Macro Theme:

Key dates ahead:

- 9/2: ISM

- 9/3: JOLTS

- 9/4: Jobless Claims/PMI

- 9/5: NFP

Update 8/28: Post NVDA earnings the key upside target remains 6,500-6,525. We update our key “risk off” pivot level to 6,450. A break below there infers a test of 6,400. <6,400 infers a test of 6,315. If NVDA survives the open on 8/28 then we think vol selling comes in, which invokes positive gamma drift into the Labor Day weekend.

8/25: Post JHOLE: At any point moving forward should SPX break under 6,400 this market could get pretty nasty, as that is where negative gamma comes in. Further, that downside action would clash with volatility expectations that are de minimus – so VIX/vol would jump. We read this as downside is wide open into 6,150. The current best case scenario is a move to 6,525 to the upside, which also syncs with QQQ needing ~2% upside to match the ATH set into Aug OPEX.

Key SG levels for the SPX are:

- Resistance: 6,450

- Pivot: 6,450 (bearish <, bullish >)

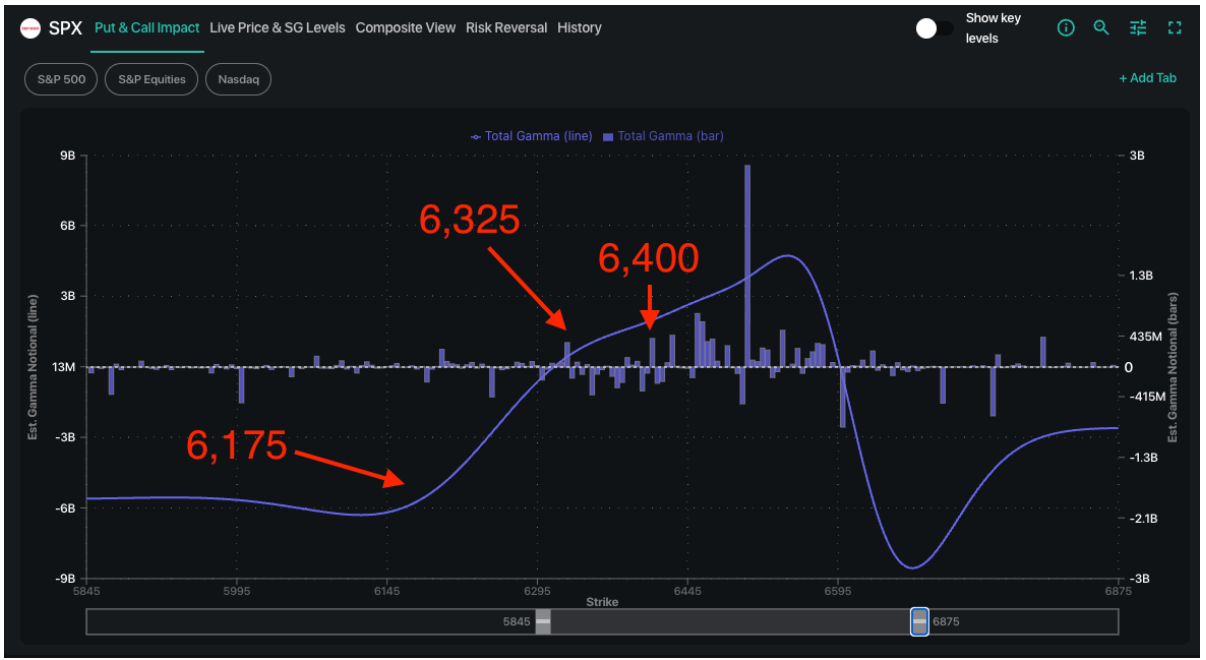

- Support: 6,400, 6,325, 6,150

Founder’s Note:

Futures are 75bps lower as we come off of the 3 day weekend.

TLDR: The break under 6,450 triggered our risk-off stance, as it implied a test of 6,400 (see Macro Theme). Now, if 6,400 breaks, we would look for a move into the 6,325 area. Given the huge bearish positions on Friday, we are not trying to be dip-buying hero’s.

If 6,400 holds, AND if >0DTE positive gamma fills in below, we could flip back to a bullish posture.

You may recall that the estimated IV for today was in the 7%’s, and so many traders are having to repricing their vol expectations for today. This repricing can itself lead to higher vol.

Here are the key SPX levels. You can see the negative SPX gamma pocked under 6,400 into a fairly large 6,325 strike. 6,325 lines up with 630 SPY – which should be a reasonable support attempt. If we get under 6,300, then the negative gamma increases all the way into the upper 6,100’s. This is assuming no one buys any puts today.

Additionally, we can see that IV is reflating. Increasing IV = negative vanna. This infers that higher IV’s mean more stock for dealers to sell.

Last night we sent out FlowPatrol (if you aren’t receiving that go here) – and it was quite negative. In particular was the140k 10/22 exp 31 calls. Thats big. EquityHub also shows a large VIX call position for funds at the 20 strike.

In FlowPatrol you may also notice a put roll for SPY of +100k, and a QQQ short put spread that was covered. We also caught 25k of RSP puts (equal weight S&P ETF), 25K XLP puts, and the big TSLA 50k call buyer from a few days ago closed up there 9/12 350 calls. That is a lot of bearish flow, and not of the 0DTE kind. People were hedging.

These position changes are not terribly surprising if you caught

HIRO

on Friday, which showed some nasty bearish action. Just consider S&P equities

HIRO

, which was -$5bn, easily its ugliest number in the last 30 days, and harkens back to the downside days of March/April.

Taking the other side of this bearish flow was BABA (+13%), which caught massive inflows of +$680mm. This after it reported earnings on Friday AM and announced some chips that were competing with NVDA. BABA stock is up another 1% premarket.

We are not fundamental analysts here, but we cant help but to think back to DeepSeek in Jan which led to a 1-day ~15% drop in NVDA – the largest 1-day market cap decline ever. Don’t take this as fear mongering, but we think it is of note as NVDA just held the largest weight in the S&P500 EVER at +8%, and the earnings were confusingly…”meh”. We made the argument that so much of that DeepSeek reaction was derivative based (options + ETF’s).

We also projected that if NVDA broke 180 it could gap down to 165. Post earnings the stock was flattish, with this Friday AM BABA news maybe serving as more of a NVDA punch-down. Now the positions in NVDA shows a big negative gamma strike at 170 (NVDA is 170 premarket), then nothing but small but positive gamma positions below. This infers the key initial downside support area is still in that 165 area – but we only feel luke warm on this support given how giant NVDA is weighted in the SPX/NDX (i.e. lots of stock could unwind). Further, if we see put buying in NVDA today (vs primarily big call selling on Friday), then we may have to consider lower support levels for NVDA.

|

| /ESU25 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6471.85 | $6460 | $645 | $23415 | $570 | $2366 | $235 |

| SG Gamma Index™: |

| 0.860 | -0.318 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.62% | 0.62% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.50% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: |

| After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6461.85 | $6450 | $644 | $23480 | $571 | $2340 | $234 |

| Absolute Gamma Strike: | $6011.85 | $6000 | $645 | $23725 | $560 | $2300 | $230 |

| Call Wall: | $6511.85 | $6500 | $650 | $23725 | $580 | $2400 | $240 |

| Put Wall: | $6411.85 | $6400 | $635 | $23000 | $560 | $2250 | $220 |

| Zero Gamma Level: | $6433.85 | $6422 | $643 | $23180 | $573 | $2343 | $235 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.101 | 0.733 | 1.103 | 0.745 | 1.043 | 0.913 |

| Gamma Notional (MM): | $329.539M | ‑$623.603M | $3.174M | ‑$393.162M | $9.77M | $42.566M |

| 25 Delta Risk Reversal: | -0.046 | 0.00 | -0.056 | 0.00 | -0.027 | -0.026 |

| Call Volume: | 497.523K | 1.173M | 10.46K | 684.588K | 15.073K | 226.076K |

| Put Volume: | 845.385K | 1.85M | 11.215K | 1.097M | 33.56K | 434.644K |

| Call Open Interest: | 7.523M | 5.196M | 67.58K | 3.50M | 300.204K | 3.736M |

| Put Open Interest: | 13.034M | 12.488M | 83.598K | 5.916M | 463.245K | 8.164M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6500, 6400, 6450] |

| SPY Levels: [645, 640, 630, 650] |

| NDX Levels: [23725, 23000, 23400, 23500] |

| QQQ Levels: [560, 570, 575, 550] |

| SPX Combos: [(6751,94.57), (6699,97.41), (6673,76.82), (6648,97.02), (6622,89.33), (6609,81.25), (6602,99.55), (6577,96.81), (6570,70.92), (6557,92.35), (6551,98.17), (6538,84.54), (6531,90.68), (6525,94.86), (6518,85.11), (6512,96.61), (6505,96.82), (6499,99.59), (6493,90.94), (6480,80.76), (6473,89.72), (6467,75.37), (6447,83.86), (6441,85.00), (6428,88.03), (6421,93.59), (6409,91.50), (6402,97.07), (6389,79.19), (6376,88.78), (6370,69.68), (6357,92.10), (6350,89.82), (6338,78.98), (6312,88.65), (6299,92.55), (6292,72.11), (6273,71.43), (6260,76.52), (6247,91.10), (6208,79.97), (6202,90.98), (6157,71.15), (6150,79.78)] |

| SPY Combos: [648.92, 651.52, 653.46, 658.65] |

| NDX Combos: [22994, 23720, 22572, 23813] |

| QQQ Combos: [579.97, 577.66, 585.16, 589.78] |

0 comentarios