by Melida Montemayor | Feb 10, 2025 | Informe Option Levels

Macro Theme: Key dates ahead: 2/11: Powell Testimony 2/12: CPI 2/21: OPEX 2/26: NVDA ER We flip to risk-off if SPX trades <6,000. 6,100 – 6,120 is a major band of resistance into 2/12 CPI. Key SG levels for the SPX are: Resistance: 6,100, 6,120 Support:...

by Melida Montemayor | Feb 6, 2025 | Informe Option Levels

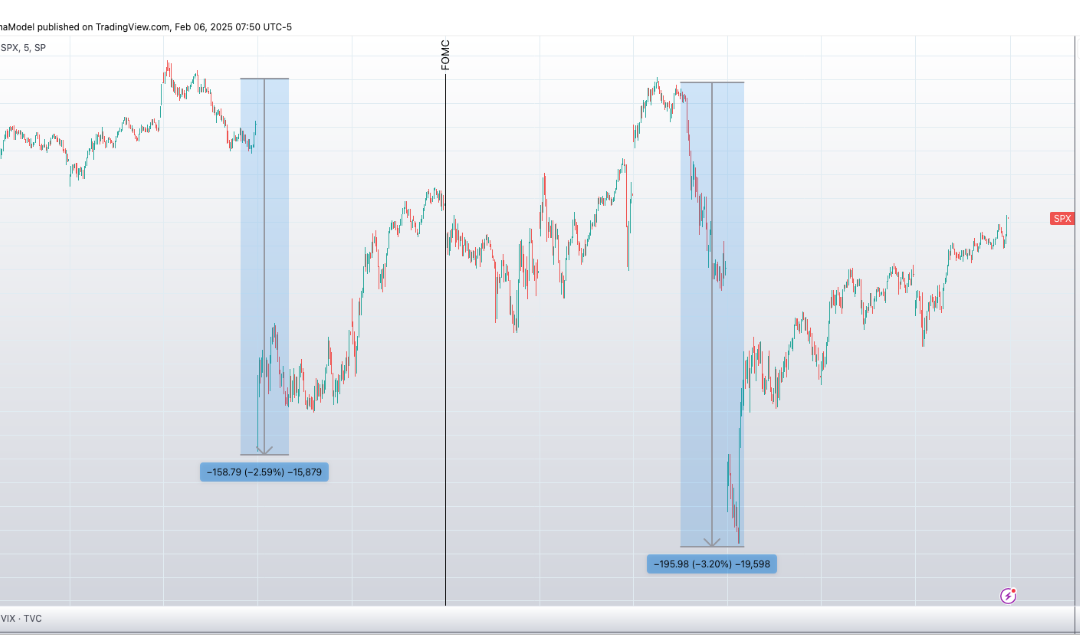

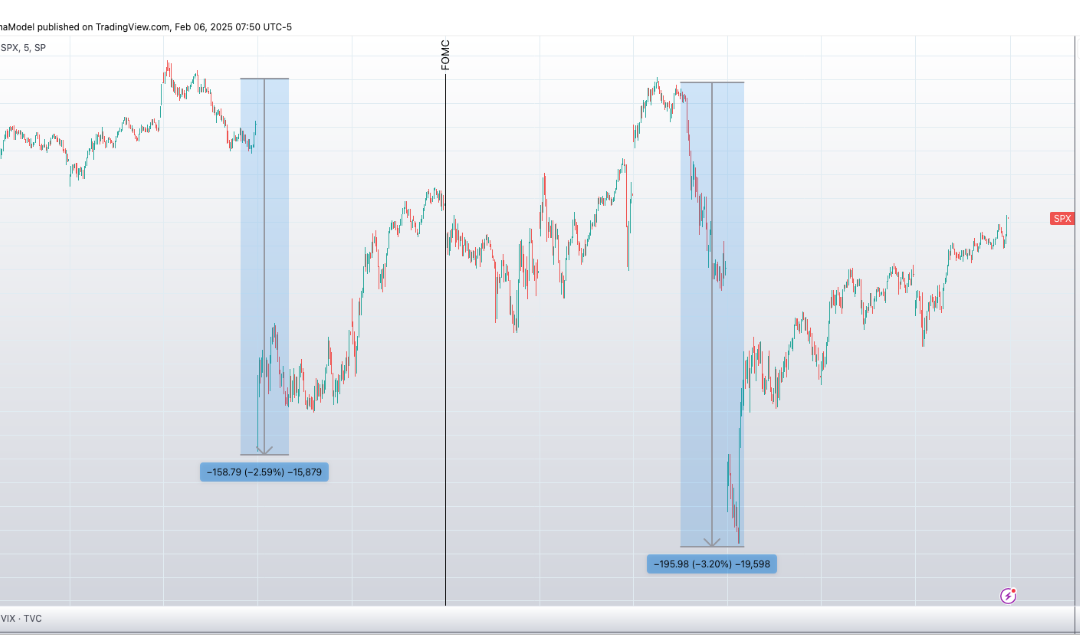

Macro Theme: Key dates ahead: 2/7: NFP 2/12: CPI 2/21: OPEX 2/26: NVDA ER We flip to risk-off if SPX trades <6,000. The 6k price level remains a sensitive spot for SPX, as major declines can occur from this “simmering” but not “overpriced”...

by Melida Montemayor | Feb 5, 2025 | Informe Option Levels

Macro Theme: Key dates ahead: 2/7: NFP 2/12: CPI 2/21: OPEX 2/26: NVDA ER We flip to risk-off if SPX trades <6,000. The 6k price level remains a sensitive spot for SPX, as major declines can occur from this “simmering” but not “overpriced”...

by Melida Montemayor | Feb 4, 2025 | Informe Option Levels

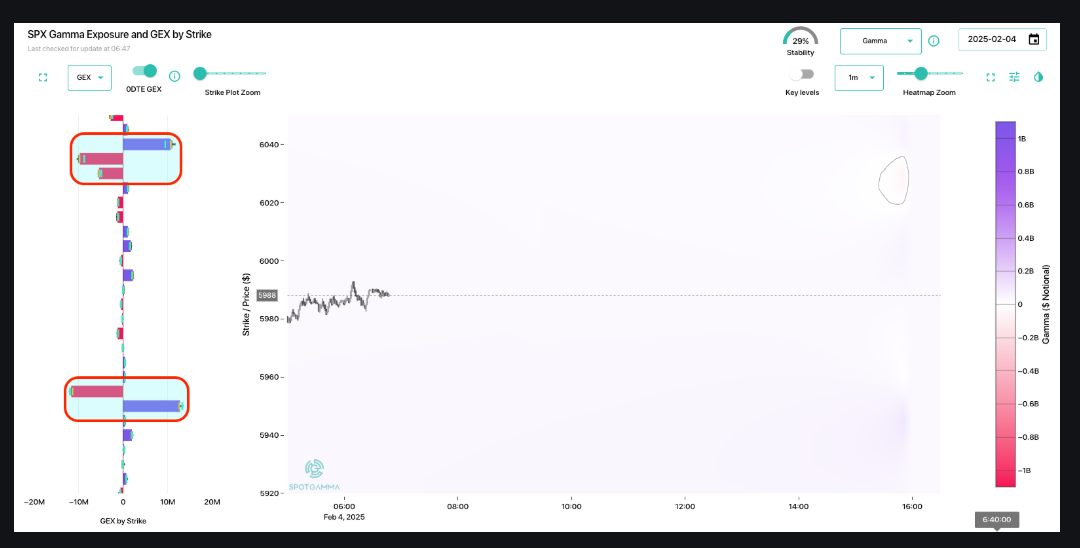

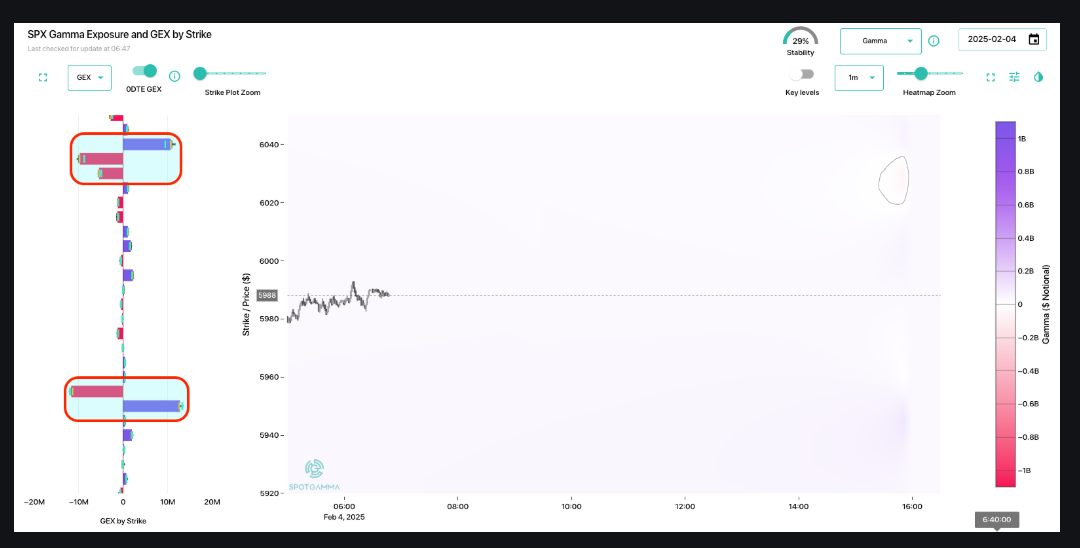

Macro Theme: Key dates ahead: 2/7: NFP 2/12: CPI 2/21: OPEX 2/26: NVDA ER We flip to risk-off as SPX traded <6,000. The 6k price level remains a sensitive spot for SPX, as major declines can occur from this “simmering” but not “ovepriced”...

by Melida Montemayor | Feb 3, 2025 | Informe Option Levels

Macro Theme: Key dates ahead: 2/3: ISM PMI 2/7: NFP 2/12: CPI 2/21: OPEX 2/26: NVDA ER We flipped to risk-off as SPX traded <6,000. This is a very sensitive spot for SPX (5,950, VIX 20), as major declines can occur from this “simmering” but not...