by Melida Montemayor | Ago 12, 2025 | Informe Option Levels

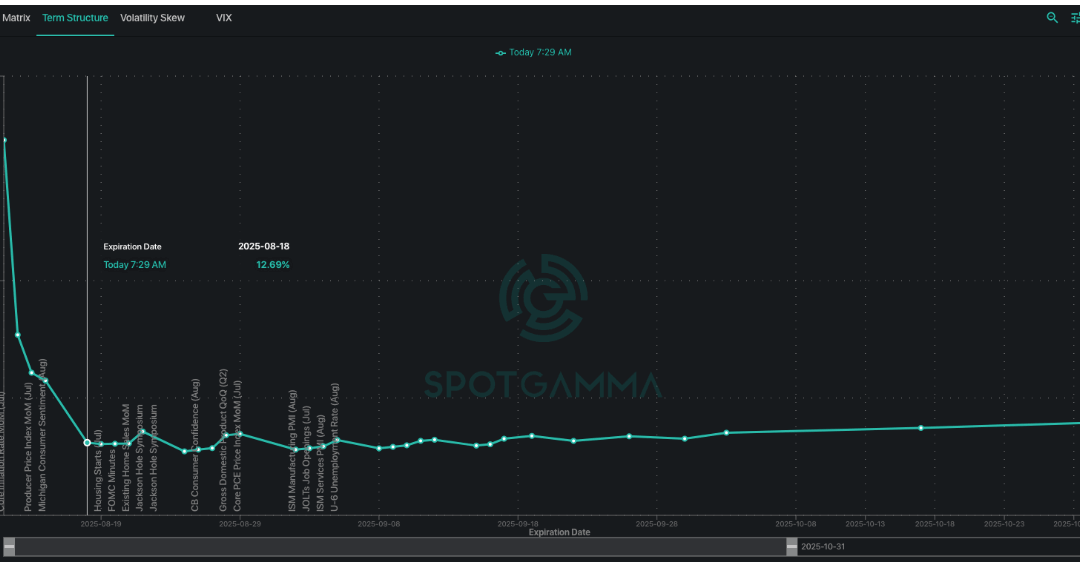

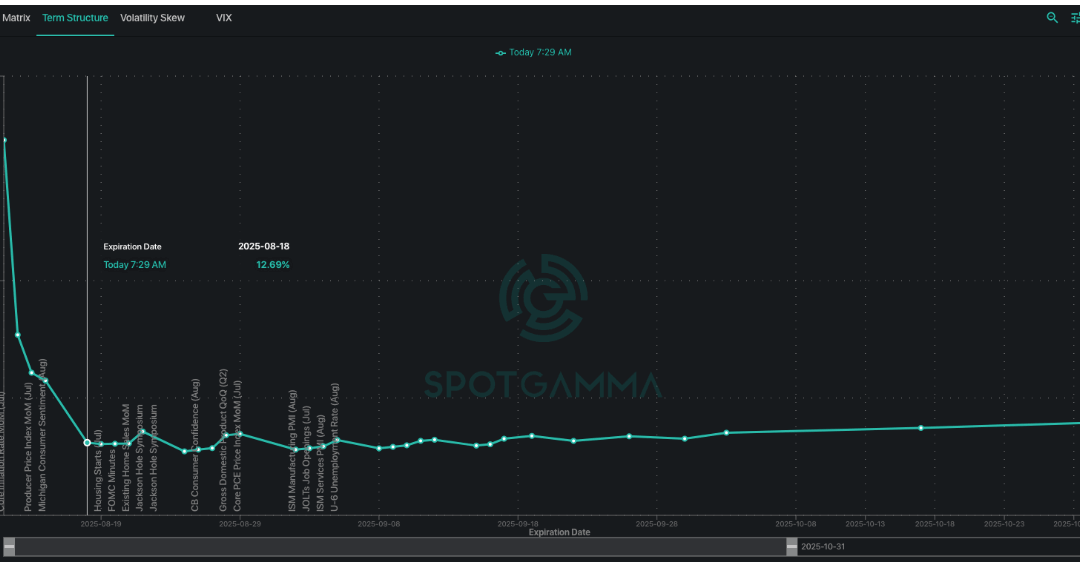

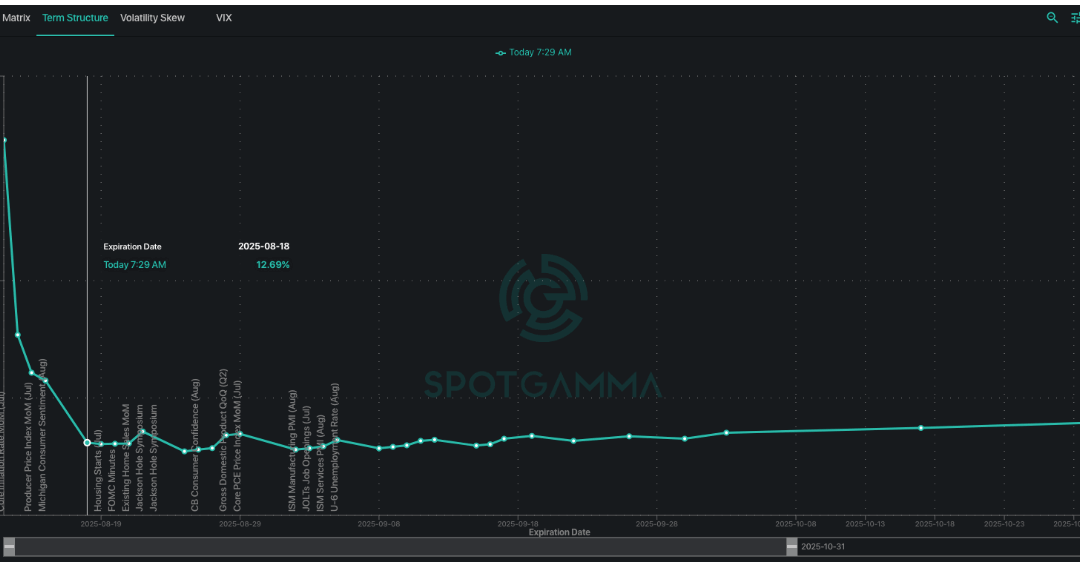

Macro Theme: Key dates ahead: 8/12: CPI 8/15: OPEX 8/20: VIX EXP 8/23: J-HOLE 8/27: NVDA ER UPDATE 8/12: We want to remain long of stocks with the SPX is >6,350. We will also being looking to own end-of-August SPX puts and/or VIX calls into CPI on the basis that IV...

by Melida Montemayor | Ago 11, 2025 | Sin categoría

Macro Theme: Key dates ahead: 8/12: CPI 8/15: OPEX 8/20: VIX EXP 8/23: J-HOLE 8/27: NVDA ER 7/30: We recommend ~8/11-8/15 exp 6,500 calls as an upside play out of FOMC, GDP, NFP and Mag 7 earnings. This is because they are trading at a 9-10% IV, and we think a vol...

by Melida Montemayor | Ago 11, 2025 | Informe Option Levels

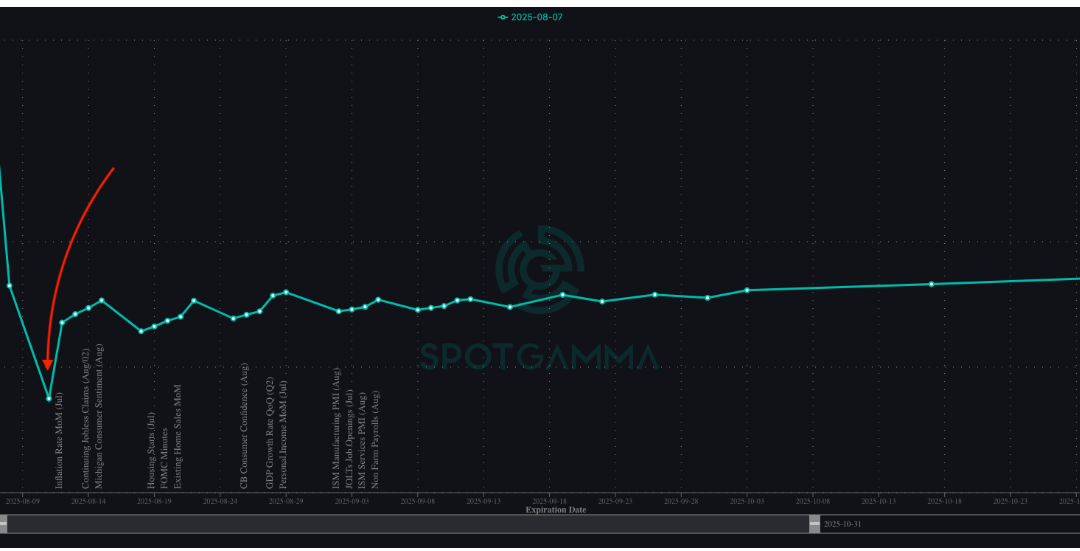

Macro Theme: Key dates ahead: 8/12: CPI 8/15: OPEX 8/20: VIX EXP 8/23: J-HOLE 8/27: NVDA ER 7/30: We recommend ~8/11-8/15 exp 6,500 calls as an upside play out of FOMC, GDP, NFP and Mag 7 earnings. This is because they are trading at a 9-10% IV, and we think a vol...

by Melida Montemayor | Ago 8, 2025 | Informe Option Levels

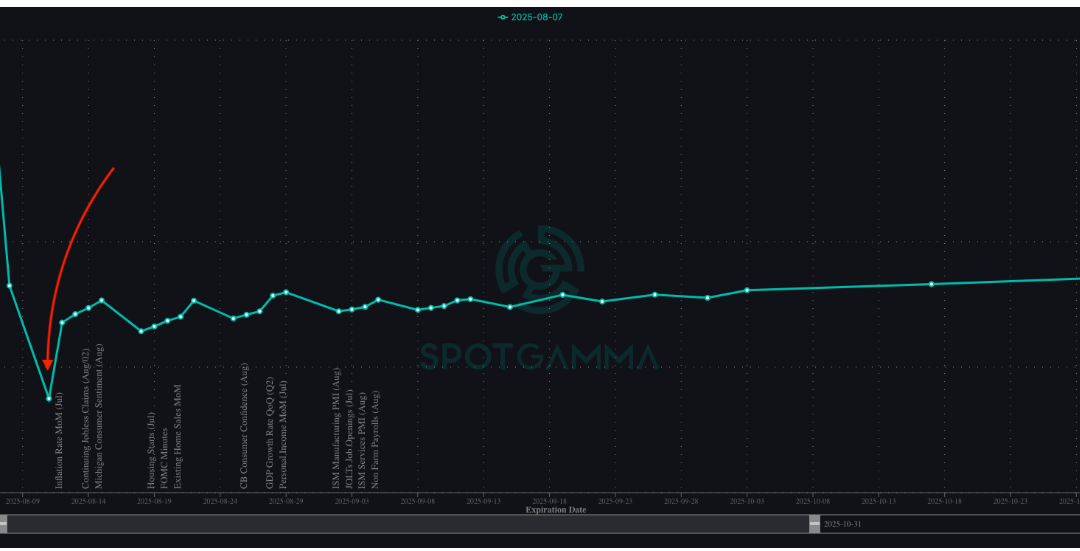

Macro Theme: Key dates ahead: 8/12: CPI 8/15: OPEX 8/20: VIX EXP 8/23: J-HOLE 8/27: NVDA ER 7/30: We recommend ~8/11-8/15 exp 6,500 calls as an upside play out of FOMC, GDP, NFP and Mag 7 earnings. This is because they are trading at a 9-10% IV, and we think a vol...

by Melida Montemayor | Ago 6, 2025 | Informe Option Levels

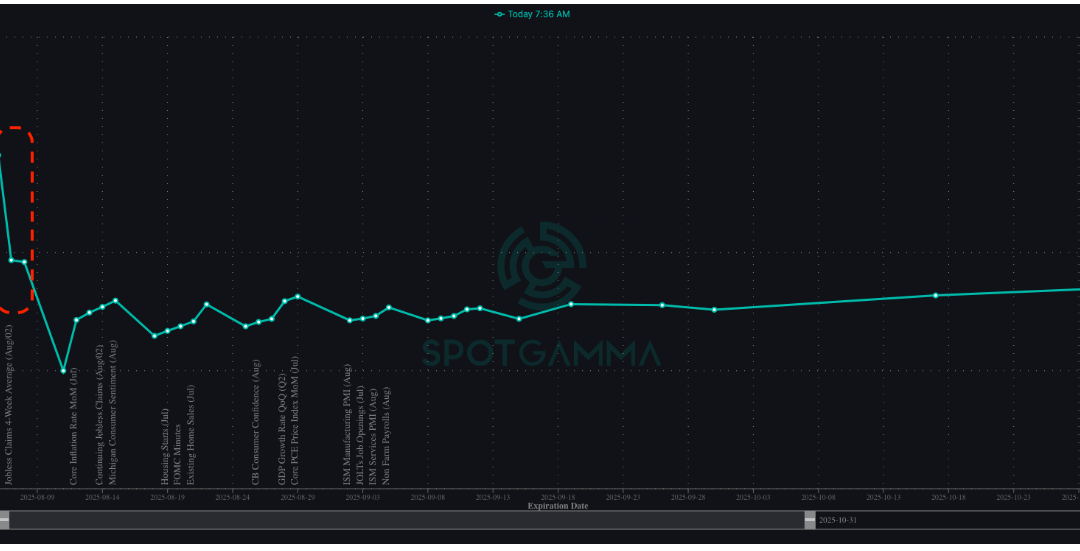

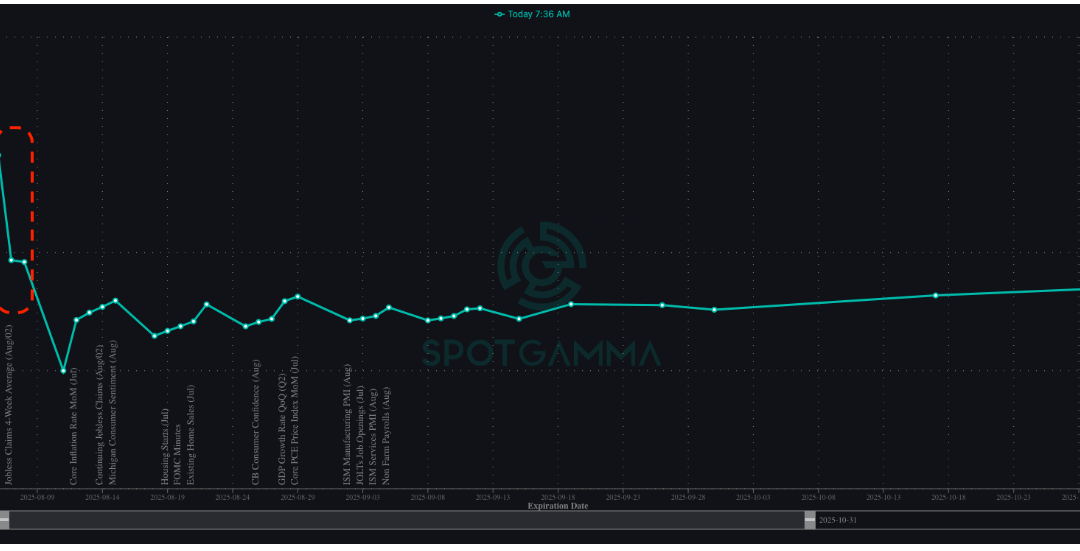

Macro Theme: Key dates ahead: 8/7 Tariff Deadline 8/12: CPI 7/30: We recommend ~8/11-8/15 exp 6,500 calls as an upside play out of FOMC, GDP, NFP and Mag 7 earnings. This is because they are trading at a 9-10% IV, and we think a vol contraction + giant positioning at...