Informe Option Levels

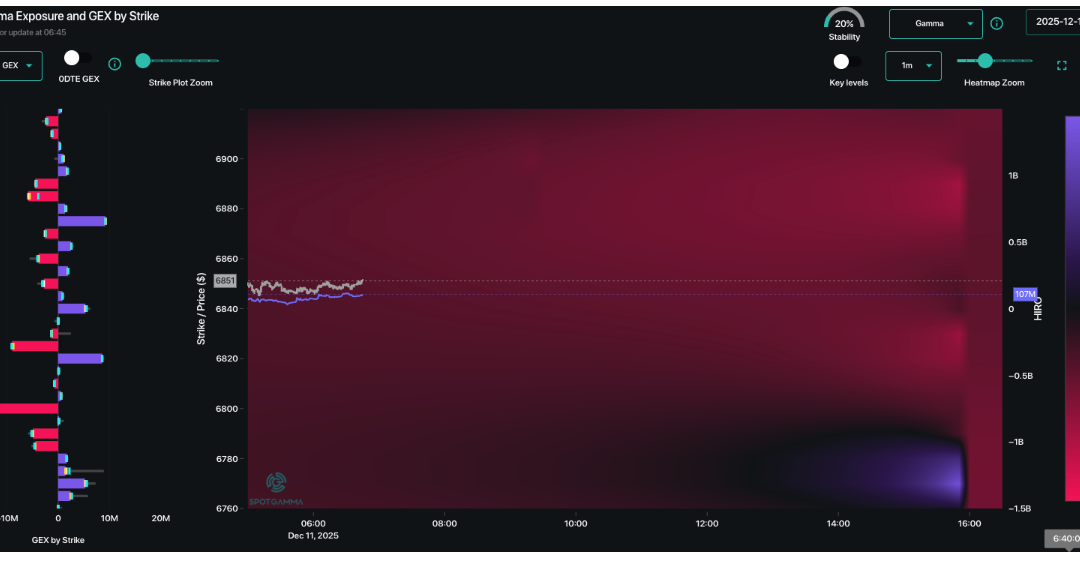

Macro Theme: Key dates ahead: 12/16: NFP 12/17 VIX Exp 12/18: CPI 12/19: OPEX 12/24: Xmas Eve 1/2 Day 12/25: Xmas SG Summary: Update: 12/16: The SPX tested and held 6,800. Given this, we’ve re-adjusted the Risk Pivot to 6,790. We continue to favor holding a...

Informe Option Levels

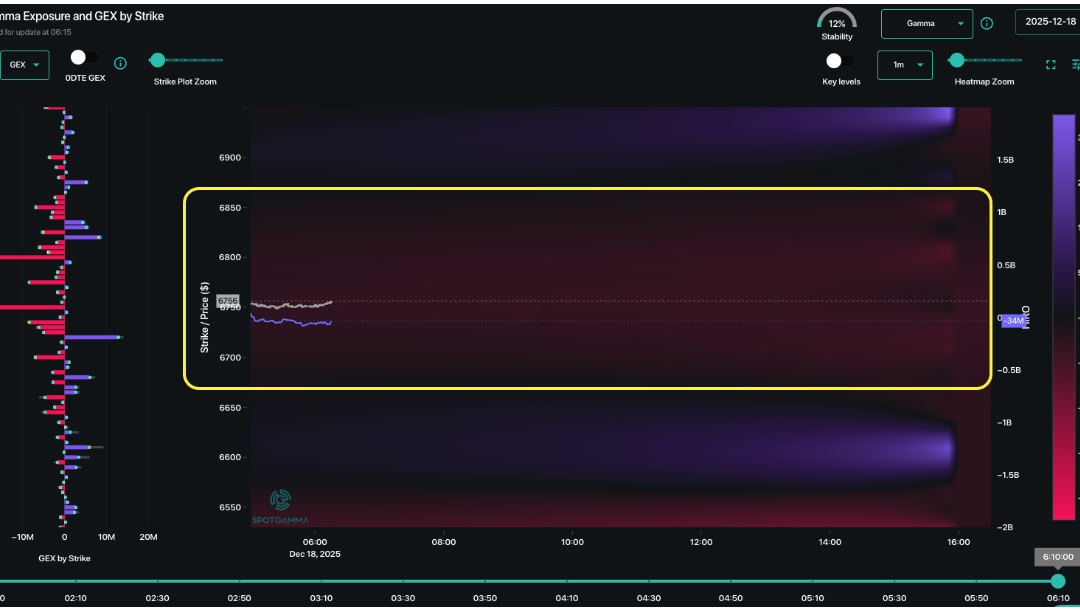

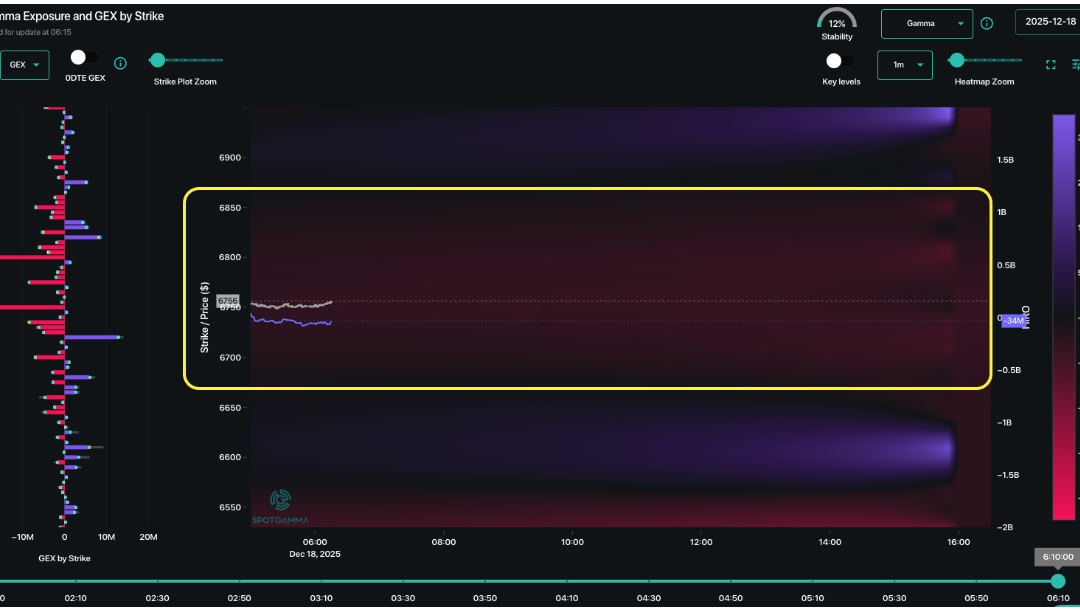

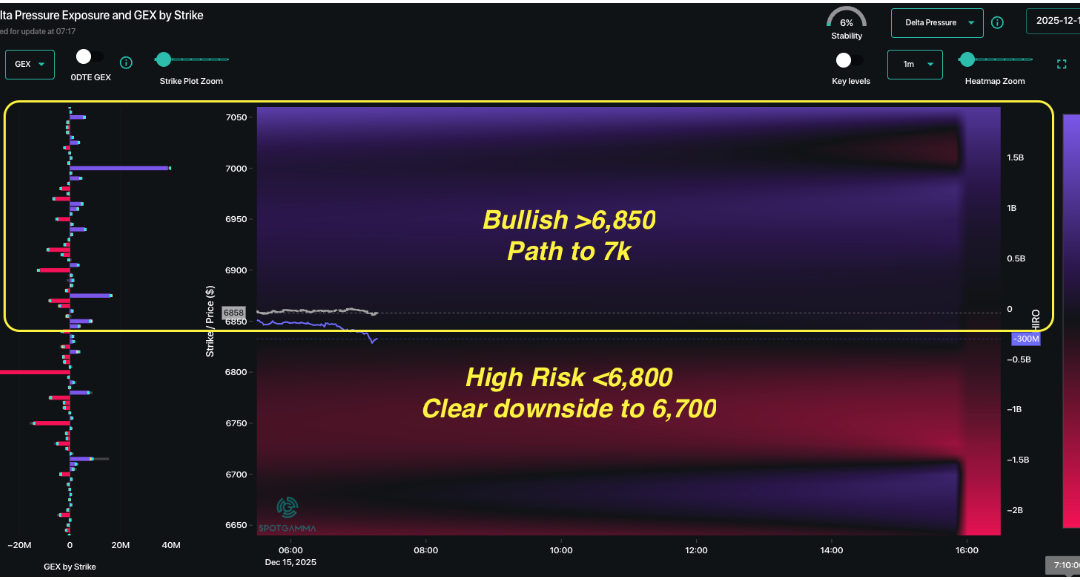

Macro Theme: Key dates ahead: 12/12: PPI 12/16: NFP 12/17 VIX Exp 12/18: CPI (confirmed) 12/19: OPEX SG Summary: Update 12/15: Should SPX 6,840 break, we will be looking to add short positions via January put spreads. 12/9: FOMC 12/10 + ORCL ER 12/10 + AVGO ER 12/11...

Informe Option Levels

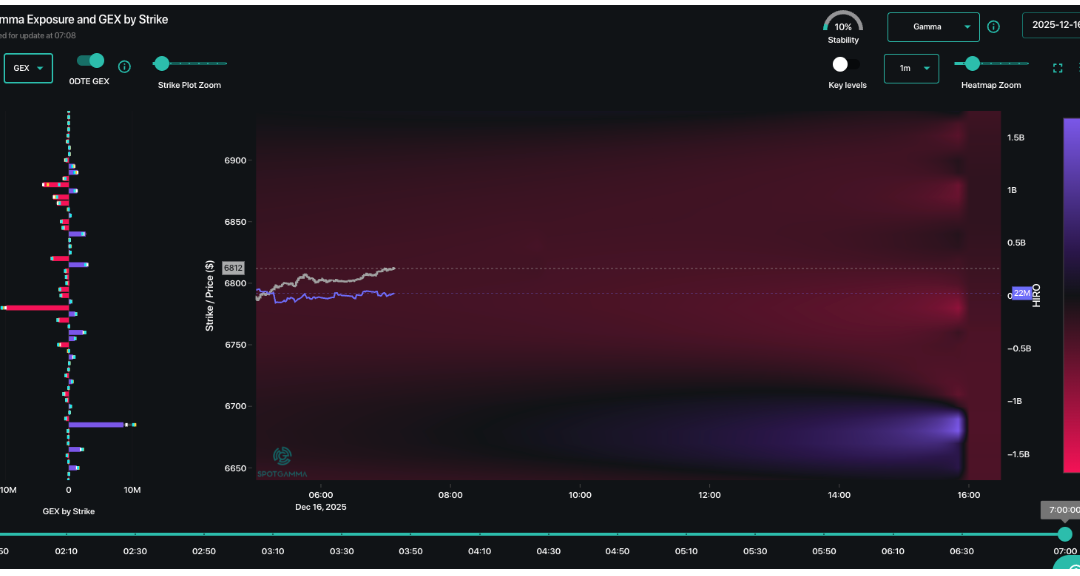

Macro Theme: Key dates ahead: 12/12: PPI 12/16: NFP 12/17 VIX Exp 12/18: CPI (confirmed) 12/19: OPEX SG Summary: Update 12/9: FOMC 12/10 + ORCL ER 12/10 + AVGO ER 12/11 make this week the directional trigger into end-of-year. We lean to the bullish side, as the benign...