by Melida Montemayor | Feb 24, 2025 | Informe Option Levels

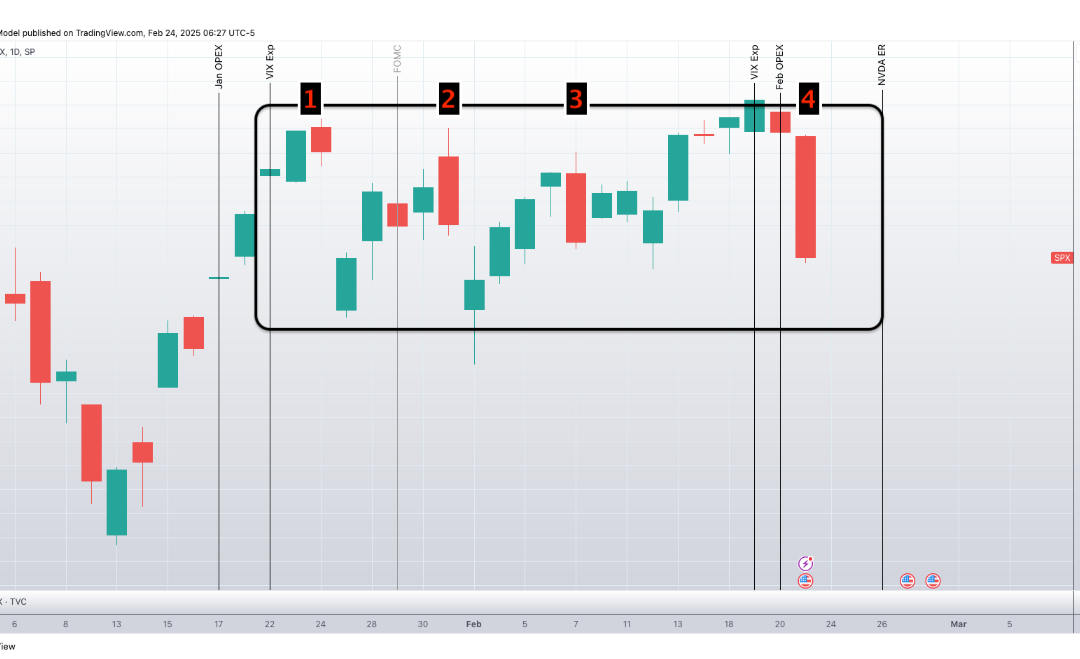

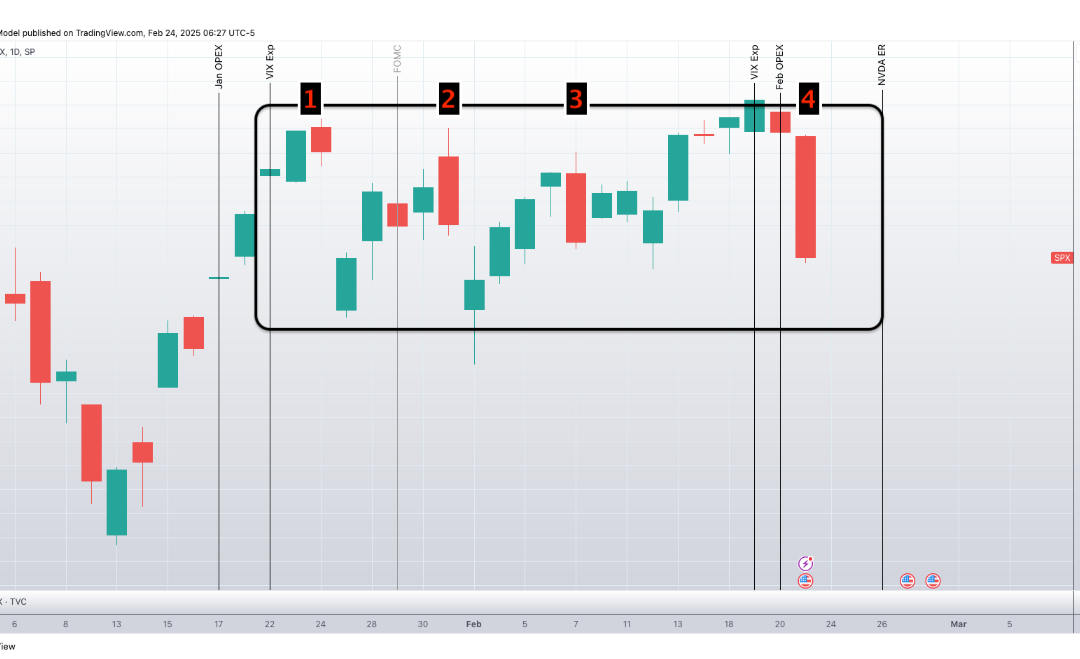

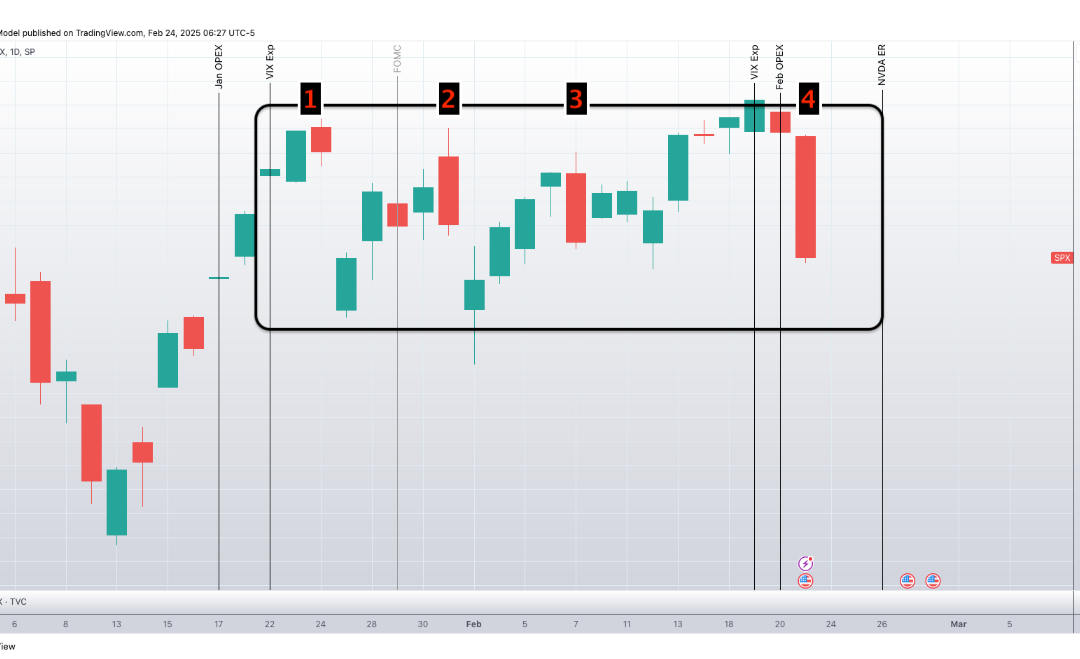

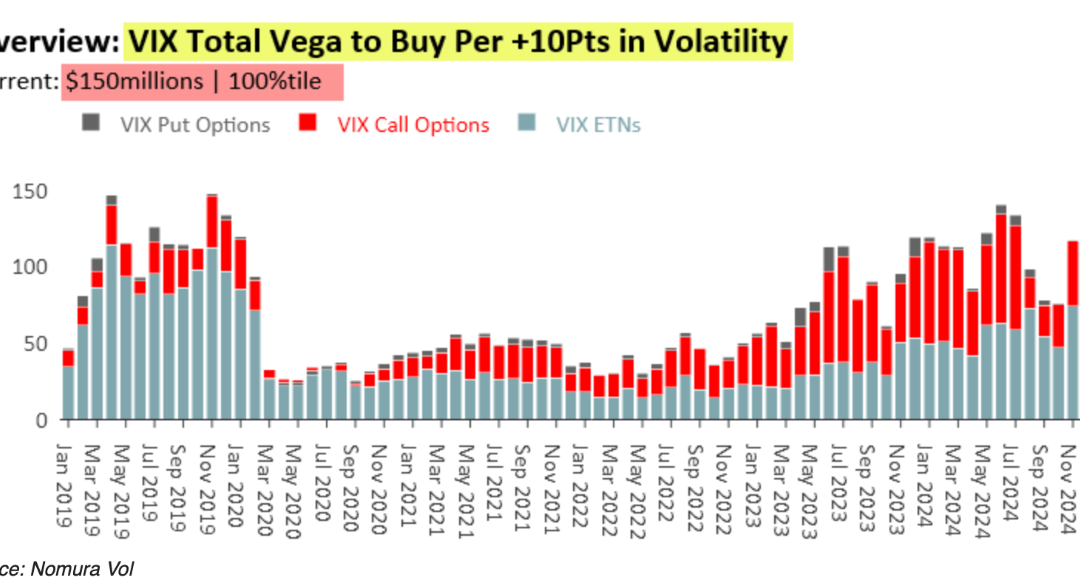

Macro Theme: Key dates ahead: 2/26: NVDA ER 2/27: GDP 2/28: PCE On 2/11 we recommended buying SPX ~1-month calls as a way to hedge a right tail move. Our data suggests calls are cheap (ex: 3/13 exp 25 delta call = 10.6% IV ref 6,200). Update (2/20): We flip to...

by Melida Montemayor | Feb 20, 2025 | Informe Option Levels

Macro Theme: Key dates ahead: 2/19: VIX Exp, FOMC Mins 2/21: OPEX 2/26: NVDA ER On 2/11 we recommended buying SPX ~1-month calls as a way to hedge a right tail move. Our data suggests calls are cheap (ex: 3/13 exp 25 delta call = 10.6% IV ref 6,200). We flip to...

by Melida Montemayor | Feb 19, 2025 | Informe Option Levels

Macro Theme: Key dates ahead: 2/19: VIX Exp, FOMC Mins 2/21: OPEX 2/26: NVDA ER On 2/11 we recommended buying SPX ~1-month calls as a way to hedge a right tail move. Our data suggests calls are cheap (ex: 3/13 exp 25 delta call = 10.6% IV ref 6,200). We flip to...

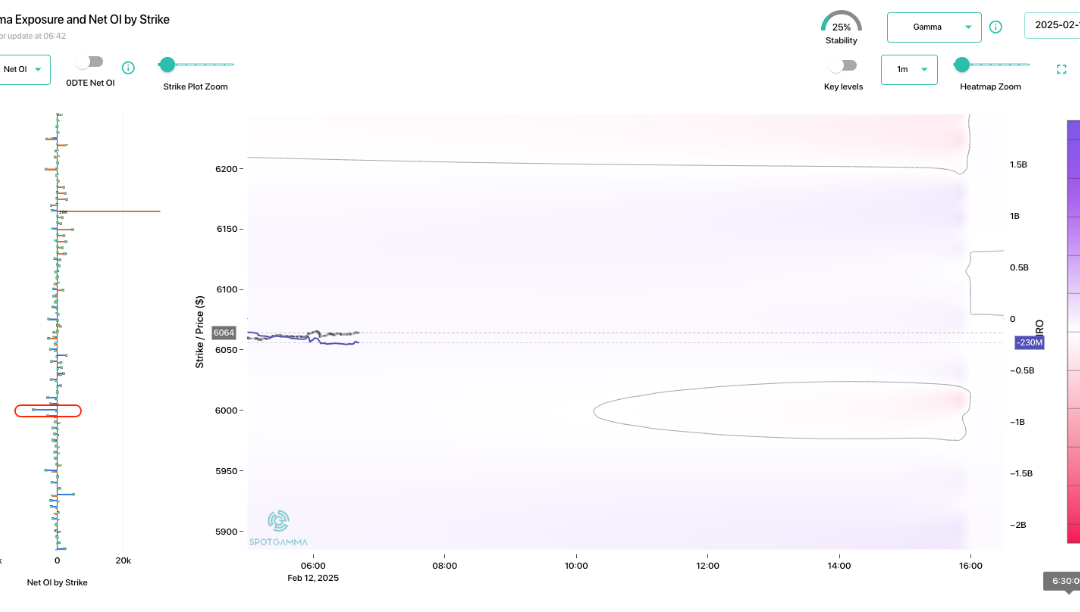

by Melida Montemayor | Feb 12, 2025 | Informe Option Levels

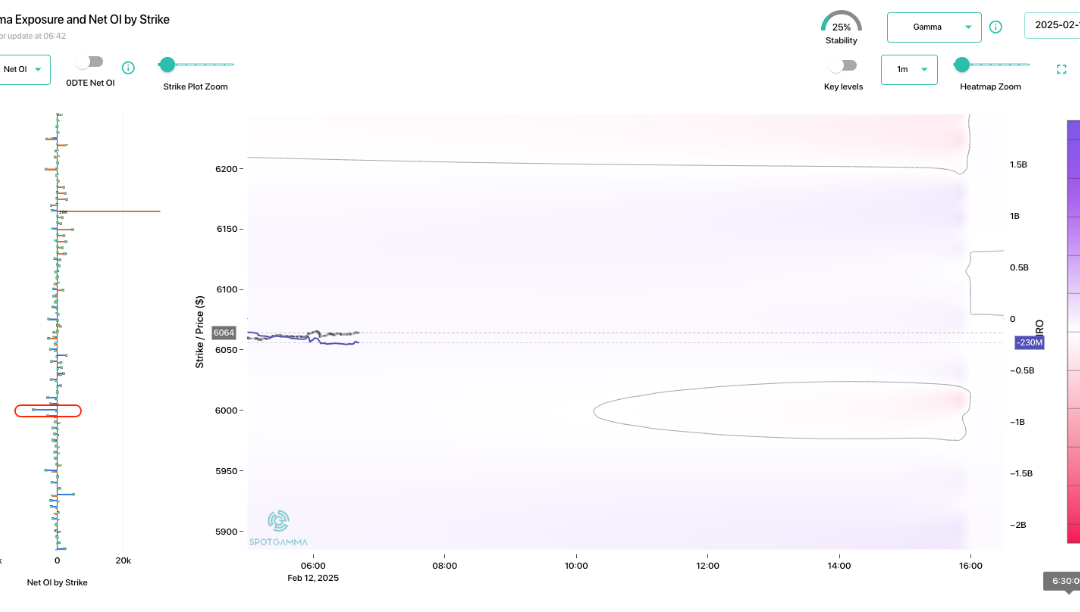

Macro Theme: Key dates ahead: 2/12: CPI + Powell Testimony 2/21: OPEX 2/26: NVDA ER On 2/11 we recommended buying SPX ~1-month calls as a way to hedge a right tail move. Our data suggests calls are cheap (ex: 3/13 exp 25 delta call = 10.6% IV ref 6,200). We flip to...

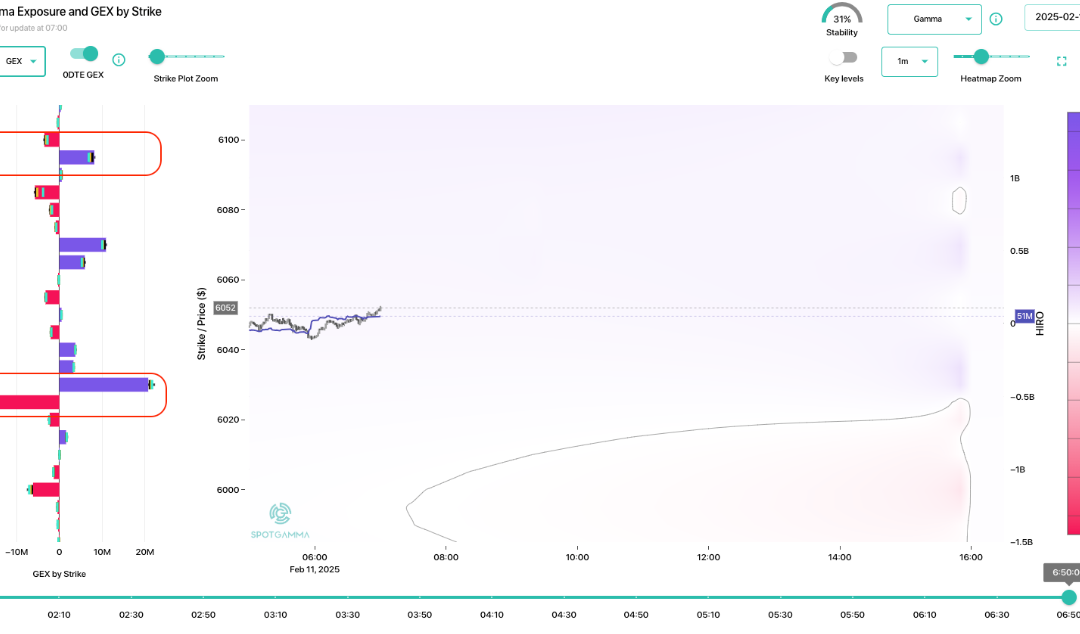

by Melida Montemayor | Feb 11, 2025 | Informe Option Levels

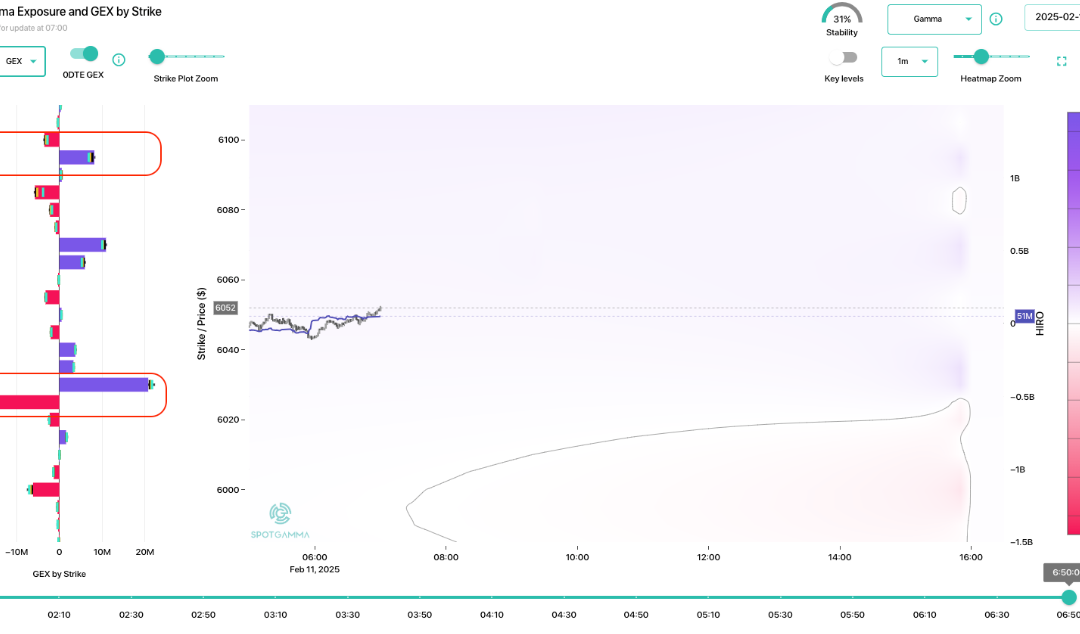

Macro Theme: Key dates ahead: 2/11: Powell Testimony 2/12: CPI 2/21: OPEX 2/26: NVDA ER On 2/11 we recommended buying SPX ~1-month calls as a way to hedge a right tail move. Our data suggests calls are cheap (ex: 3/13 exp 25 delta call = 10.6% IV ref 6,200). We flip...