Macro Theme:

¿Key dates ahead:

- 7/30: GDP, FOMC

- 7/31: Jobless Claims

- 8/1: NFP, PMI

Update 7/28: SMH 1-month options scan as both very low IV, and neutral call vs put prices. As such we will be adding 1-month ~300 strike SMH calls into the upcoming earnings deluge (ref $287).

7/25: We reiterate wanting to own a sliver of >=1 month SPX puts as SPX ATM IV’s are now <=10%, with call skews sharply elevated vs puts.

7/23: Trade deals and extensions have re-pumped the bulls, and so we look to maintain longs as long as the SPX remains above the risk pivot. Further, it appears that another blow-off top phase is underway, leading to us looking to express longs in top sectors/single stocks into “stock up, vol up” scenarios.

7/10: Call skews are getting quite elevated and so we are looking to ~1-month sell call skew in select names – most notably SPY. Check Compass for other names. We will also be looking to add ~2-month puts to play a market correction into the data-heavy window coming up 7/15-8/1.

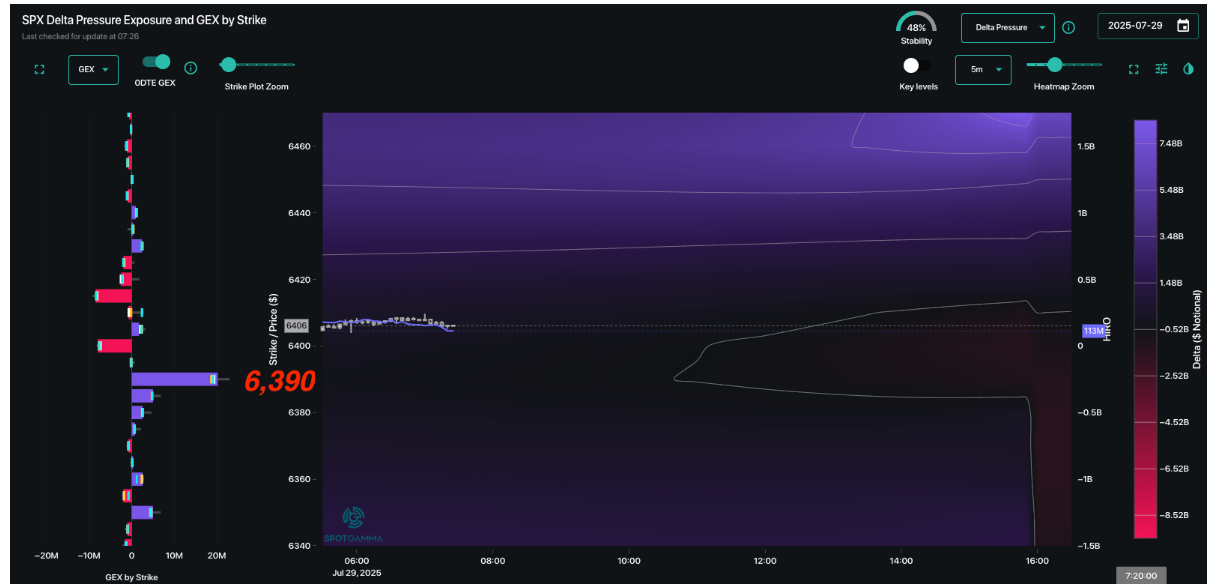

Key SG levels for the SPX are:

- Resistance: 6,460

- Pivot: 6,390 (bearish <, bullish >)

- Support: 6,400, 6,390, 6,350, 6,300

Founder’s Note:

Futures are +20bps. JOLTS is at 10AM ET.

The only major level on the board is 6,390, which is key support on the day. That support level comes against the market pricing essentially no movement: 0DTE straddle is $18.6/IV 11.3% – thats just 29 bps of movement. The sad thing is that, while you don’t want to short that, we can’t really make a case to buy it, either.

Tomorrow is FOMC & GDP, so some short term movement should kick in. If the market is happy with Powells comments, then we likely see the VIX start to sniff 12-13, which likely boosts the S&P500 to 6,500 into early next week, then its “full zombie” into Aug OPEX. This is currently our base case.

Of course with IV’s in the gutter, if Powell upsets markets they we would expect some violet downside action as the SPX is priced to no-volatility perfection. This is why we like owning a sliver of puts/VIX calls over this next week (FOMC, GDP, NFP, etc).

As we discussed yesterday AM, this somewhat forces us all to go to the single stock space for action. SMH was discussed as our favorite long due to cheap IV’s and SMCI was +10% yesterday (8/5 ER), AMD + 4%.

Another interesting trade today may be NVO (Novo), which is -18% to $55 pre-market – likely offering up some spicy vols. Further, if you look at your Total OI model you see there are essentially no positions <=55, which signals a lack of hedging pressure down below. Often times this corresponds with short term lows in a stock.

|

| /ESU25 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6421.33 | $6388 | $636 | $23272 | $568 | $2261 | $224 |

| SG Gamma Index™: |

| 2.303 | 0.018 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.63% | 0.63% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: |

| After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6403.33 | $6370 | $635 | $22940 | $566 | $2245 | $223 |

| Absolute Gamma Strike: | $6033.33 | $6000 | $640 | $23050 | $570 | $2200 | $230 |

| Call Wall: | $6533.33 | $6500 | $640 | $23050 | $570 | $2250 | $230 |

| Put Wall: | $6378.33 | $6345 | $620 | $23390 | $550 | $2170 | $210 |

| Zero Gamma Level: | $6337.33 | $6304 | $631 | $22694 | $562 | $2255 | $225 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.329 | 1.017 | 1.658 | 1.112 | 0.983 | 0.731 |

| Gamma Notional (MM): | $859.774M | $510.107M | $13.232M | $334.406M | $4.723M | ‑$349.122M |

| 25 Delta Risk Reversal: | -0.04 | 0.00 | -0.039 | 0.00 | 0.00 | -0.018 |

| Call Volume: | 521.723K | 1.171M | 8.584K | 529.388K | 21.576K | 202.949K |

| Put Volume: | 751.256K | 1.449M | 10.112K | 674.295K | 22.011K | 346.459K |

| Call Open Interest: | 7.224M | 5.529M | 65.259K | 3.295M | 262.148K | 3.819M |

| Put Open Interest: | 12.236M | 12.706M | 71.10K | 5.273M | 422.317K | 7.859M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6400, 6300, 6500] |

| SPY Levels: [640, 635, 620, 630] |

| NDX Levels: [23050, 23000, 23300, 23200] |

| QQQ Levels: [570, 560, 565, 567] |

| SPX Combos: [(6702,95.71), (6651,92.87), (6599,98.40), (6574,85.94), (6548,96.16), (6523,95.78), (6510,70.59), (6504,91.91), (6497,99.91), (6491,77.24), (6478,86.58), (6472,97.59), (6459,83.92), (6453,89.22), (6446,99.46), (6440,88.70), (6433,80.35), (6427,98.92), (6421,96.99), (6414,86.21), (6408,94.69), (6401,99.87), (6395,70.76), (6389,90.27), (6376,86.31), (6369,86.59), (6363,72.33), (6357,84.34), (6344,84.14), (6331,86.35), (6318,72.38), (6312,75.16), (6286,75.93), (6280,70.39), (6267,83.60), (6216,86.00), (6197,78.47), (6171,76.71), (6146,79.61), (6120,75.47), (6101,83.56)] |

| SPY Combos: [647.86, 638.3, 642.76, 640.85] |

| NDX Combos: [23342, 22970, 23552, 23761] |

| QQQ Combos: [569.79, 566.96, 560.73, 574.89] |

0 comentarios