the assumption that FOMC will be benign, and the contraction of the related event vol of a quiet FOMC + market closure on Thursday (Juneteenth) can squeeze the SPX higher for Friday’s OPEX. Our preferred way to express equity upside is through SMH & its cheap calls, as it may have cleaner upside vs SPY (from a gamma perspective).

Post OPEX we think there could then be some equity contraction, with 5,900 a target.

Update 6/13: Futures tested ~5,925 overnight 6/12-6/13, and rallied back to 6k. That move emphasized the slippery downside <6k to 5,900. We continue to see little support from 6k back to 5,900, particularly into an uncertain weekend (due to Israel/Iran). ✅

Key SG levels for the SPX are:

- Resistance: 6,050, 6,100 (We see a long term top in the 5,900 – 6k area)

- Pivot: 6,000 (bearish <, bullish >)

- Support: 5,905 (6/30 Exp JPM Call)

Founder’s Note:

Futures are 50bps higher after weekend geopolitical events failed to stoke more fear.

Vols for this week are still a bit sticky at higher levels due to the upcoming FOMC, but we’d wager that the 0DTE crew will come in hard to zap any vol premium they can both for today session, and likely tomorrows. This should help keep the SPX above 6k, but we think the SPX will not break above the 6,050 high pre-FOMC. This is in line with our projections from 6/12. Given that, its feels like a “condor” environment, wherein we like betting the SPX will maintain that 6k-6,050 range today into tomorrow.

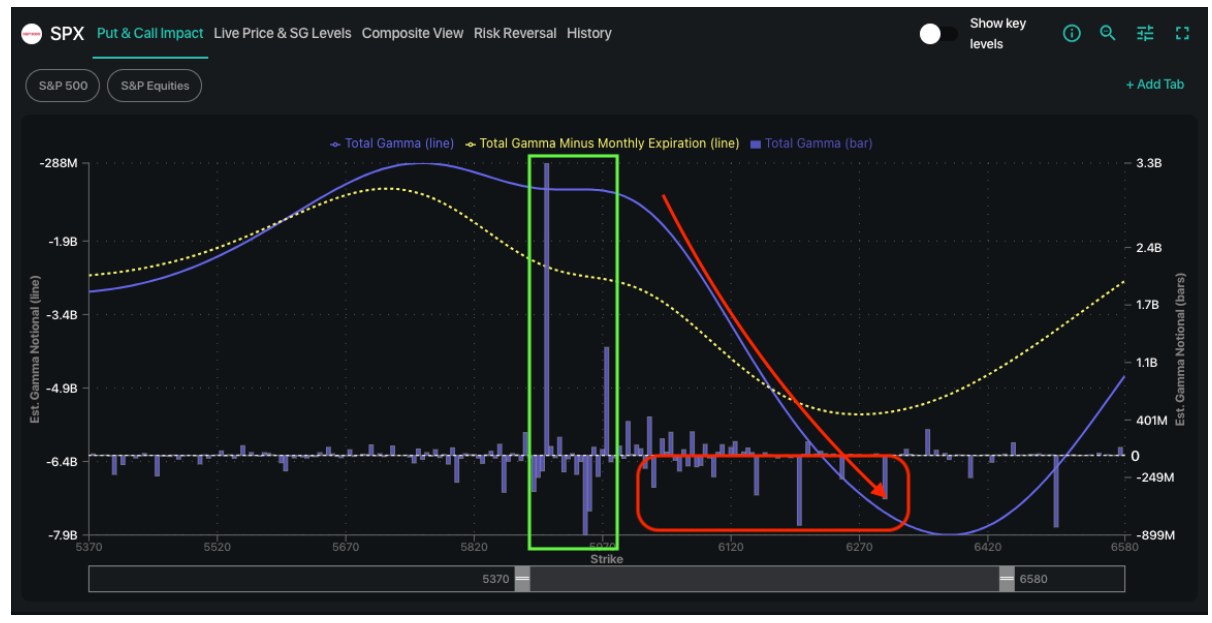

To the downside, the stabilizers of the JPM call at 5,905 & a large gamma position at 5,970 (green box) have been enough to absorb selling. The JPM call doesn’t expire until 6/30, and so we watch for the market to be well supported into 5,900 through that date.

To the upside, we currently see a lot of dealer short calls (red box) which could invoke a squeezy upside. However, that position changes by a decent amount following this weeks expiration. You can see this by comparing the current SPX GEX (purple) to the GEX-Friday’s OPEX (yellow). The general shape is still the same (i.e. the yellow line still slopes lower/more negatively at higher SPX prices), but it has less magnitude.

Implied vols for anything past this week are a quiet 15% (bottom of the shaded stat cone) which is essentially where realized vol is marked. This is not a panicked/worried market as there is really no vol premium. If FOMC passes without issue, that should allow this weeks/short dated/event vol to contract – particularly with markets closed on Thursday – and so we think 6,100 could be in play for Fridays close.

Lastly, a quick update on some assets we marked last week: USO (CL) and GLD. USO closed on Friday with a ~100% IV & risk reversal rank. Crude is down a bit this AM, but we will be looking to short some ~1-month call spreads into this extreme pricing. Additionally, we see gold IV sliding higher with gold off a bit this AM. While its not a 75% IV rank, it may be interesting to look at some short call spreads/overwriting in GLD.

Sector/stock ETFs are also marking as low IV & cheap calls, particularly SMH. If vol does come in, and the FOMC is benign, SMH should sharply outperform SPY on the week.

|

|

/ES |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6031.43 |

$5976 |

$597 |

$21631 |

$526 |

$2100 |

$208 |

|

SG Gamma Index™: |

|

-0.003 |

-0.173 |

|

|

|

|

|

SG Implied 1-Day Move: |

0.57% |

0.57% |

0.57% |

|

|

|

|

|

SG Implied 5-Day Move: |

1.95% |

1.95% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

After open |

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

After open |

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$6050.43 |

$5995 |

$597 |

$21240 |

$529 |

$2090 |

$208 |

|

Absolute Gamma Strike: |

$6055.43 |

$6000 |

$600 |

$21325 |

$520 |

$2100 |

$210 |

|

Call Wall: |

$6155.43 |

$6100 |

$600 |

$21325 |

$540 |

$2200 |

$215 |

|

Put Wall: |

$5955.43 |

$5900 |

$590 |

$19500 |

$520 |

$2030 |

$200 |

|

Zero Gamma Level: |

$5997.43 |

$5942 |

$595 |

$21094 |

$522 |

$2111 |

$213 |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

1.000 |

0.822 |

1.297 |

0.991 |

0.858 |

0.574 |

|

Gamma Notional (MM): |

$92.811M |

‑$292.093M |

$8.532M |

$92.176M |

‑$15.955M |

‑$770.427M |

|

25 Delta Risk Reversal: |

-0.063 |

0.00 |

-0.063 |

0.00 |

-0.062 |

-0.058 |

|

Call Volume: |

494.068K |

1.565M |

6.757K |

718.151K |

21.248K |

724.305K |

|

Put Volume: |

949.44K |

2.694M |

9.969K |

1.092M |

43.264K |

823.247K |

|

Call Open Interest: |

8.686M |

6.311M |

72.036K |

3.935M |

318.037K |

4.011M |

|

Put Open Interest: |

13.868M |

12.336M |

89.144K |

5.512M |

478.735K |

9.077M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [6000, 5900, 5950, 5000] |

|

SPY Levels: [600, 590, 595, 580] |

|

NDX Levels: [21325, 21500, 22000, 21700] |

|

QQQ Levels: [520, 510, 530, 525] |

|

SPX Combos: [(6252,91.28), (6210,72.50), (6198,96.36), (6174,76.87), (6150,92.96), (6126,82.30), (6108,82.63), (6102,98.67), (6085,69.93), (6079,84.69), (6073,93.76), (6061,69.45), (6055,77.75), (6049,96.47), (6037,72.29), (6031,70.18), (6025,79.13), (6019,71.88), (6007,85.00), (6001,93.31), (5977,84.72), (5947,90.40), (5923,73.50), (5905,78.01), (5899,96.86), (5887,85.33), (5875,79.80), (5869,76.39), (5857,85.04), (5851,82.36), (5828,73.48), (5798,95.12), (5774,74.98), (5750,85.64), (5702,90.07)] |

|

SPY Combos: [609.18, 619.45, 614.01, 604.35] |

|

NDX Combos: [21328, 21350, 22172, 21956] |

|

QQQ Combos: [540.06, 519.25, 535.79, 544.87] |

0 comentarios