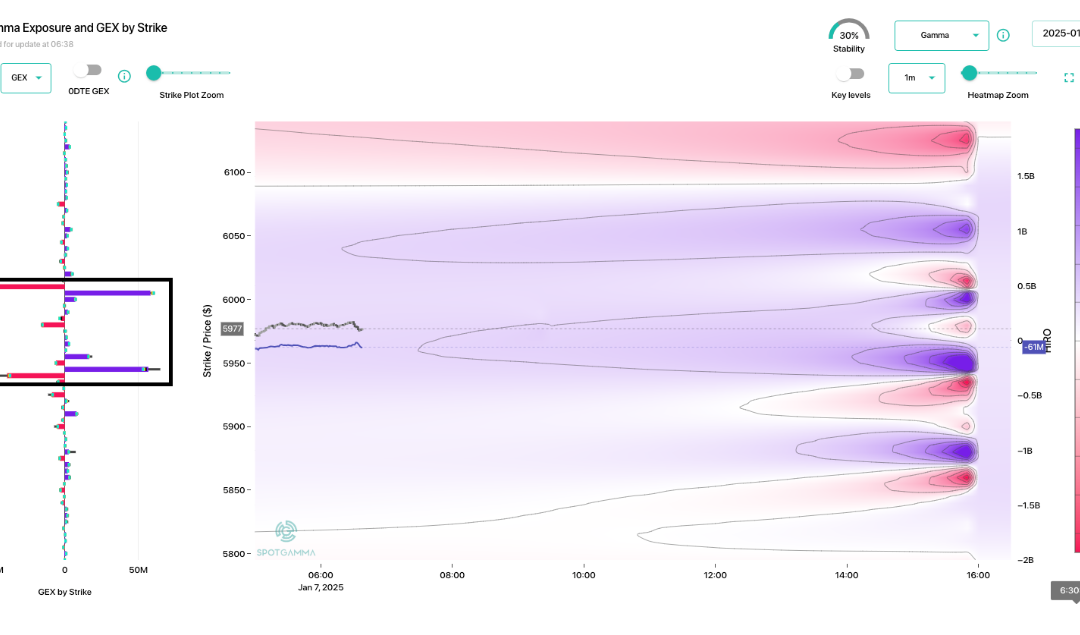

by Melida Montemayor | Ene 7, 2025 | Informe Option Levels

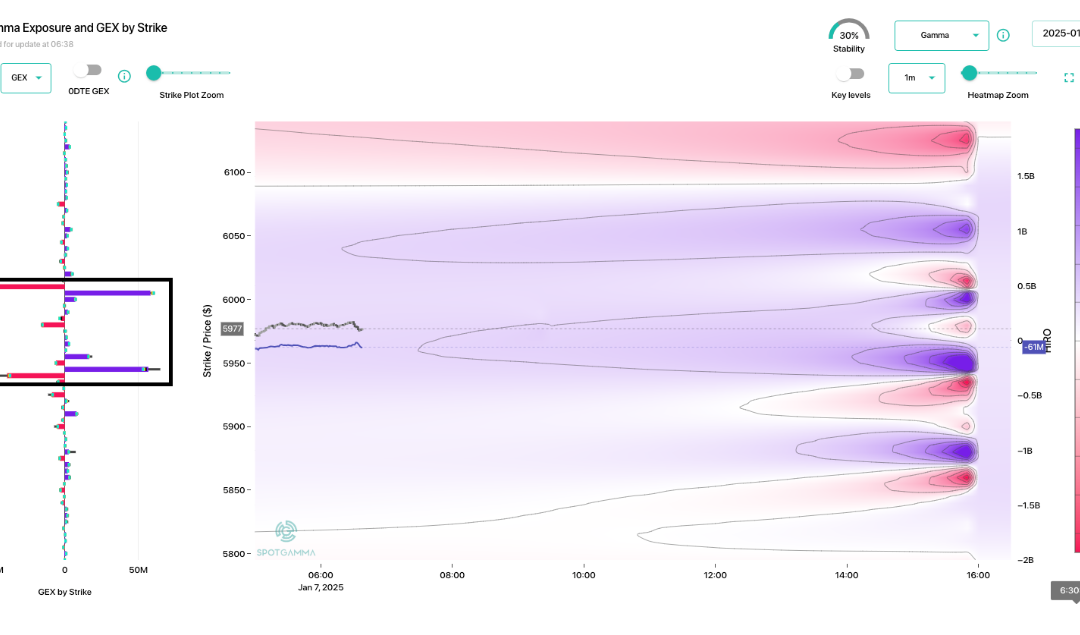

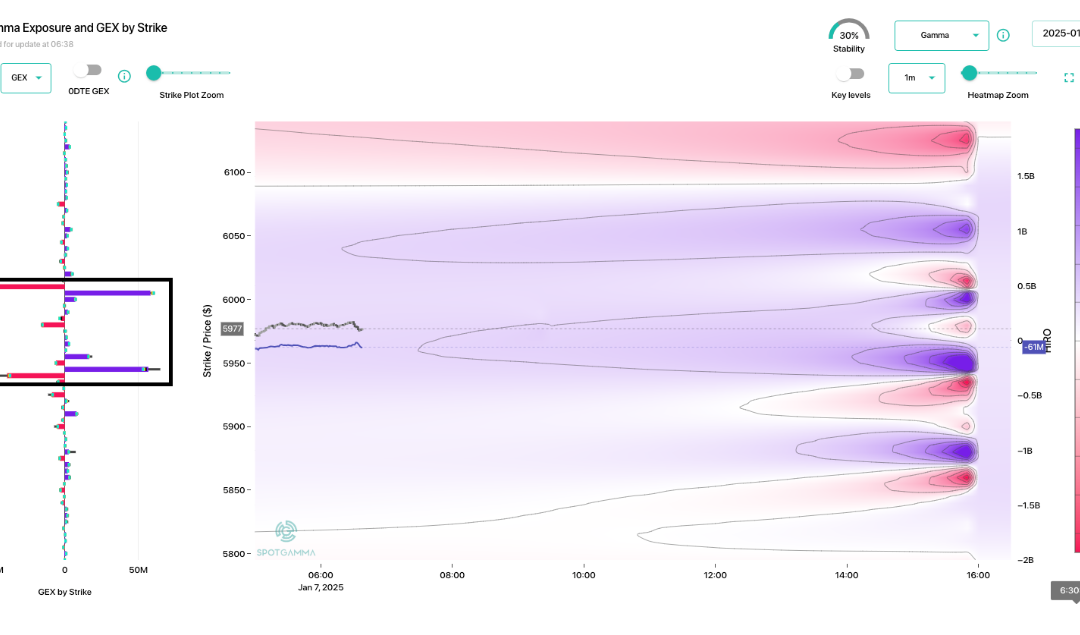

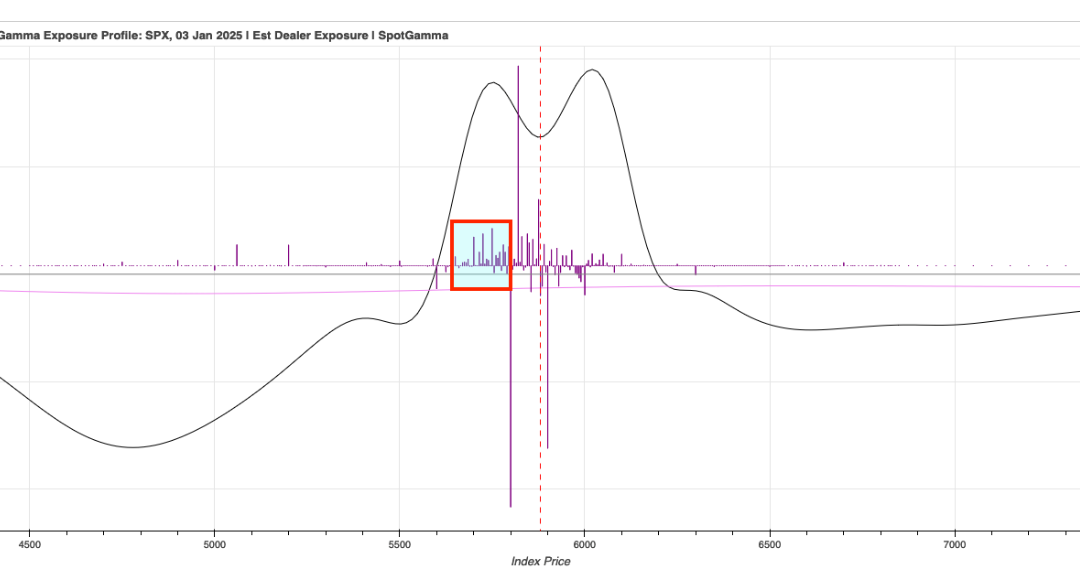

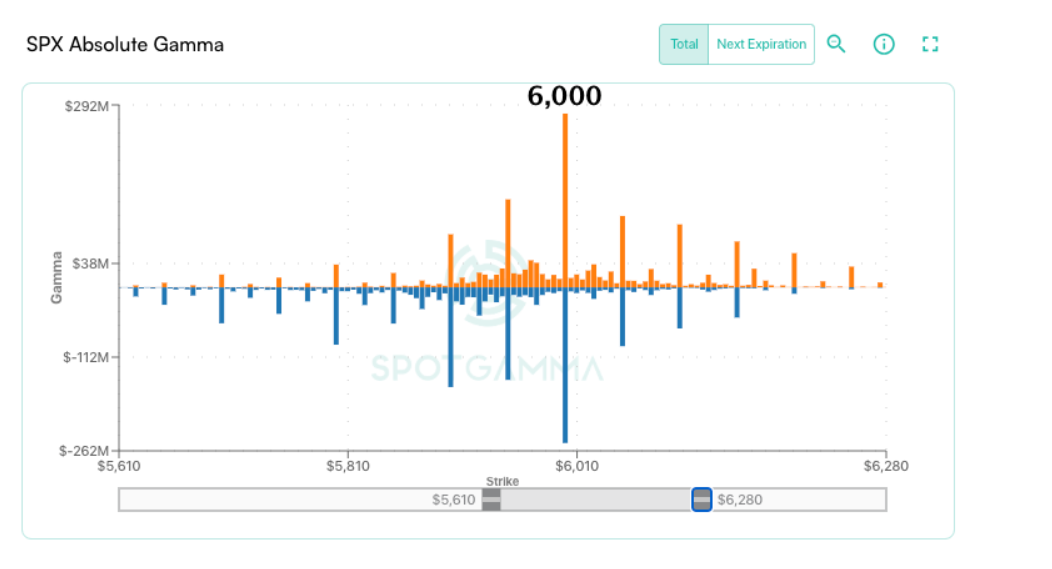

Macro Theme: Key dates ahead: 1/7: PMI, NVDA CES Analyst Day 1/8: Jobless claims, FOMC Mins 1/9: Market Closed: President Carter 1/10: NFP 1/14: PPI As of 1/6: With SPX near 6,000 resistance we shift to a neutral stance, as IV fuel has been drained off....

by Melida Montemayor | Ene 6, 2025 | Informe Option Levels

Macro Theme: Key dates ahead: 1/7: PMI, NVDA CES 1/8: Jobless claims, FOMC Mins 1/9: Market Closed: President Carter 1/10: NFP 1/14: PPI As of 1/6: With SPX near 6,000 resistance we shift to a neutral stance, as IV fuel has been drained off. Upcoming data 1/7-1/10...

by Melida Montemayor | Ene 3, 2025 | Informe Option Levels

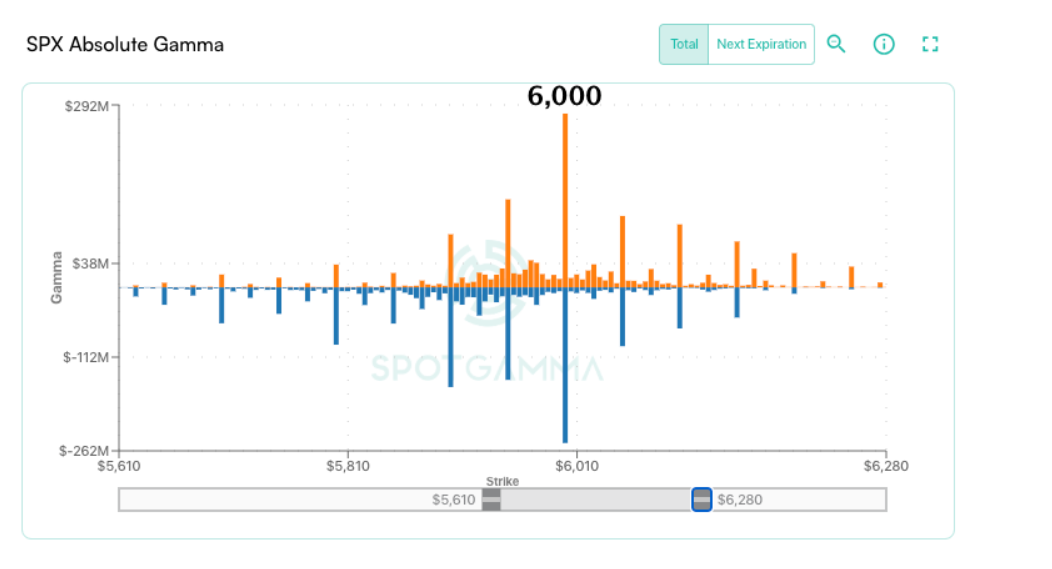

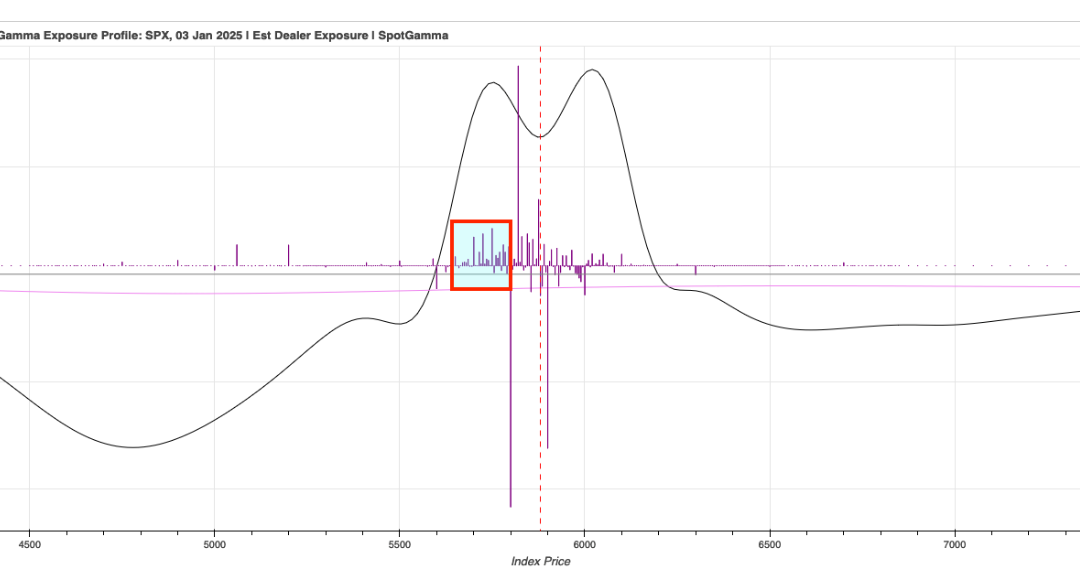

Macro Theme: Key dates ahead: 1/9: Market Closed: President Carter 1/10: NFP As of 1/3: We remain in “risk off” positioning until/unless the SPX is >=5,900. Traders met recent downside by selling puts, which suggests a short term rally/bounce is in...

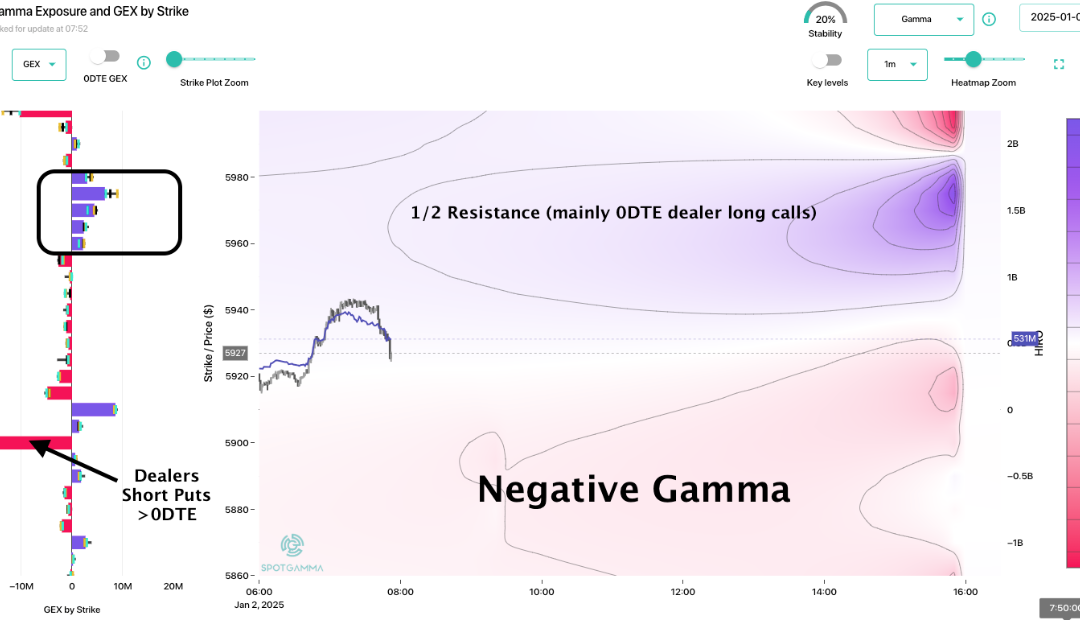

by Melida Montemayor | Ene 2, 2025 | Informe Option Levels

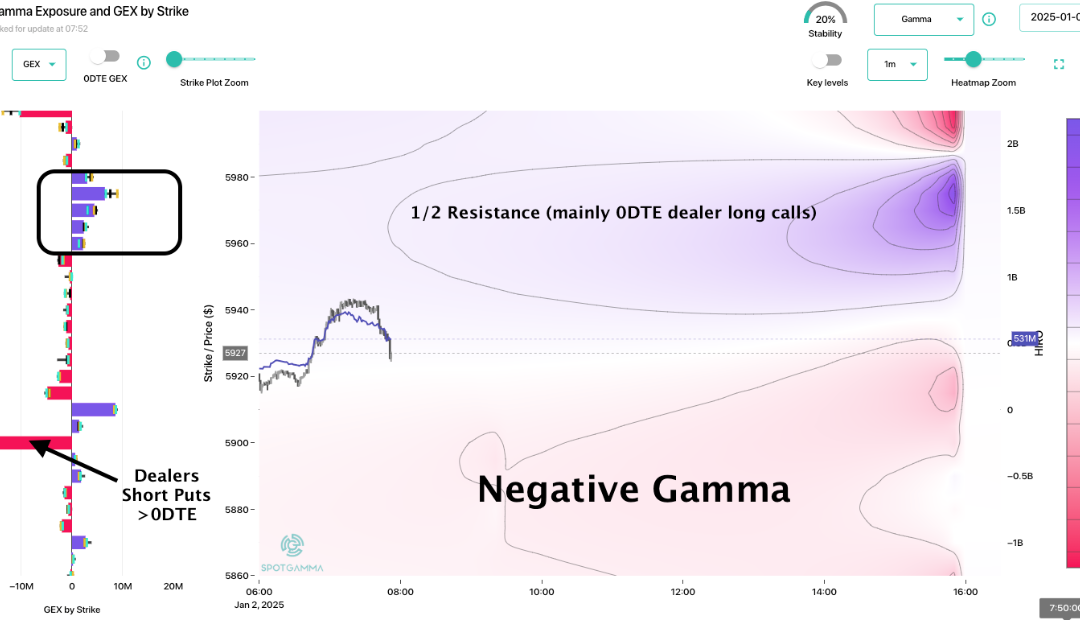

Macro Theme: Key dates ahead: 1/2: Jobs data 1/3: NFP 1/9: Market Closed: President Carter As of 12/31: We remain in “risk off” positioning until/unless the SPX is >=6,000. This means we look to hold longer dated downside hedges, while tactically...

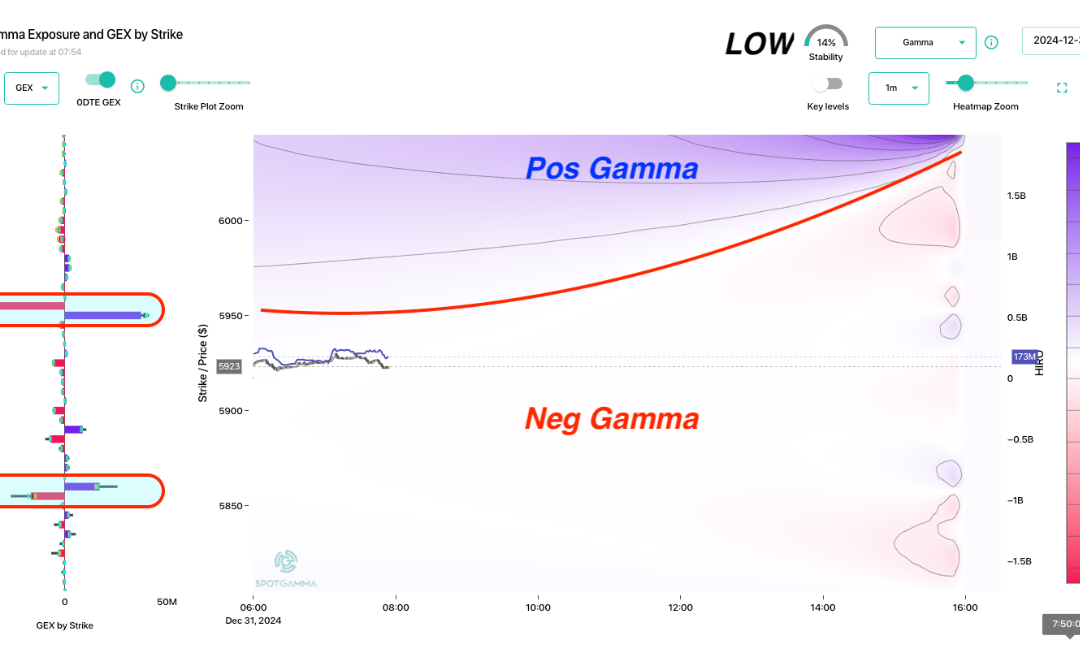

by Melida Montemayor | Dic 31, 2024 | Informe Option Levels

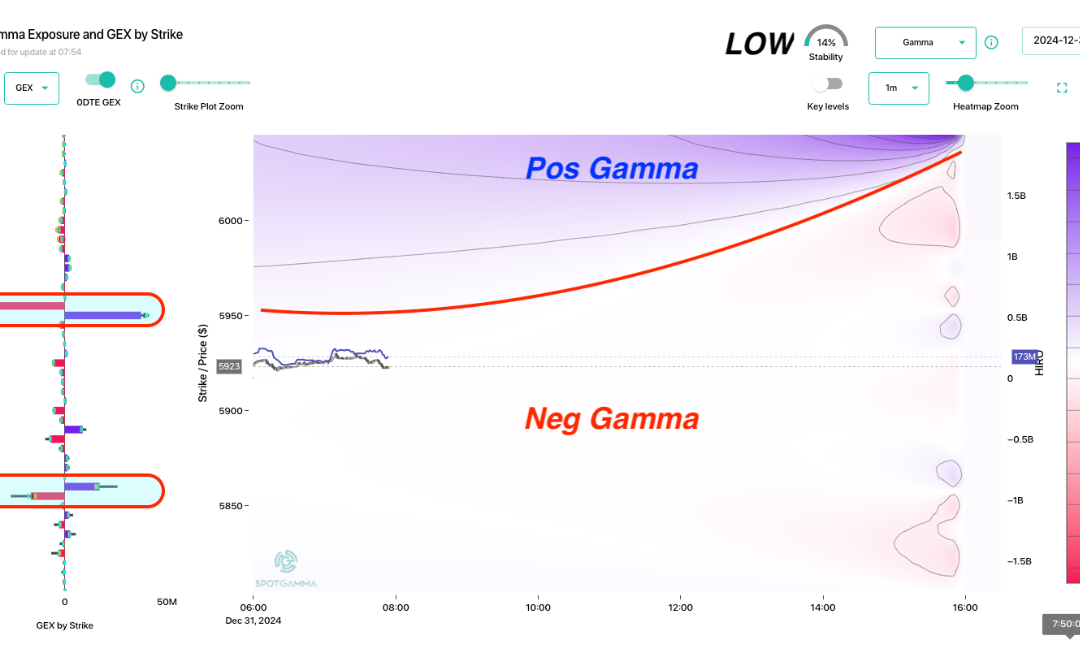

Macro Theme: Key dates ahead: 12/31 OPEX Q-end 6k was recovered on 12/24, which invokes the JPM collar pin into 6,055 by 12/31 expiration. Should the SPX break <5,990 our view of pinning 6,055 would be removed, and we’d flip to risk off. Into 12/31 we will be...