by Melida Montemayor | Ene 21, 2025 | Informe Option Levels

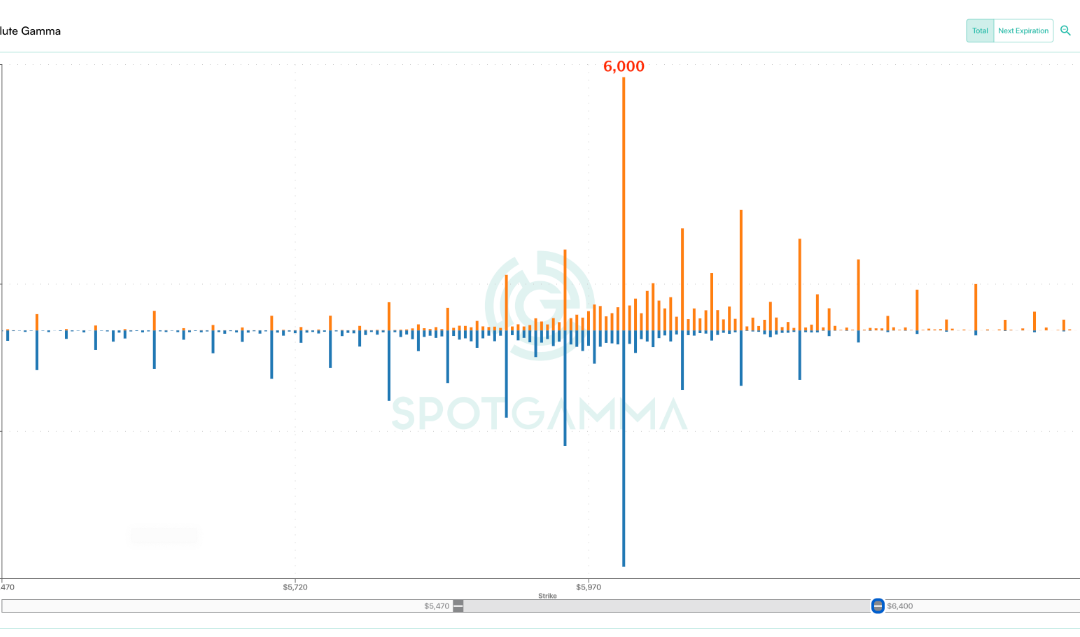

Macro Theme: Key dates ahead: 1/29: FOMC We are risk off (short delta+long vol) if SPX <5,975. Key SG levels for the SPX are: Support: 6,000 Resistance: 6,050, 6,075, 6,100 Founder’s Note: Futures are +40 bps. Resistance: 6,050, 6,075, 6,100 Support: 6,000,...

by Melida Montemayor | Ene 17, 2025 | Informe Option Levels

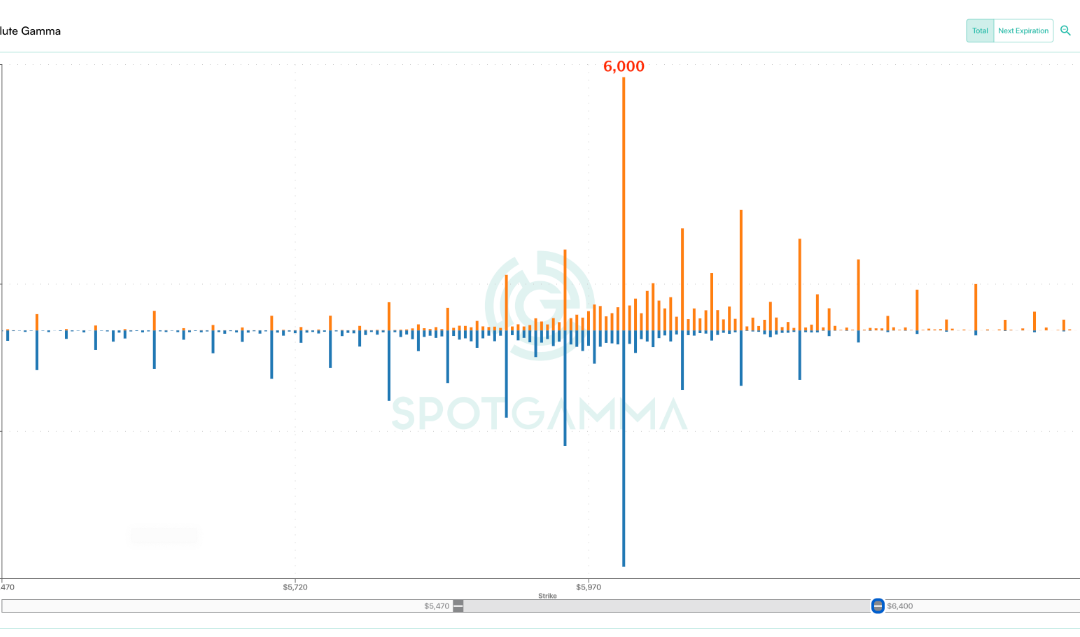

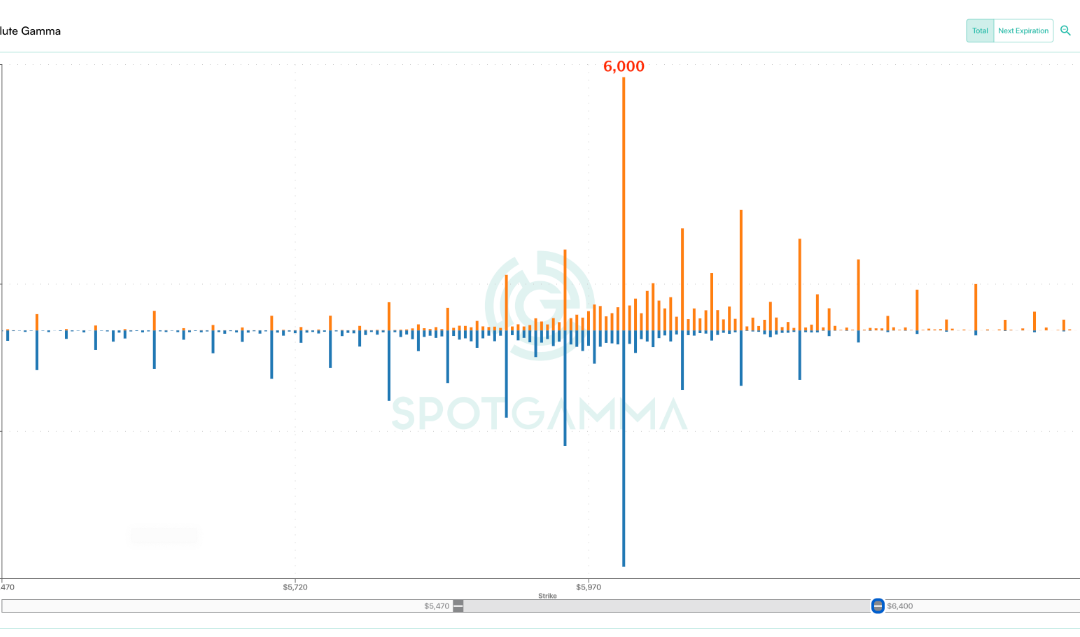

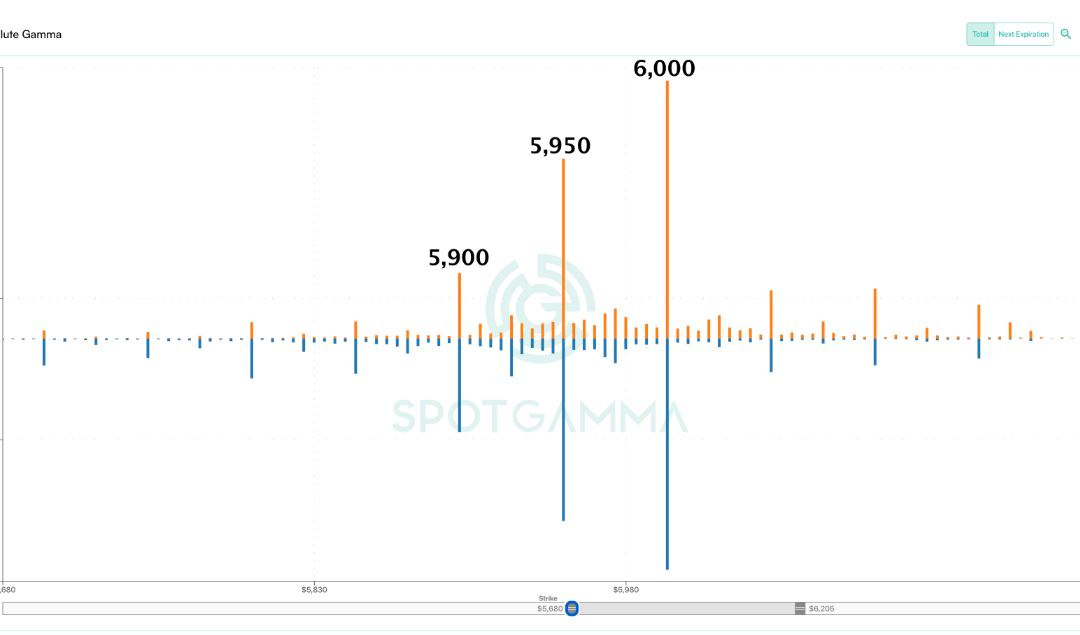

Macro Theme: Key dates ahead: 1/17: OPEX 1/20: MLK (market closed) + Inauguration 1/29: FOMC 5,950 – 6,000 is likely major resistance into 1/17 OPEX. We are risk off (short delta+long vol) if SPX <5,900. Key SG levels for the SPX are: Support: 5,900...

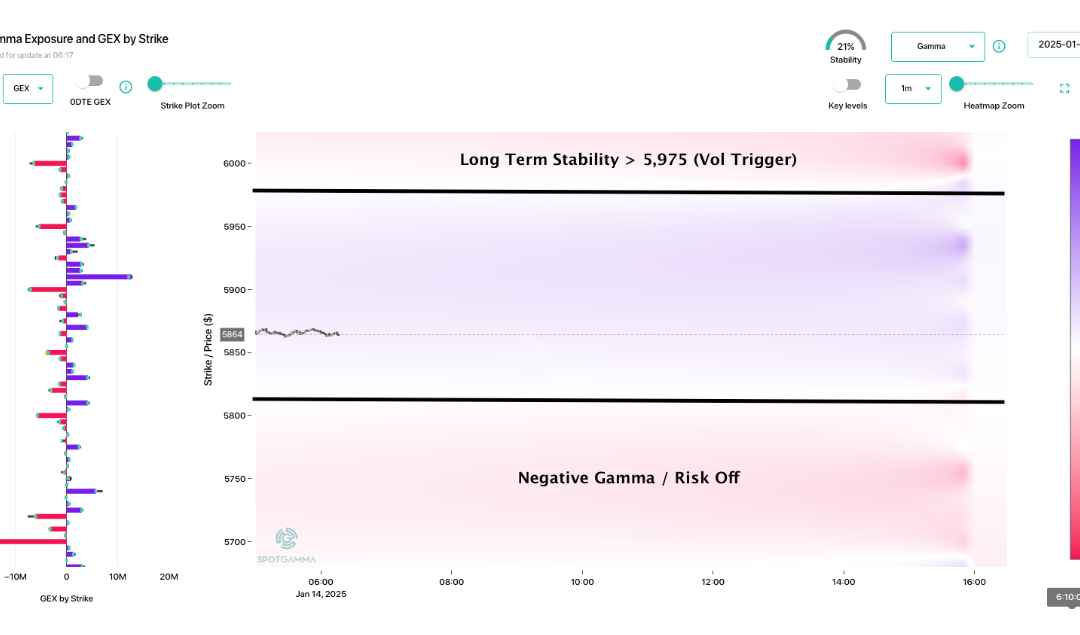

by Melida Montemayor | Ene 14, 2025 | Informe Option Levels

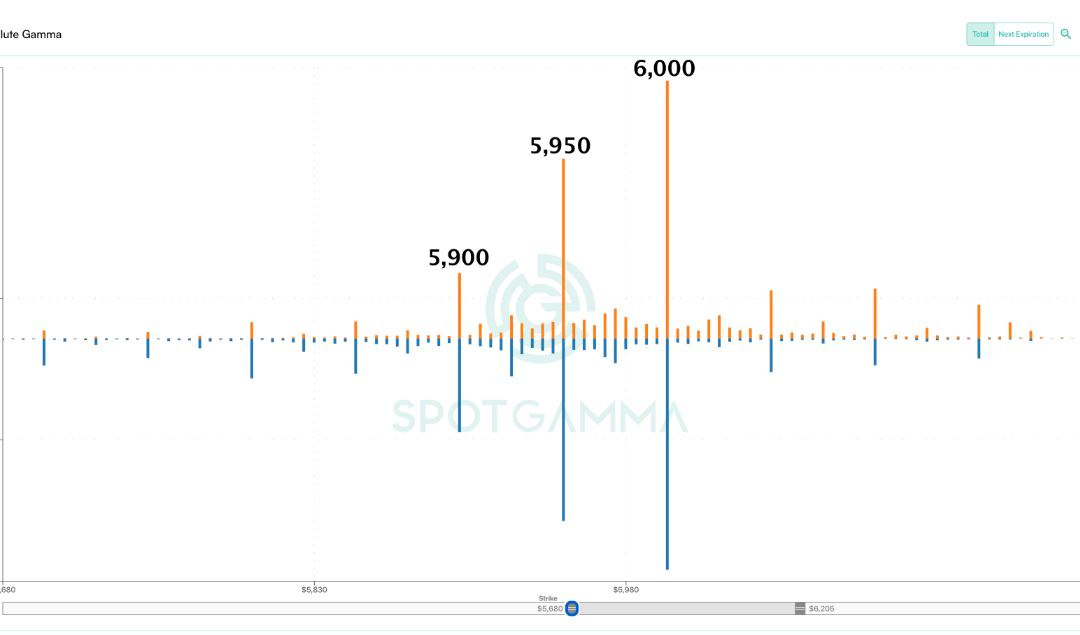

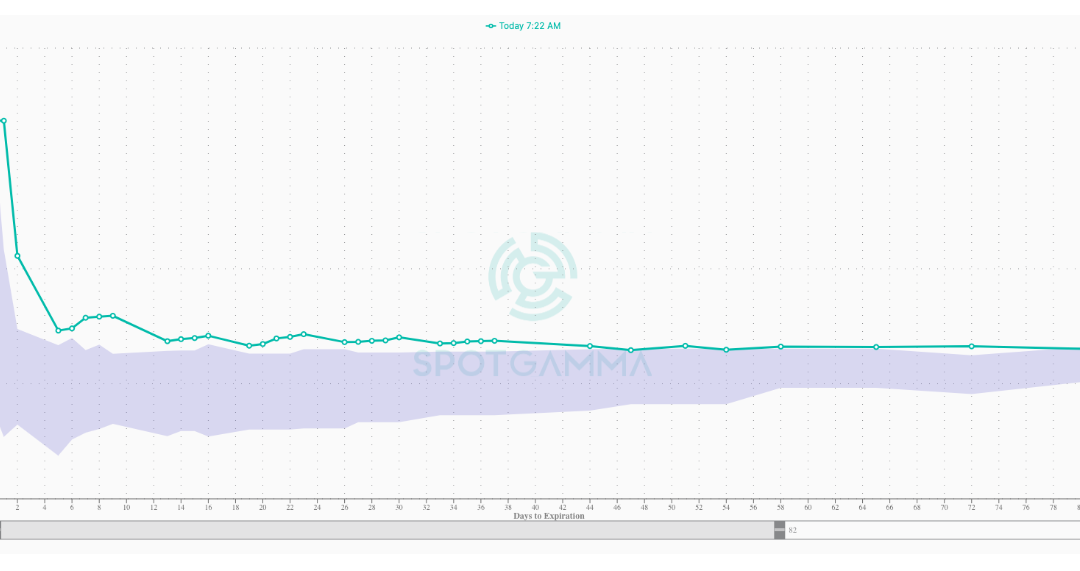

Macro Theme: Key dates ahead: 1/14: PPI 1/15: CPI 1/17: OPEX 1/20: MLK (market closed) + Inauguration 1/29: FOMC 6,050 – 6,100 is likely major resistance into 1/17 OPEX. 1/14: We believe traders are under-pricing volatility, as both SPX & NDX trade at a...

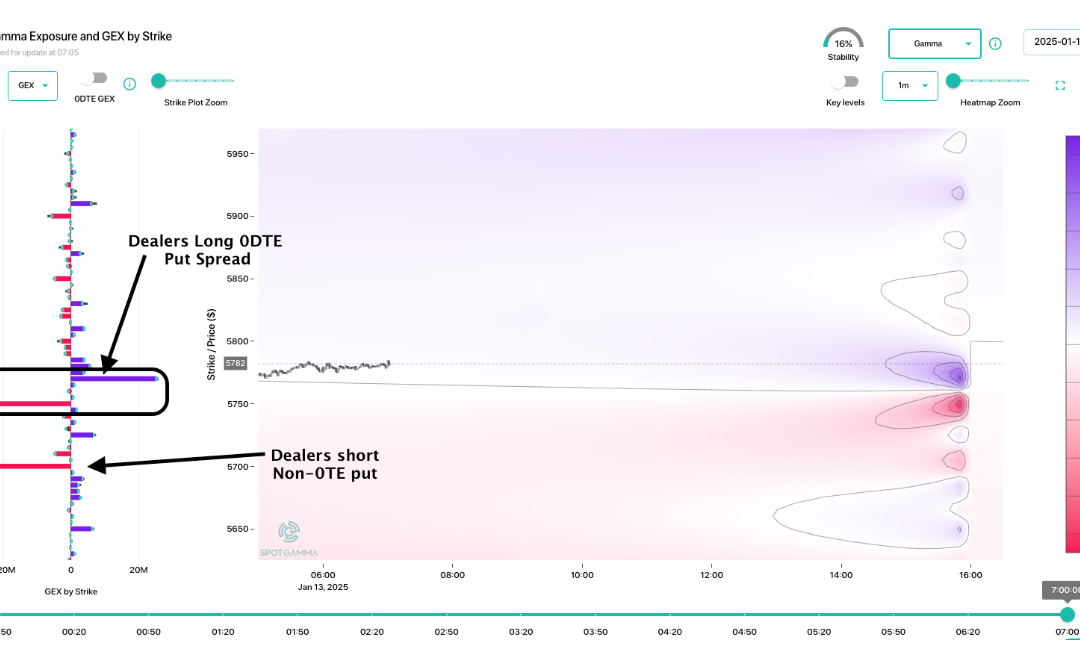

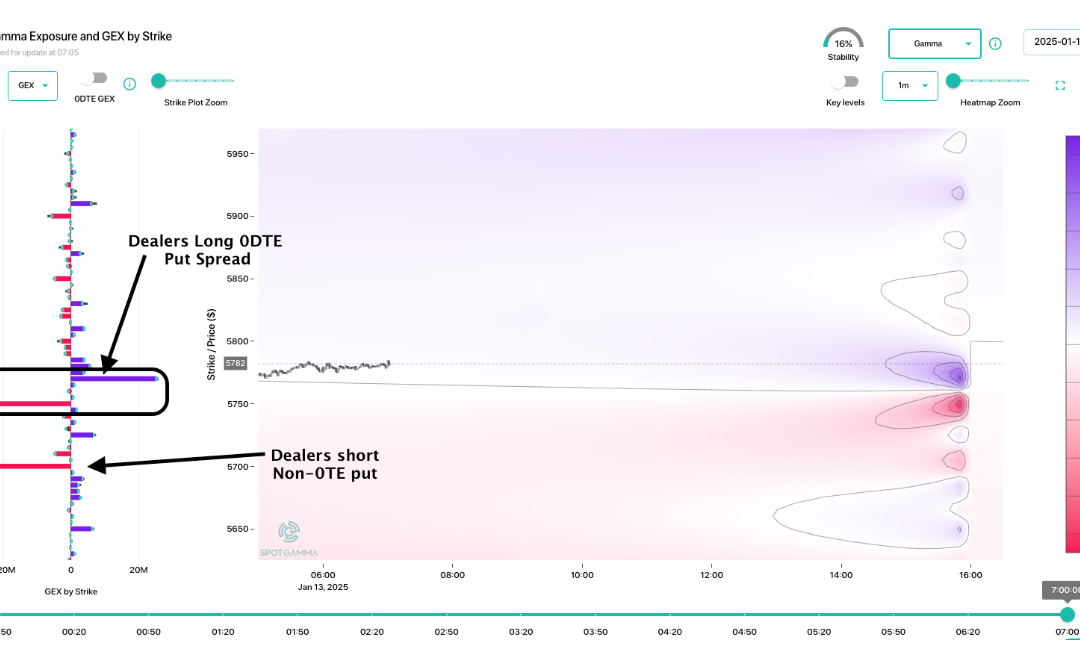

by Melida Montemayor | Ene 13, 2025 | Informe Option Levels

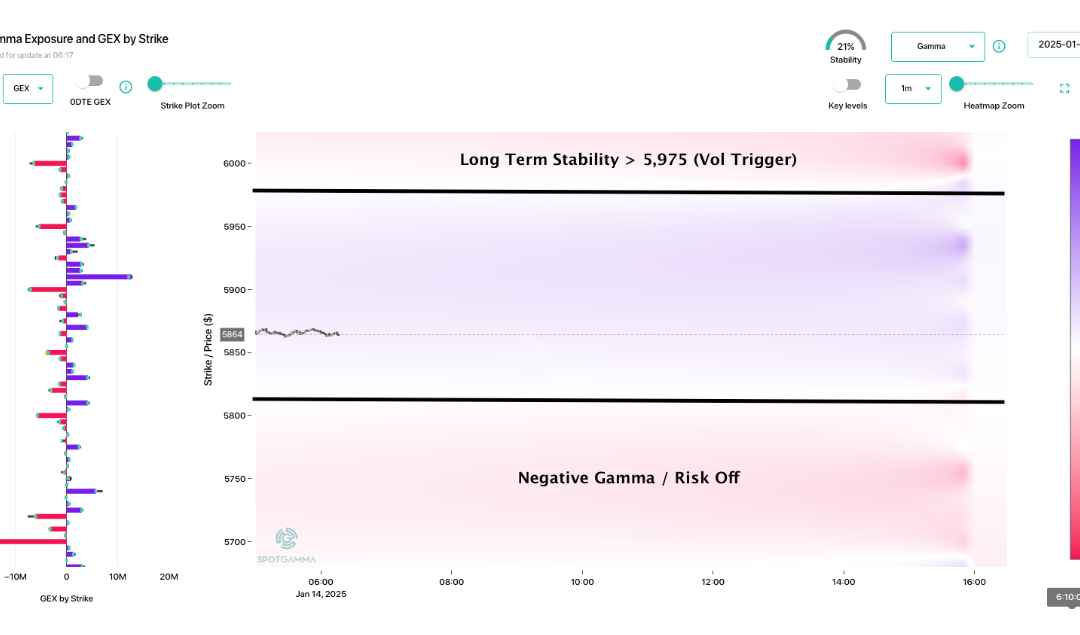

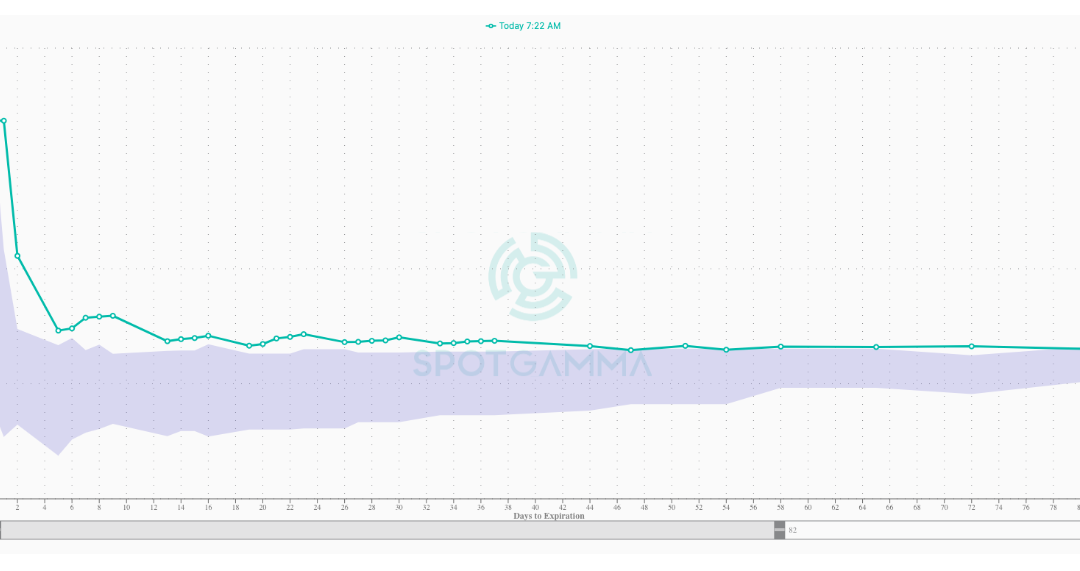

Macro Theme: Key dates ahead: 1/14: PPI 1/15: CPI 1/17: OPEX 1/20: MLK (market closed) + Inauguration 1/29: FOMC 6,050 – 6,100 is likely major resistance into 1/17 OPEX. Friday 1/10: This is a high risk environment, wherein a small trigger could elicit a tail...

by Melida Montemayor | Ene 8, 2025 | Informe Option Levels

Macro Theme: Key dates ahead: 1/8: Jobless claims, FOMC Mins 1/9: Market Closed: President Carter 1/10: NFP 1/14: PPI 1/15: CPI 1/17: OPEX 1/20: Inauguration 1/31: FOMC As of 1/8: 5,800 is now major support. Any rally that fails to close >6k should be seen as a...