by Melida Montemayor | May 19, 2025 | Informe Option Levels

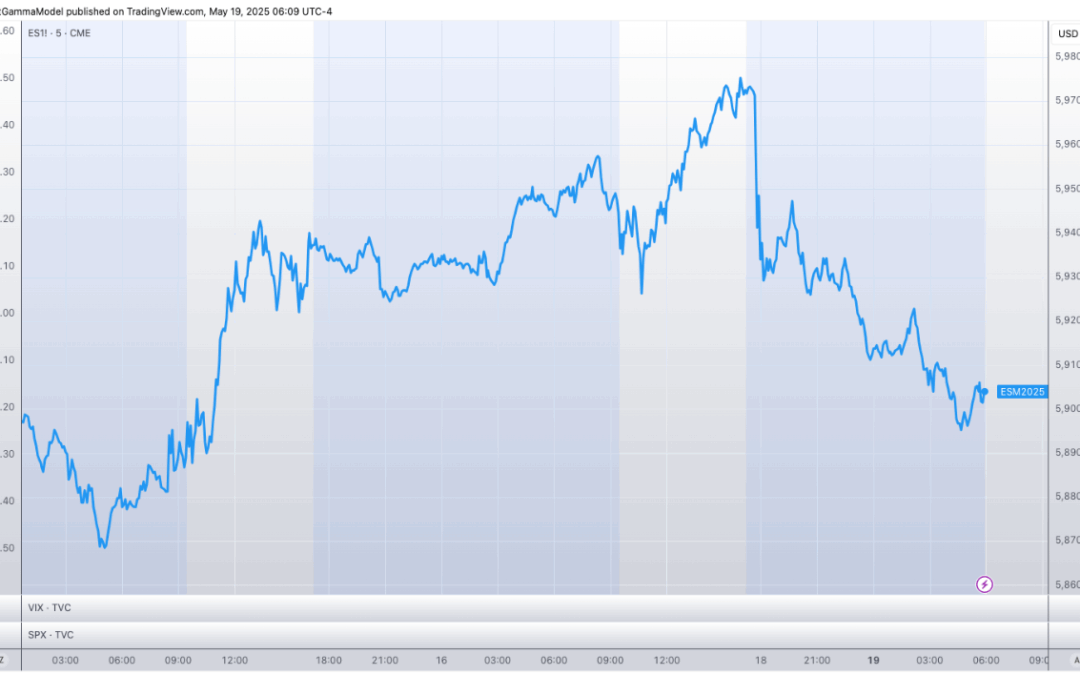

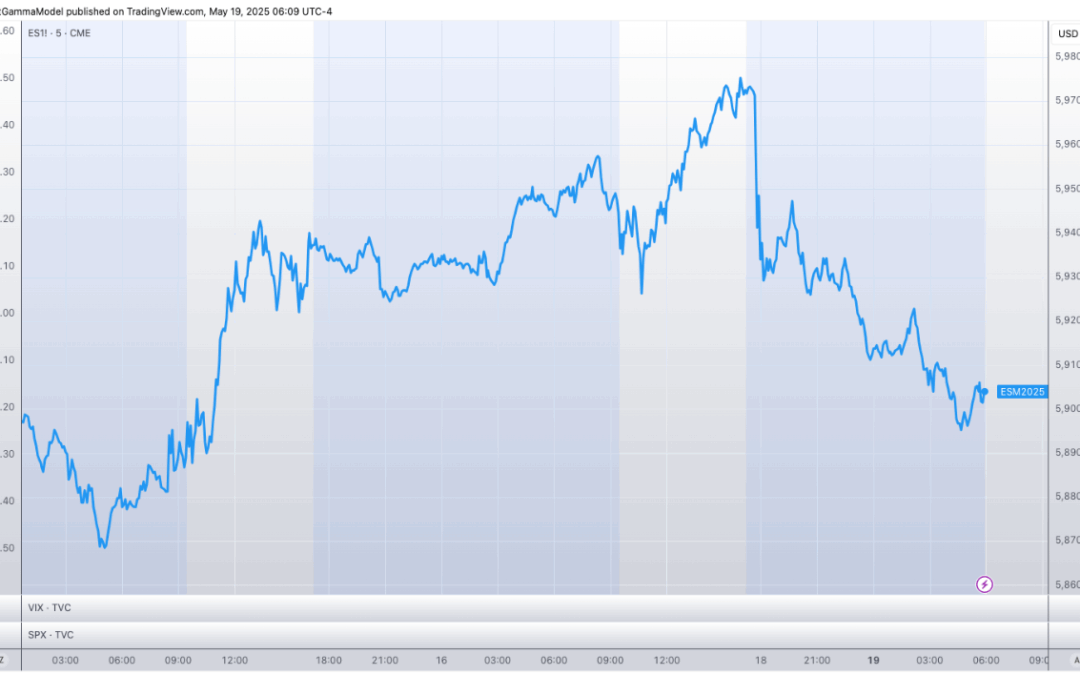

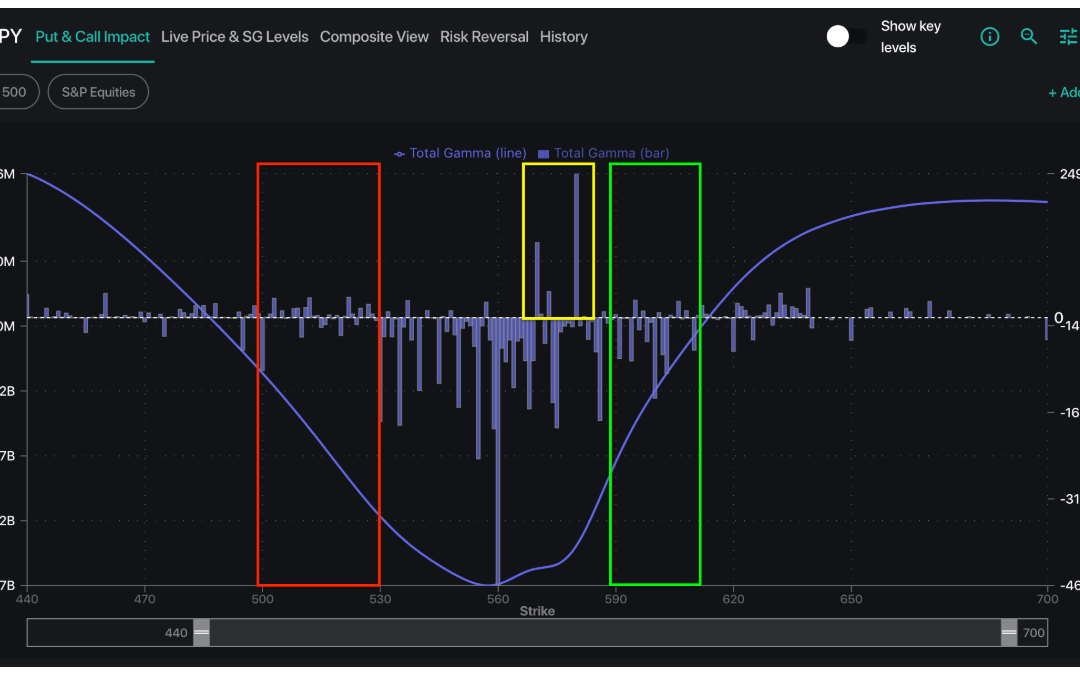

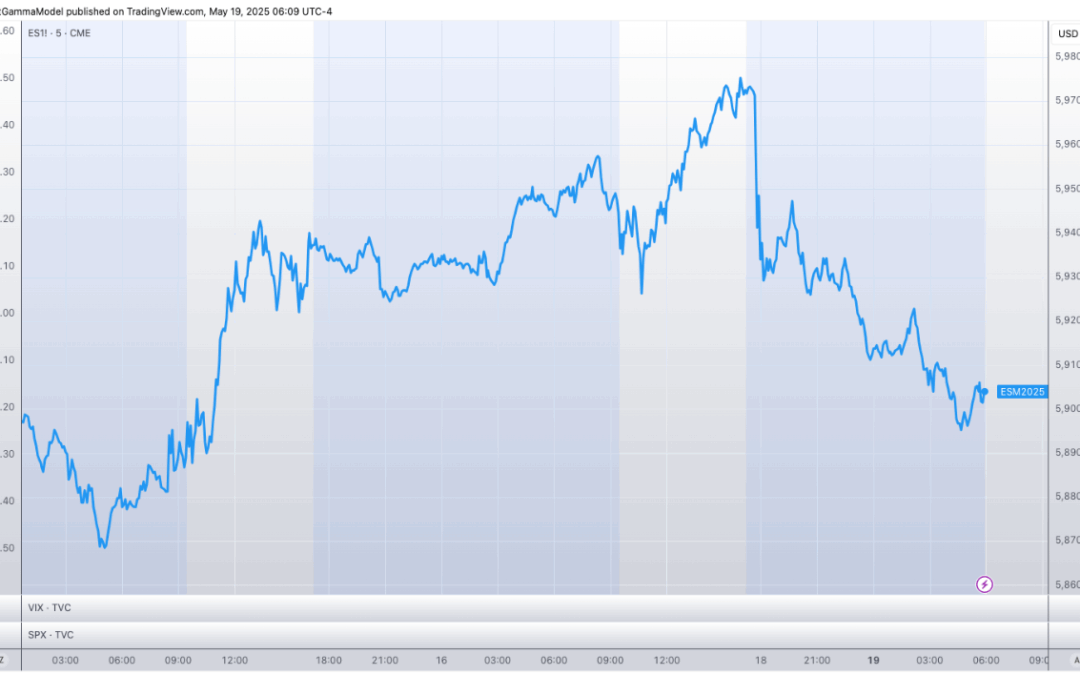

Macro Theme: Key dates ahead: 5/21 VIX Exp 5/13: With the SPX >=5,825, we see Friday’s OPEX (5/16) as one of the most call-lopsided expirations ever. We think this may lead to a market correction next week. 5/12: Following the US/China trade advancements, we...

by Melida Montemayor | May 16, 2025 | Informe Option Levels

Macro Theme: Key dates ahead: 5/16 OPEX 5/21 VIX Exp 5/13: With the SPX >=5,825, we see Friday’s OPEX (5/16) as one of the most call-lopsided expirations ever. We think this may lead to a market correction next week. 5/12: Following the US/China trade...

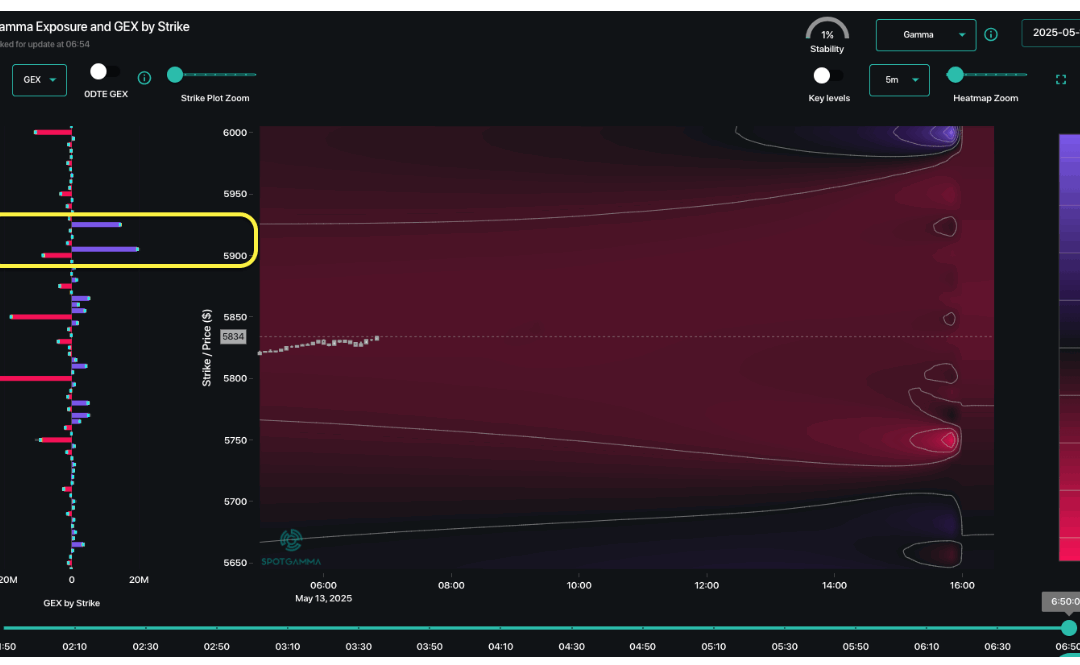

by Melida Montemayor | May 13, 2025 | Informe Option Levels

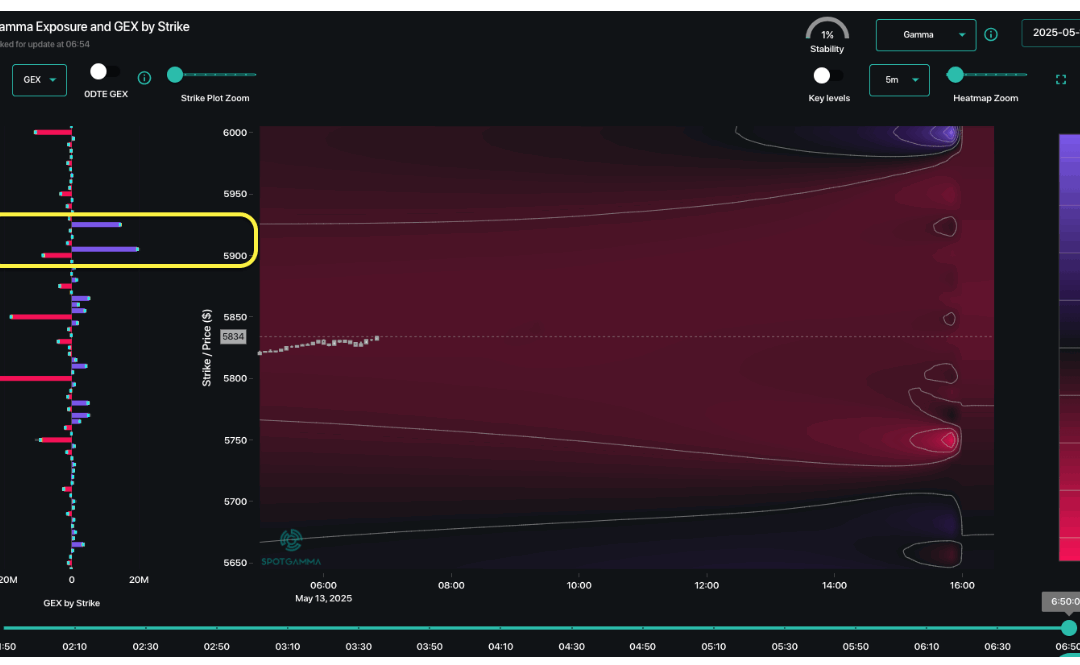

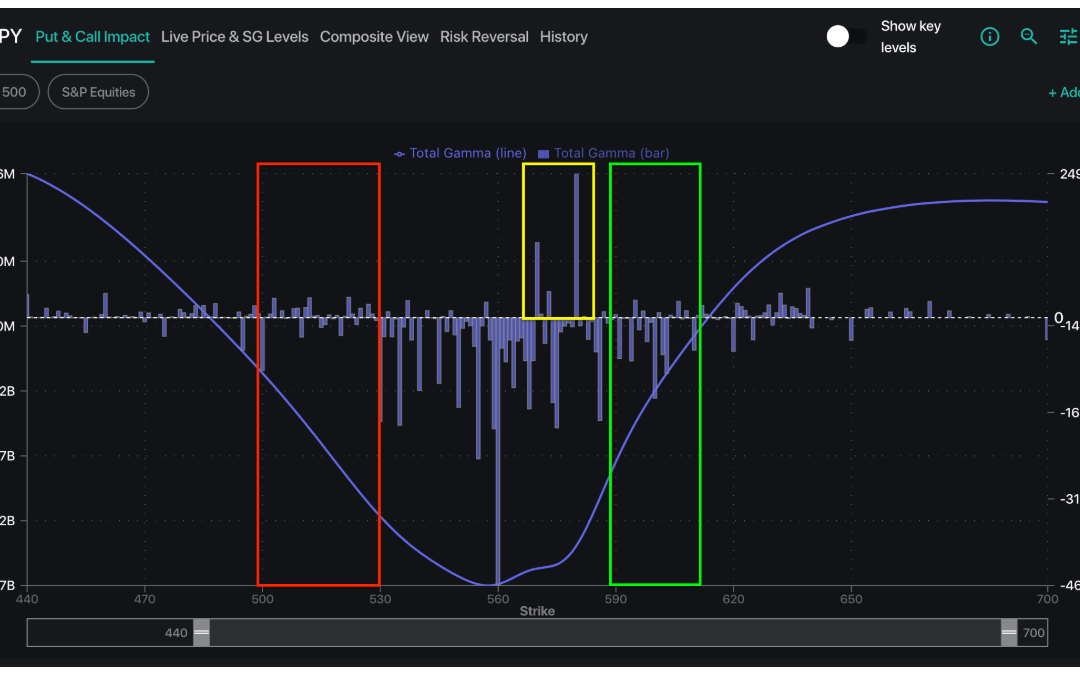

Macro Theme: Key dates ahead: 5/13 CPI 5/15 PPI 5/16 OPEX 5/21 VIX Exp 5/13: With the SPX >=5,825, we see Friday’s OPEX (5/16) as one of the most call-lopsided expirations ever. We think this may lead to a market correction next week. 5/12: Following the...

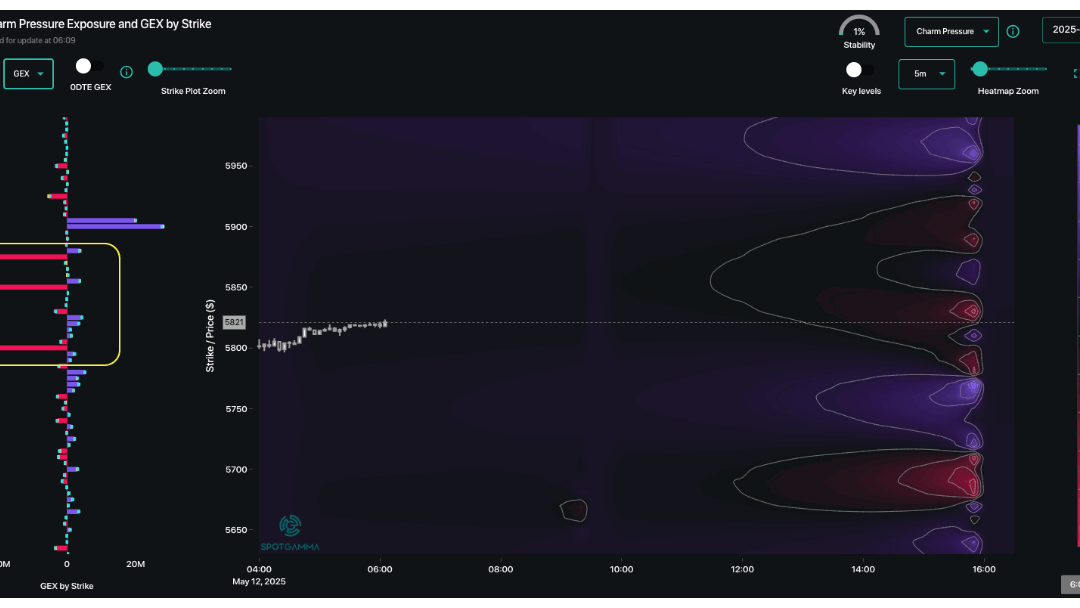

by Melida Montemayor | May 12, 2025 | Informe Option Levels

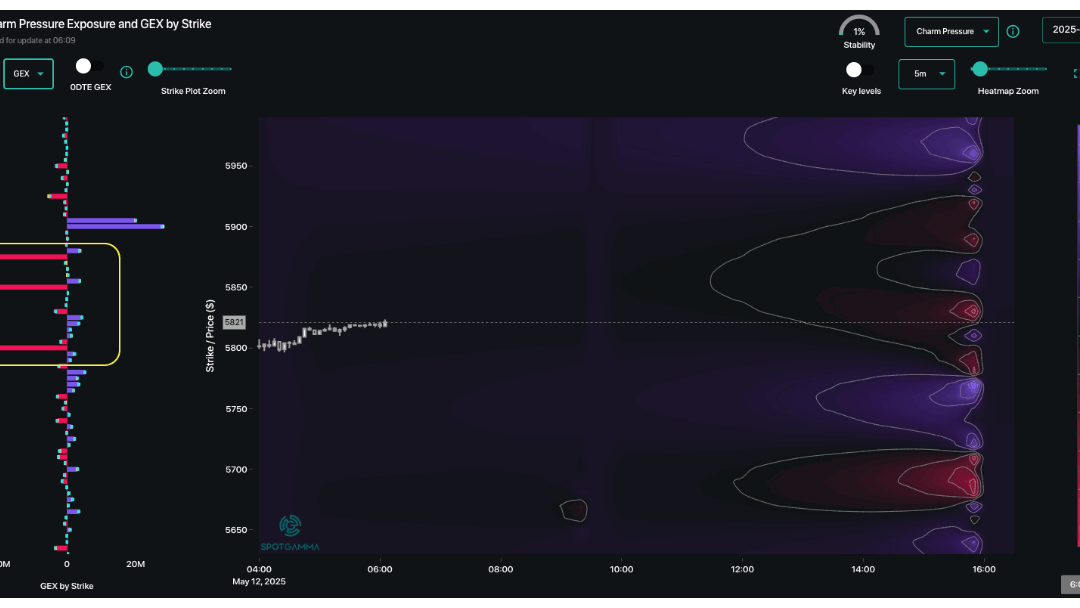

Macro Theme: Key dates ahead: 5/11: US/China Tariff Meeting 5/13 CPI 5/5: We continue to see a negative volatility premium in the S&P500, which validates owning 1-2 month put spreads as referenced on 4/25. Those puts were hedged with short dated/Friday exp long...

by Melida Montemayor | May 8, 2025 | Informe Option Levels

Macro Theme: Key dates ahead: 5/11: US/China Tariff Meeting 5/5: We continue to see a negative volatility premium in the S&P500, which validates owning 1-2 month put spreads as referenced on 4/25. Those puts were hedged with short dated/Friday exp long call...