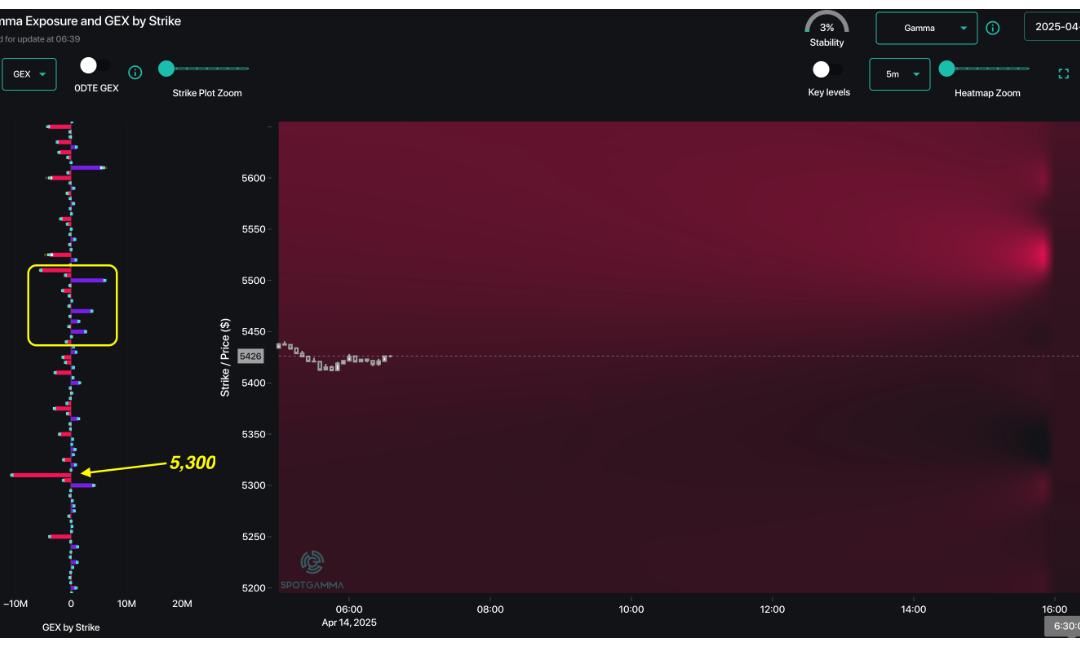

by Melida Montemayor | Abr 14, 2025 | Informe Option Levels

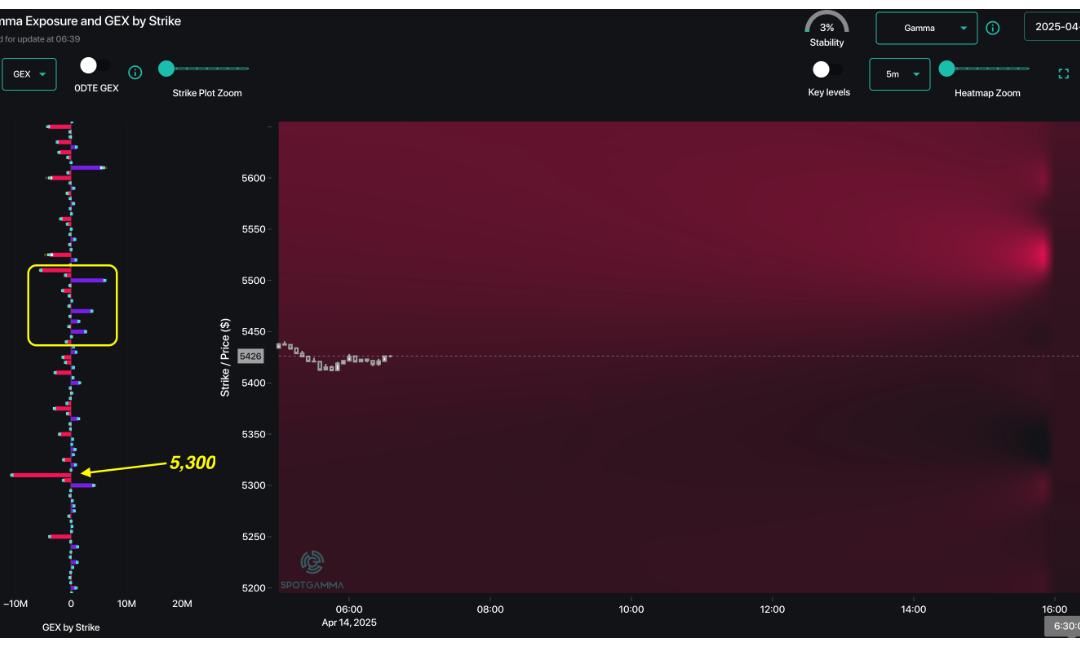

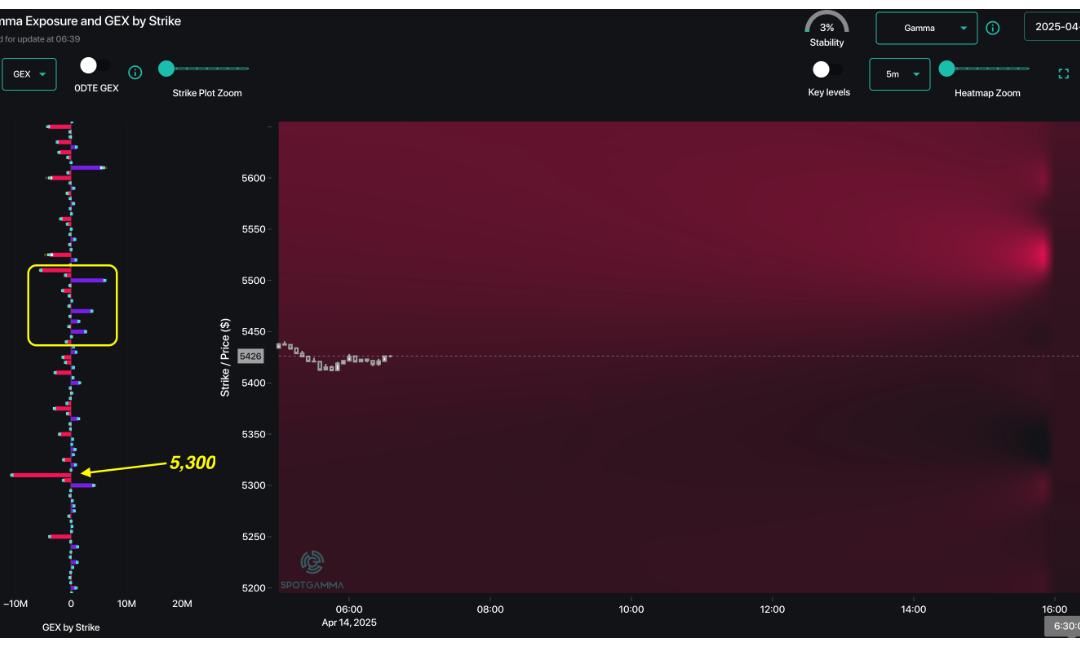

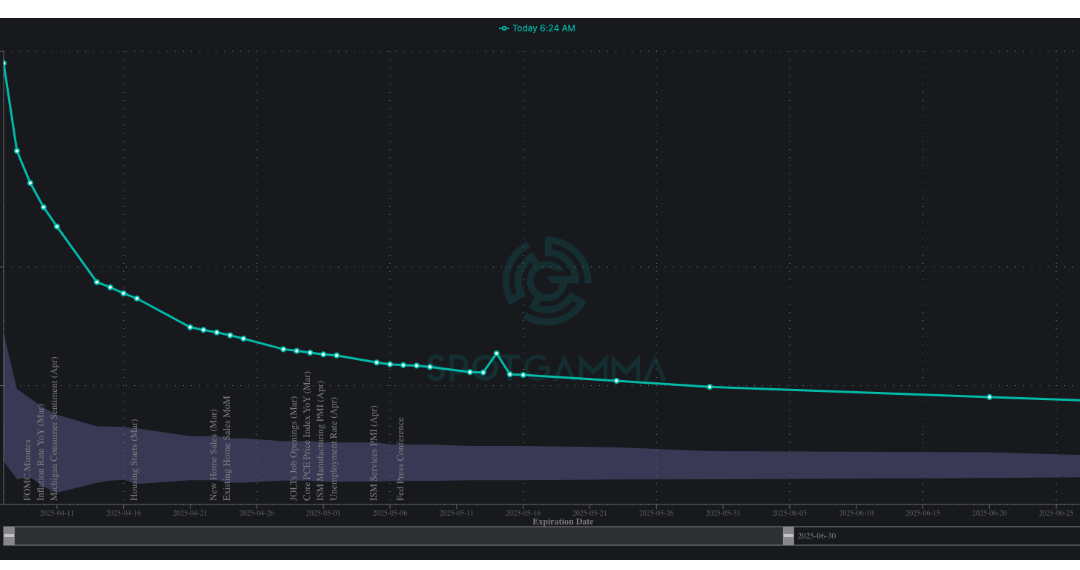

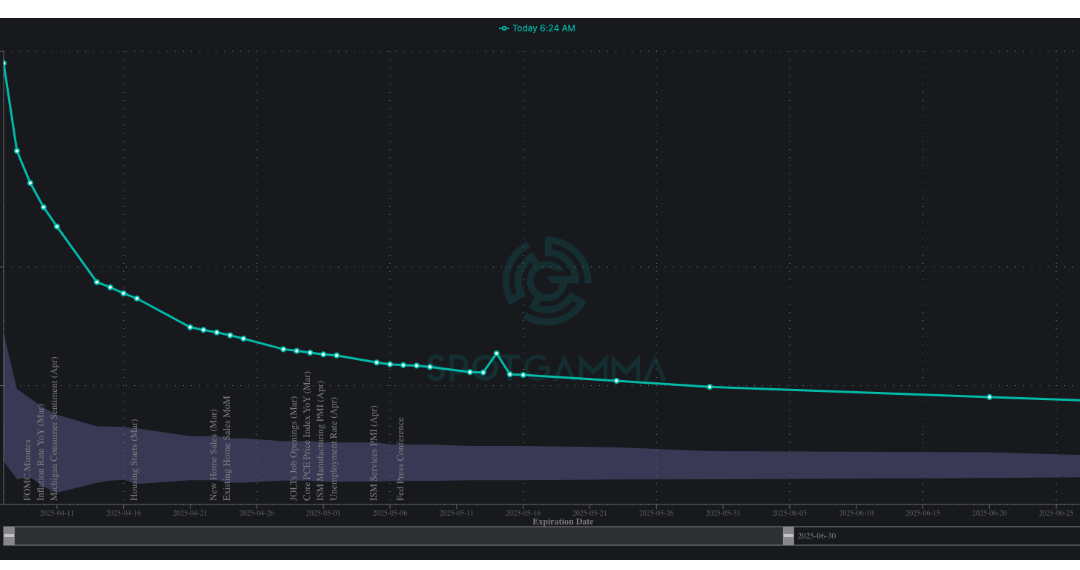

Macro Theme: Key dates ahead: 4/17: Jobs + OPEX 4/14: Fixed risk short volatility trades make sense to us this week, as realized volatility should come in, which allows implied volatility to come in. Further, Thursday’s OPEX adds supportive flows due to put...

by Melida Montemayor | Abr 8, 2025 | Informe Option Levels

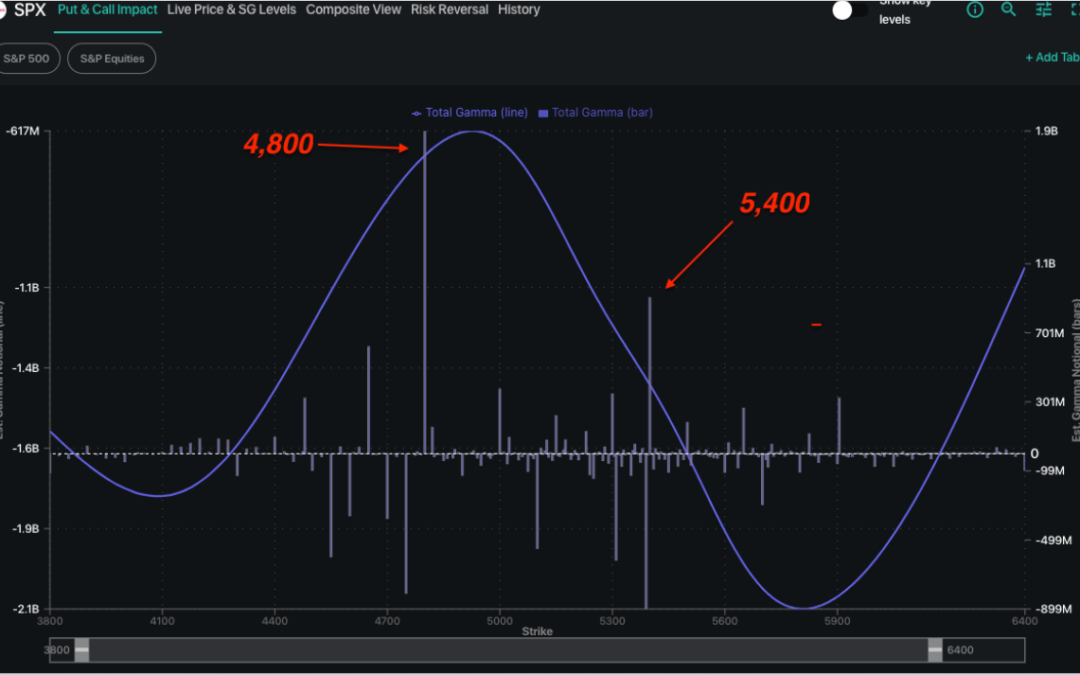

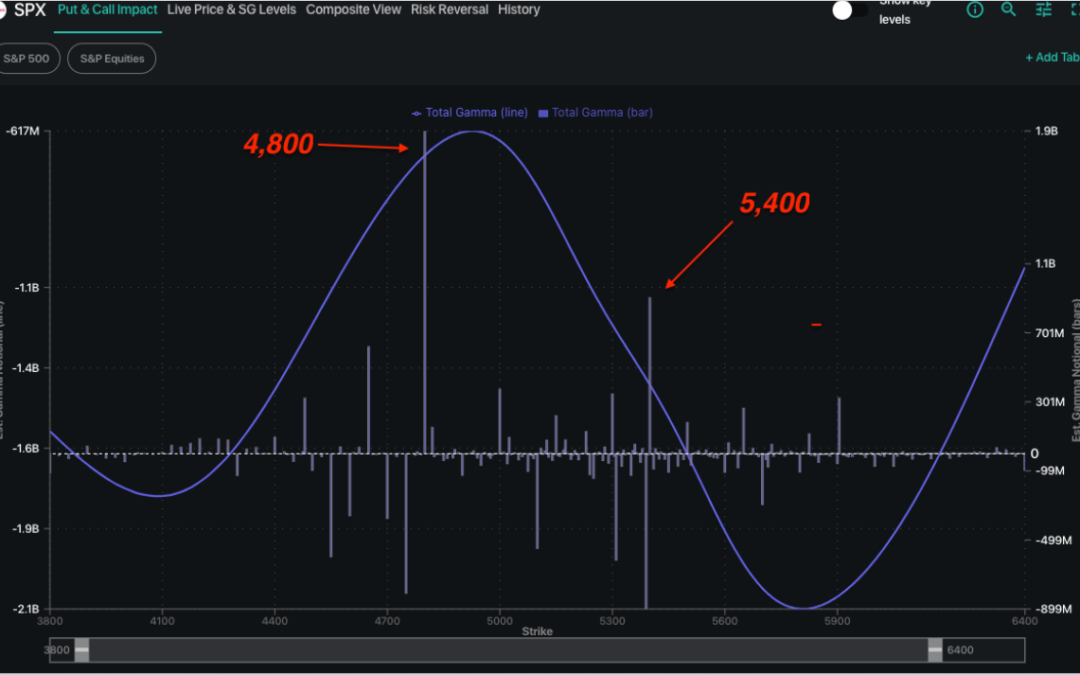

Macro Theme: Key dates ahead: 4/9: FOMC Mins 4/7: Into record high IV/VIX levels, we are looking at ways to play volatility contraction over the next 1-2 weeks via +2 month call spreads and/or flies, with a possible rally “resistance free” into the 5,400...

by Melida Montemayor | Abr 7, 2025 | Informe Option Levels

Macro Theme: Key dates ahead: 4/9: FOMC Mins 4/7: Into record high IV/VIX levels, we are looking at ways to play volatility contraction over the next 1-2 weeks via +2 month call spreads and/or flies, with a possible rally “resistance free” into the 5,400...

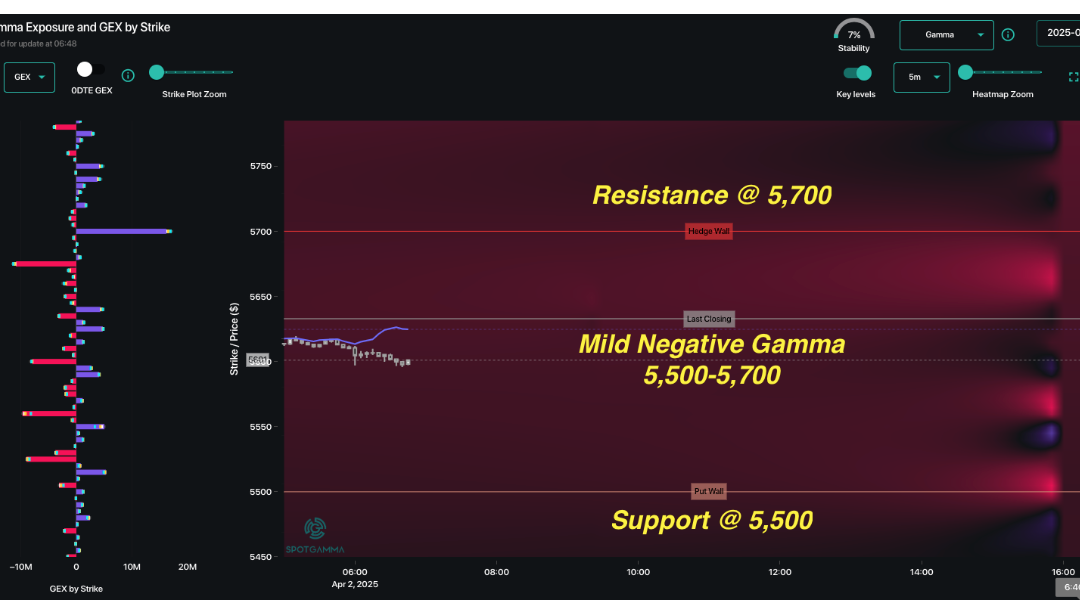

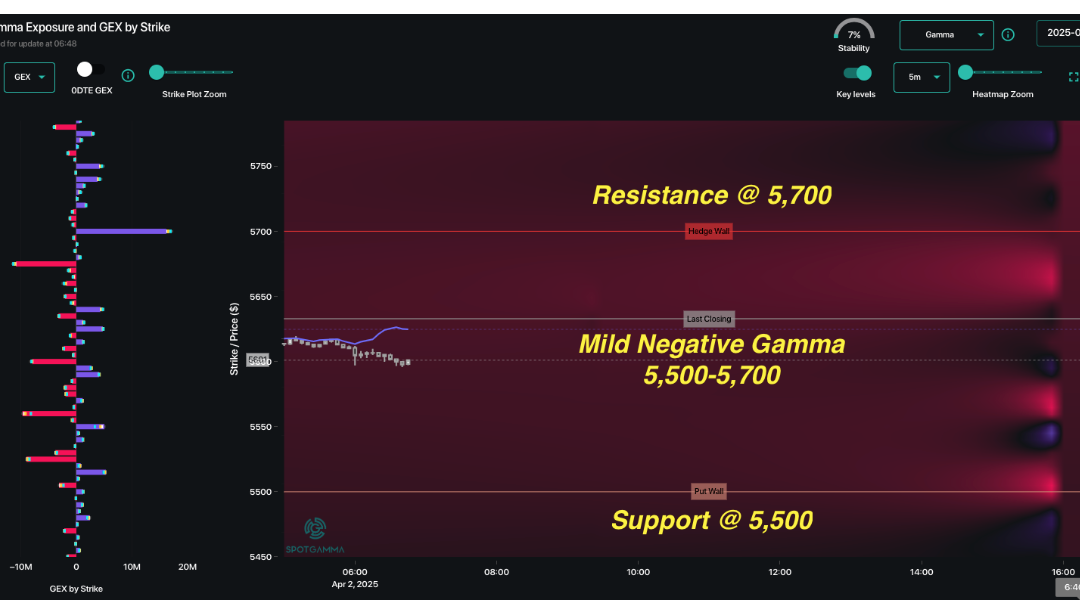

by Melida Montemayor | Abr 2, 2025 | Informe Option Levels

Macro Theme: Key dates ahead: 4/2: Tariff Deadline 3/25: April 2 Tariff Scenario: In a positive outcome, we’d look for a move into 5,950, with major resistance at 6,000. This area is also where we believe vanna fuel would be totally “burned off” with...

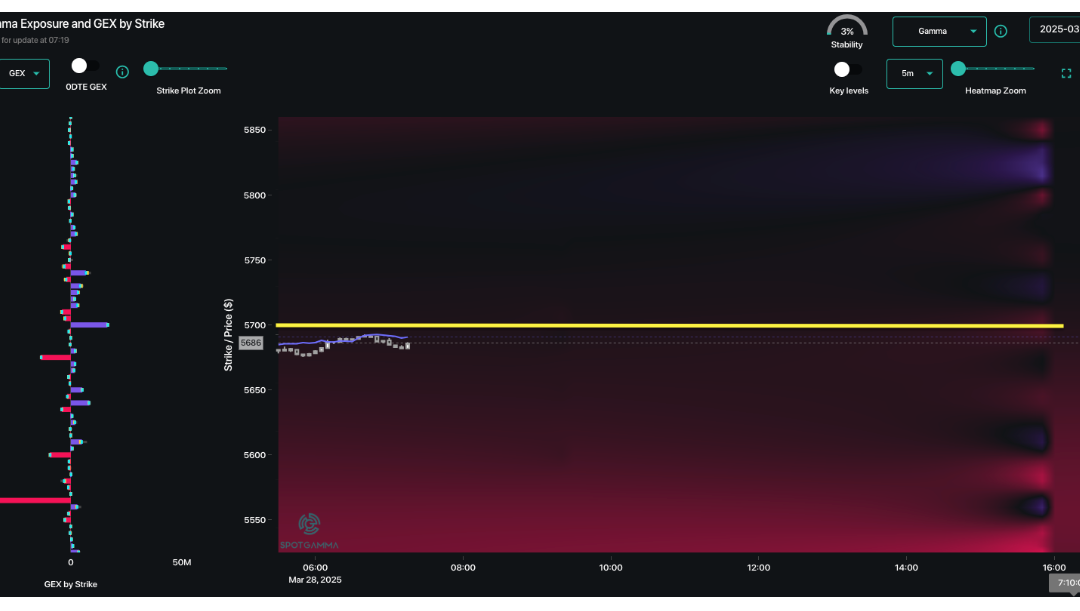

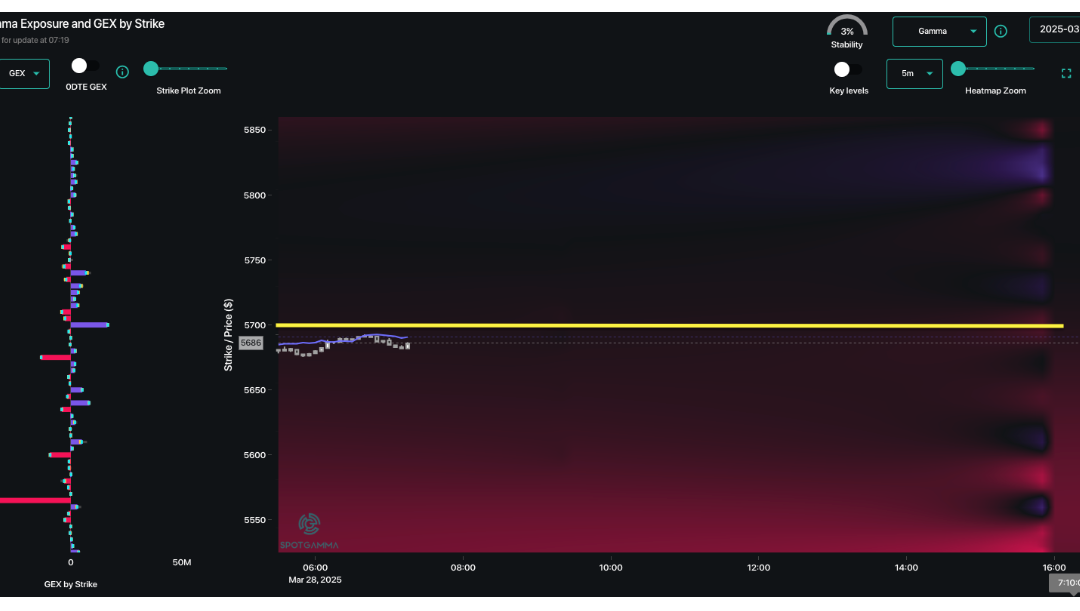

by Melida Montemayor | Mar 28, 2025 | Informe Option Levels

Macro Theme: Key dates ahead: 3/28: Core PCE 3/31: Q-End OPEX (JPM Roll) 4/2: Tariff Deadline 3/27: Vol continues to look cheap after the 3/26 ~1% SPX decline ahead of GDP/Jobs data today (3/27), Core PCE tomorrow (3/28), the JPM expiry (3/31) and an alleged tariff...