Macro Theme:

Key dates ahead:

- 8/27: NVDA ER

- 8/28: Jobless Claims

- 8/29: PCE

8/25: Post JHOLE: At any point moving forward should SPX break under 6,400 this market could get pretty nasty, as that is where negative gamma comes in. Further, that downside action would clash with volatility expectations that are de minimus – so VIX/vol would jump. We read this as downside is wide open into 6,150. The current best case scenario is a move to 6,525 to the upside, which also syncs with QQQ needing ~2% upside to match the ATH set into Aug OPEX.

8/18: Per recent updates, due to 11-12% SPX IV’s we want to now own a small amount of Sep puts, and/or Sep VIX call spreads into JHOLE & NVDA (8/27), while maintaining a core long position as long as the SPX is >6,400. The core long position can be stock, or expressed via call options as call IV’s are also quite cheap particularly in tech like SMH, XLK. For that upside we will likely elect to go with short dated (early Sep) call spreads or flies that we will likely look to buy Friday to play positive outcomes of JHOLE and NVDA ER.

Key SG levels for the SPX are:

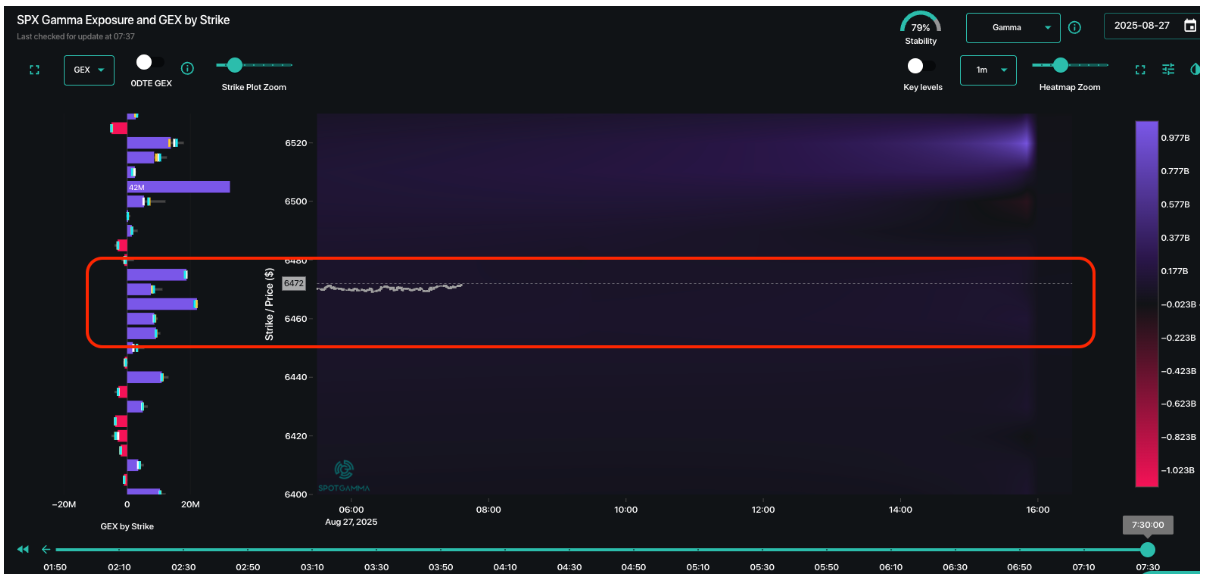

- Resistance: 6,475, 6,500

- Pivot: 6,400 (bearish <, bullish >)

- Support: 6,300, 6,150

Founder’s Note:

Futures are flat with no major data listed for this AM. All eyes are on NVDA ER, tonight.

SPX is blanketed in positive gamma for now, which infers another low volatility session.

Zooming out, this is what the map looks like:

- >=decent NVDA earnings move the SPX to 6,500-6,525, which unlocks “The Zombie”: a low volatility regime that dominates into Sep OPEX. We would want to select top “memes and themes” i.e. tech or small caps vs owning indexes, as we think vol suppression in the S&P500 would lead to S&P lagging top sectors

- Bulls will hold the edge until/unless SPX 6,400 breaks. If 6,400 breaks we think things can get quite nasty due to dealer short put positions in through 6,1xx’s.

NVDA Earnings

The options implied move for earnings is 5.6%. We see predominantly large positive gamma strikes from 180 all the way up through 200, which should suppress upside vol. Given that, a meet-to-strong outcome and we think 185-190 is the move, with the best case 200 (its a massive OI strike). >200 we’d read as overbought. Given the implied move is 5%, we don’t see much edge in outright options plays to the upside (unless you are playing for a full-on blowout). Further, if you look at short dated skew the call prices are relatively depressed, which syncs with this dealer positive gamma.

A miss is not really being priced in. To the downside there is a pocket of negative gamma from 180 down to 165. Given that, weak earnings could bring the stock -9%, which is obviously larger than the implied move. Placing a cheap bet that NVDA will miss is obviously sacrilege, but this, for us, is where the soft spot to pricing is.

|

| /ESU25 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6480.1 | $6465 | $645 | $23525 | $572 | $2358 | $234 |

| SG Gamma Index™: |

| 1.654 | -0.251 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.61% | 0.61% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.51% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| $6498 | $648.43 |

|

|

|

|

| SG Implied 1-Day Move Low: |

| $6419.2 | $640.57 |

|

|

|

|

| SG Volatility Trigger™: | $6460.1 | $6445 | $644 | $23420 | $571 | $2260 | $229 |

| Absolute Gamma Strike: | $6015.1 | $6000 | $640 | $23725 | $560 | $2300 | $230 |

| Call Wall: | $6515.1 | $6500 | $650 | $23725 | $580 | $2400 | $235 |

| Put Wall: | $6315.1 | $6300 | $635 | $23560 | $550 | $2250 | $220 |

| Zero Gamma Level: | $6395.1 | $6380 | $644 | $23289 | $571 | $2317 | $232 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.193 | 0.787 | 1.227 | 0.899 | 1.241 | 1.054 |

| Gamma Notional (MM): | $802.348M | ‑$239.032M | $10.081M | $39.264M | $26.305M | $218.155M |

| 25 Delta Risk Reversal: | -0.044 | -0.038 | -0.055 | -0.042 | -0.026 | -0.022 |

| Call Volume: | 641.327K | 906.564K | 6.206K | 569.33K | 24.955K | 357.848K |

| Put Volume: | 1.026M | 1.189M | 10.622K | 752.225K | 28.585K | 353.566K |

| Call Open Interest: | 7.542M | 5.273M | 67.398K | 3.581M | 300.482K | 3.867M |

| Put Open Interest: | 13.169M | 13.006M | 83.521K | 5.731M | 463.854K | 8.24M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6500, 6450, 6400] |

| SPY Levels: [640, 630, 645, 650] |

| NDX Levels: [23725, 23600, 23000, 23400] |

| QQQ Levels: [560, 570, 580, 575] |

| SPX Combos: [(6750,93.96), (6699,97.30), (6673,77.88), (6647,96.97), (6628,87.54), (6615,71.00), (6602,99.47), (6582,76.89), (6576,94.69), (6563,93.12), (6550,98.45), (6537,94.33), (6531,87.32), (6524,96.94), (6518,97.59), (6511,88.16), (6505,97.77), (6498,99.84), (6492,97.08), (6485,94.43), (6479,90.75), (6472,98.91), (6466,80.51), (6459,80.43), (6453,85.11), (6447,68.87), (6440,85.79), (6434,85.77), (6427,94.50), (6421,76.40), (6414,89.25), (6408,86.17), (6401,88.91), (6395,73.05), (6388,69.73), (6382,88.90), (6375,76.35), (6362,91.45), (6350,85.81), (6343,80.25), (6317,86.26), (6298,92.42), (6272,77.67), (6265,74.87), (6253,90.29), (6214,76.74), (6201,85.73), (6162,71.12), (6149,79.12)] |

| SPY Combos: [648.27, 658.55, 646.34, 653.41] |

| NDX Combos: [23713, 23831, 22608, 23219] |

| QQQ Combos: [564.62, 577.73, 580.02, 565.19] |

0 comentarios