by Melida Montemayor | May 2, 2025 | Informe Option Levels

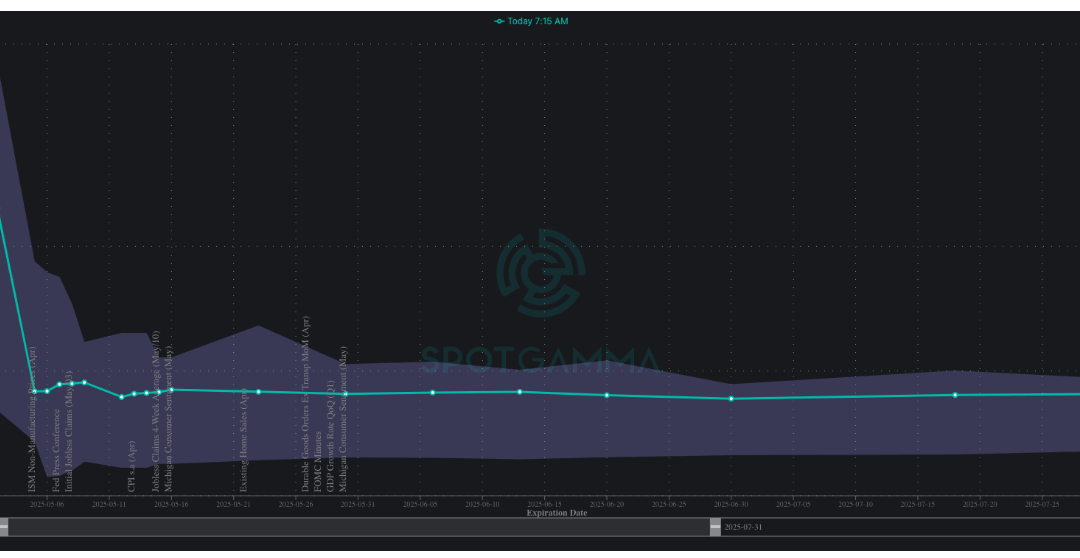

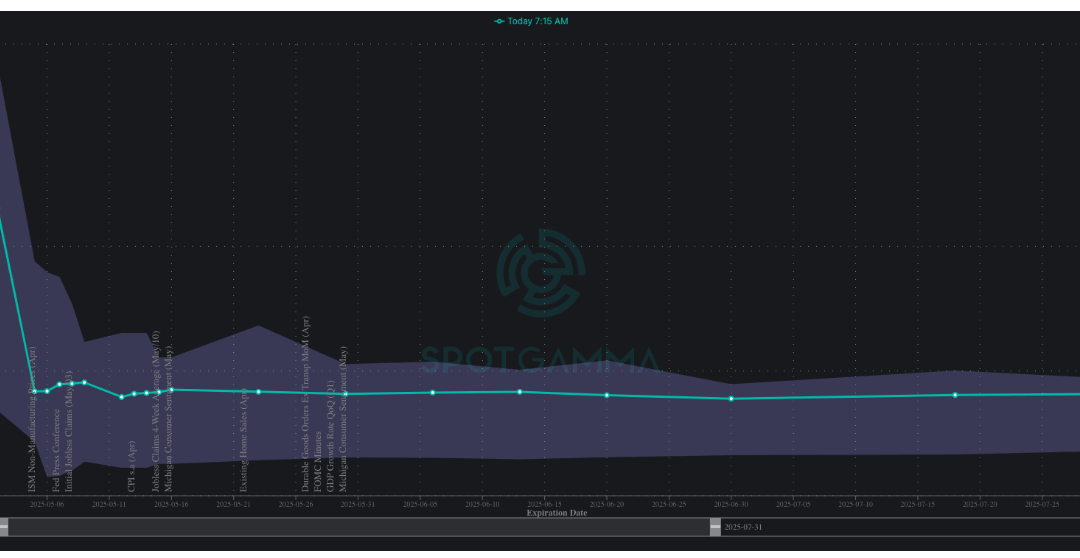

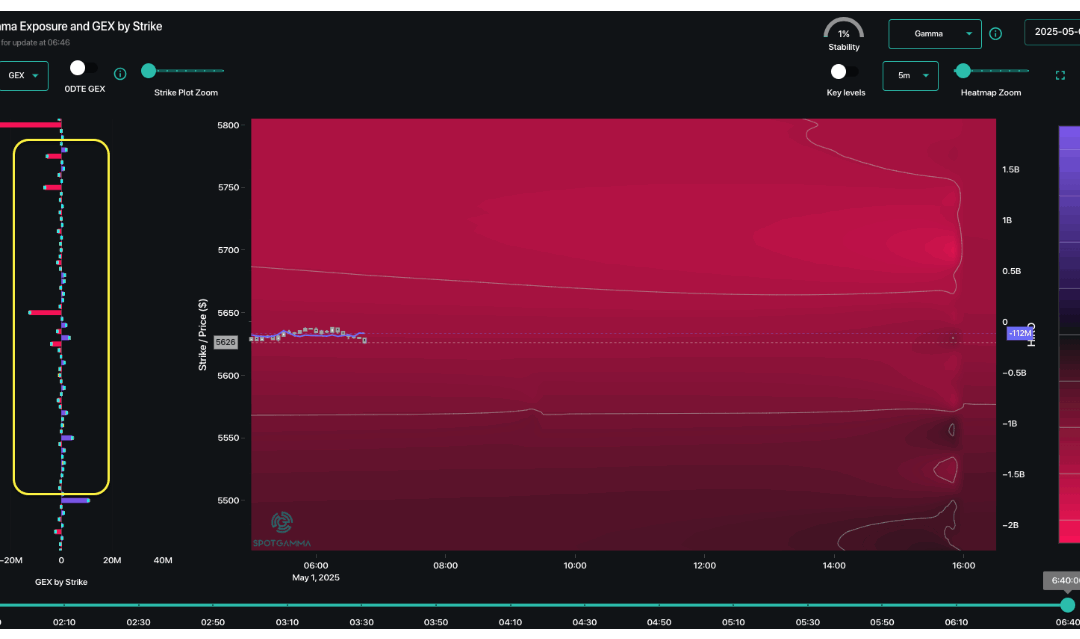

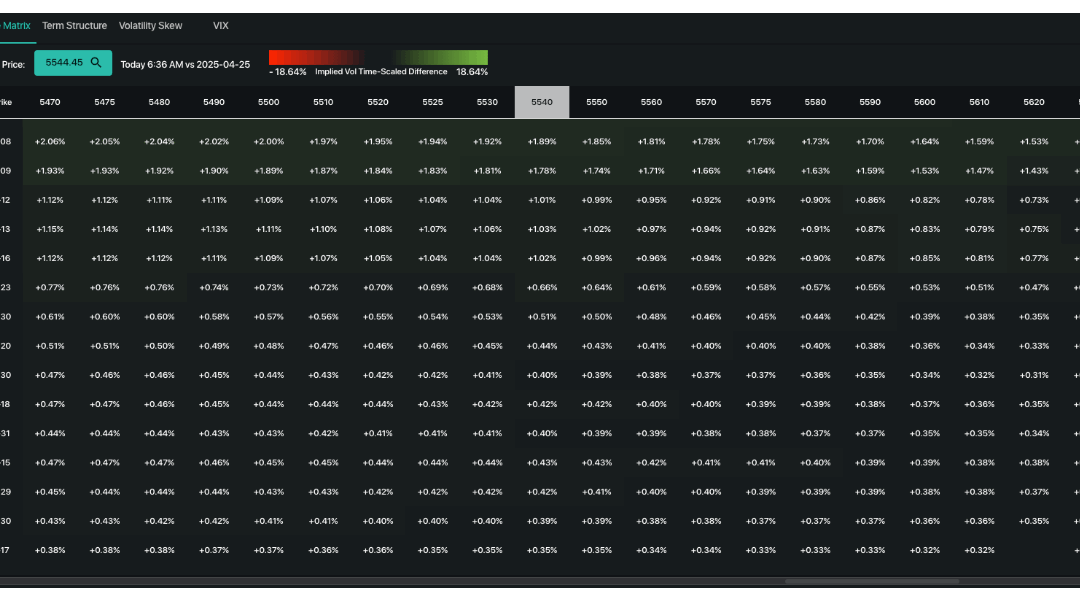

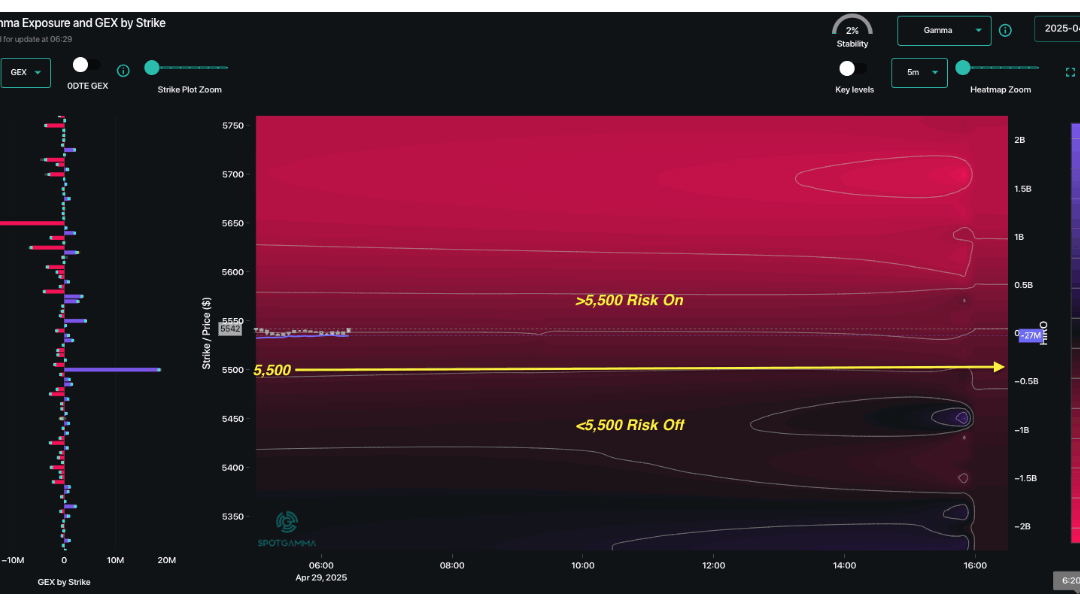

Macro Theme: Key dates ahead: 5/2: NFP 4/29: Based on the formation of light positive gamma >5,500, we look to be net long of stocks while SPX holds that level. We recommend short dated (May exp) calls or call spreads. This does not invalidate the view of owning...

by Melida Montemayor | May 1, 2025 | Informe Option Levels

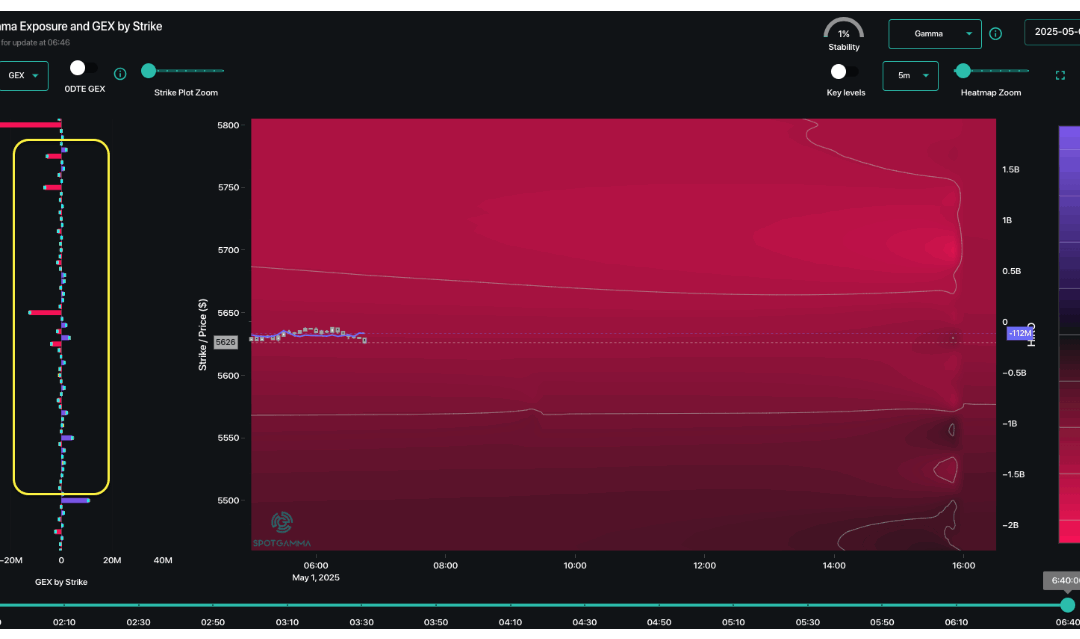

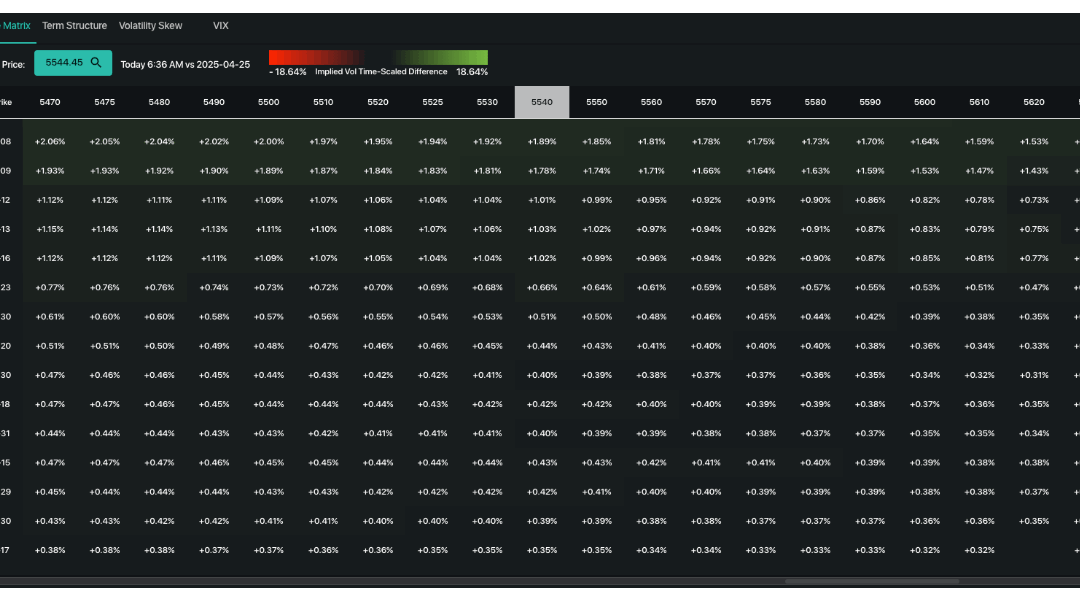

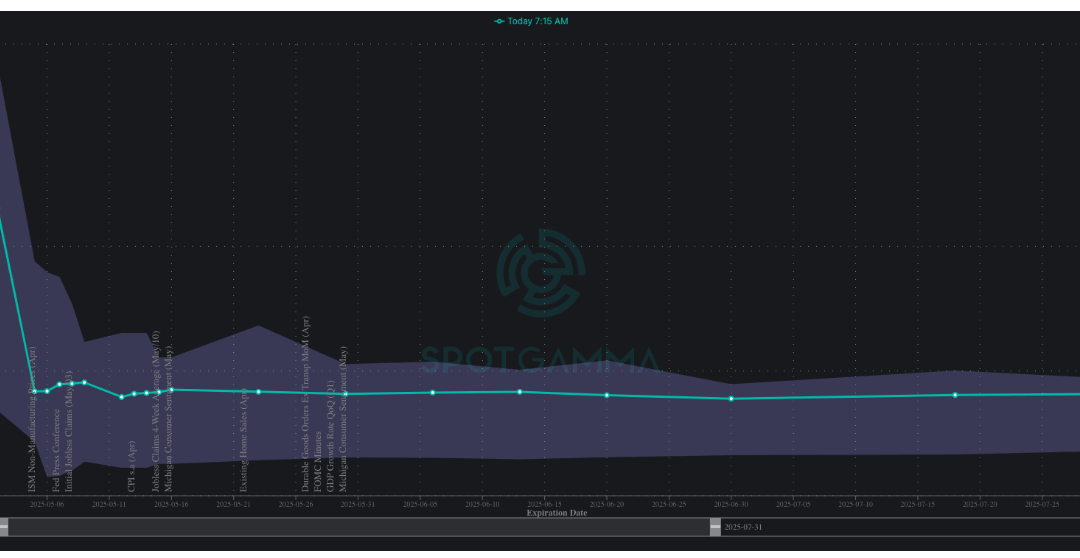

Macro Theme: Key dates ahead: 5/1: Jobless Claims, ISM, AAPL + AMZN earnings 5/2: NFP 4/29: Based on the formation of light positive gamma >5,500, we look to be net long of stocks while SPX holds that level. We recommend short dated (May exp) calls or call spreads....

by Melida Montemayor | Abr 30, 2025 | Informe Option Levels

Macro Theme: Key dates ahead: 4/30: PCE, Earnings: META, MSFT 5/1: ISM 5/2: NFP 4/29: Based on the formation of light positive gamma >5,500, we look to be net long of stocks while SPX holds that level. We recommend short dated (May exp) calls or call spreads. This...

by Melida Montemayor | Abr 29, 2025 | Informe Option Levels

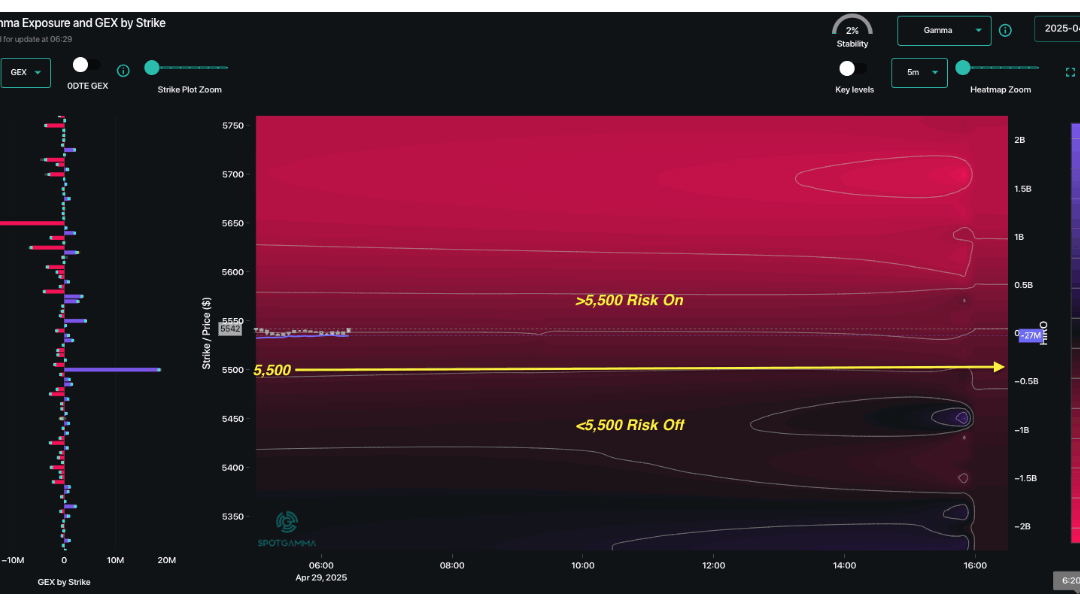

Macro Theme: Key dates ahead: 4/29: Bessent, JOLTS 4/30: PCE, Earnings: META, MSFT 5/1: ISM 5/2: NFP 4/29: Based on the formation of light positive gamma >5,500, we look to be net long of stocks while SPX holds that level. We recommend short dated (May exp) calls...

by Melida Montemayor | Abr 28, 2025 | Informe Option Levels

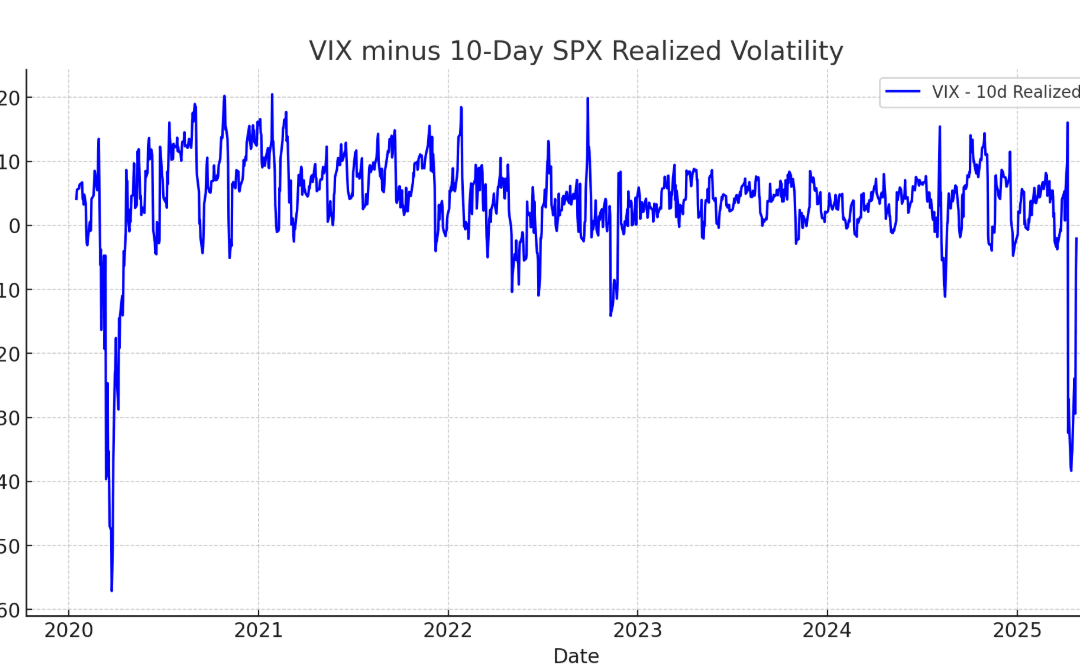

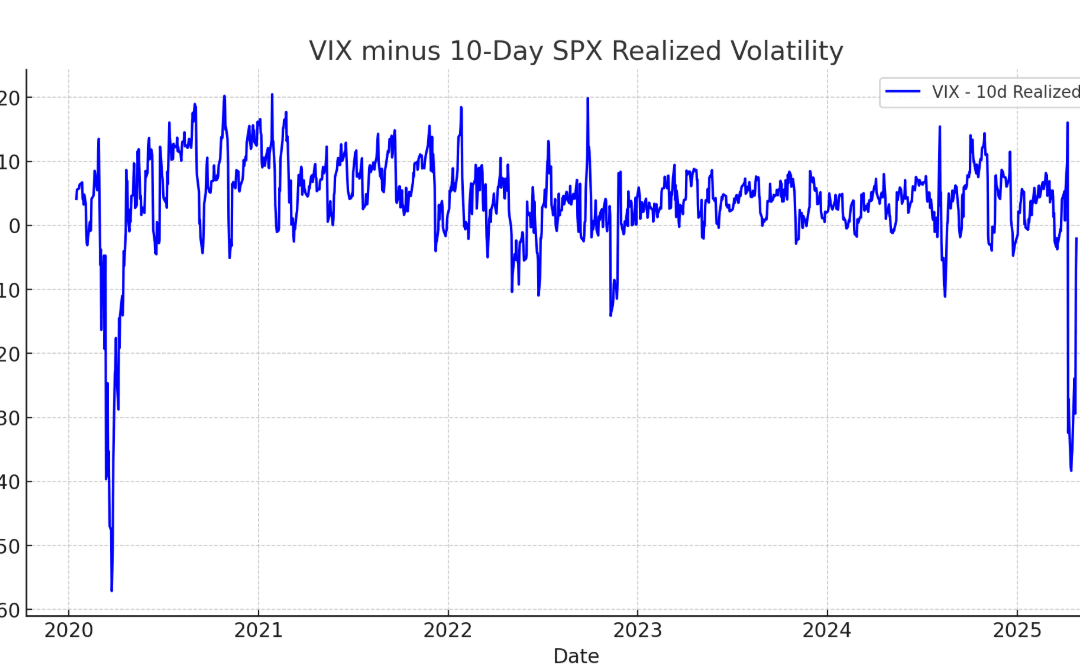

Macro Theme: Key dates ahead: 4/30: Earnings: META, MSFT 5/1: ISM 5/2: NFP 4/25: <=25 delta 1-month S&P500 puts/put spreads make sense on a risk/reward basis given ATM IV in SPX is ~25%, which is at or below short term realized vol. This is not a call for a...