Informe Option Levels

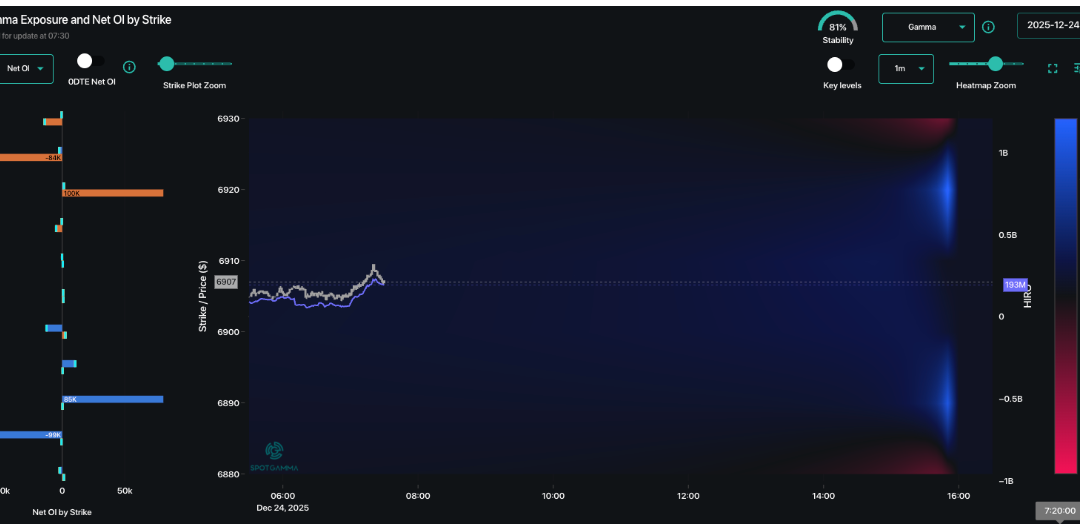

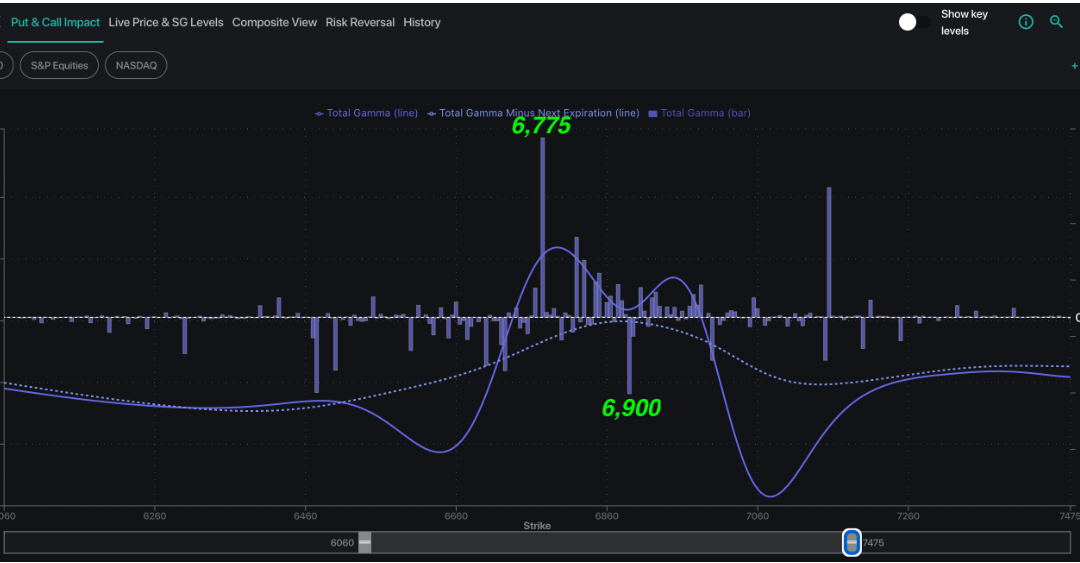

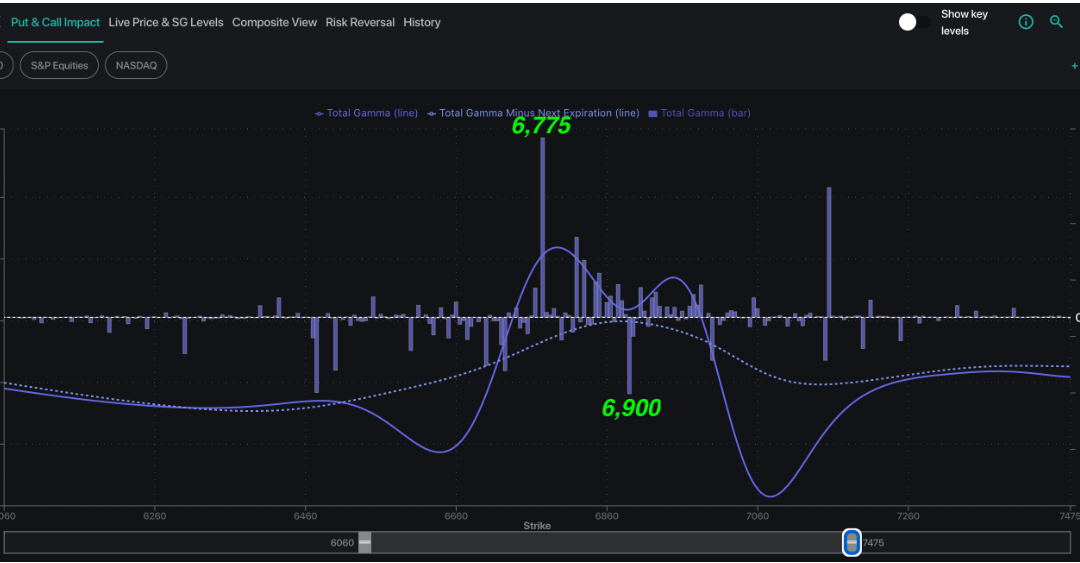

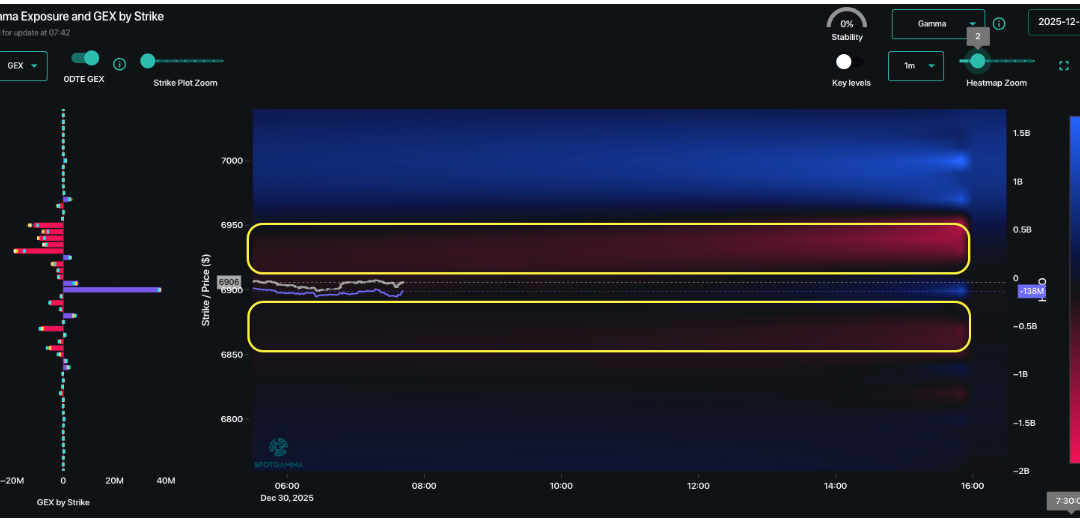

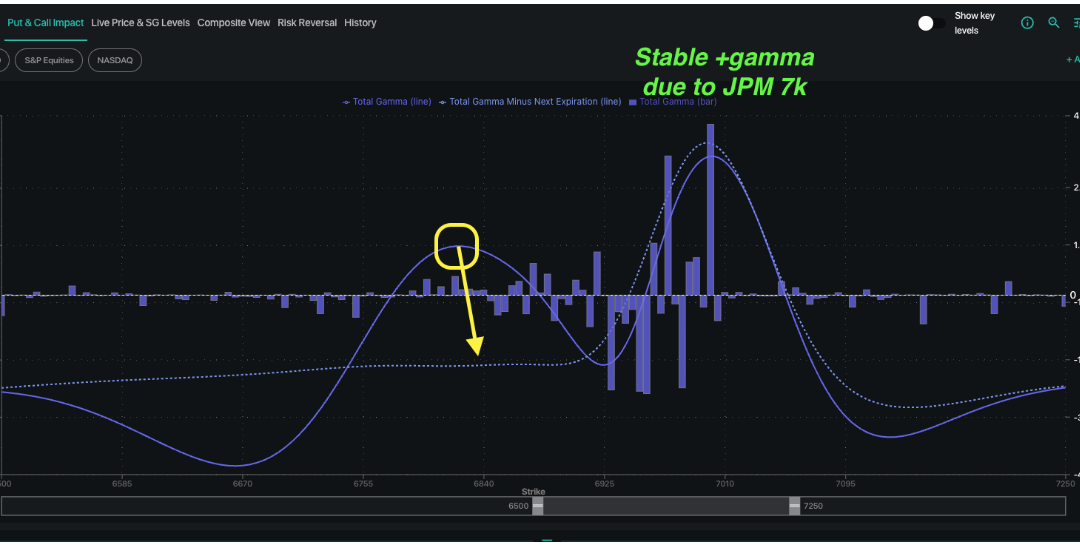

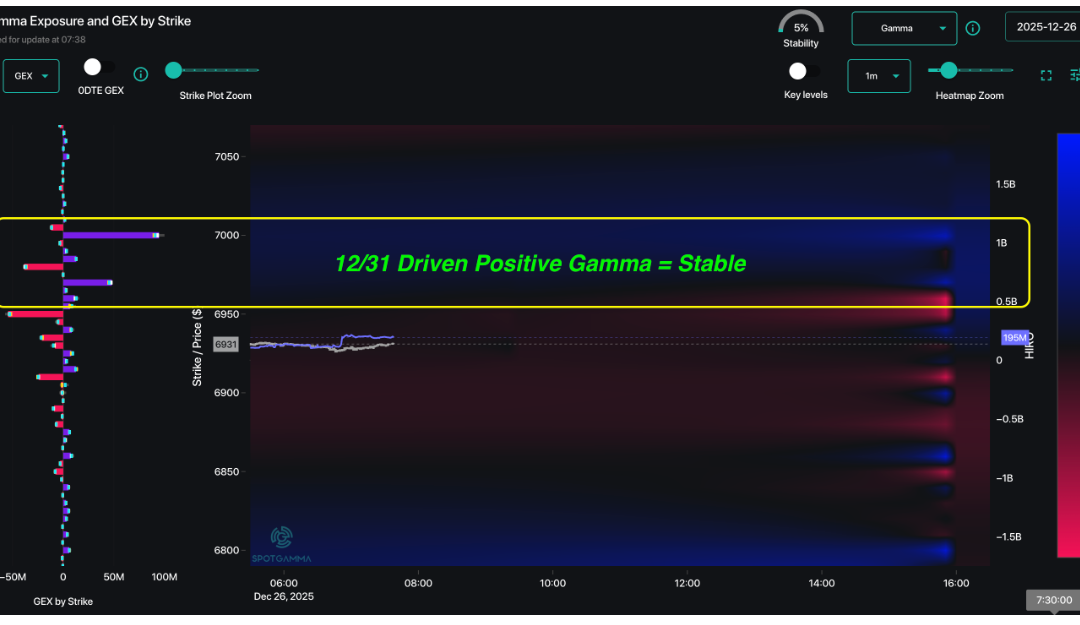

Macro Theme: Key dates ahead: 12/31: Jobless Claims, year end exp (JPM) 1/1: New Years 1/2: NFP SG Summary: Update 12/26: The Risk Pivot is now 6,900. As the bullish OPEXMas closes today, we also shift to a generally more neutral stance vs bullish. IVs are now at...

Informe Option Levels

Macro Theme: Key dates ahead: 12/31: Jobless Claims, year end exp (JPM) 1/1: New Years 1/2: NFP SG Summary: Update 12/26: The Risk Pivot is now 6,900. As the bullish OPEXMas closes today, we also shift to a generally more neutral stance vs bullish. IVs are now at...

Informe Option Levels

Macro Theme: Key dates ahead: 12/31: Jobless Claims, year end exp (JPM) 1/1: New Years 1/2: NFP SG Summary: Update 12/26: The Risk Pivot is now 6,900. As the bullish OPEXMas closes today, we also shift to a generally more neutral stance vs bullish. IVs are now at...