Macro Theme:

Key dates ahead:

- 7/2: Jobless Claims

- 7/3: NFP

- 7/4: July 4th (market closed)

June OPEX Playbook:

Update 6/30 (Looking past todays roll): Due to the large negative SPX gamma above, we will be looking to play long equity calls into the holiday weekend, likely in SMH due to cheap relative vol in names like NVDA & AVGO. Reference SPX 6,200.

Update: 6/27: We think implied volatility will have a brief uptick on Monday as quarter end hits and the JPM collar trade & its related positions expire/roll off. With that we think a quick 1-2 session shake out is due, and that shake out would quickly recover ahead of the July 4th weekend. As a result, we are looking to be small long 6/30 or 7/1 S&P options (ex: straddle/strangle), buying them because the IV is just 9.1%. If equities should correct some on Monday we would look to buy the dip/sell IV pops into next weeks 3 day weekend.

Key SG levels for the SPX are:

- Resistance: 6,200, 6,222, 6,300

- Pivot: 6,170 (bearish <, bullish >)

- Support: 6,180, 6,170, 6,100

Founder’s Note:

Futures are flat overnight, with the major update being passage of the Big Beautiful Bill. 8:30 AM ET are Jobless Claims.

TLDR: Support at 6,180 resistance at 6,220 – we just don’t expect much happening in index land except for vols to leak lower. The SPX

Call Wall

has shifted to 6,300 from 6,220 which is a bullish action as we now model higher highs available.

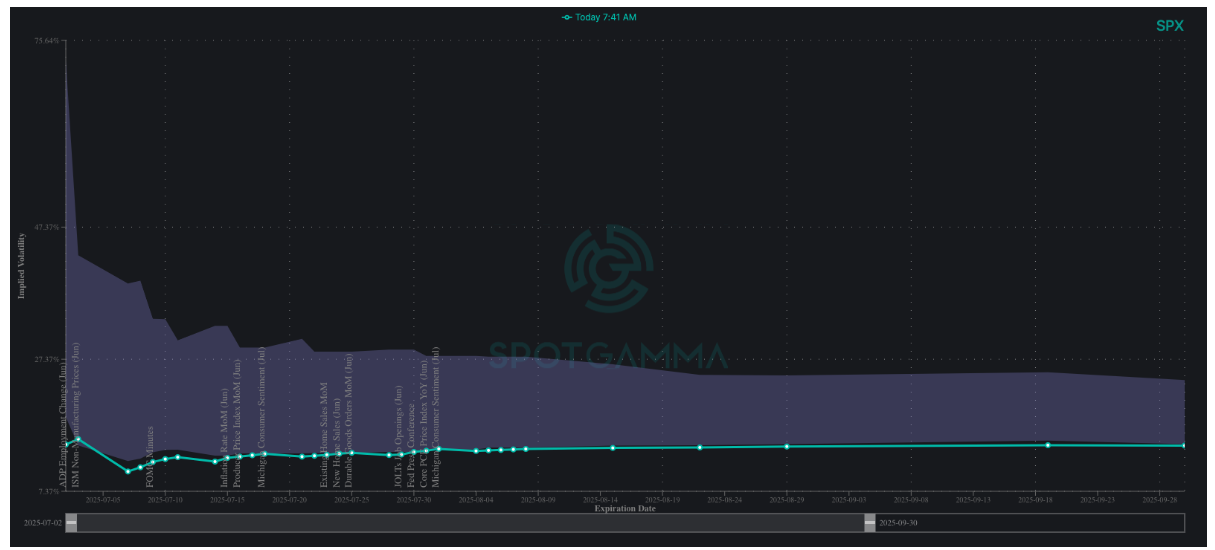

Assuming Jobless Claims are a non event then we’d expect to see vols leak lower – but the more important item is PCE tomorrow. Unless these are big tail prints we think this market is just really not going to care, and that will allow us to see 10% ATM IV’s by Thursday’s close.

Looking at the SPX term structure we see >2 week IV’s near 12-13% and VIX at 16.8.

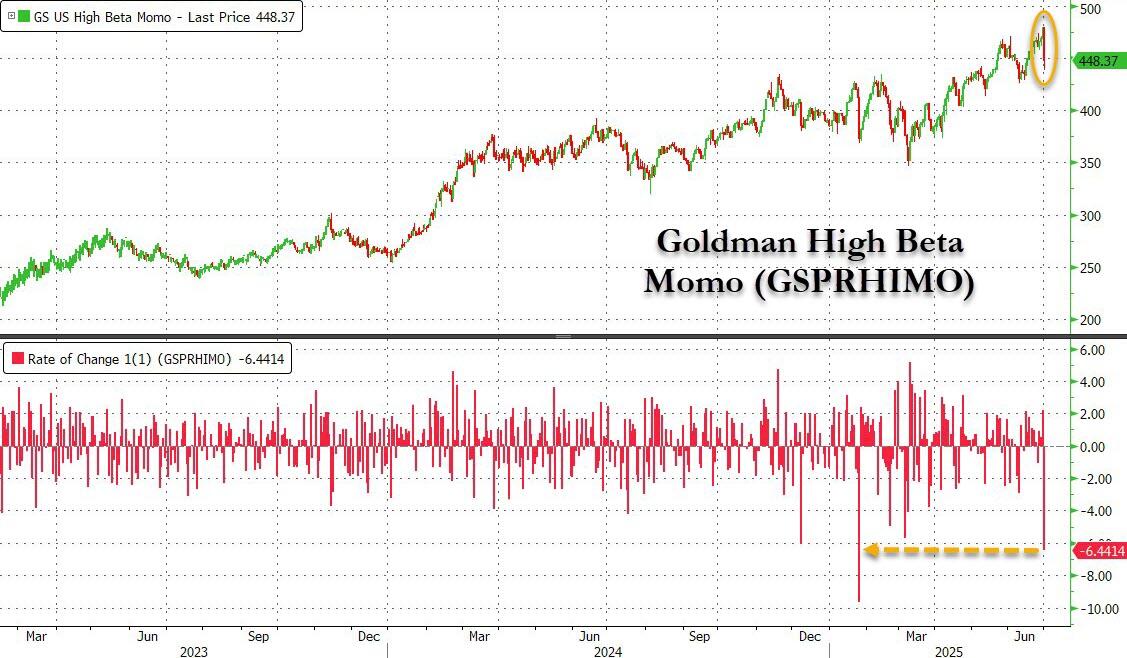

The big talk in trading land was the momentum smackdown yesterday, as seen in this Goldman plot below (h/t ZH). Given that we just started a new quarter we’re not sure there is much to read into, but it does highlight this theme of “stock picking” being more in focus. For example the GS analyst specifically mentions the “springy” XLV/SPY pair (XLV being a poor performer YTD)…

…and that was the sector highlighted as being bought in calls a few days ago (red arrow now higher priced calls). Now you see XLY (yellow) as the definite laggard in terms of call prices. Maybe that is the next vector of bidding?

|

| /ESU25 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6254.6 | $6204 | $617 | $22679 | $546 | $2175 | $218 |

| SG Gamma Index™: |

| 2.509 | 0.074 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.64% | 0.64% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: |

| After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6220.6 | $6170 | $614 | $22390 | $547 | $2100 | $216 |

| Absolute Gamma Strike: | $6050.6 | $6000 | $620 | $22250 | $550 | $2200 | $220 |

| Call Wall: | $6350.6 | $6300 | $620 | $21625 | $550 | $2115 | $220 |

| Put Wall: | $5950.6 | $5900 | $600 | $22250 | $500 | $2090 | $200 |

| Zero Gamma Level: | $6126.6 | $6076 | $616 | $22451 | $542 | $2153 | $217 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.438 | 1.084 | 1.126 | 1.09 | 1.307 | 0.926 |

| Gamma Notional (MM): | $854.923M | $346.86M | $15.294M | $168.533M | $6.039M | ‑$15.158M |

| 25 Delta Risk Reversal: | -0.041 | -0.024 | -0.046 | -0.022 | -0.024 | 0.00 |

| Call Volume: | 560.987K | 1.396M | 8.112K | 749.625K | 38.698K | 687.995K |

| Put Volume: | 1.032M | 1.723M | 10.684K | 1.04M | 49.684K | 610.951K |

| Call Open Interest: | 6.841M | 5.441M | 58.329K | 3.144M | 242.273K | 3.693M |

| Put Open Interest: | 11.455M | 11.782M | 77.168K | 4.853M | 380.126K | 7.28M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6200, 6250, 6100] |

| SPY Levels: [620, 600, 615, 618] |

| NDX Levels: [22250, 22500, 22240, 21625] |

| QQQ Levels: [550, 545, 540, 530] |

| SPX Combos: [(6509,98.96), (6459,91.76), (6435,75.43), (6410,97.28), (6385,80.70), (6379,68.95), (6360,94.15), (6335,90.95), (6329,83.90), (6310,99.42), (6298,74.28), (6286,98.48), (6279,89.45), (6267,88.19), (6261,76.01), (6255,99.43), (6248,91.34), (6242,80.69), (6236,92.96), (6230,99.55), (6224,79.95), (6217,87.44), (6211,84.65), (6205,99.23), (6180,86.49), (6081,71.19), (6025,77.20), (5957,72.71), (5907,82.91)] |

| SPY Combos: [614.76, 620.94, 621.56, 622.17] |

| NDX Combos: [22815, 22430, 22452, 21817] |

| QQQ Combos: [552.19, 554.95, 559.91, 558.26] |

0 comentarios