by Melida Montemayor | Nov 24, 2025 | Informe Option Levels

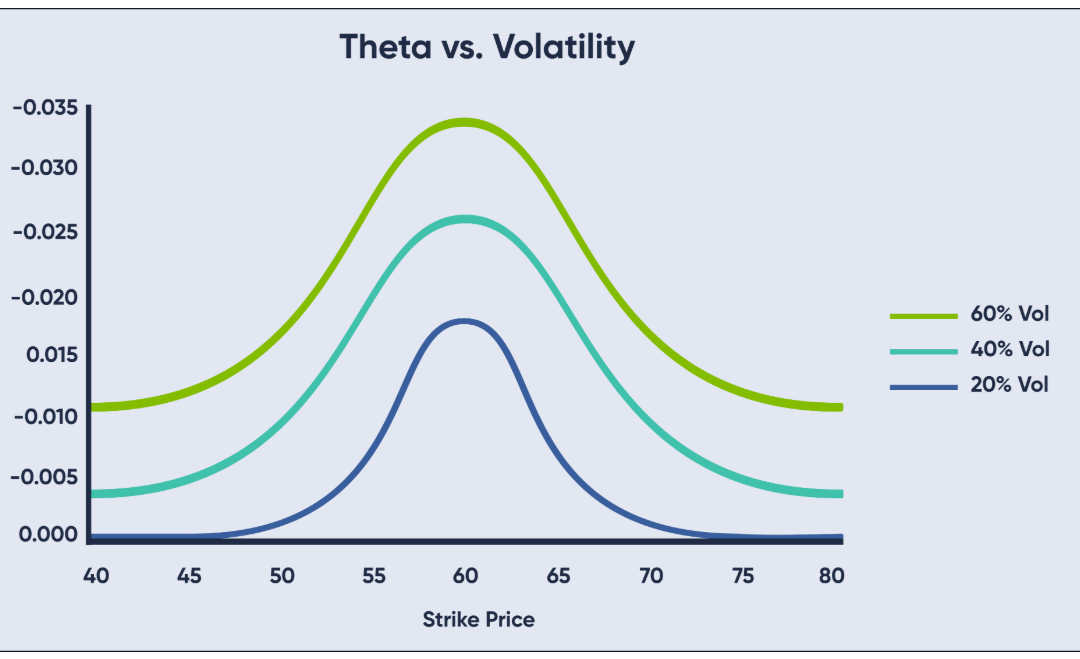

Macro Theme: Key dates ahead: 11/27: Thanksgiving 11/28: Early Close 12/10: FOMC 12/15: ORCL ER 12/19: OPEX SG Summary: Update 11/24: We want to lean long of stocks with SPX >6,600 as we believe put option decay into a holiday week will be a dominant tailwind for...

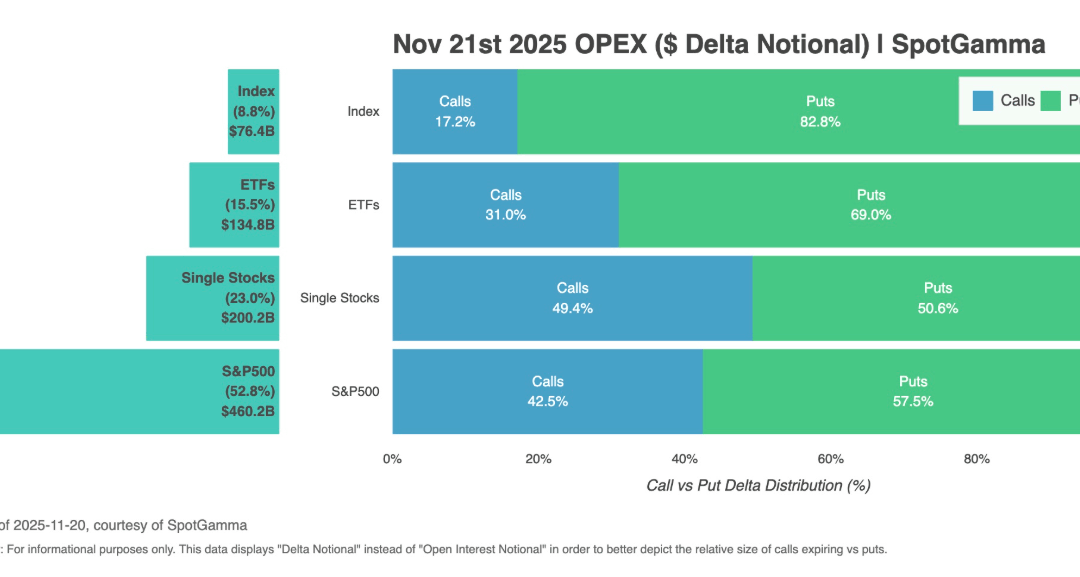

by Melida Montemayor | Nov 21, 2025 | Informe Option Levels

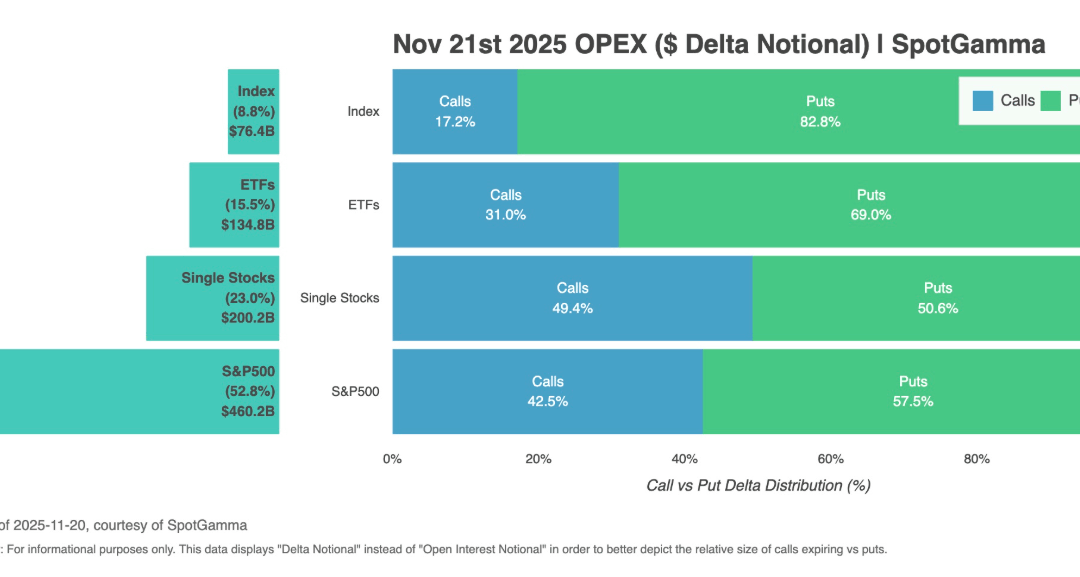

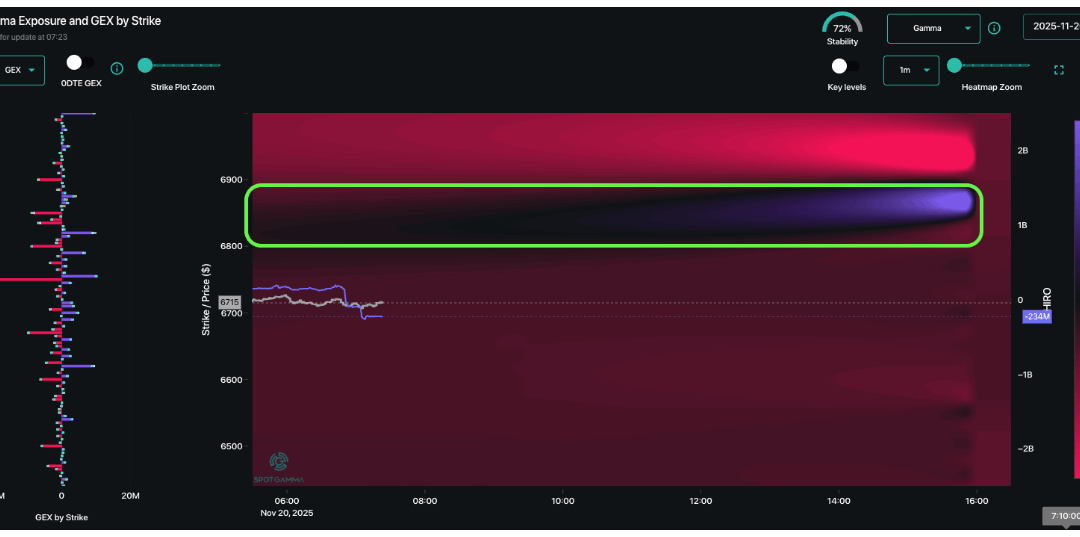

Macro Theme: Key dates ahead: 11/21: OPEX 11/27: Thanksgiving 12/10: FOMC 12/15: ORCL ER 12/19: OPEX SG Summary: Update 11/21: Yesterday’s break of 6,700 opened the downside plunge which occurs into todays OPEX + a weekend. Puts are now expensive, which in the...

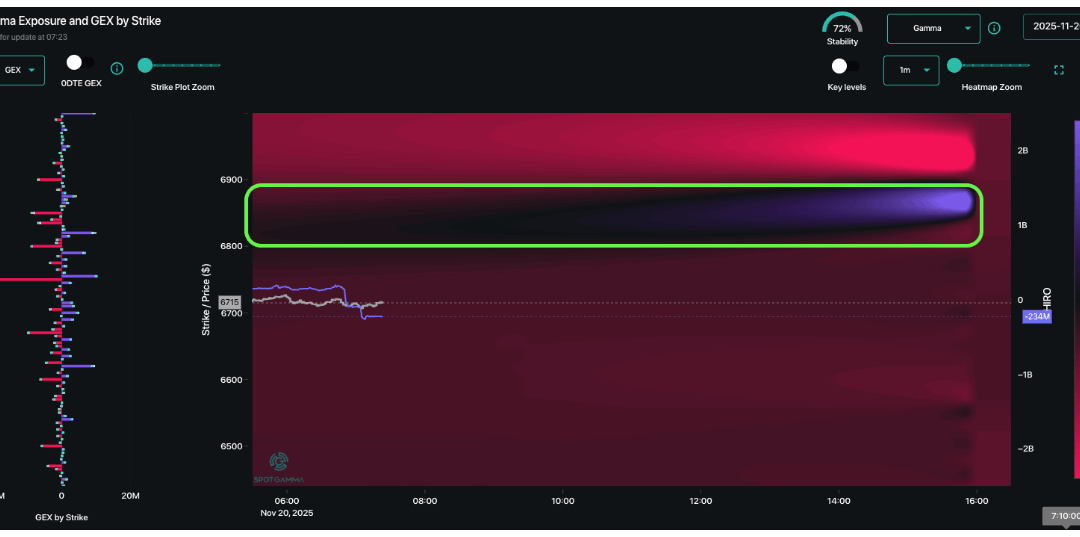

by Melida Montemayor | Nov 20, 2025 | Informe Option Levels

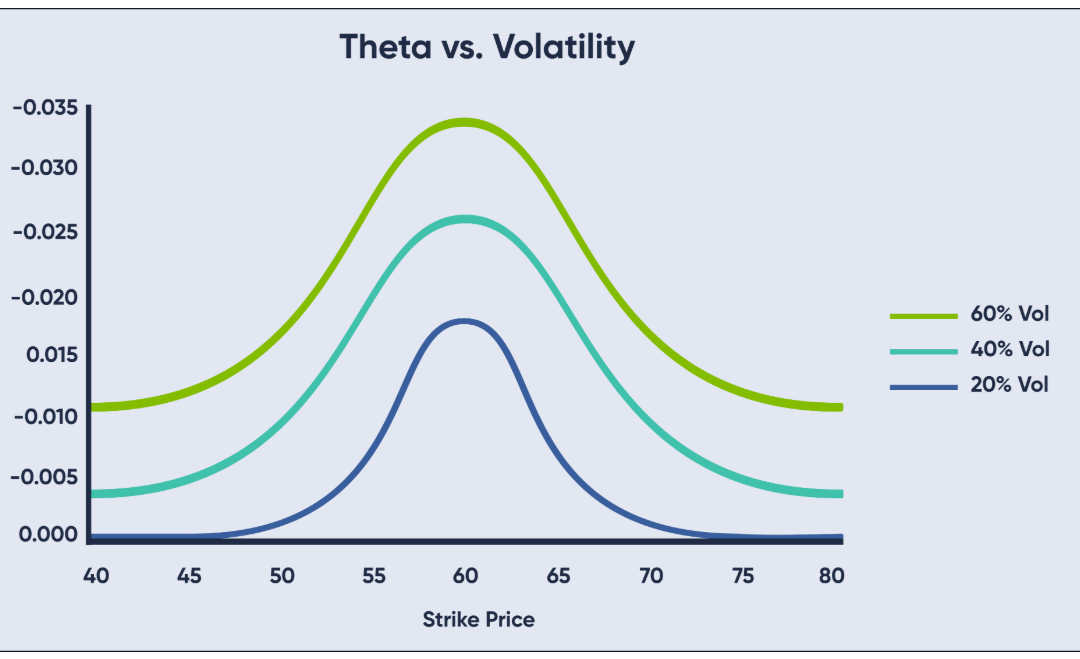

Macro Theme: Key dates ahead: 11/20: Jobs 11/21: OPEX 11/27: Thanksgiving 12/10: FOMC 12/15: ORCL ER 12/19: OPEX SG Summary: Update 11/20: With decent NVDA earnings, should the Jobs data pass we’d look for a move to 6,800 into tomorrow’s OPEX (ref SPX...

by Melida Montemayor | Nov 19, 2025 | Informe Option Levels

Macro Theme: Key dates ahead: 11/19: VIX Exp, NVDA ER 11/21: OPEX 11/27: Thanksgiving 12/10: FOMC 12/15: ORCL ER SG Summary: Update 11/19: With positive NVDA earnings, we see 7,000 as the major upside level into Dec as the Thanksgiving holiday combines with a calming...

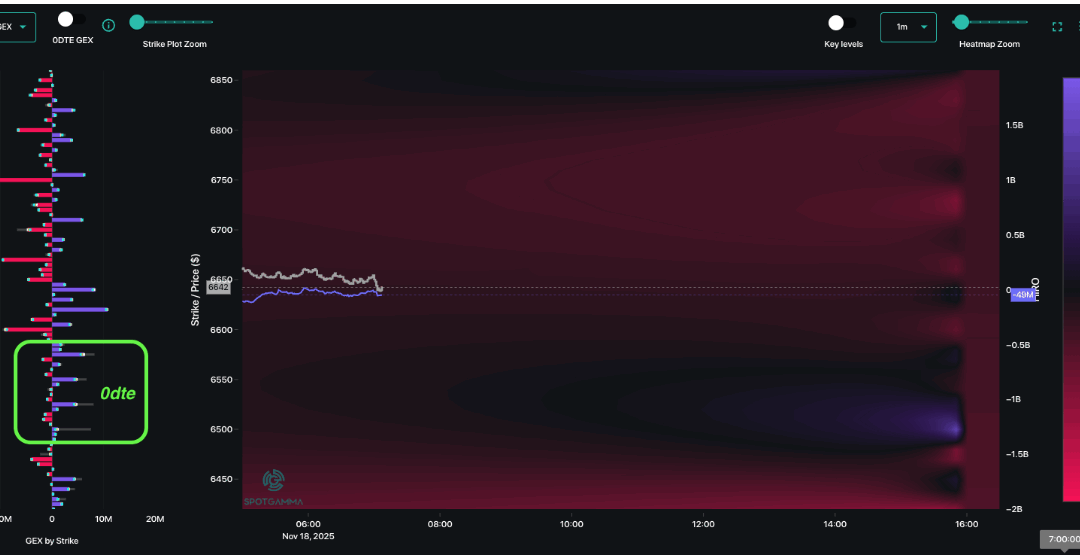

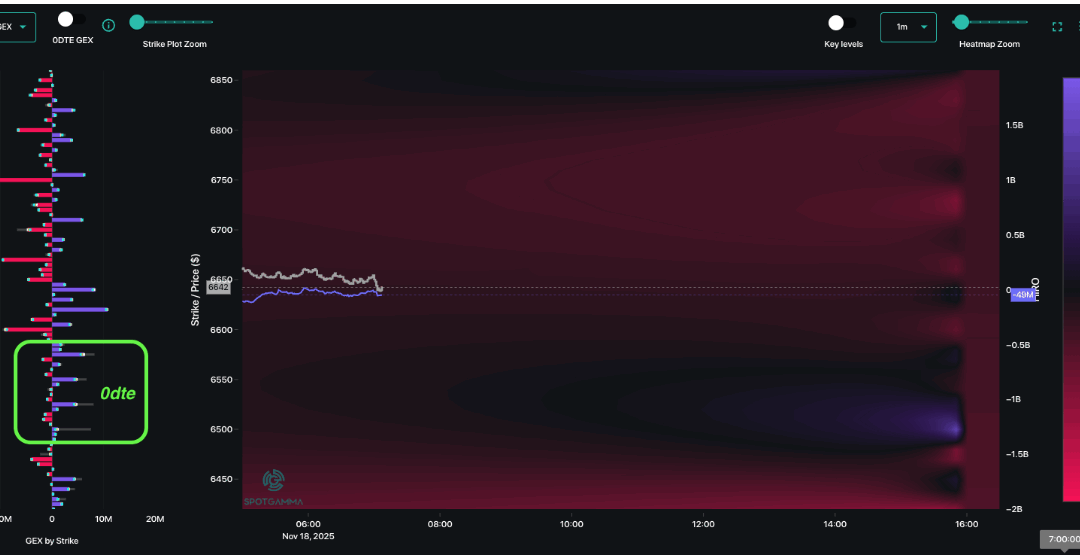

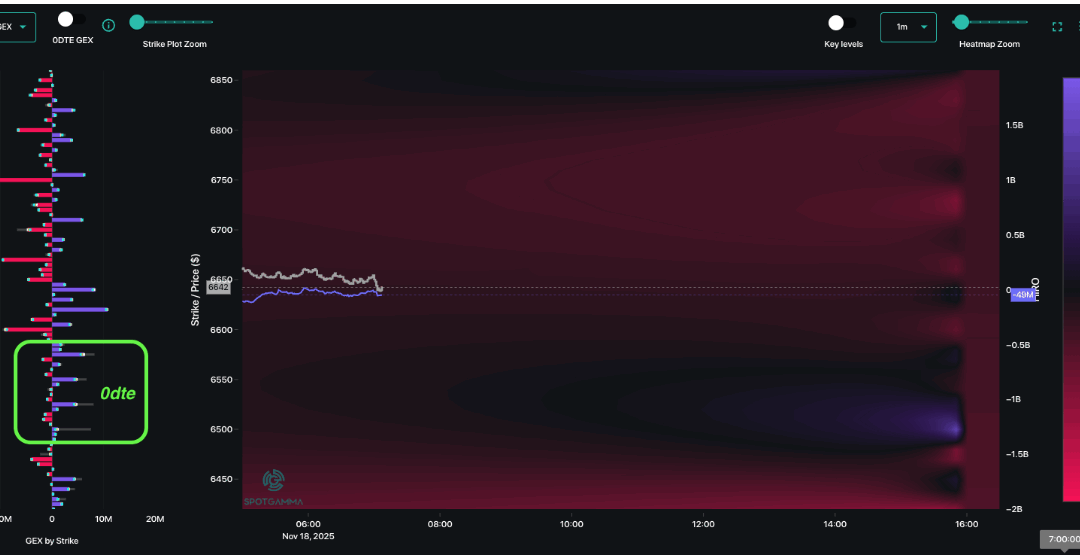

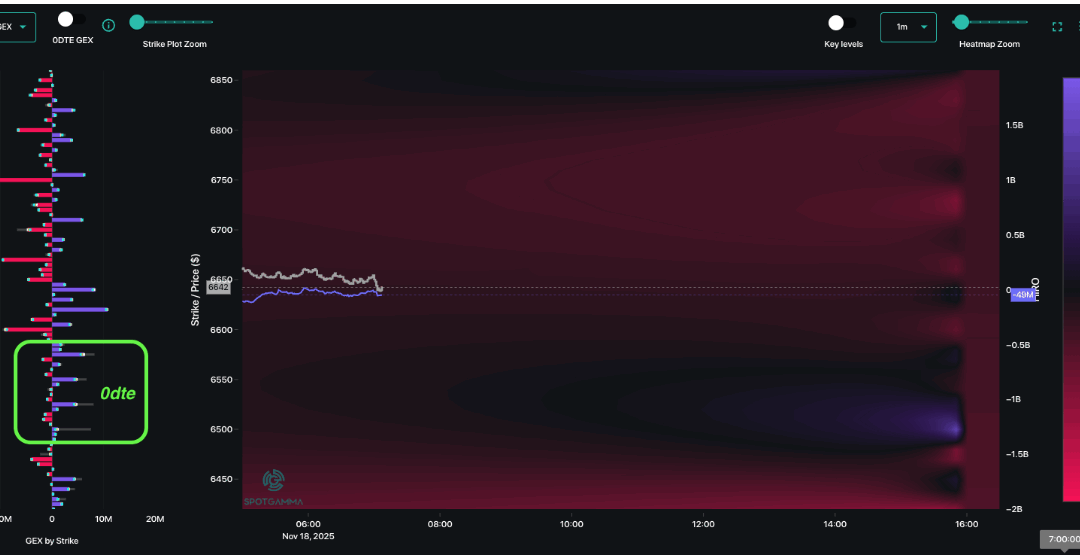

by Melida Montemayor | Nov 18, 2025 | Informe Option Levels

Macro Theme: Key dates ahead: 11/19: VIX Exp, NVDA ER 11/21: OPEX 11/27: Thanksgiving 12/10: FOMC 12/15: ORCL ER SG Summary: UPDATE 11/17: VIX Exp is Wed AM, and we could make the case for a sneaky vol decline & equity support into tomorrow afternoon as traders...