Macro Theme:

Key dates ahead:

- 6/18 FOMC + VIX Expiration

- 6/19 Juneteenth – Market Closed

- 6/20 OPEX

- 6/30 Quarterly OPEX

June OPEX Playbook:

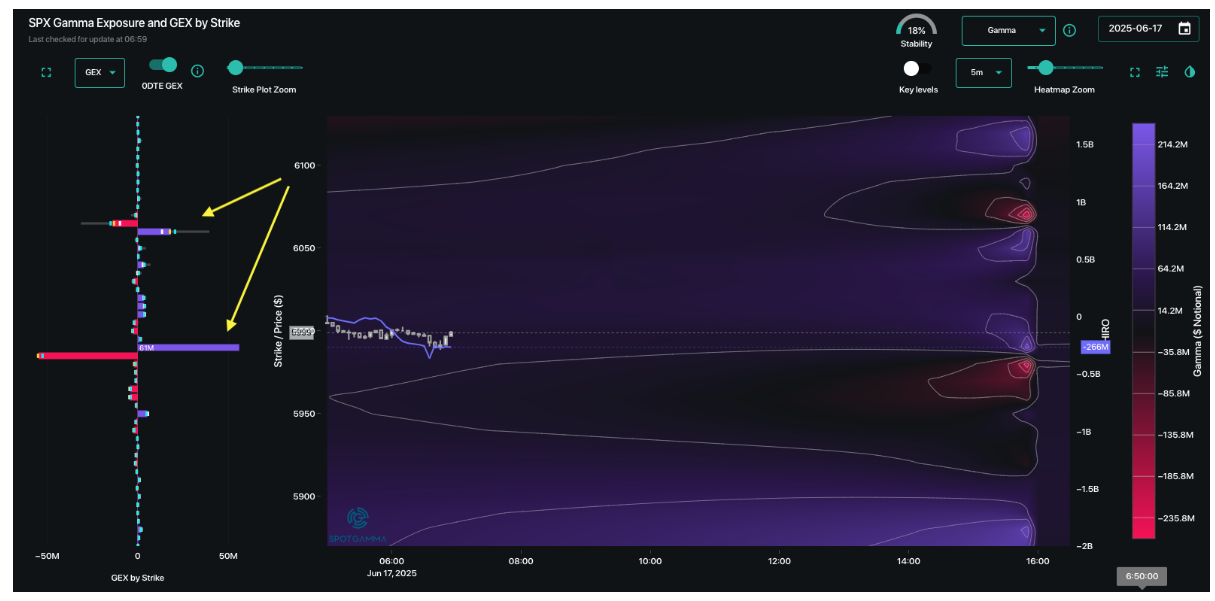

Update 6/16: 5,900 is likely support in through 6/30 even with a negative FOMC reaction. Given that, we are now giving edge to the SPX rallying into 6,100 for Friday with the assumption that FOMC will be benign, and the contraction of the related event vol of a quiet FOMC + market closure on Thursday (Juneteenth) can squeeze the SPX higher for Friday’s OPEX. Our preferred way to express equity upside is through SMH & its cheap calls, as it may have cleaner upside vs SPY (from a gamma perspective).

Post OPEX we think there could then be some equity contraction, with 5,900 a target.

Update 6/13: Futures tested ~5,925 overnight 6/12-6/13, and rallied back to 6k. That move emphasized the slippery downside <6k to 5,900. We continue to see little support from 6k back to 5,900, particularly into an uncertain weekend (due to Israel/Iran). ✅

Key SG levels for the SPX are:

- Resistance: 6,050, 6,100 (We see a long term top in the 5,900 – 6k area)

- Pivot: 6,000 (bearish <, bullish >)

- Support: 5,905 (6/30 Exp JPM Call)

Founder’s Note:

Futures are off 60bps after an uptick in Middle East tensions. This has the SPX back at the big support 6,000 level. Retail sales are at 8:30AM.

Today is the last day VIX options for June can trade (before the expire at 9:30AM ET tomorrow) and this can often create unique flows in the market. Well dive into this below.

While eyes are partially on the geopolitical headlines, the big show for traders is tomorrows FOMC. As a result, we think the likely path here is for the 0DTE traders to come out and short options/”sell vol” today, which pushes the SPX back into the 6,025/SPY600 area.

Adding to the 6k area support is our pal Captain Condor, who has a ~11k condor at 6,060×6,065 & 5,990×5,985. The S&P500 loves to tag these levels – particularly when they get to be of such large size.

Given the VIX expiration (discussed below) and the Captain up at ~6,060 we wouldn’t rule out a test of that 6,050-6,060 level for today, but that would be our likely high into tomorrows FOMC.

Onto the VIX.

The SGOI model shows dealers have short gamma positions down through 18, and this mainly comes from being short sizable calls at 20 (~200k OI) and 25 (~100k OI). The “max pain” logic suggest that they’d want these calls to close out-of-the-money, which means the VIX may push to the 18 area. We take this as a tailwind for stocks today, because if vol can get squeezed a bit it can boost stocks. This is interesting, too, because of the vol bid that perked up with last nights increased tensions…thats vol bid overnight may just give more for vol for 0DTE traders to jam today.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6032.85 | $5976 | $602 | $21631 | $534 | $2100 | $210 |

| SG Gamma Index™: |

| 1.225 | 0.014 |

|

|

|

|

| SG Implied 1-Day Move: | 0.57% | 0.57% | 0.57% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6051.85 | $5995 | $599 | $21240 | $532 | $2090 | $210 |

| Absolute Gamma Strike: | $6056.85 | $6000 | $600 | $22000 | $530 | $2100 | $210 |

| Call Wall: | $6156.85 | $6100 | $605 | $21325 | $540 | $2200 | $215 |

| Put Wall: | $6046.85 | $5990 | $590 | $19500 | $520 | $2030 | $200 |

| Zero Gamma Level: | $6043.85 | $5987 | $597 | $21253 | $525 | $2111 | $213 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.12 | 1.015 | 1.559 | 1.321 | 0.976 | 0.638 |

| Gamma Notional (MM): | ‑$222.08M | $347.599M | $5.624M | $531.513M | ‑$19.902M | ‑$582.744M |

| 25 Delta Risk Reversal: | -0.055 | 0.00 | -0.054 | 0.00 | -0.046 | -0.029 |

| Call Volume: | 554.73K | 1.309M | 6.916K | 509.422K | 13.755K | 181.728K |

| Put Volume: | 937.28K | 2.328M | 10.495K | 833.196K | 23.192K | 293.877K |

| Call Open Interest: | 8.863M | 6.363M | 72.253K | 3.965M | 321.519K | 3.962M |

| Put Open Interest: | 14.145M | 12.827M | 93.093K | 5.609M | 483.798K | 9.158M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6050, 6100, 5900] |

| SPY Levels: [600, 595, 605, 590] |

| NDX Levels: [22000, 21900, 21325, 21500] |

| QQQ Levels: [530, 540, 520, 535] |

| SPX Combos: [(6240,95.42), (6192,94.01), (6168,75.52), (6150,79.69), (6144,97.99), (6114,87.69), (6097,77.55), (6091,97.15), (6073,70.85), (6067,89.71), (6061,87.28), (6055,77.68), (6049,89.79), (6043,99.61), (6037,72.17), (6031,94.08), (6025,86.69), (6019,95.93), (6013,91.94), (6007,96.36), (6001,99.22), (5995,97.75), (5977,73.44), (5953,84.68), (5941,87.83), (5935,94.35), (5929,93.95), (5917,95.17), (5893,75.03), (5887,91.64), (5869,73.69), (5851,83.59), (5845,88.85), (5822,76.26), (5804,73.64), (5798,84.45), (5744,92.33), (5696,80.62)] |

| SPY Combos: [609.54, 589.24, 604.16, 619.09] |

| NDX Combos: [21869, 21025, 21696, 21588] |

| QQQ Combos: [519.58, 520.11, 540.13, 534.86] |

0 comentarios