by Melida Montemayor | Dic 31, 2024 | Informe Option Levels

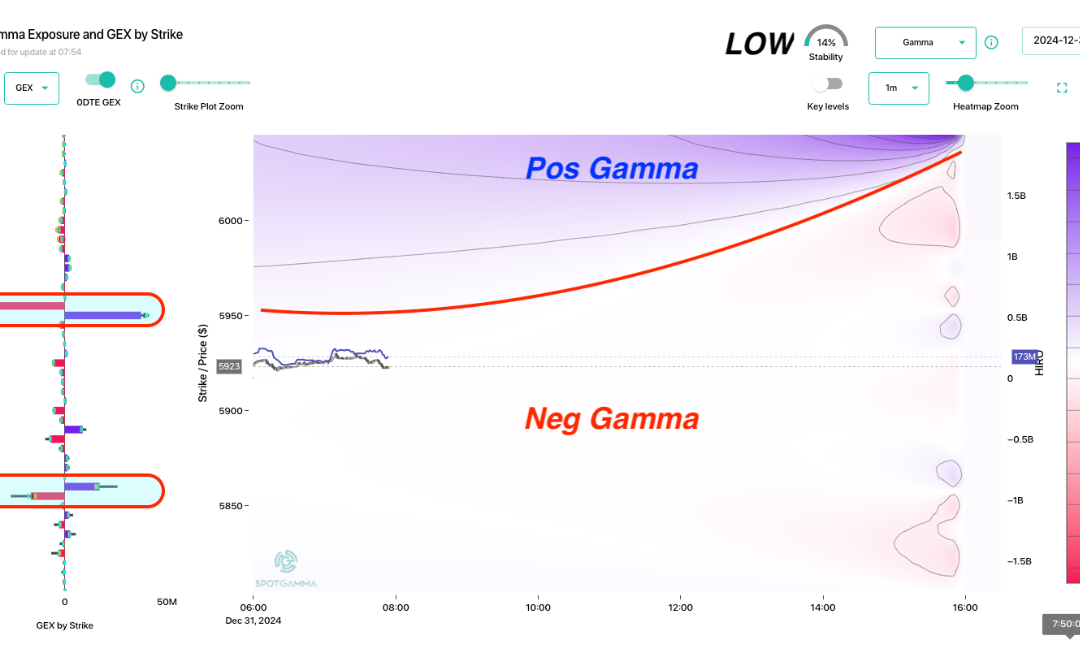

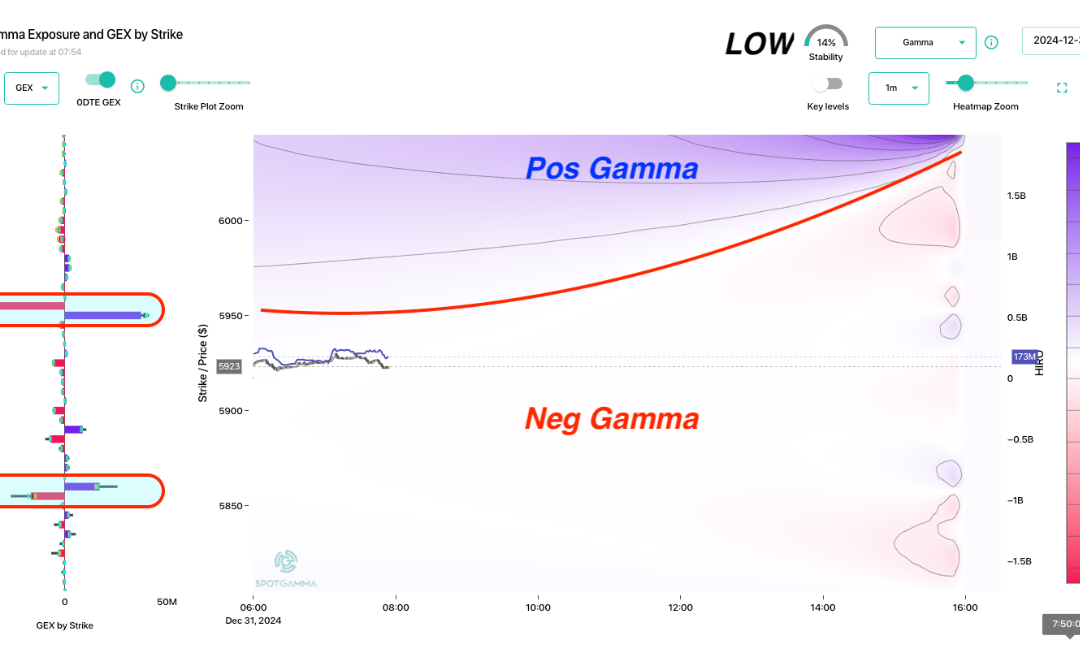

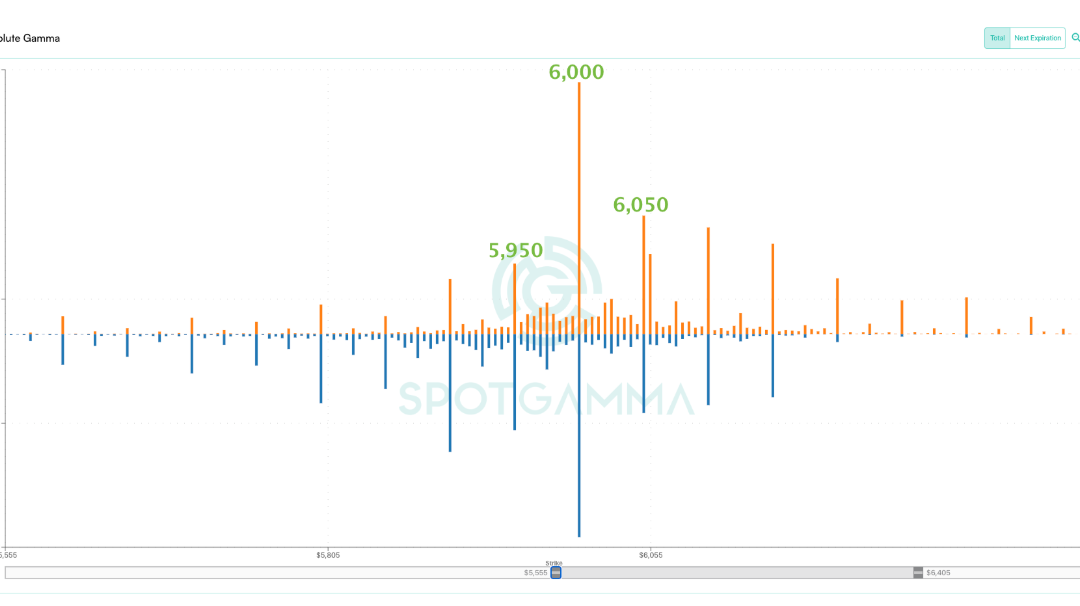

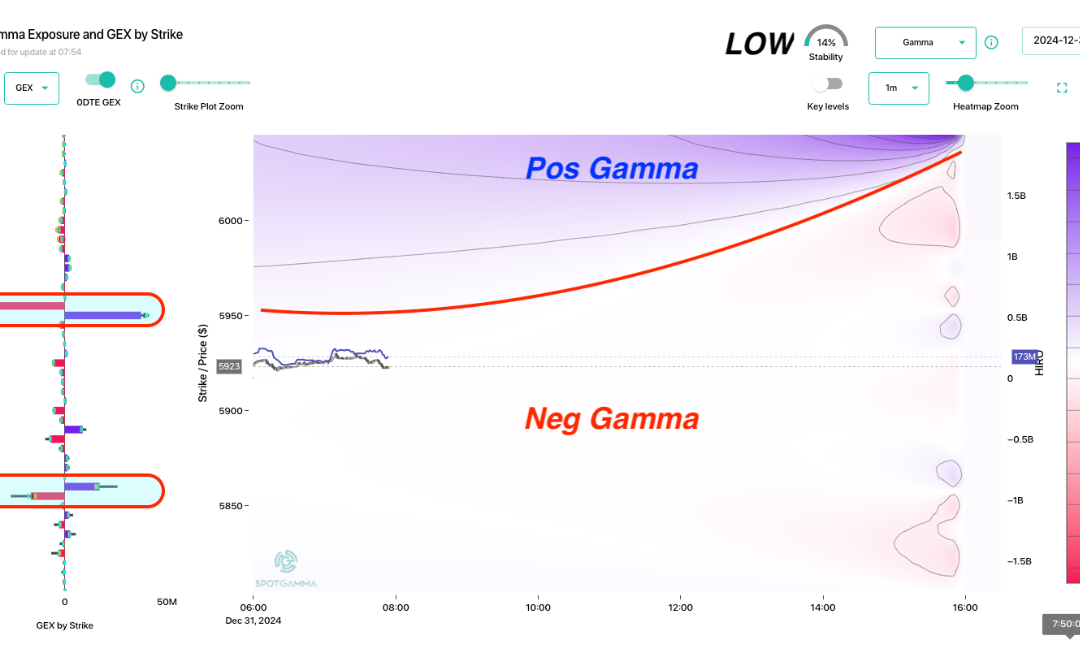

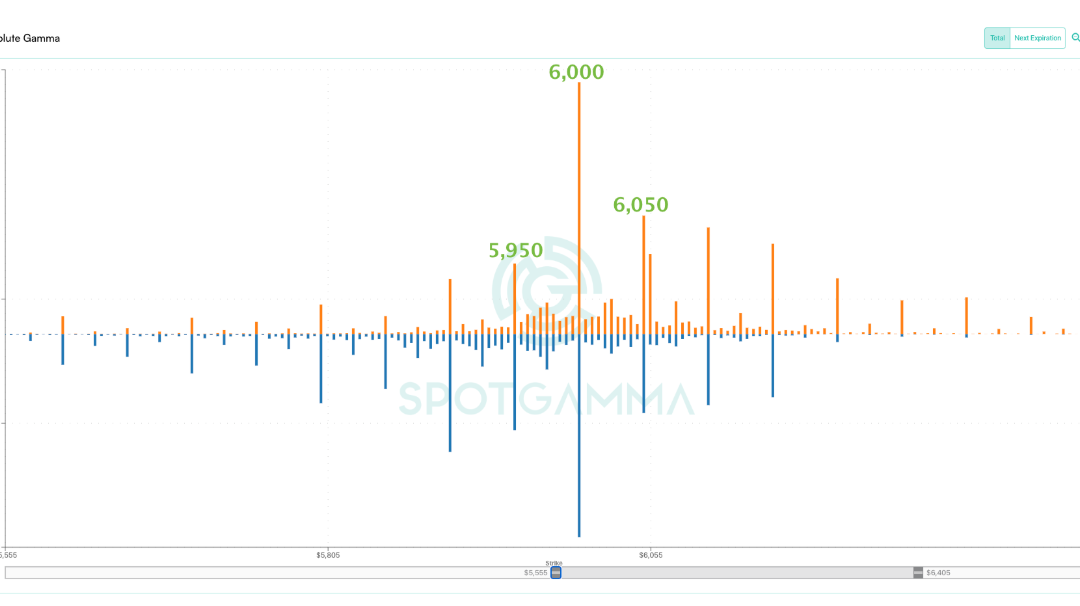

Macro Theme: Key dates ahead: 12/31 OPEX Q-end 6k was recovered on 12/24, which invokes the JPM collar pin into 6,055 by 12/31 expiration. Should the SPX break <5,990 our view of pinning 6,055 would be removed, and we’d flip to risk off. Into 12/31 we will be...

by Melida Montemayor | Dic 27, 2024 | Informe Option Levels

Macro Theme: Key dates ahead: 12/31 OPEX Q-end 6k was recovered on 12/24, which invokes the JPM collar pin into 6,055 by 12/31 expiration. Should the SPX break <5,990 our view of pinning 6,055 would be removed, and we’d flip to risk off. Into 12/31 we will be...

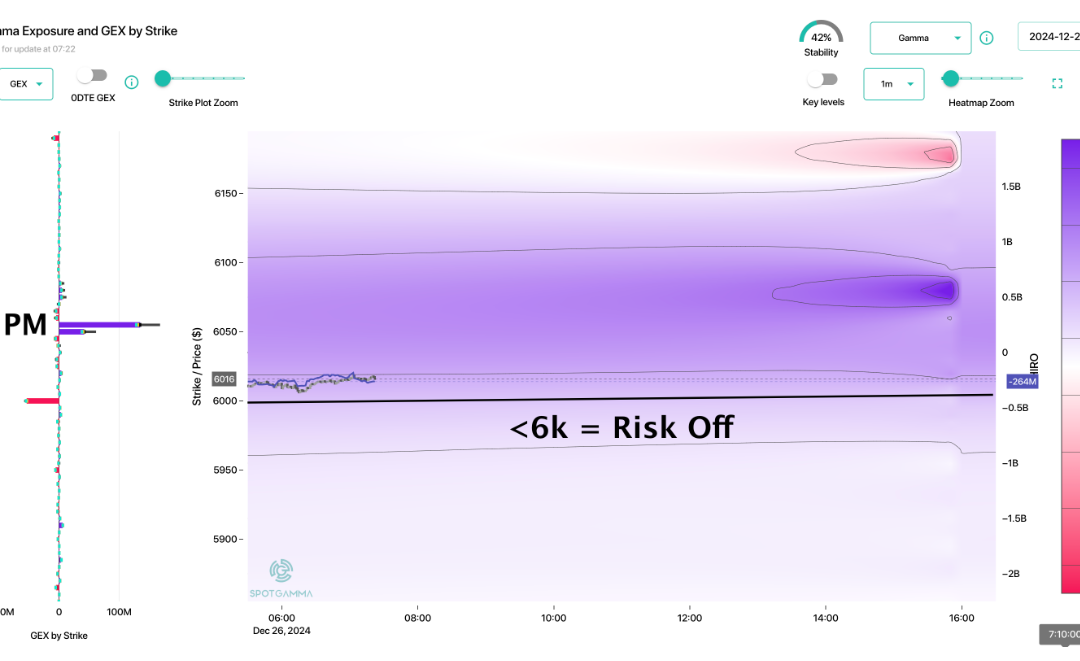

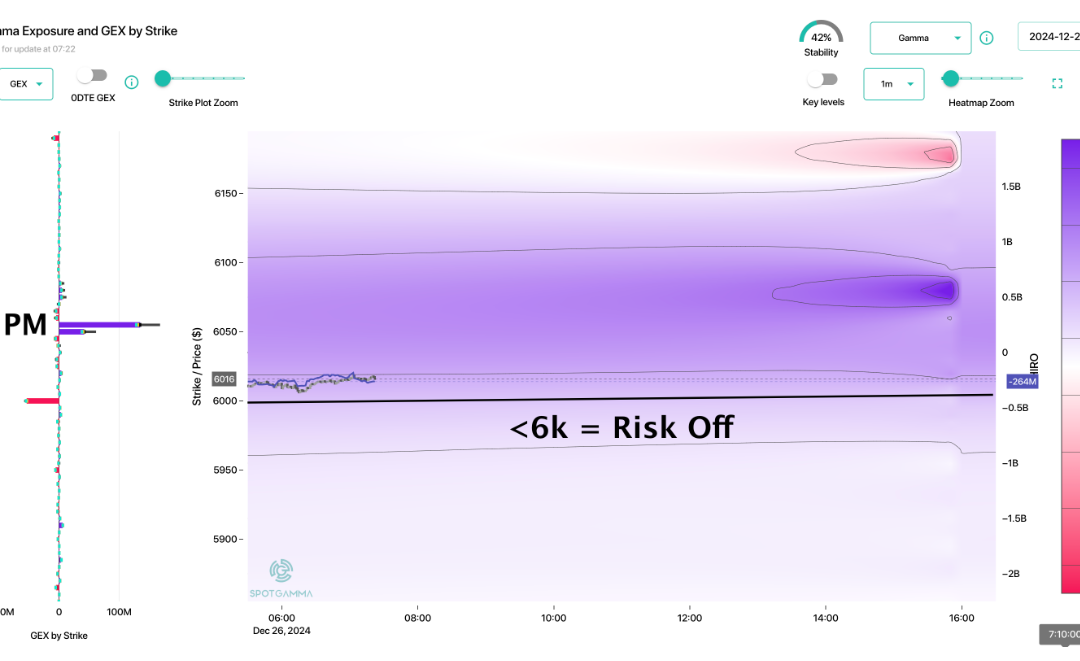

by Melida Montemayor | Dic 26, 2024 | Informe Option Levels

Macro Theme: Key dates ahead: 12/31 OPEX Q-end 6k was recovered on 12/24, which invokes the JPM collar pin into 6,055 by 12/31 expiration. Should the SPX break <5,990 our view of pinning 6,055 would be removed, and we’d flip to risk off. Into 12/31 we will be...

by Melida Montemayor | Dic 24, 2024 | Informe Option Levels

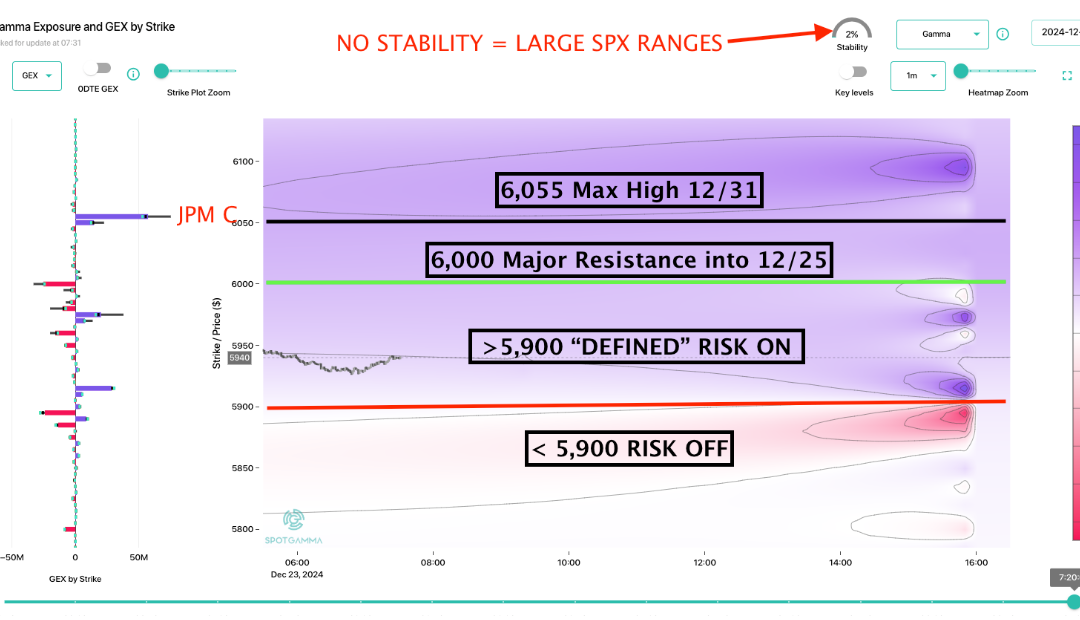

Macro Theme: Key dates ahead: 12/24 1/2 day (Xmas Eve) 12/25 Market Closed 12/31 OPEX Q-end 12/20: We think vols indicate oversold conditions into a massive put-clearing OPEX. For this reason we are looking to removing short, and looking for defined risk ways to play...

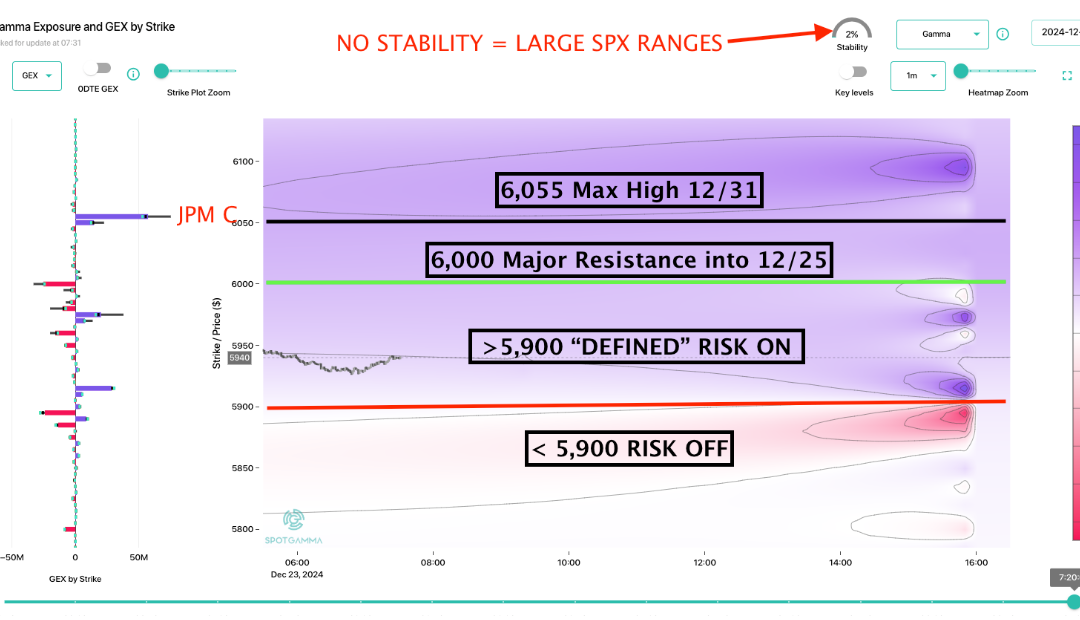

by Melida Montemayor | Dic 23, 2024 | Informe Option Levels

Macro Theme: Key dates ahead: 12/24 1/2 day (Xmas Eve) 12/25 Market Closed 12/31 OPEX Q-end 12/20: We think vols indicate oversold conditions into a massive put-clearing OPEX. For this reason we are looking to removing short, and looking for defined risk ways to play...