by Melida Montemayor | Ago 25, 2025 | Informe Option Levels

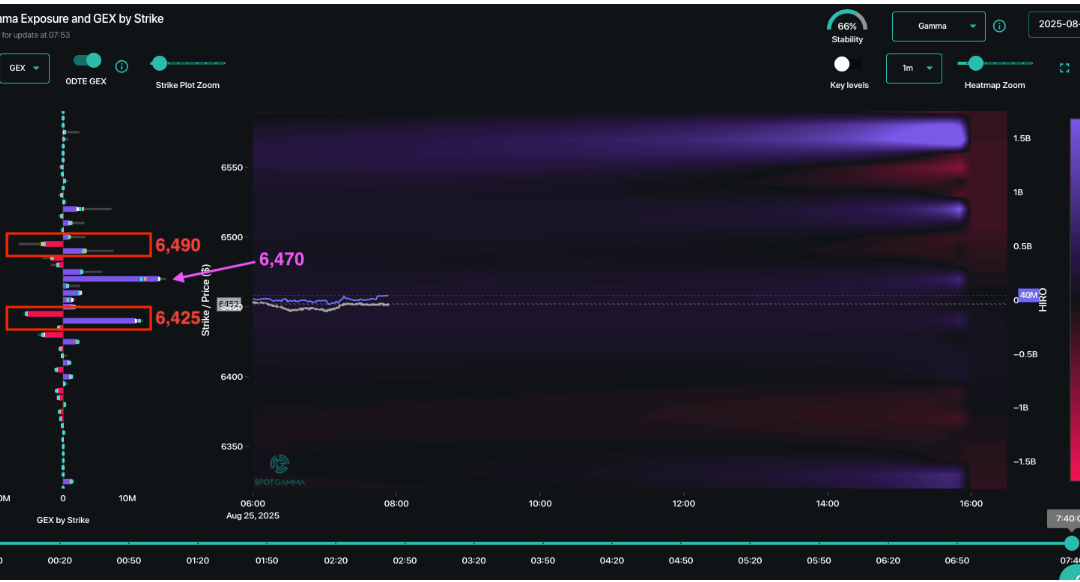

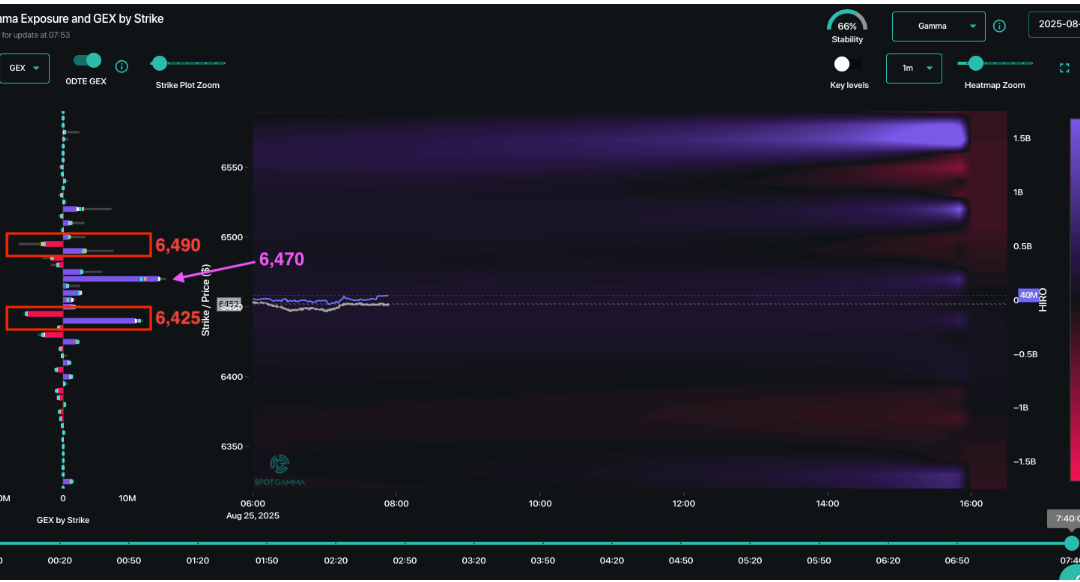

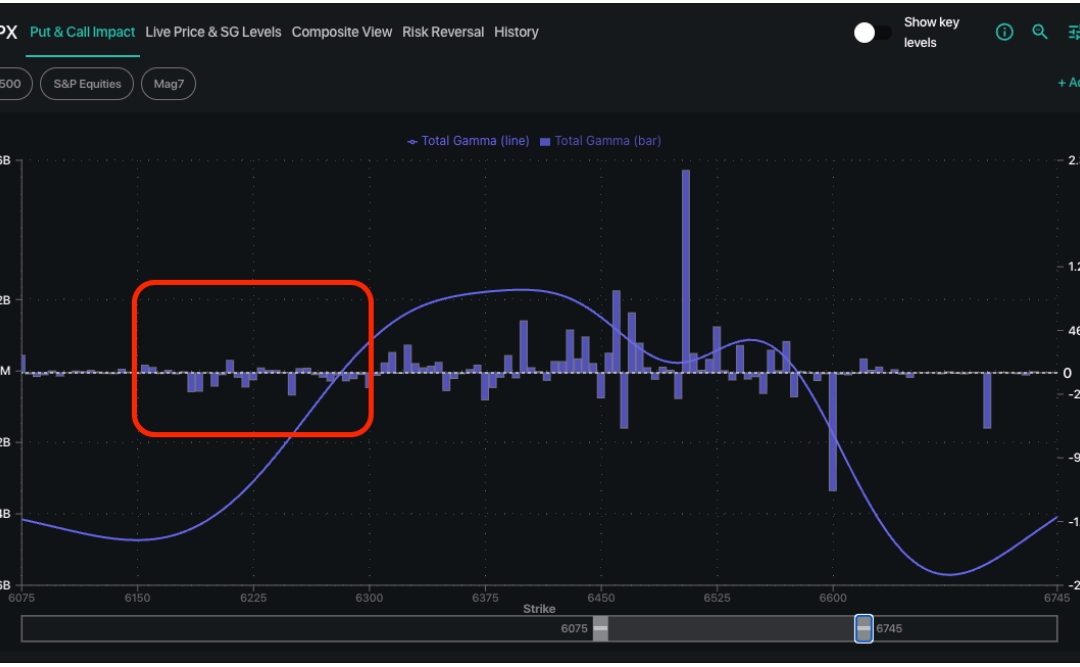

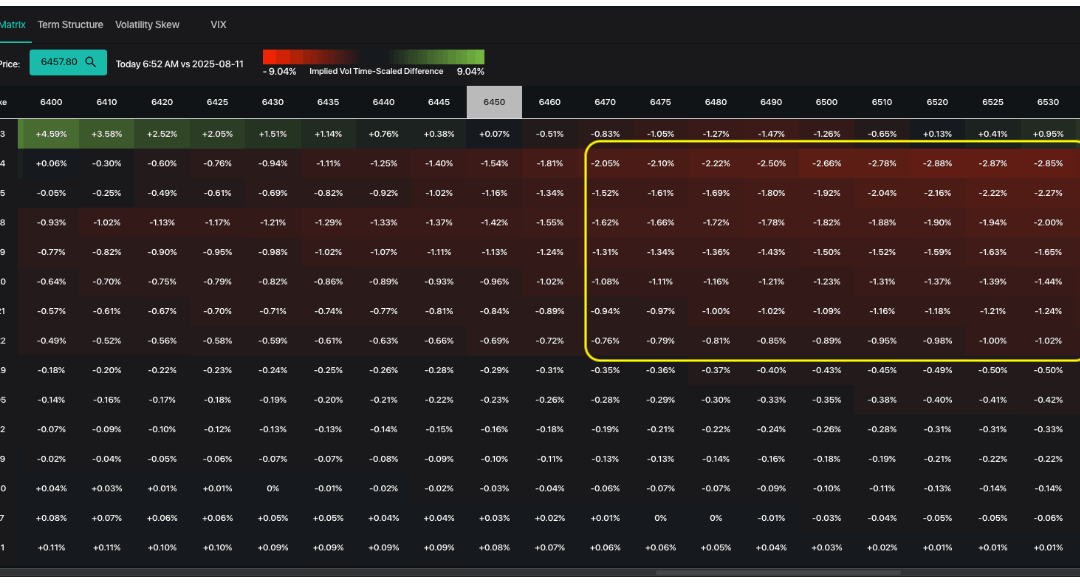

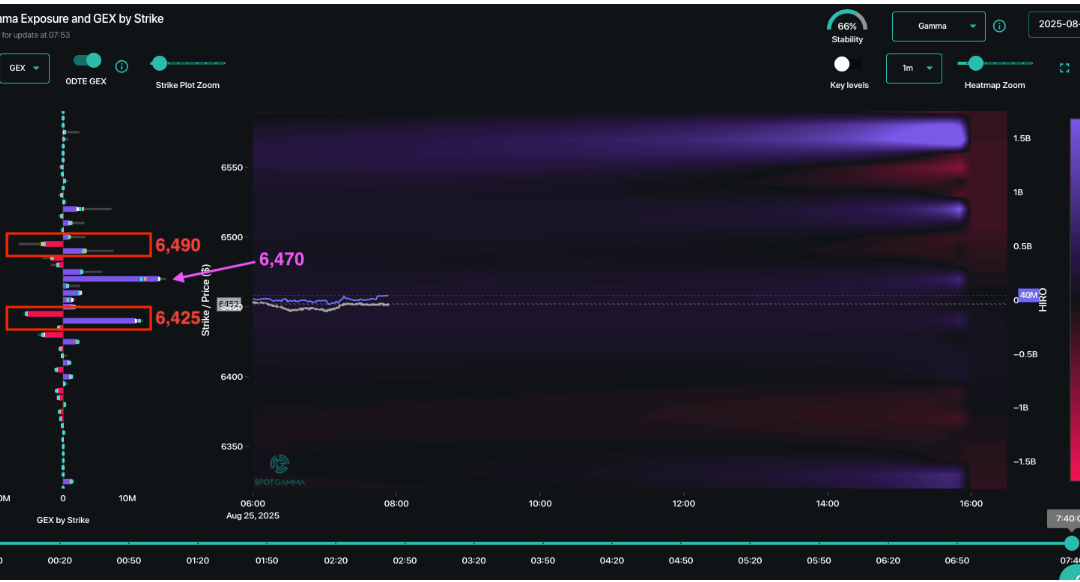

Macro Theme: Key dates ahead: 8/27: NVDA ER 8/28: Jobless Claims 8/29: PCE Update 8/25: Post JHOLE: At any point moving forward should SPX break under 6,400 this market could get pretty nasty, as that is where negative gamma comes in. Further, that downside action...

by Melida Montemayor | Ago 20, 2025 | Informe Option Levels

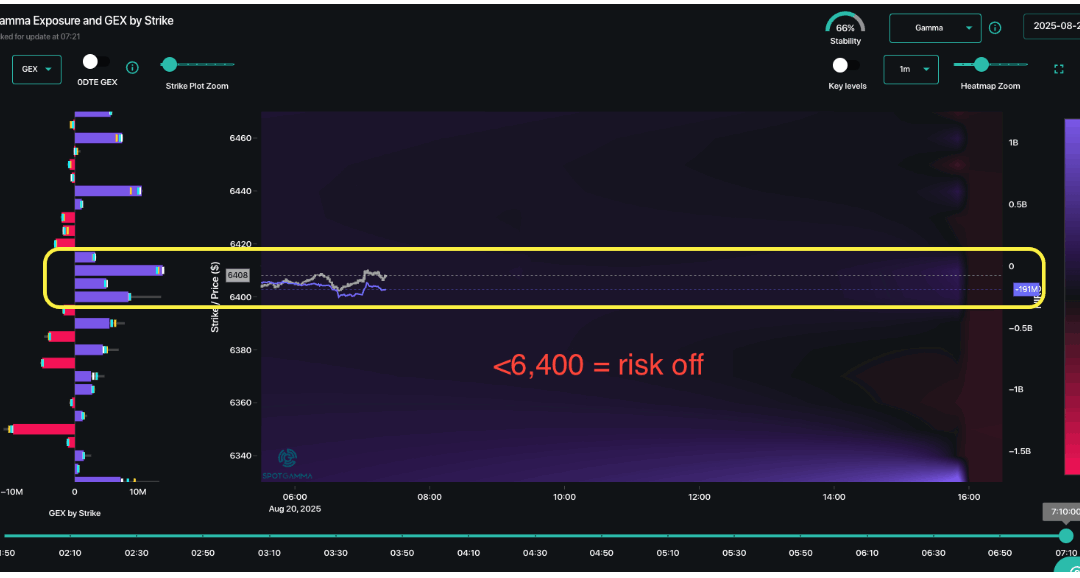

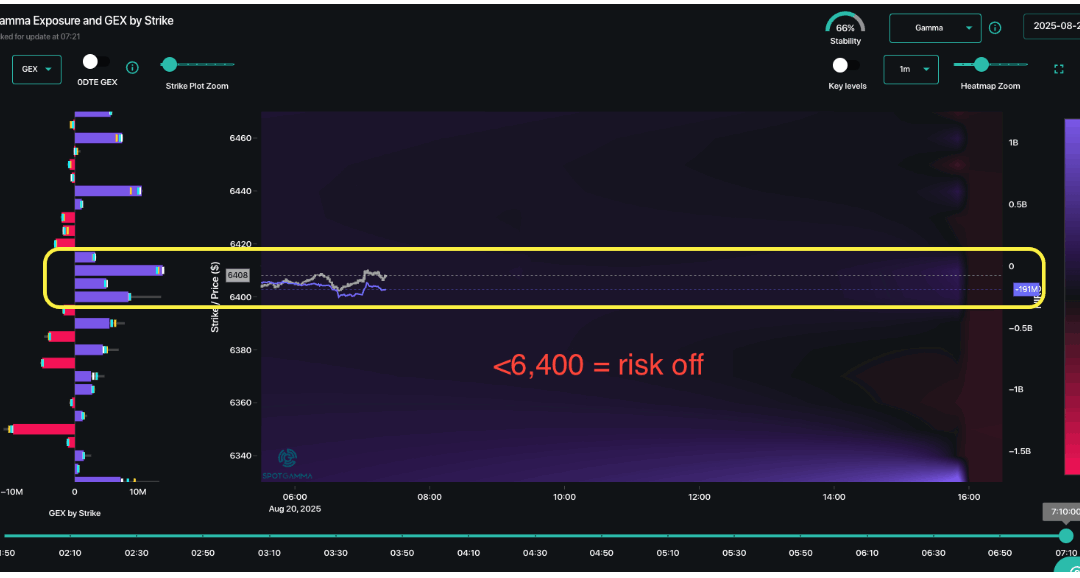

Macro Theme: Key dates ahead: 8/20: VIX EXP 8/23: J-HOLE 8/27: NVDA ER Update 8/18: Per recent updates, due to 11-12% SPX IV’s we want to now own a small amount of Sep put, and/or Sep VIX call spreads into JHOLE & NVDA (8/27), while maintaining a core long...

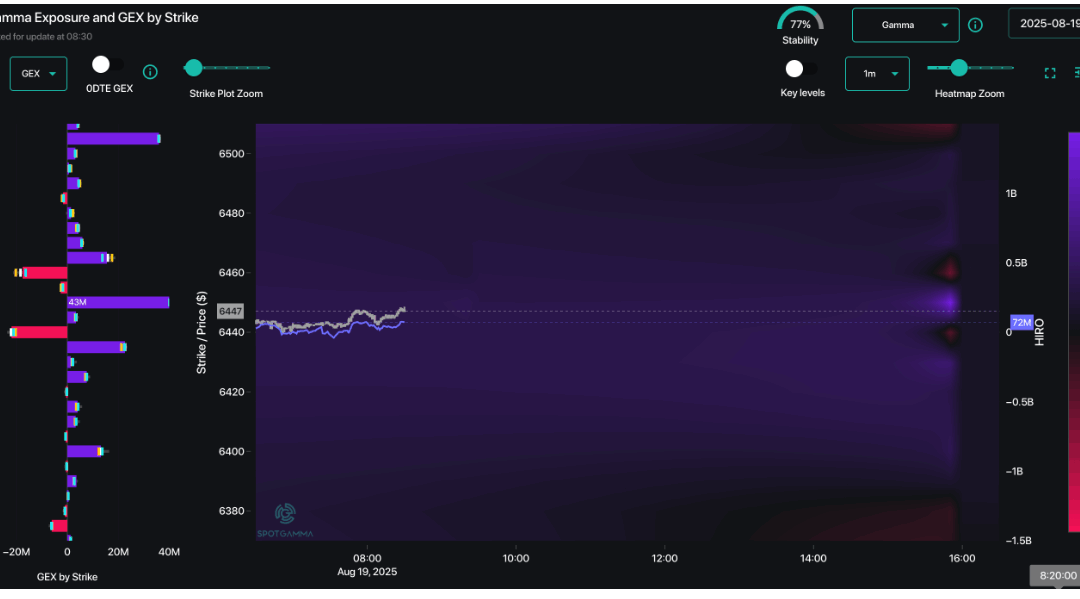

by Melida Montemayor | Ago 19, 2025 | Informe Option Levels

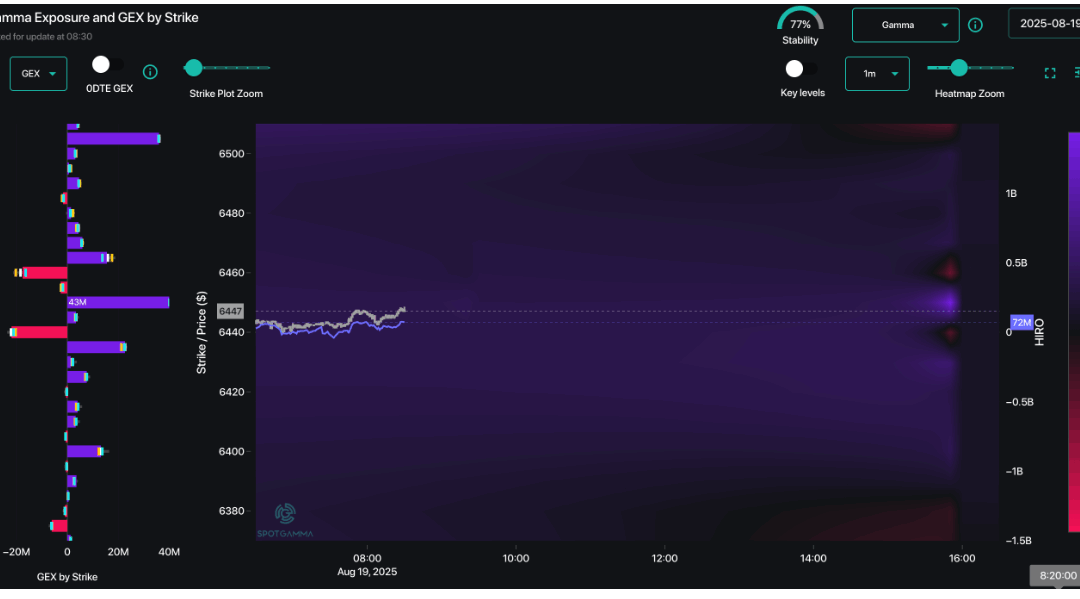

Macro Theme: Key dates ahead: 8/20: VIX EXP 8/23: J-HOLE 8/27: NVDA ER Update 8/18: Per recent updates, due to 11-12% SPX IV’s we want to now own a small amount of Sep put, and/or Sep VIX call spreads into JHOLE & NVDA (8/27), while maintaining a core long...

by Melida Montemayor | Ago 18, 2025 | Informe Option Levels

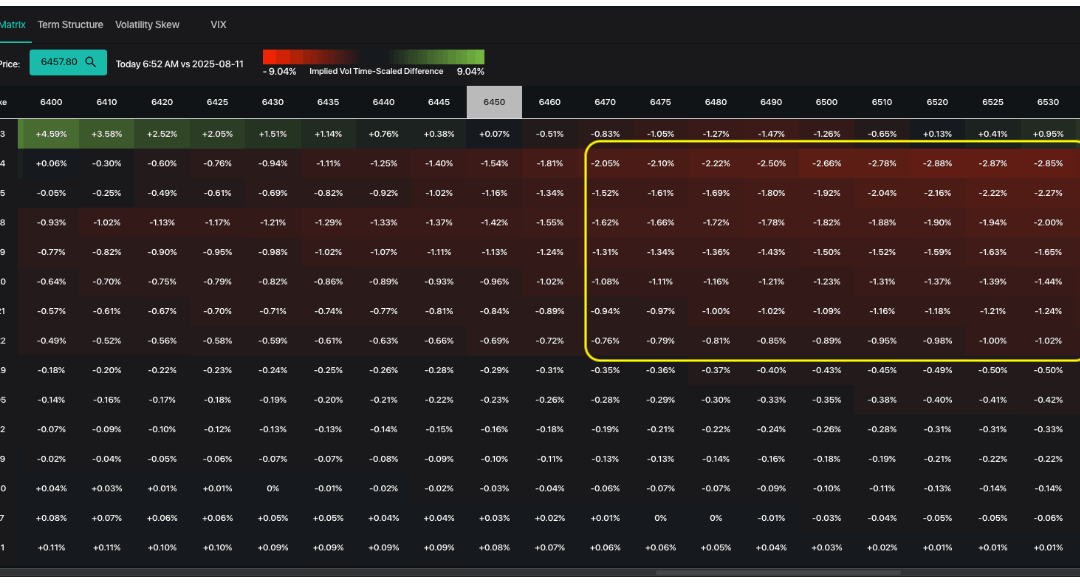

Macro Theme: Key dates ahead: 8/20: VIX EXP 8/23: J-HOLE 8/27: NVDA ER Update 8/18: Per recent updates, due to 11-12% SPX IV’s we want to now own a small amount of Sep put, and/or Sep VIX call spreads into JHOLE & NVDA (8/27), while maintaining a core long...

by Melida Montemayor | Ago 13, 2025 | Informe Option Levels

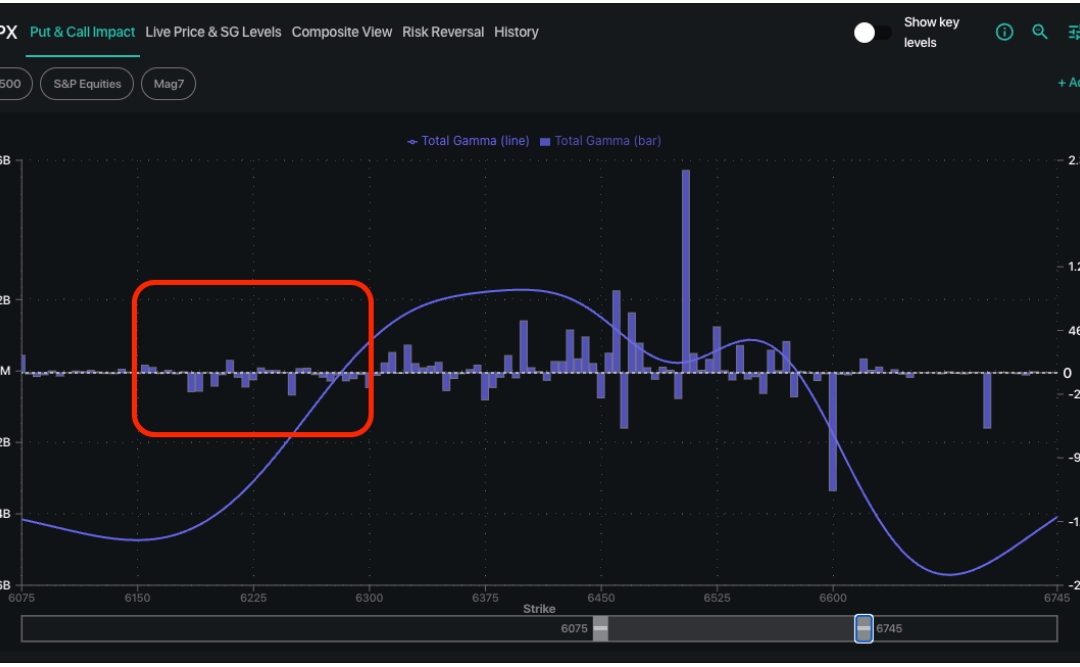

Macro Theme: Key dates ahead: 8/14: PPI 8/15: OPEX 8/20: VIX EXP 8/23: J-HOLE 8/27: NVDA ER Update 8/13: Our new risk pivot is 6,400. We are looking for a tag of 6,500 into Friday, which implies the bulk of SPX short term gains are now made (ref SPX 6,459). Per...