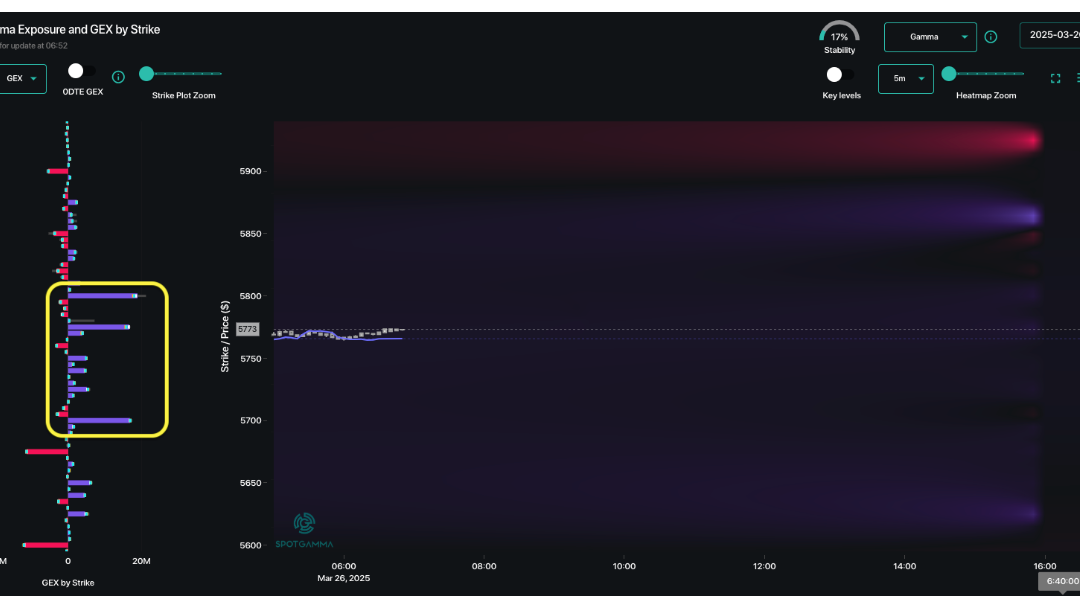

by Melida Montemayor | Mar 26, 2025 | Informe Option Levels

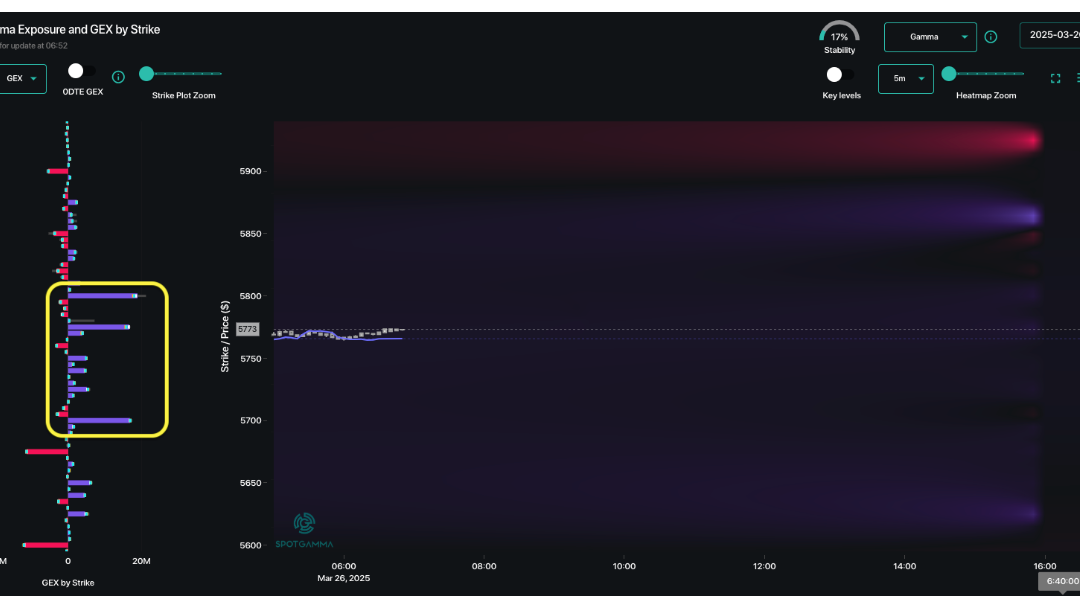

Macro Theme: Key dates ahead: 3/27: GDP + Jobs 3/28: Core PCE 3/31: Q-End OPEX 4/2: Tariff Deadline 3/24: We are looking to lock in some long call/short put gains (see 3/19 note) into the strong stock rally on into 3/24 because a signed tariff deal has not been...

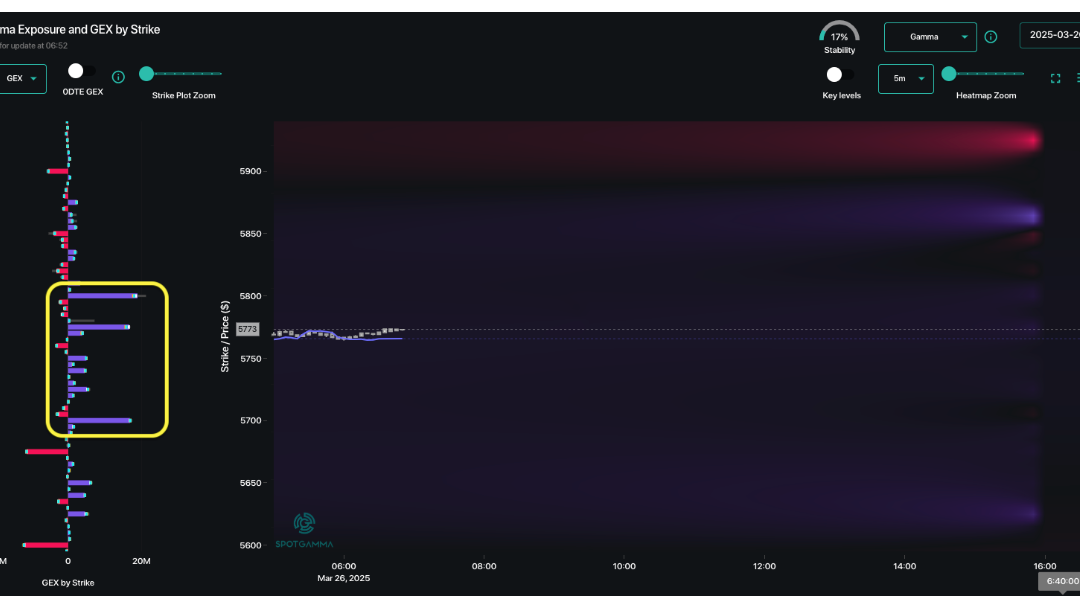

by Melida Montemayor | Mar 21, 2025 | Informe Option Levels

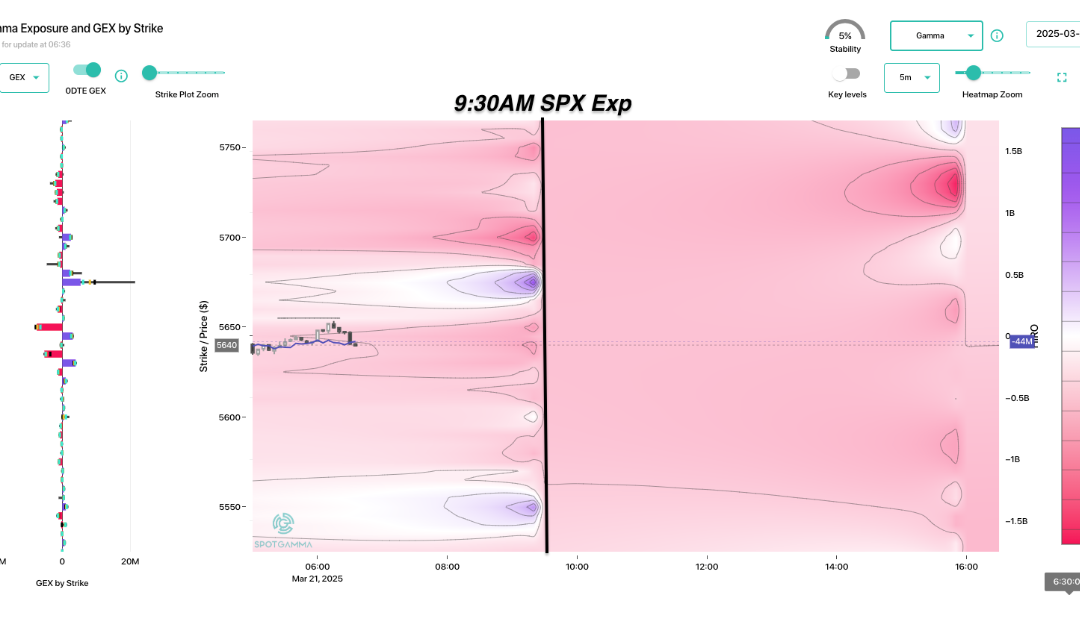

Macro Theme: Key dates ahead: 3/21: OPEX 3/31: Q-End OPEX 4/2: Tariff Deadline 3/21: OPEX Update: We continue our view of wanting to own “cheap” long calls/call spreads >=1-month exp, which show in names like: semis (SMH, NVDA, AMD), and dare we say it:...

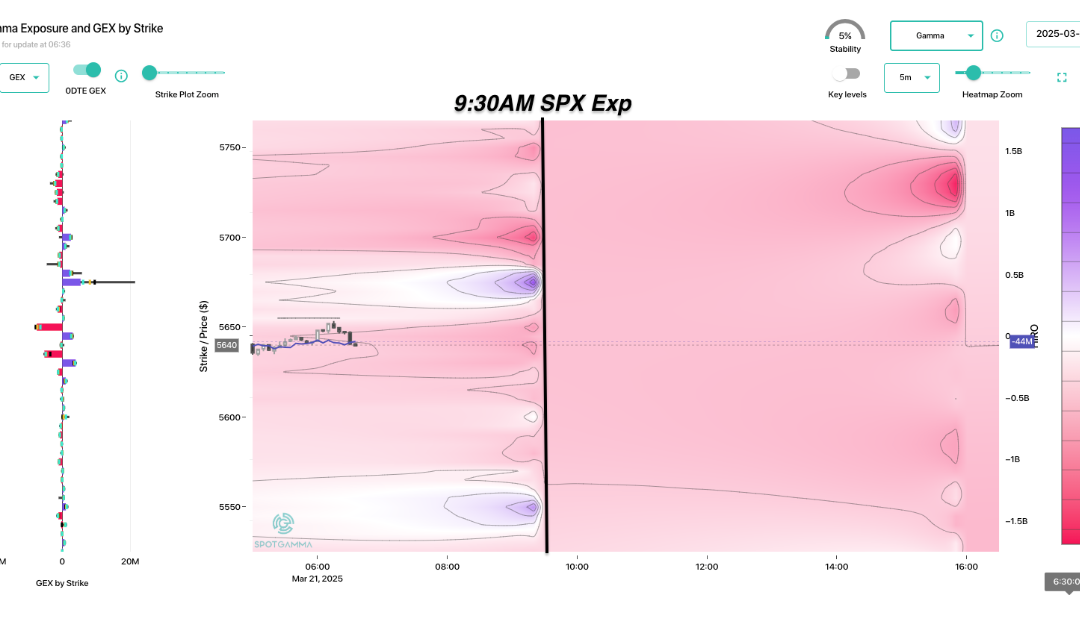

by Melida Montemayor | Mar 20, 2025 | Informe Option Levels

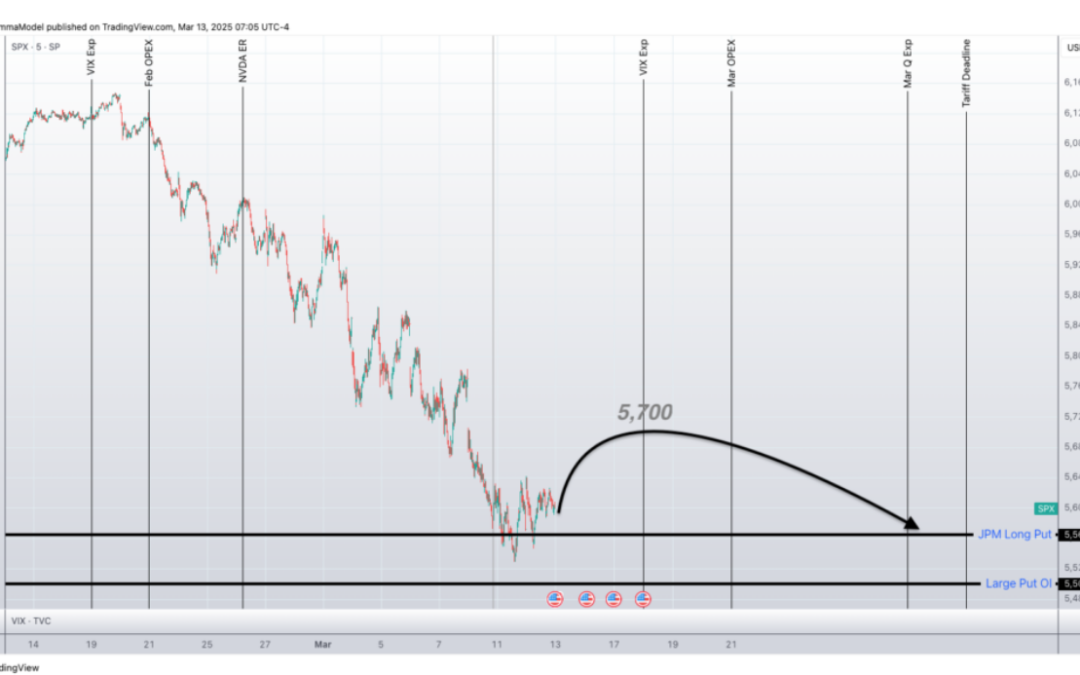

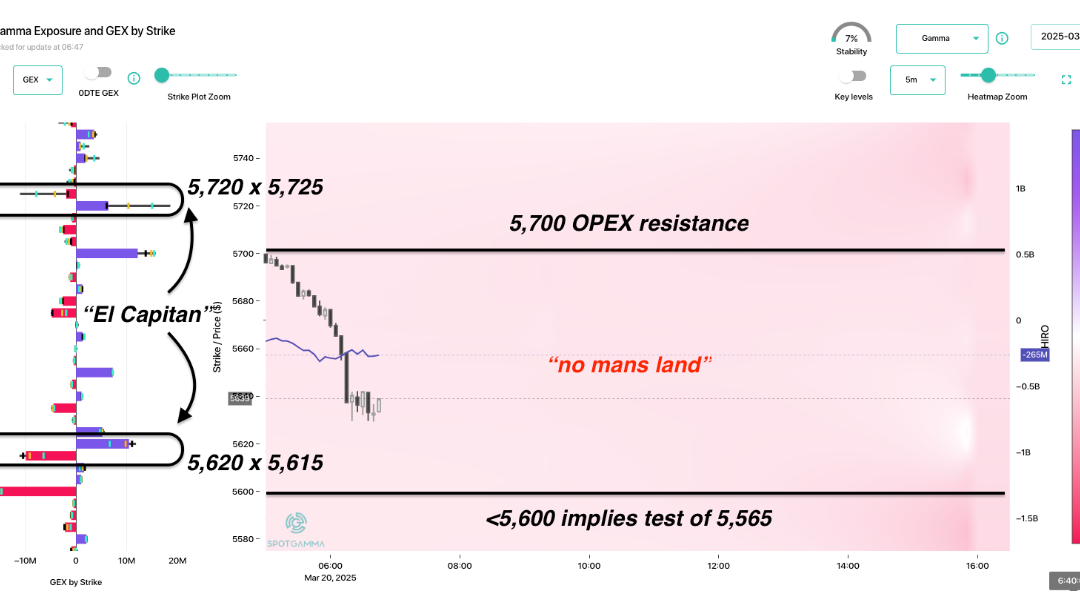

Macro Theme: Key dates ahead: 3/21: OPEX 3/31: Q-End OPEX 4/2: Tariff Deadline 3/19: Into FOMC downside seems exhausted, and OPEX may bring some relief. We prefer to express the next week as a “short put” scenario, meaning we think downside is pretty...

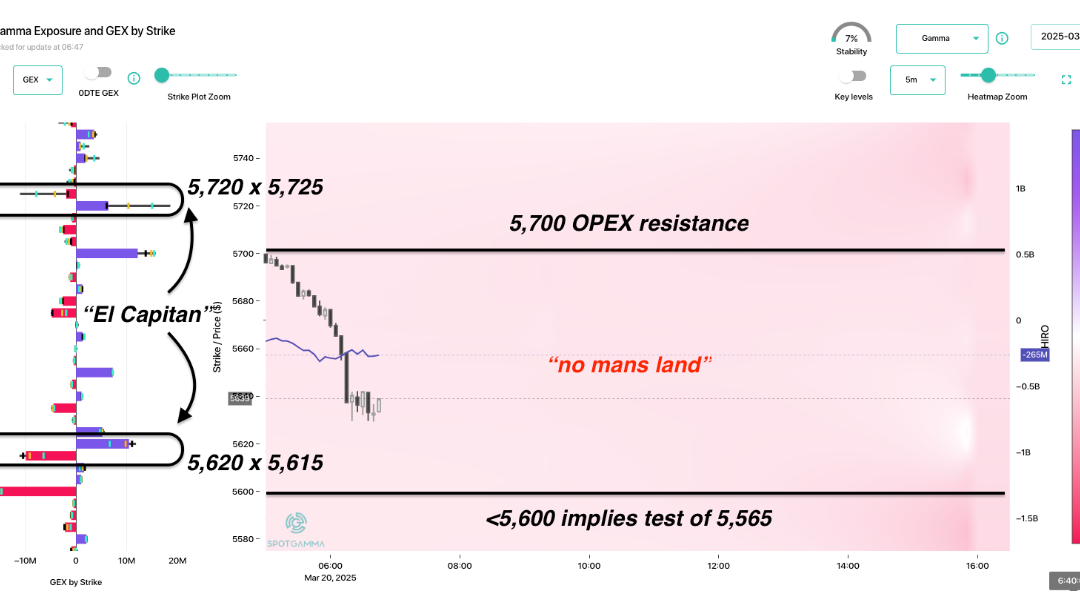

by Melida Montemayor | Mar 19, 2025 | Informe Option Levels

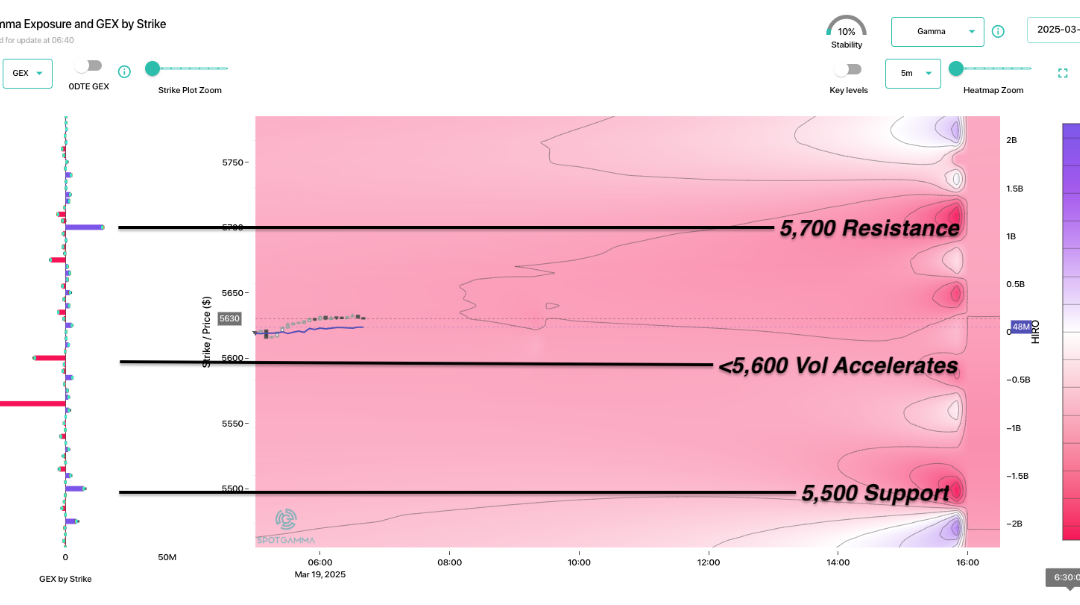

Macro Theme: Key dates ahead: 3/19: FOMC 3/21: OPEX 3/31: Q-End OPEX 4/2: Tariff Deadline 3/19: Into FOMC downside seems exhausted, and OPEX may bring some relief. We prefer to express the next week as a “short put” scenario, meaning we think downside is...

by Melida Montemayor | Mar 18, 2025 | Informe Option Levels

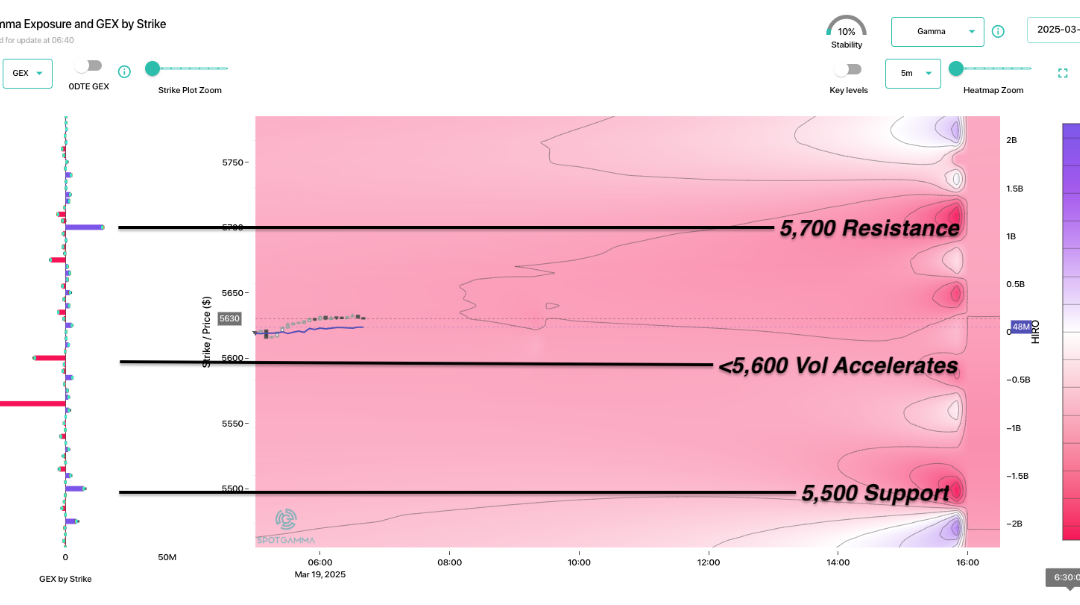

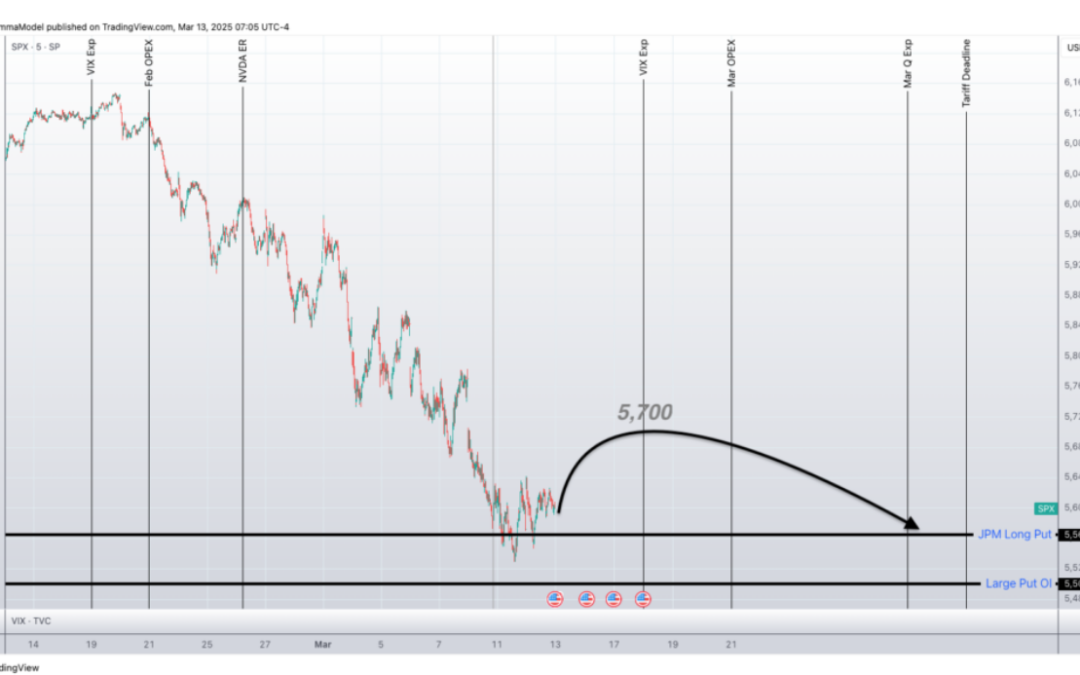

Macro Theme: Key dates ahead: 3/18: VIX expiration (Tuesday) 3/19: FOMC 3/21: OPEX 3/31: Q-End OPEX 4/2: Tariff Deadline 3/18: We look for short term equity weakness after this mornings VIX expiration (ref 5,675), with a target area of 5,565. Should that target hit,...