by Melida Montemayor | Ago 6, 2025 | Informe Option Levels

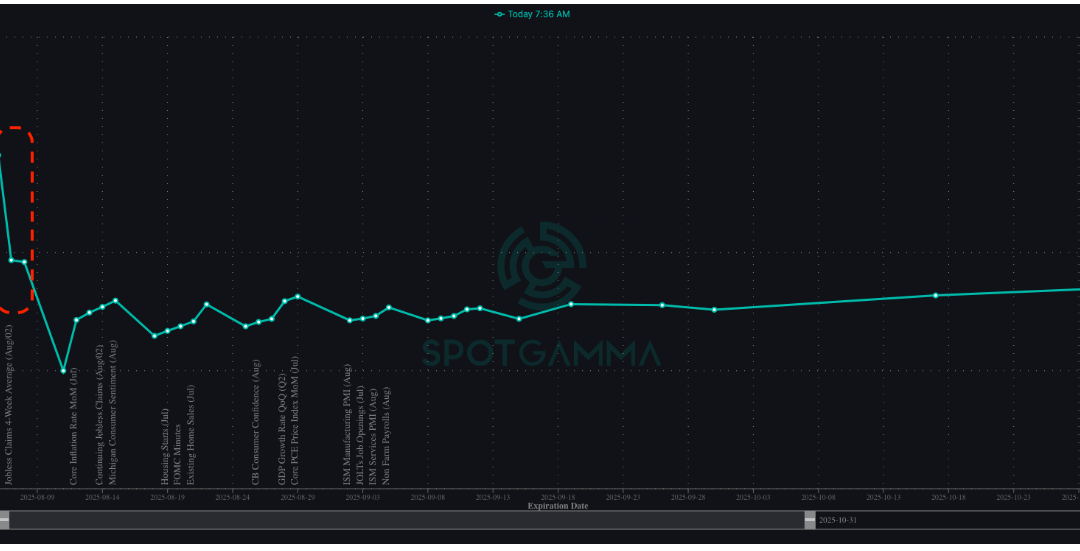

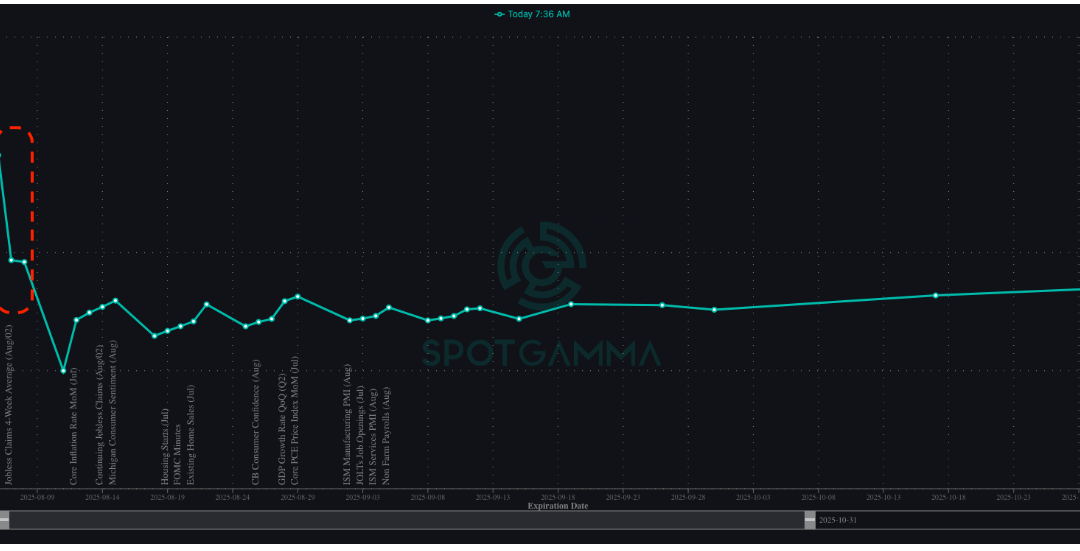

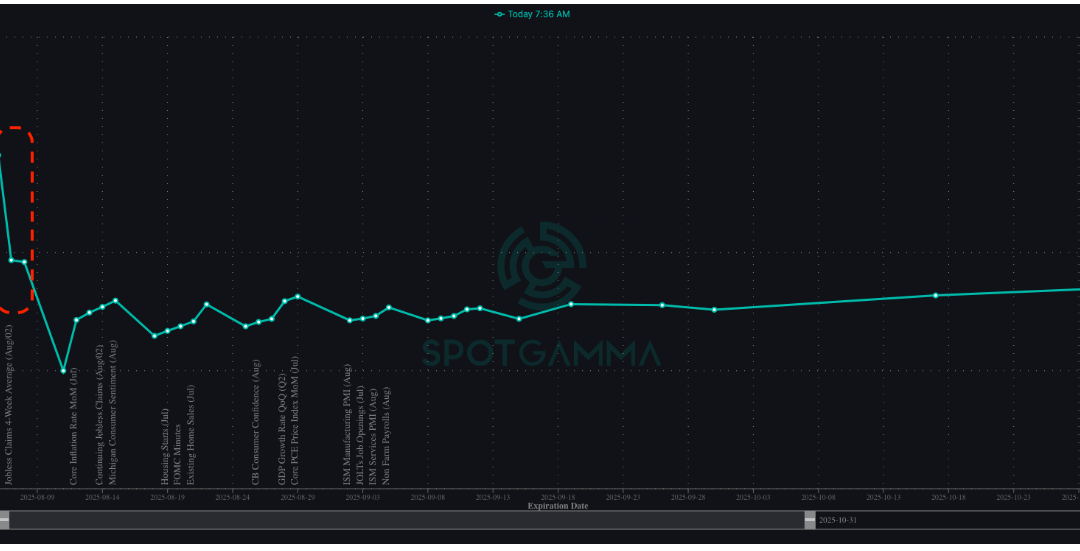

Macro Theme: Key dates ahead: 8/7 Tariff Deadline 8/12: CPI 7/30: We recommend ~8/11-8/15 exp 6,500 calls as an upside play out of FOMC, GDP, NFP and Mag 7 earnings. This is because they are trading at a 9-10% IV, and we think a vol contraction + giant positioning at...

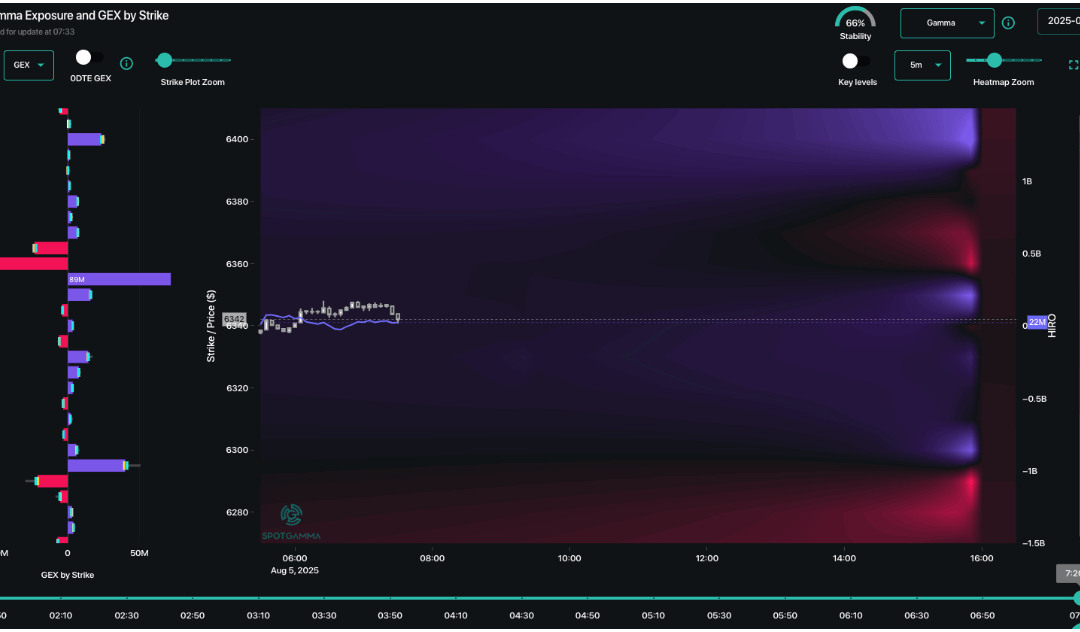

by Melida Montemayor | Ago 5, 2025 | Informe Option Levels

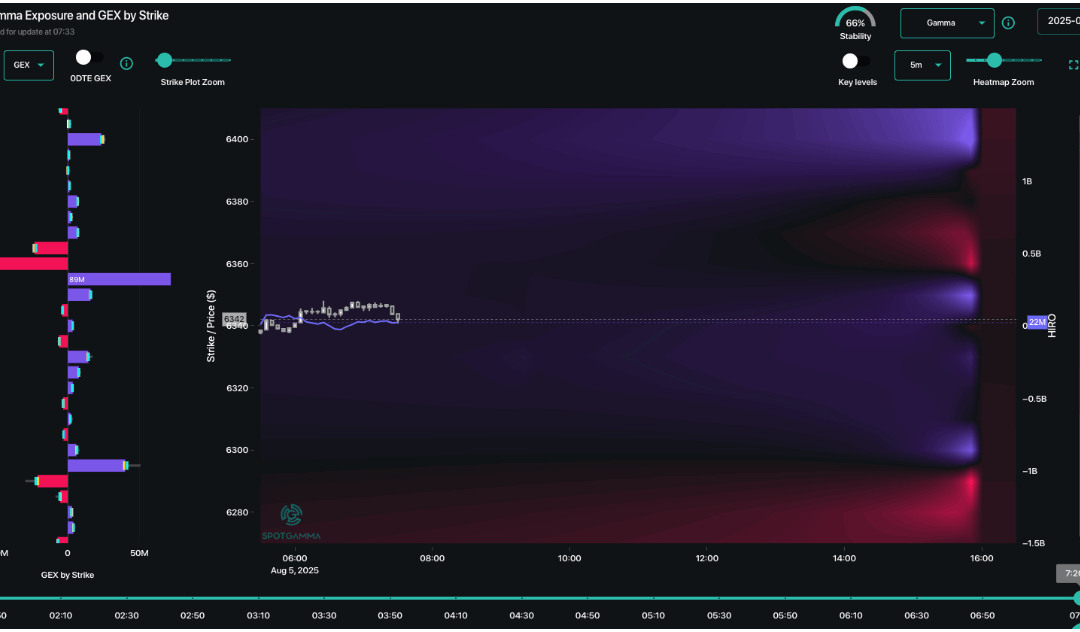

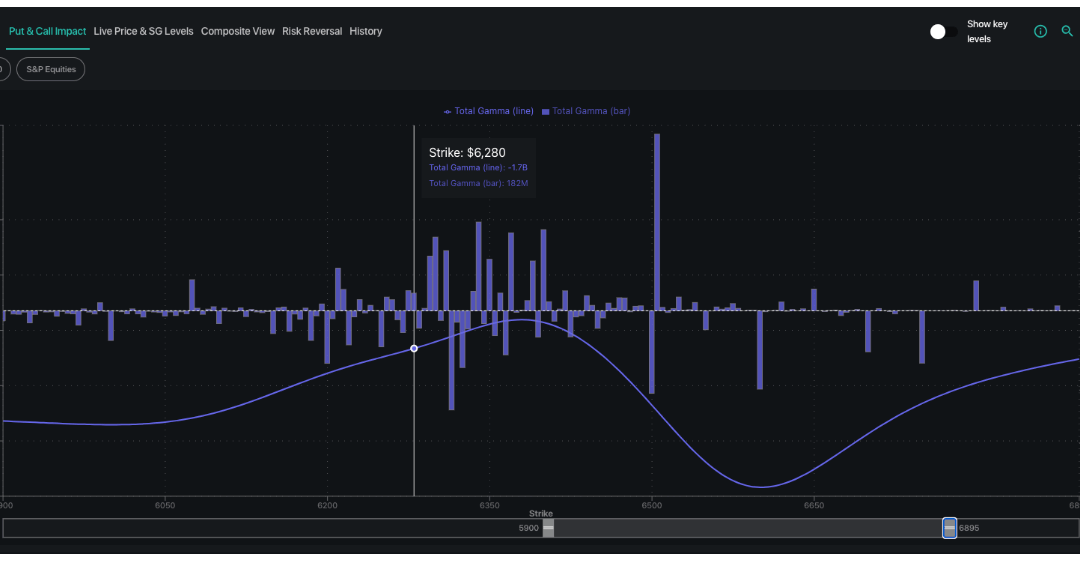

Macro Theme: Key dates ahead: 8/5: PMI 8/12: CPI 7/30: We recommend ~8/11-8/15 exp 6,500 calls as an upside play out of FOMC, GDP, NFP and Mag 7 earnings. This is because they are trading at a 9-10% IV, and we think a vol contraction + giant positioning at 6,500 could...

by Melida Montemayor | Ago 1, 2025 | Informe Option Levels

Macro Theme: Key dates ahead: 7/31: Jobless Claims, AAPL, AMZN, MSTR, COIN 8/1: NFP, PMI Update 8/1: Puts & VIX calls are paying, and we look to close and/or roll that sliver of puts today as SPX popped into risk-off levels <6,300. We see an ultimate possible...

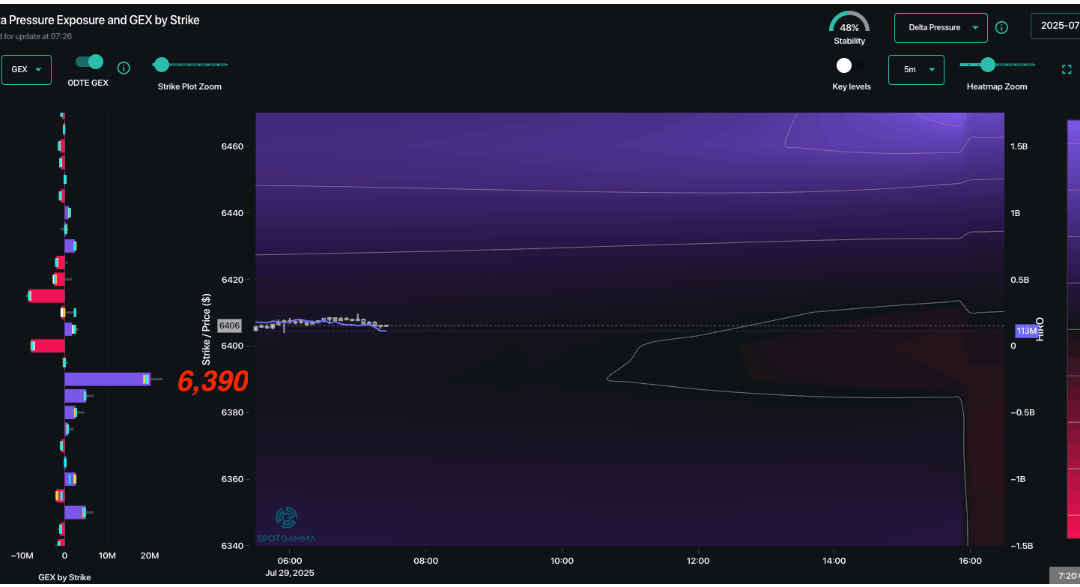

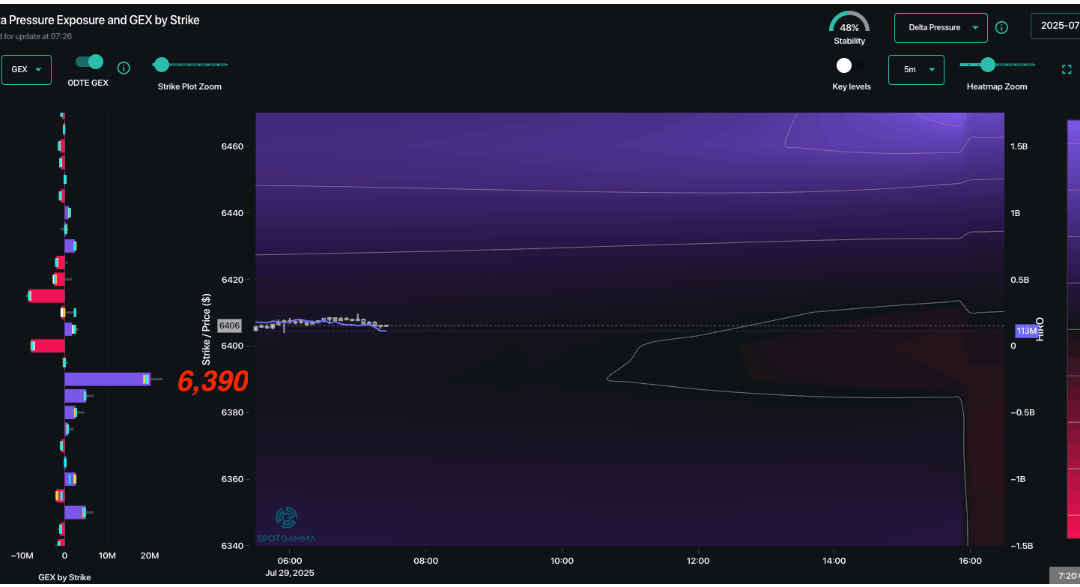

by Melida Montemayor | Jul 29, 2025 | Informe Option Levels

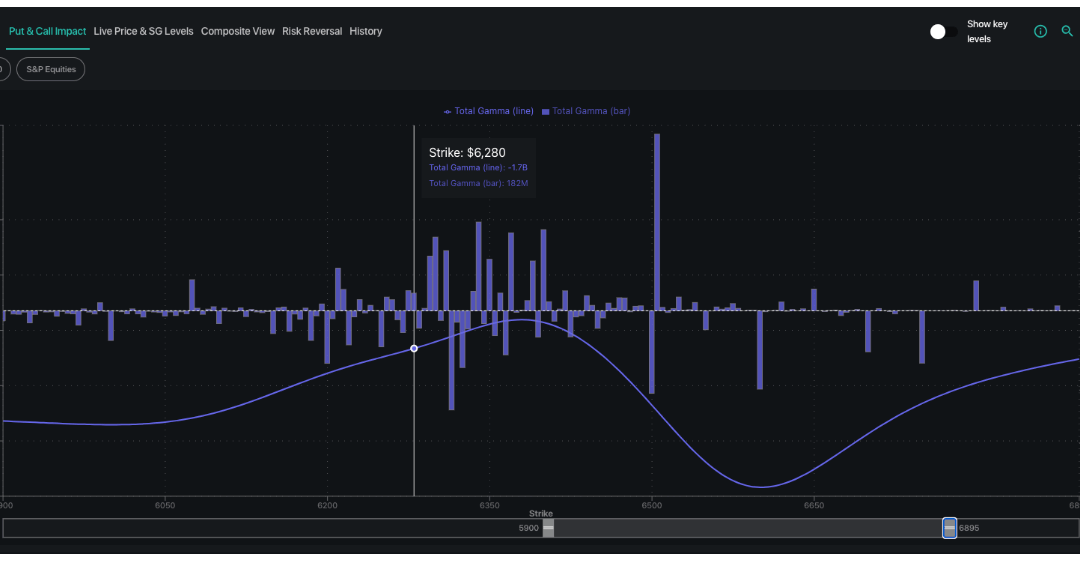

Macro Theme: ¿Key dates ahead: 7/30: GDP, FOMC 7/31: Jobless Claims 8/1: NFP, PMI Update 7/28: SMH 1-month options scan as both very low IV, and neutral call vs put prices. As such we will be adding 1-month ~300 strike SMH calls into the upcoming earnings deluge (ref...

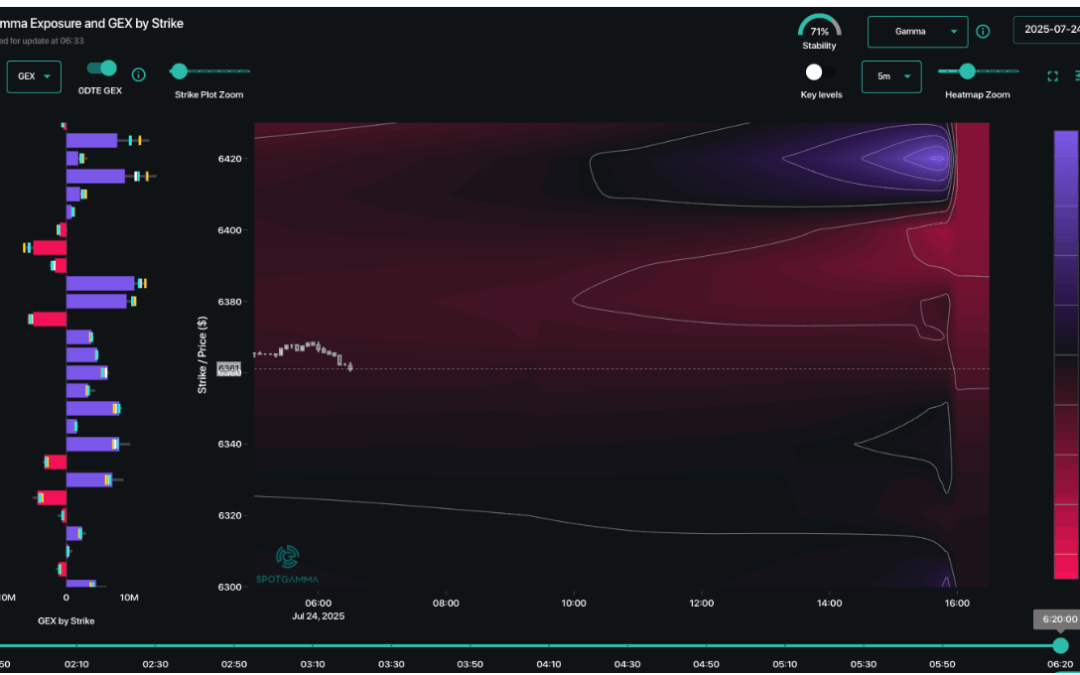

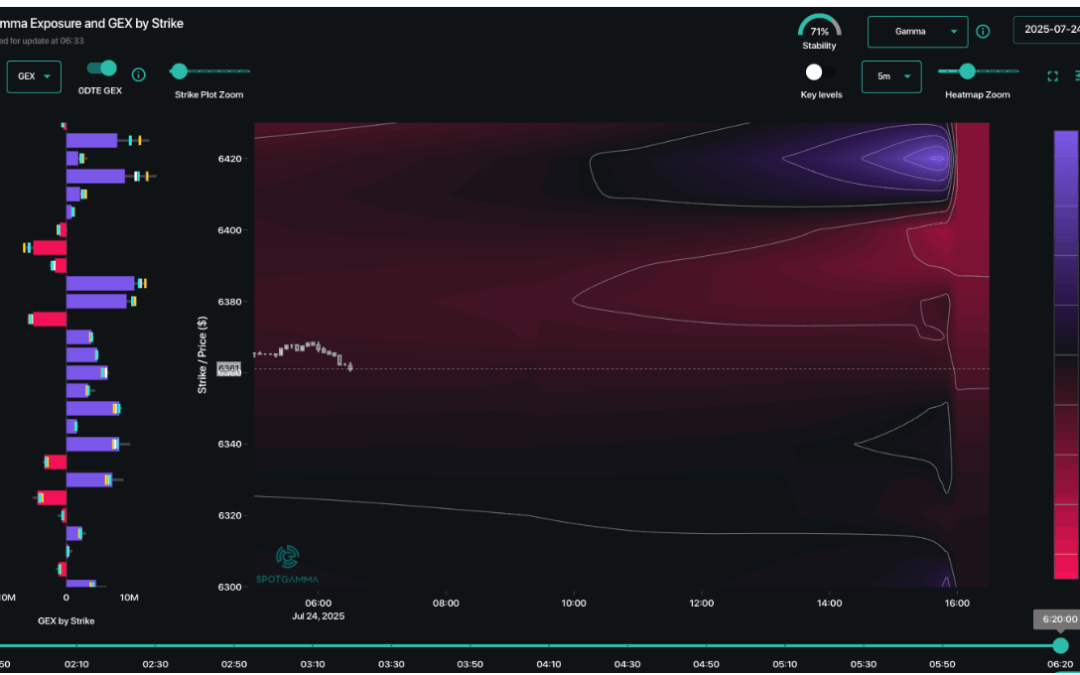

by Melida Montemayor | Jul 24, 2025 | Informe Option Levels

Macro Theme: Key dates ahead: 7/24: Jobless Claims, Trump visit Fed 7/30: FOMC 8/1: Tariff Deadline Update: 7/23: Trade deals and extensions have re-pumped the bulls, and so we look to maintain longs as long as the SPX remains above the risk pivot. Further, it appears...