Macro Theme:

Key dates ahead:

- 6/20 OPEX

- 6/30 Quarterly OPEX

June OPEX Playbook:

Update 6/20: Post OPEX and into Monday 6/30 we are looking for the SPX to move to 5,900 and revolve around that strike. Given that, we will be looking to enter into put flies for next week around 5,900. We like flies here because we think the massive 5,905 JPM strike will be a shock absorber into 6/30 – unless there is some truly large escalation in Middle East tensions (lets pray that doesn’t happen).

Update 6/16: 5,900 is likely support in through 6/30 even with a negative FOMC reaction. Given that, we are now giving edge to the SPX rallying into 6,100 for Friday with the assumption that FOMC will be benign, and the contraction of the related event vol of a quiet FOMC + market closure on Thursday (Juneteenth) can squeeze the SPX higher for Friday’s OPEX. Our preferred way to express equity upside is through SMH & its cheap calls, as it may have cleaner upside vs SPY (from a gamma perspective).

Key SG levels for the SPX are:

- Resistance: 6,050, 6,100 (We see a long term top in the 5,900 – 6k area)

- Pivot: 6,000 (bearish <, bullish >)

- Support: 5,905 (6/30 Exp JPM Call)

Founder’s Note:

Futures are flat ahead of today’s OPEX, which is slated to be the largest expiration ever. Futures were about 40 handles lower overnight, which suggests the SPX was probing the ~5,925 area. We mention this as we still watch 5,900 as a major support/target zone into next week, and 6/30 expiration.

For today, 6,000 SPX is certainly the biggest OPEX strike, with ~500k total OI expiring. That is the major overhead level for today with 5,950 & 5,900 the big downside strikes.

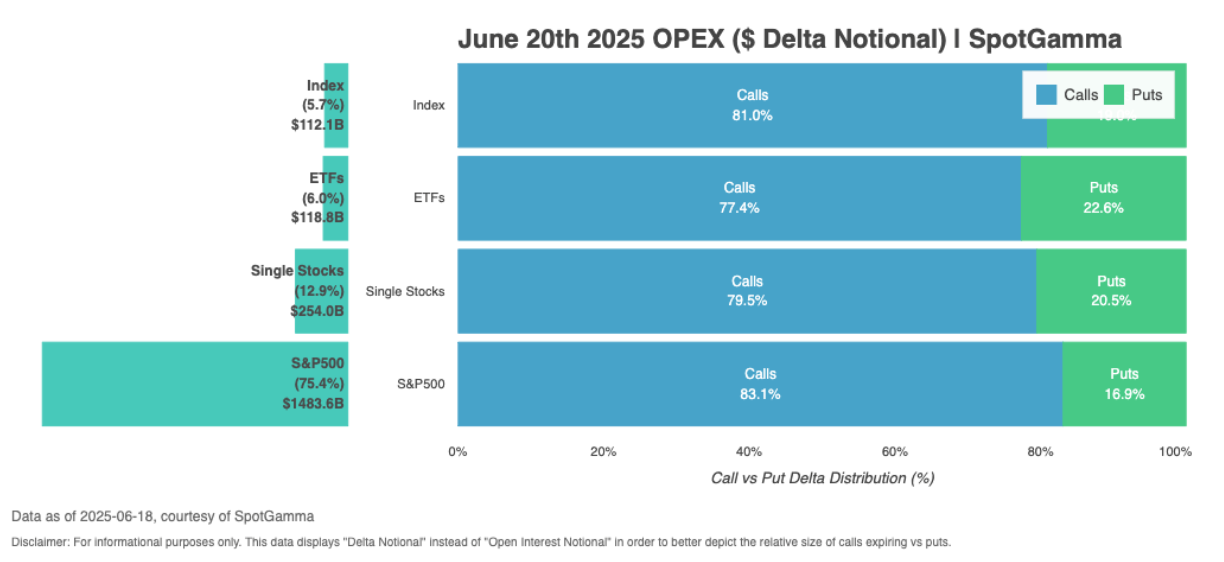

In terms of OPEX size, the delta of calls heavily outweighs that of puts which is only in part due to the stock market rally over the past month (+1%). Select single stocks have certainly rallied more that 1% in the last few weeks – but overall this has not been a massively bullish few weeks for stocks. However, when we see heavy call weightings into an expiration we generally think stocks will sell off or consolidate post-OPEX – and this situation is no different. Here, though, we see massive support at that 5,900. Post 6/30 expiration its less clear to us whats ahead. With that we last week recommended entering positions that benefit from a short term 5,900 test, and we reiterate that today.

While the world is watching pizza deliveries to navigate geopolitical tensions, we will focus on vol & positioning. SPX fixed strike vols are ~1 point lower for any expiration before 6/30. Curious.

Trump supposedly gave a 2 week time frame to escalate with Iran, which seemed to have let short term-shorts back off a bit. If you look for any expiration >=July you see vols as flat.

This suggests that the vol contraction is related to the Trump tweet, but we’d suggest that it is the massive JPM call at 5,905 for 6/30 OPEX that is the vol suppressor. Dealers are long a boat load of gamma near that strike, which could be suppressive implied vols. Post 6/30 that huge position goes away, and the vol surface seems to be suggesting higher vols around that time.

We don’t think we are overhyping the 5,905 position at this time – you can see it in the SPX GEX chart below as the massive positive bar. Below that level there are very few SPX dealer short puts, which indicates traders do not own a lot of put protection. This syncs up with the idea that this OPEX is quite call heavy – despite there not being a massive stock market rally over the past few weeks.

If we had to lay out a path here due to this positioning: 5,900 pin next week (to Monday 6/30), baring any significant Israel/Iran escalation. If that number is tagged between now and then, we would monetize put positions.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6037.21 | $5982 | $597 | $21719 | $528 | $2101 | $209 |

| SG Gamma Index™: |

| 0.103 | -0.083 |

|

|

|

|

| SG Implied 1-Day Move: | 0.70% | 0.70% | 0.70% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6040.21 | $5985 | $595 | $21700 | $529 | $2090 | $210 |

| Absolute Gamma Strike: | $6055.21 | $6000 | $600 | $22000 | $530 | $2100 | $210 |

| Call Wall: | $6155.21 | $6100 | $600 | $22000 | $540 | $2100 | $215 |

| Put Wall: | $5855.21 | $5800 | $590 | $19500 | $520 | $2030 | $200 |

| Zero Gamma Level: | $6003.21 | $5948 | $596 | $21340 | $524 | $2112 | $214 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.008 | 0.914 | 1.305 | 1.103 | 0.958 | 0.646 |

| Gamma Notional (MM): | ‑$37.878M | ‑$291.079M | $7.165M | $140.317M | ‑$17.46M | ‑$657.97M |

| 25 Delta Risk Reversal: | -0.063 | -0.062 | -0.065 | -0.05 | -0.049 | -0.034 |

| Call Volume: | 566.598K | 1.988M | 16.559K | 742.018K | 20.852K | 255.88K |

| Put Volume: | 1.035M | 1.98M | 8.393K | 789.141K | 27.451K | 614.395K |

| Call Open Interest: | 8.996M | 5.848M | 72.598K | 4.003M | 336.978K | 3.989M |

| Put Open Interest: | 14.677M | 13.191M | 93.255K | 5.687M | 505.142K | 9.235M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6050, 5900, 5950] |

| SPY Levels: [600, 595, 590, 605] |

| NDX Levels: [22000, 21500, 21800, 21700] |

| QQQ Levels: [530, 520, 525, 535] |

| SPX Combos: [(6252,92.10), (6228,70.14), (6210,75.39), (6204,96.46), (6180,82.55), (6156,70.40), (6150,93.13), (6126,83.18), (6120,79.77), (6114,70.10), (6108,77.73), (6102,98.49), (6090,89.38), (6084,79.53), (6078,91.93), (6072,79.85), (6066,69.88), (6060,92.01), (6055,91.17), (6037,77.43), (6031,89.93), (6025,74.82), (6007,91.15), (6001,96.12), (5977,88.44), (5971,81.85), (5959,69.52), (5953,90.86), (5947,79.23), (5941,72.85), (5935,76.45), (5929,91.38), (5911,87.69), (5905,78.59), (5887,69.22), (5875,84.06), (5857,82.35), (5851,90.86), (5845,72.19), (5815,70.69), (5809,72.39), (5803,94.21), (5779,68.57), (5755,91.09), (5725,74.83), (5702,90.57)] |

| SPY Combos: [602.91, 609.48, 603.51, 590.96] |

| NDX Combos: [21958, 22175, 22001, 21328] |

| QQQ Combos: [519.56, 544.95, 534.9, 540.19] |

0 comentarios