Macro Theme:

Key dates ahead:

- 7/15: CPI

- 7/16: VIX Exp, Earnings Start

- 7/30: FOMC

July OPEX Playbook:

Update 7/10: Call skews are getting quite elevated and so we are looking to ~1-month sell call skew in select names – most notably SPY. Check Compass for other names. We will also be looking to add ~2-month puts to play a market correction into the data-heavy window coming up 7/15-8/1.

7/8: Watch the second half of July as a possible turning point/change in bullish trend: 7/15 CPI, 7/18 OPEX, 7/30 FOMC & 8/1 tariff deadline. If SPX breaks 6,200 at any time from now through that window we will flip to risk-off.

7/7: We think the SPX holds the 6,250-6,300 area this week, and short dated IV’s like contract sharply (ref 15% ATM IV). Next week could be a big turning point with CPI/OPEX & earnings kicking off.

Key SG levels for the SPX are:

- Resistance: 6,260, 6,300

- Pivot: 6,200 (bearish <, bullish >)

- Support: 6,200, 6,100

Founder’s Note:

Futures are +50bps higher (pressing ATH’s) after it was announced NVDA can resume H20 chip sales to China. NVDA is +4% to 171, with the 170 level a huge strike (read below).

CPI is the on deck at 8:30AM ET, with the SPX 0DTE straddle pricing at $31/49bps/IV 19.8% (ref 6,295). Thats not all that rich given the CPI data point, and the fact that ES futures are already up 40bps overnight.

Resistance currently stands at 6,300 then 6,340, with support at 6,250 then 6,200. Given the NVDA pump, we have to believe that any benign/good CPI reading presses the S&P up into the SPY 630 area (6,325-6,340).

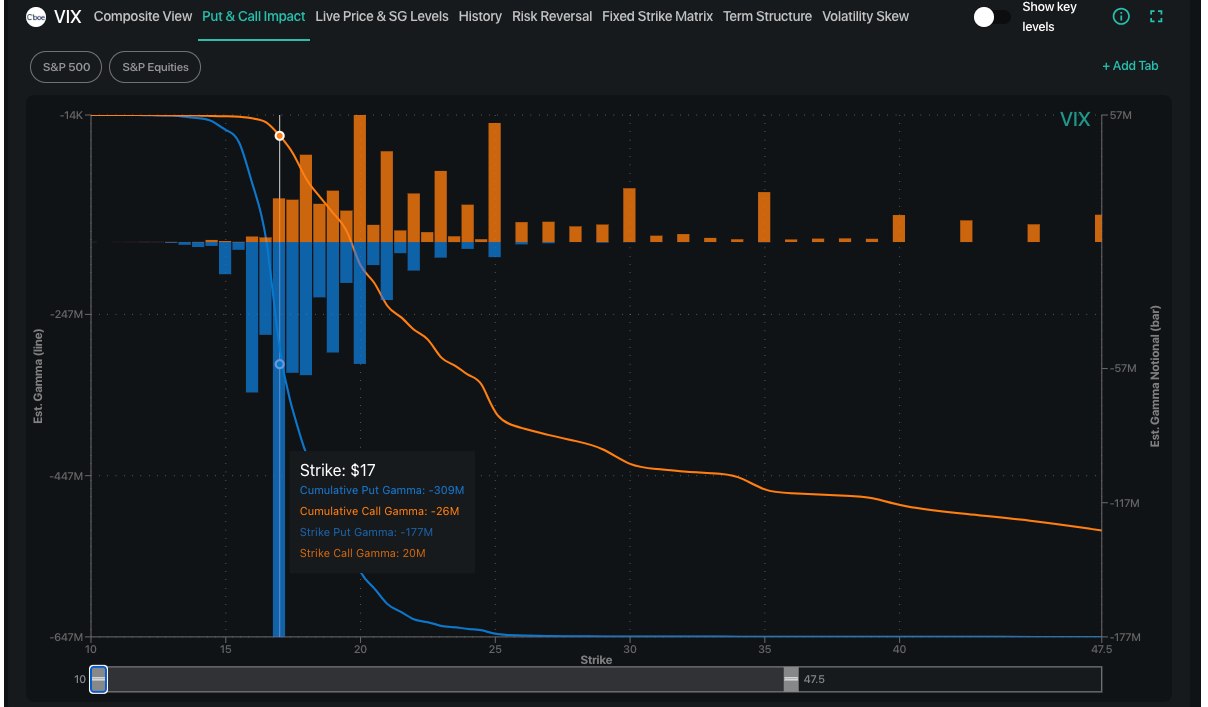

Today is also the final day July VIX contracts to trade as they settle at 9:30AM ET tomorrow. This has been shown to offer some market influence in the past – particularly if there is some apparent IV premium. In this case we have the VIX at 16.86 and one could believe that an in line CPI could help to squeeze 0DTE IV’s a bit lower, which could uptick stocks. The trick with the VIX index here is that it ultimately is anchored to longer dated events like FOMC & 8/1 tariffs.

If we play the “max pain” game, we see that far & away biggest strike is the 17’s and this seems to read as “get VIX <=17 into expiration” to destroy max value”. If you removed the NVDA news we’d read this VIX expiration as a clear “release point” for vols, as we lose the 17 tether. Now…not so clear.

We’re too ignorant with respect to NVDA fundamentals to know how big of a deal this China thing is, but from our standpoint there is not a lot of negative gamma in the name. You can see that there is this massive 170 positive gamma strike, which would have us as a baseline look for a pin in this stock around 170. If the China deal is a paradigm shift – and we see a lot of long HIRO signal – then maybe we get some negative gamma above.

Lastly BTC via IBIT –

We flagged the massive IBIT volume yesterday (>1mm contracts) which played into fresh BTC ATH’s. That volume appeared to be a lot of call selling of this weeks calls into the 70 strike area of IBIT – a signal that traders are taking some gains here. This morning we see BTC down 4-5% from yesterdays highs. This implies that BTC needs a few days to digest recent gains.

|

| /ESU25 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6299.97 | $6259 | $624 | $22780 | $556 | $2234 | $223 |

| SG Gamma Index™: |

| 2.10 | -0.093 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.64% | 0.64% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: |

| After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6285.97 | $6245 | $624 | $22770 | $554 | $2195 | $219 |

| Absolute Gamma Strike: | $6040.97 | $6000 | $620 | $22800 | $550 | $2200 | $220 |

| Call Wall: | $6340.97 | $6300 | $630 | $23000 | $560 | $2240 | $230 |

| Put Wall: | $6245.97 | $6205 | $610 | $22550 | $553 | $2160 | $200 |

| Zero Gamma Level: | $6216.97 | $6176 | $623 | $22552 | $551 | $2229 | $221 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.319 | 0.909 | 1.435 | 1.068 | 1.103 | 1.044 |

| Gamma Notional (MM): | $603.406M | $1.96M | $6.93M | $201.296M | $1.727M | $194.154M |

| 25 Delta Risk Reversal: | -0.043 | 0.00 | -0.043 | 0.00 | 0.00 | -0.019 |

| Call Volume: | 410.465K | 901.416K | 8.233K | 492.411K | 17.135K | 355.082K |

| Put Volume: | 697.484K | 1.391M | 9.736K | 774.571K | 26.093K | 364.98K |

| Call Open Interest: | 7.217M | 5.714M | 64.282K | 3.257M | 258.089K | 4.086M |

| Put Open Interest: | 12.232M | 13.035M | 80.307K | 5.224M | 424.525K | 8.207M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6300, 6250, 6200] |

| SPY Levels: [620, 630, 600, 625] |

| NDX Levels: [22800, 23000, 22900, 22500] |

| QQQ Levels: [550, 555, 560, 545] |

| SPX Combos: [(6566,74.07), (6541,90.00), (6516,68.68), (6498,87.40), (6491,99.58), (6466,76.65), (6441,94.66), (6416,85.97), (6410,76.91), (6391,98.53), (6372,73.57), (6366,90.17), (6360,87.65), (6354,88.97), (6341,98.60), (6329,88.49), (6322,88.82), (6316,95.34), (6310,96.90), (6304,97.80), (6297,77.95), (6291,99.74), (6285,77.24), (6279,94.84), (6272,84.41), (6266,94.01), (6260,90.51), (6241,92.59), (6235,78.11), (6228,72.35), (6210,87.40), (6197,81.42), (6185,83.12), (6172,75.86), (6160,86.33), (6110,84.16), (6091,74.80), (6041,73.54), (6009,77.18), (5991,72.96)] |

| SPY Combos: [627.98, 647.93, 637.95, 632.96] |

| NDX Combos: [22940, 23145, 23350, 22735] |

| QQQ Combos: [547.56, 559.75, 564.74, 569.73] |

0 comentarios