Macro Theme:

Key dates ahead:

- 6/30: Quarterly OPEX

- 7/1: Powell Speaking 9:30AM, ISM 10AM

- 7/3: NFP

- 7/4: July 4th (market closed)

June OPEX Playbook:

Update 6/30 (Looking past todays roll): Due to the large negative SPX gamma above, we will be looking to play long equity calls into the holiday weekend, likely in SMH due to cheap relative vol in names like NVDA & AVGO. Reference SPX 6,200.

Update: 6/27: We think implied volatility will have a brief uptick on Monday as quarter end hits and the JPM collar trade & its related positions expire/roll off. With that we think a quick 1-2 session shake out is due, and that shake out would quickly recover ahead of the July 4th weekend. As a result, we are looking to be small long 6/30 or 7/1 S&P options (ex: straddle/strangle), buying them because the IV is just 9.1%. If equities should correct some on Monday we would look to buy the dip/sell IV pops into next weeks 3 day weekend.

Update 6/25: The apparent resolution of the Middle East conflict put a bid into stocks, which has rendered the JPM Call for 6/30 irrelevant. SPX vols have since collapsed, and we now look for equity correlation to decline. This means we think SPX stays fairly sticky in the 6,100-6,120 area, and we look to play longs in top single stocks which currently reflect cheaper calls vs SPY/QQQ: SMH/semis, Mag 7 etc.

Key SG levels for the SPX are:

- Resistance: 6,200, 6,222

- Pivot: 6,135 (bearish <, bullish >)

- Support: 6,150, 6,100, 6000

Founder’s Note:

Futures are up +50bps implying the SPX will open at a record high 6,200.

Today is quarter end, and the roll of the JPM collar. While its hard to forecast the exact impact of the roll (the hedge behavior shifts) we do know that a very large intraday trade will occur some time around mid day. Historically you will see a new Sep position print, along with a deep in-the-money 0DTE call. This position will not be the final roll strikes – the final strikes will print between 4 & 4:15. Those final strikes are determined by how much the market moves from the time of the first print, to the end-of-day. The current JPM call is very deep in the money meaning its worth somewhere near $20bn. Yes there are hedges around that, etc, but we are none-the-less talking about some large value swinging today.

The critical thing here is that we think we are likely to see some large unusual swings today. The way we are looking to play this is to own some 0DTE straddles. Why? Because they are trading at $25.5/41bps/IV16.5% and we think the JPM roll can invoke more movement than that. Accordingly if there is a big intraday move we would close those straddles.

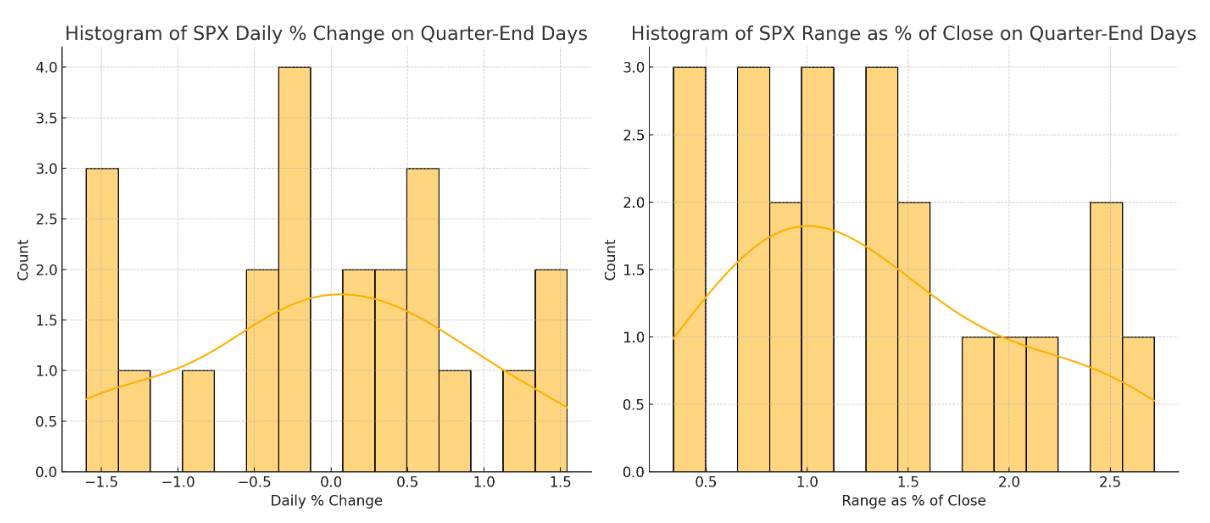

Historically the SPX has a 1.3% trading range on quarter end days (size ’20, n=22), with the smallest every quarter end move being 33bps.

The intraday range however is tightly correlated with where the SPX is trading relative to the JPM short call or long put. The more deep in the money the call is, the less intraday range we tend to have. For reference, the JPM short all is -4% from here (bottom right).

With this in mind the 0DTE straddle at 40bps seems quite fairly valued, but I like the risk reward of buying very cheap options in front of a known catalyst.

Outside of that – if those swings occur to drive equity prices lower we will then look to buy dips and/or sell vol into the upcoming 4th of July weekend. If the market rallies sharply higher intraday we may look for a very short term fade…maybe even just intraday.

Why are we currently so bullish?

First – vol has been getting smashed. Into Friday night the vols for this week were showing <=10% (!!!), but they have popped/normalized a bit this morning. I don’t think this is a coincidence as the vol-suppressing JPM roll happens today.

However, we now have some vol premium to squash – and I don’t think that happens today, but today is the setup for vol smash the rest of the week due to the upcoming holiday and “start of summer”. Vols down stocks up is how this usually works.

Second – dealers are short upside calls and have negative gamma above >6,200 (see how GEX curve drops into 6,300). This suggests some possible chasing to the upside, and we think that vanna can be the tailwind to get the ball rolling.

We will be looking to play upside via long tech calls like SMH, NVDA & AVGO due to their relatively cheap IV.

|

|

/ESU25 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6223.7 |

$6173 |

$614 |

$22534 |

$548 |

$2172 |

$215 |

|

SG Gamma Index™: |

|

2.09 |

0.050 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.66% |

0.66% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.95% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$6185.7 |

$6135 |

$611 |

$21610 |

$539 |

$2100 |

$214 |

|

Absolute Gamma Strike: |

$6050.7 |

$6000 |

$600 |

$22500 |

$545 |

$2200 |

$215 |

|

Call Wall: |

$6250.7 |

$6200 |

$615 |

$21625 |

$550 |

$2200 |

$220 |

|

Put Wall: |

$6180.7 |

$6130 |

$590 |

$22250 |

$500 |

$2100 |

$200 |

|

Zero Gamma Level: |

$6095.7 |

$6045 |

$609 |

$21810 |

$539 |

$2135 |

$215 |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

1.328 |

1.057 |

1.652 |

1.197 |

1.154 |

0.872 |

|

Gamma Notional (MM): |

$957.745M |

$716.481M |

$14.297M |

$384.465M |

$15.629M |

‑$60.232M |

|

25 Delta Risk Reversal: |

-0.04 |

0.00 |

-0.039 |

-0.024 |

0.00 |

-0.006 |

|

Call Volume: |

732.28K |

1.711M |

9.994K |

767.516K |

24.156K |

705.04K |

|

Put Volume: |

979.404K |

2.372M |

10.763K |

1.148M |

35.912K |

505.627K |

|

Call Open Interest: |

6.86M |

5.604M |

57.429K |

3.157M |

242.515K |

3.66M |

|

Put Open Interest: |

11.714M |

12.083M |

76.102K |

4.722M |

383.809K |

7.278M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [6000, 6150, 6200, 6100] |

|

SPY Levels: [600, 615, 610, 620] |

|

NDX Levels: [22500, 22550, 21625, 22200] |

|

QQQ Levels: [545, 550, 540, 530] |

|

SPX Combos: [(6476,69.01), (6451,87.29), (6426,78.44), (6401,96.17), (6377,79.45), (6352,91.66), (6327,92.02), (6303,98.58), (6278,96.94), (6259,74.28), (6247,98.95), (6235,69.48), (6229,73.78), (6222,98.81), (6216,77.84), (6210,86.28), (6204,94.96), (6198,99.87), (6192,88.88), (6185,83.16), (6179,87.37), (6173,99.05), (6167,76.94), (6161,76.75), (6148,94.74), (6130,94.17), (6124,84.07), (6099,89.44), (6050,78.30), (6025,80.22), (6000,69.80), (5951,81.30), (5926,80.36), (5901,85.22)] |

|

SPY Combos: [617.39, 614.94, 612.49, 611.88] |

|

NDX Combos: [22602, 23007, 21633, 22805] |

|

QQQ Combos: [550.04, 526.01, 545.13, 547.31] |

0 comentarios