Macro Theme:

Key dates ahead:

- 8/7 Tariff Deadline

- 8/12: CPI

7/30: We recommend ~8/11-8/15 exp 6,500 calls as an upside play out of FOMC, GDP, NFP and Mag 7 earnings. This is because they are trading at a 9-10% IV, and we think a vol contraction + giant positioning at 6,500 could be a target with benign to good outcomes from these events/data.

7/28: SMH 1-month options scan as both very low IV, and neutral call vs put prices. As such we will be adding 1-month ~300 strike SMH calls into the upcoming earnings deluge (ref $287).

Update 8/1: Puts & VIX calls are paying, and we look to close and/or roll that sliver of puts today as SPX popped into risk-off levels <6,300. We see an ultimate possible low at 6,000-6,100, with a view that what is happening here is more of a mild correction vs start of something more nefarious. If large non-0DTE puts are bought today, then we would likely change that view.

Key SG levels for the SPX are:

- Resistance: 6,350, 6,400

- Pivot: 6,290 (bearish <, bullish >)

- Support: 6,250, 6,200, 6,100 (6,050 – 6,100 a likely long term bottom)

Founder’s Note:

Futures are up 20bps, with no major data on deck.

For today, support remains at 6,290, and resistance remains at 6,350. A break <6,290 flips us back to “risk off” and we’d look for a test of 6,250. Ultimately we don’t see positioning in place for an extended volatility spike unless SPX breaks <6,200.

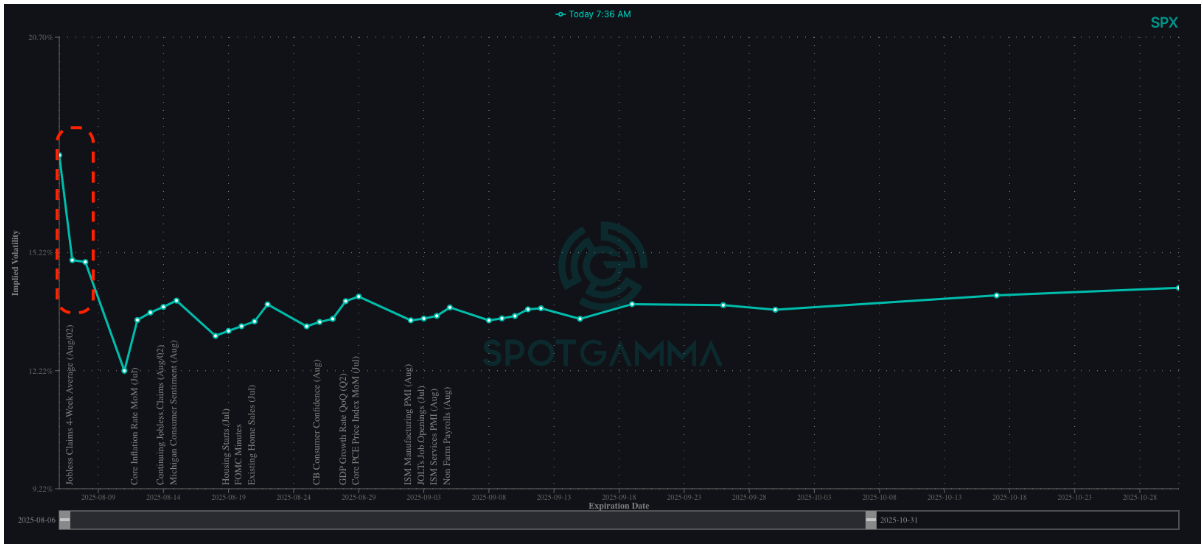

There is an alleged tariff deadline tomorrow that some are flagging as a risk. SPX vols into 8/8 definitely show a kink, with those IV’s near 15% and longer dated IV’s closer to 13%. We’re not terribly convinced this matters that much for market risk, as you would think longer dated IV’s would hold higher vol levels if this 8/7 event was such a trigger.

Weighing on things are the semis, with ugly results from AMD (-5% premarket) and SMCI (-16% premarket). Those stocks both had tremendous runs into these results, but through our eyes is a signal of struggling leaderships – with out the semi/AI narrative to lead us then what will? NVDA earnings are not until 8/27, which is also the timing of Jackson Hole (and talk-up of potential rate cuts).

We note SMCI may be approaching short term bottom area <=45 as positioning wanes under there.

From a flows perspective the vols contracted a fair amount – one could argue that IV’s could continue to contract which would be supportive of equities but not a heavy-handed catalyst. The positive clearing of some tariff deals could allow a short term IV contraction, which helps to keep SPX >6,300. Should we slip under <6,290, then we would look to play some downside but things likely don’t get too spicy unless SPX <6,200 as there are very few long buyside puts in the 6,200-6,300 range.

The ultimate take from the ramblings above show that there really is a lack of conviction at this moment and things seem tired. We see this view in the single stock space, wherein the IV’s are all over the map vs consolidated in a bullish or bearish stance. This means we will be on the look for longer term single stock plays if names move to IV/price extremes, while we look for opportunistic intraday mean reversion trades in the indexes (or a directional short <6,290).

|

| /ESU25 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6325.01 | $6299 | $627 | $23018 | $560 | $2225 | $220 |

| SG Gamma Index™: |

| 0.211 | -0.384 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.61% | 0.61% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| $6348.84 | $632.91 |

|

|

|

|

| SG Implied 1-Day Move Low: |

| $6271.86 | $625.23 |

|

|

|

|

| SG Volatility Trigger™: | $6341.01 | $6315 | $627 | $23040 | $560 | $2205 | $221 |

| Absolute Gamma Strike: | $6026.01 | $6000 | $630 | $23050 | $560 | $2200 | $220 |

| Call Wall: | $6526.01 | $6500 | $640 | $23050 | $570 | $2250 | $230 |

| Put Wall: | $6226.01 | $6200 | $620 | $22900 | $560 | $2200 | $210 |

| Zero Gamma Level: | $6288.01 | $6262 | $631 | $22788 | $563 | $2220 | $227 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.026 | 0.699 | 1.288 | 0.800 | 0.911 | 0.531 |

| Gamma Notional (MM): | $57.692M | ‑$1.075B | $8.474M | ‑$339.758M | ‑$7.825M | ‑$964.251M |

| 25 Delta Risk Reversal: | -0.057 | -0.037 | -0.062 | -0.041 | -0.049 | -0.03 |

| Call Volume: | 419.133K | 1.237M | 9.939K | 691.669K | 15.513K | 211.335K |

| Put Volume: | 741.735K | 2.315M | 10.215K | 978.079K | 31.803K | 875.283K |

| Call Open Interest: | 7.459M | 5.629M | 69.011K | 3.482M | 274.174K | 3.853M |

| Put Open Interest: | 12.896M | 13.332M | 77.713K | 5.348M | 438.566K | 8.727M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6300, 6400, 6350] |

| SPY Levels: [630, 620, 625, 600] |

| NDX Levels: [23050, 23000, 23200, 23300] |

| QQQ Levels: [560, 550, 565, 570] |

| SPX Combos: [(6602,97.08), (6576,80.09), (6551,91.90), (6526,82.43), (6520,71.09), (6507,92.17), (6501,99.09), (6482,70.17), (6476,84.37), (6469,78.00), (6450,95.55), (6438,73.23), (6425,86.48), (6419,87.99), (6413,83.14), (6400,98.87), (6387,83.16), (6381,78.54), (6375,85.10), (6368,88.13), (6362,89.27), (6350,97.76), (6337,82.68), (6324,85.50), (6299,80.07), (6293,71.44), (6280,84.46), (6268,95.72), (6261,82.85), (6249,91.19), (6242,85.86), (6236,77.47), (6230,72.92), (6217,95.21), (6198,94.30), (6192,86.16), (6186,71.30), (6173,73.39), (6167,87.04), (6148,92.84), (6123,78.23), (6117,83.71), (6098,92.73), (6072,74.90), (6047,81.53), (6016,77.76), (6003,92.23)] |

| SPY Combos: [638.11, 648.21, 627.38, 633.69] |

| NDX Combos: [23042, 23019, 22604, 23410] |

| QQQ Combos: [560.72, 560.15, 569.74, 550] |

0 comentarios