by Melida Montemayor | Dic 20, 2024 | Informe Option Levels

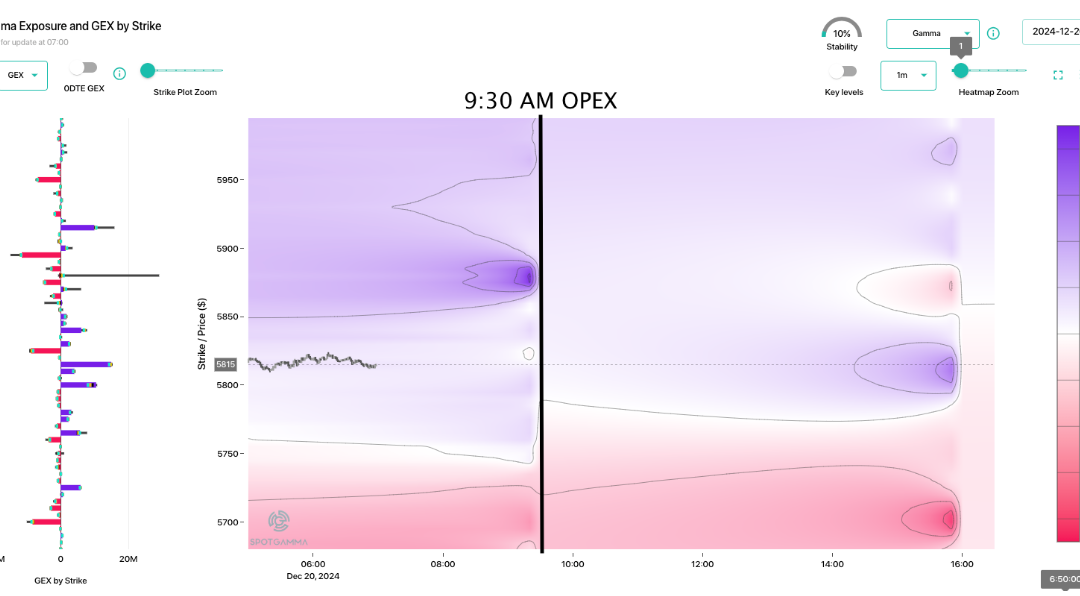

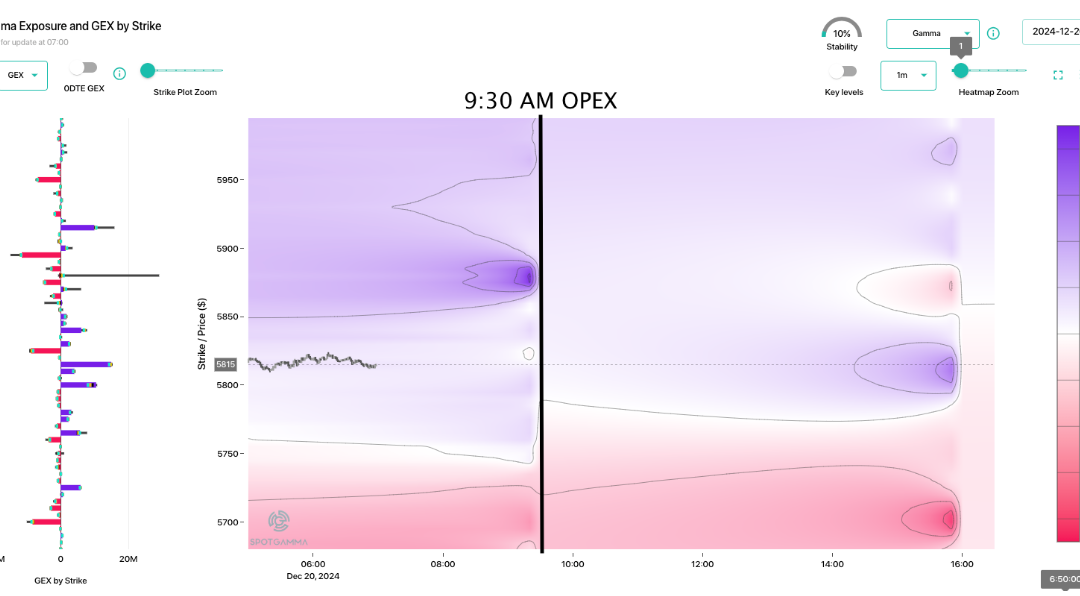

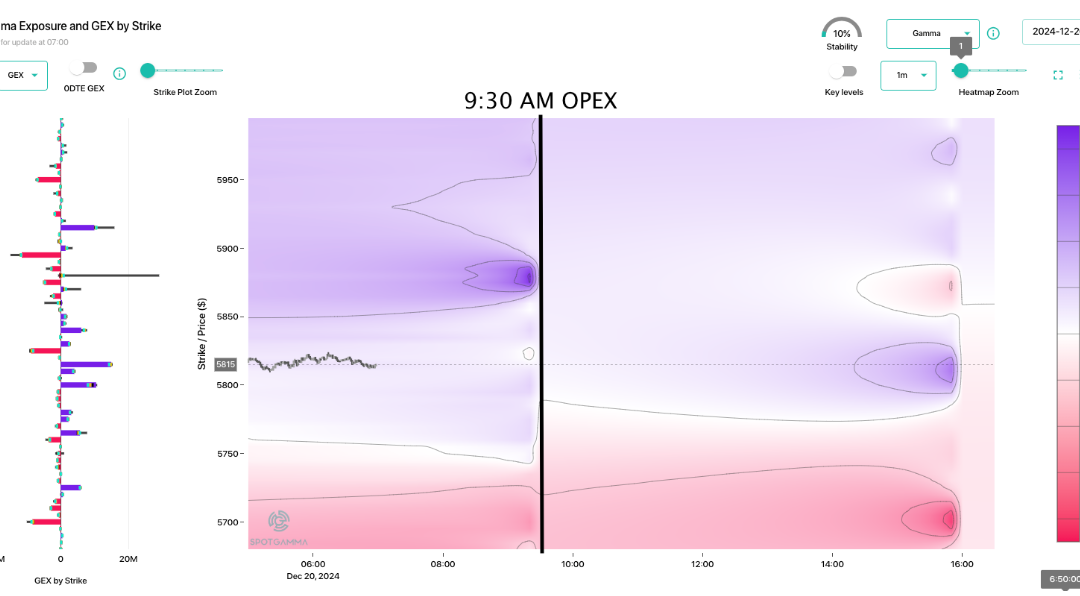

Macro Theme: Key dates ahead: 12/20 OPEX 12/31 OPEX Q-end 12/24 1/2 day (Xmas Eve) 12/25 Market Closed 12/20: We think vols indicate oversold conditions into a massive put-clearing OPEX. For this reason we are looking to removing short, and looking for defined risk...

by Melida Montemayor | Dic 16, 2024 | Informe Option Levels

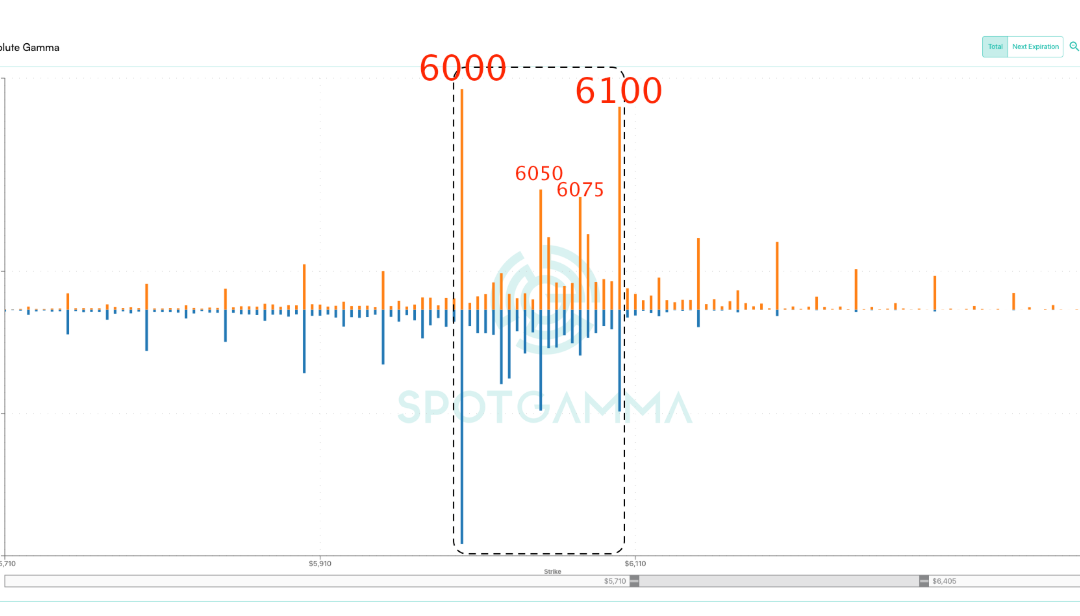

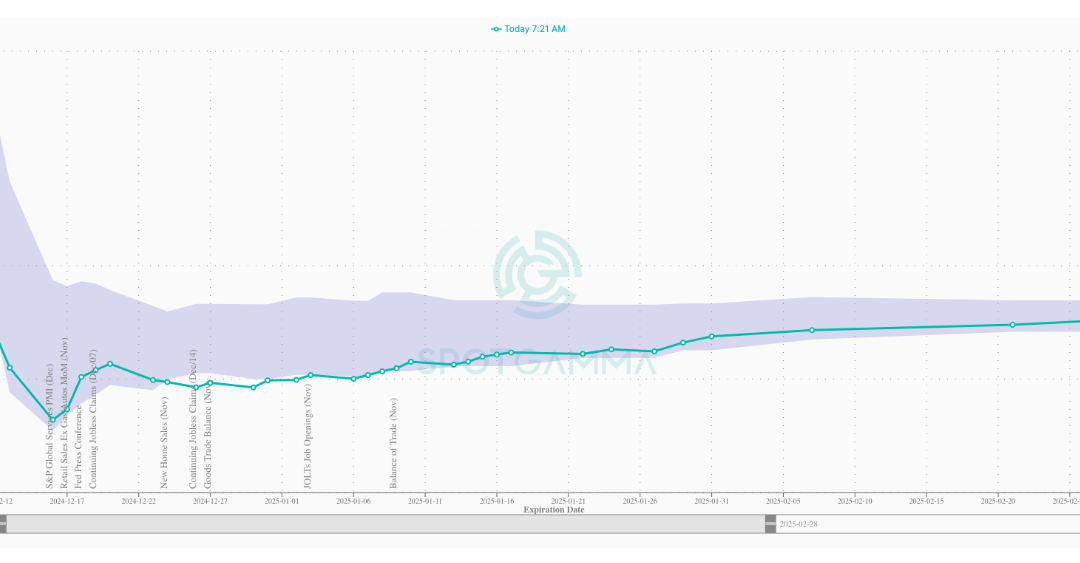

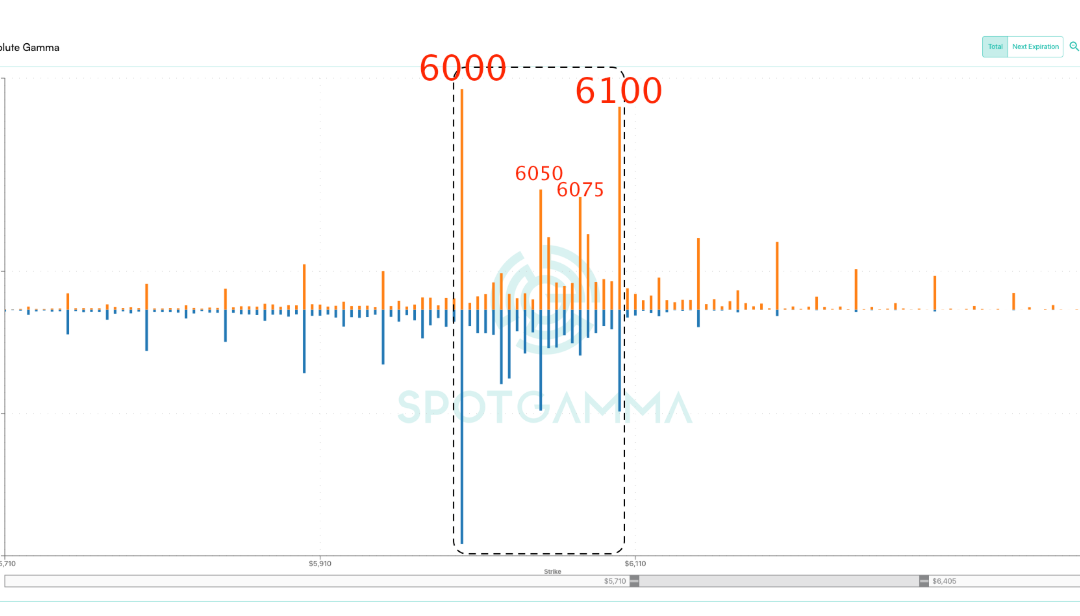

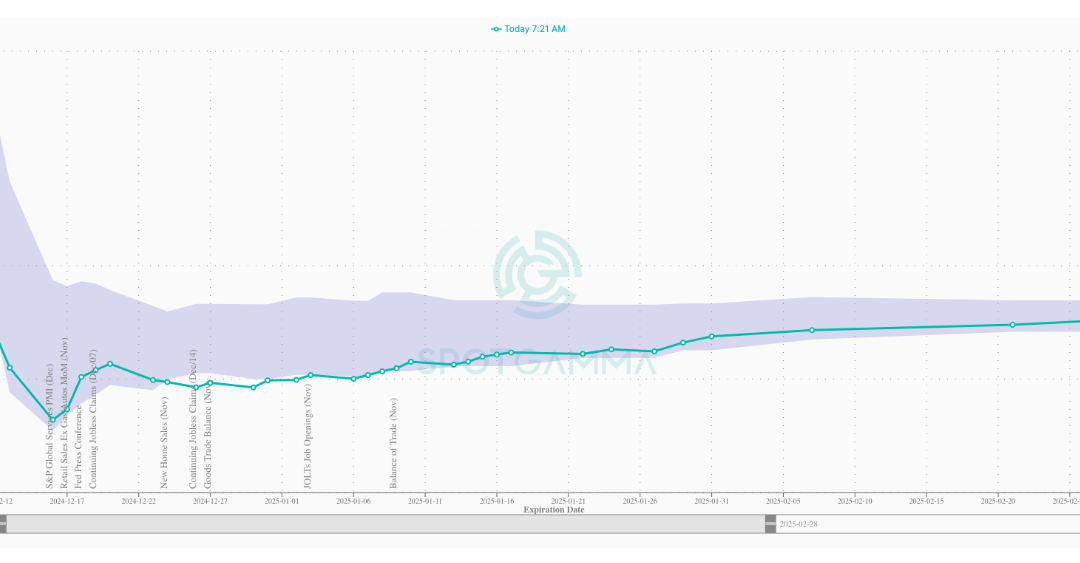

Macro Theme: Key dates ahead: 12/18 FOMC 12/20 OPEX 12/31 OPEX Q-end Our primary risk metric signals being long of equities while SPX >6,000 with an upside target 6,100. <6,000 we flip to risk-off. Through to 12/20 OPEX we plan to operate in “buy the dip...

by Melida Montemayor | Dic 13, 2024 | Informe Option Levels

Macro Theme: Key dates ahead: 12/12 PPI/Jobs 12/18 FOMC 12/20 OPEX 12/31 OPEX Q-end Our primary risk metric signals being long of equities while SPX >6,000 with an upside target 6,100. <6,000 we flip to risk-off. Through to 12/20 OPEX we plan to operate in...

by Melida Montemayor | Dic 12, 2024 | Informe Option Levels

Macro Theme: Key dates ahead: 12/12 PPI/Jobs 12/18 FOMC 12/20 OPEX 12/31 OPEX Q-end Our primary risk metric signals being long of equities while SPX >6,000 with an upside target 6,100. <6,000 we flip to risk-off. Through to 12/20 OPEX we plan to operate in...

by Melida Montemayor | Dic 10, 2024 | Informe Option Levels

Macro Theme: Key dates ahead: 12/6 NFP 12/11 CPI Our primary risk metric signals being long of equities while SPX >6,000 with an upside target 6,100. <6,000 we flip to risk-off. Through to 12/20 OPEX we plan to operate in “buy the dip mode”...