by Melida Montemayor | Nov 10, 2025 | Informe Option Levels

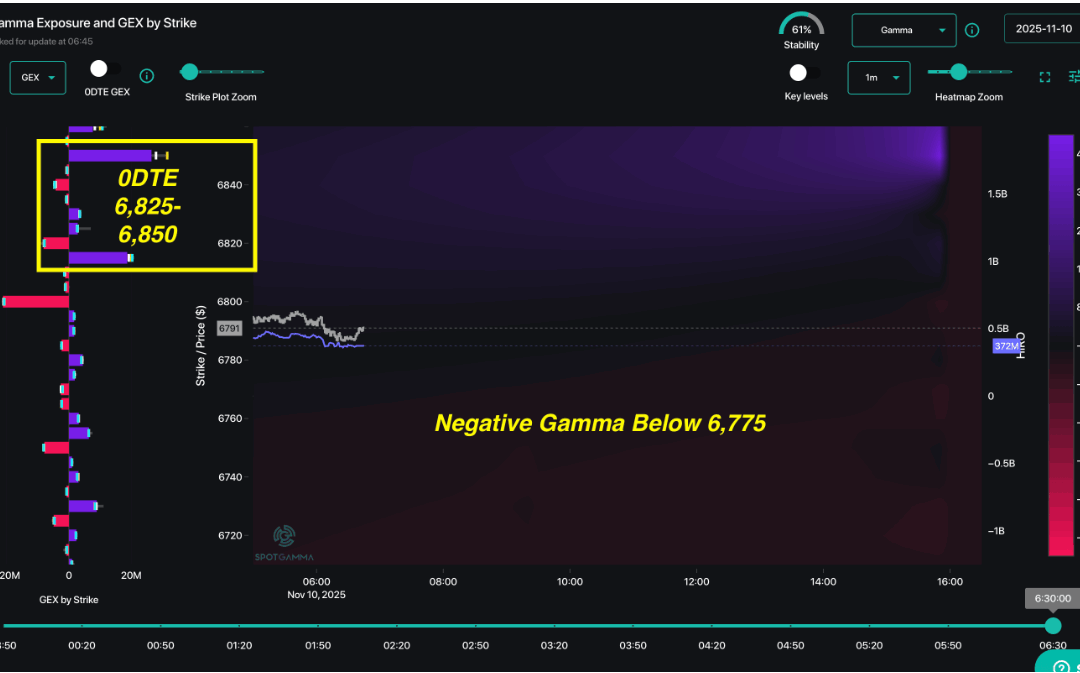

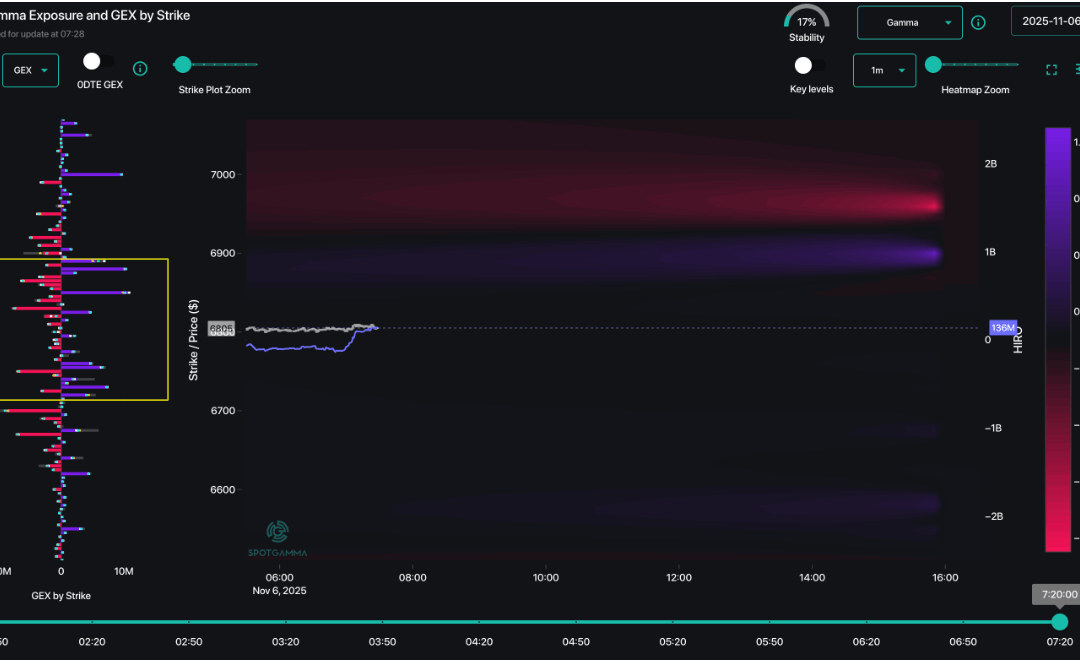

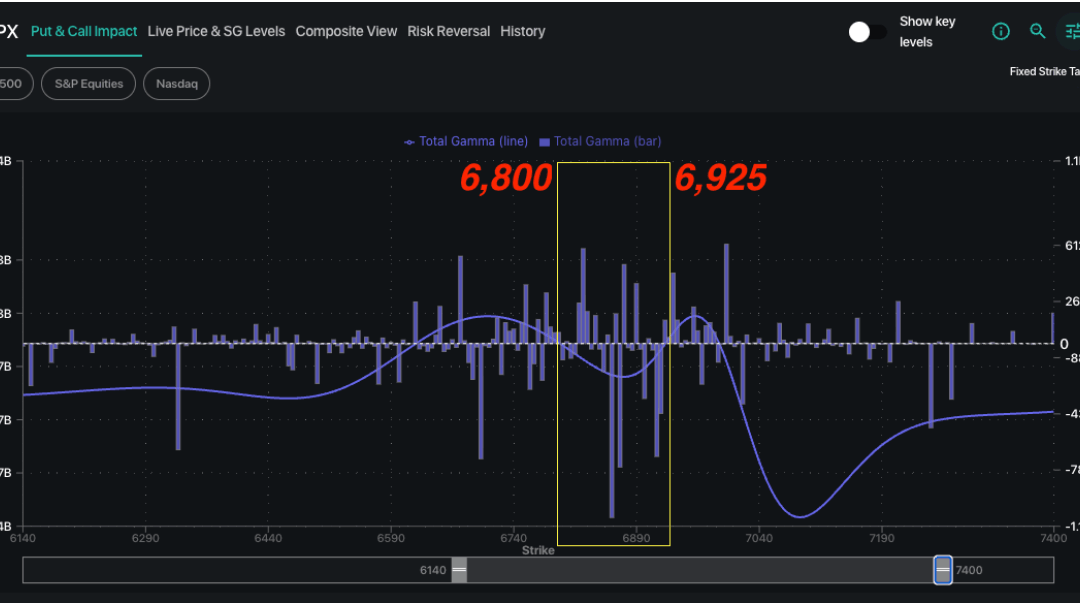

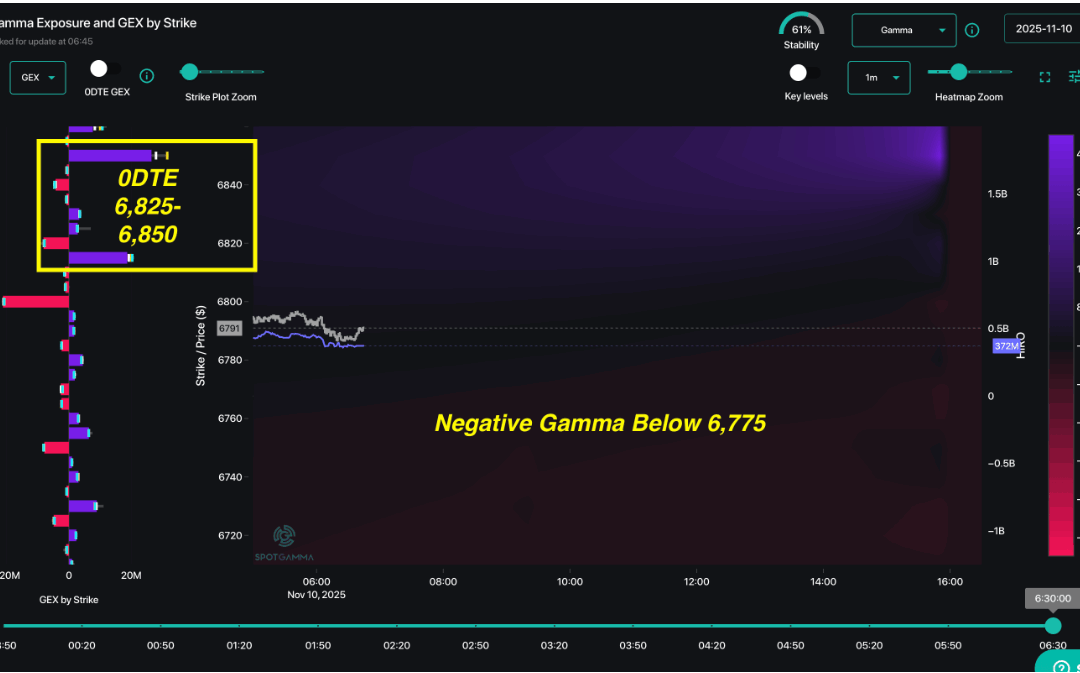

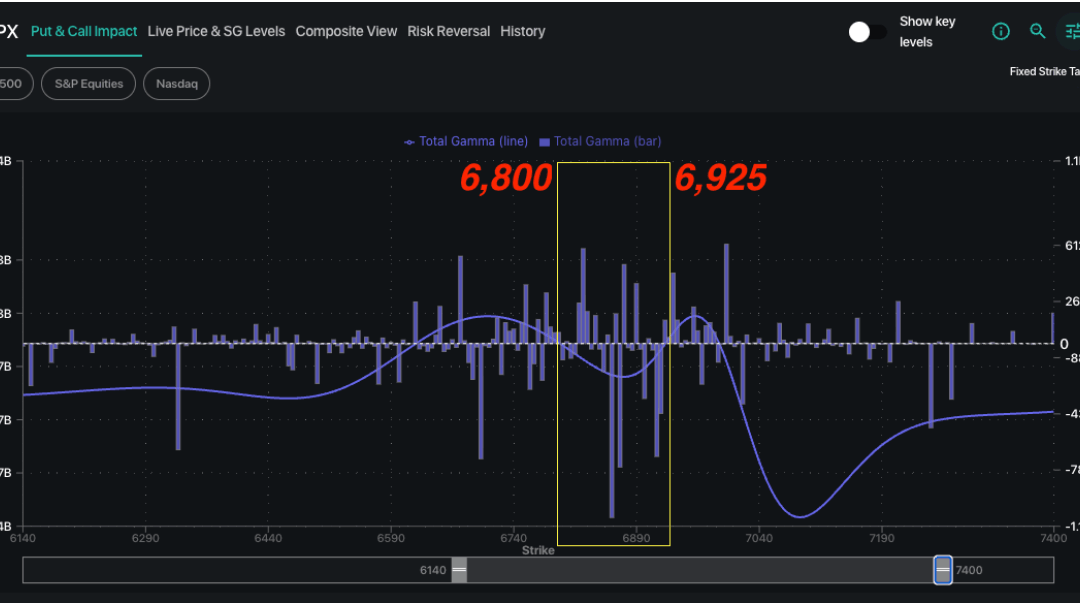

Macro Theme: Key dates ahead: 11/13 CPI 11/14: PPI 11/19: NVDA ER SG Summary: UPDATE 11/10: With the government shudown apparently ending we are adjusting our risk-on pivot from 6,900 to 6,800. We think the week of 11/10 is setting up to be a bullish one, with more...

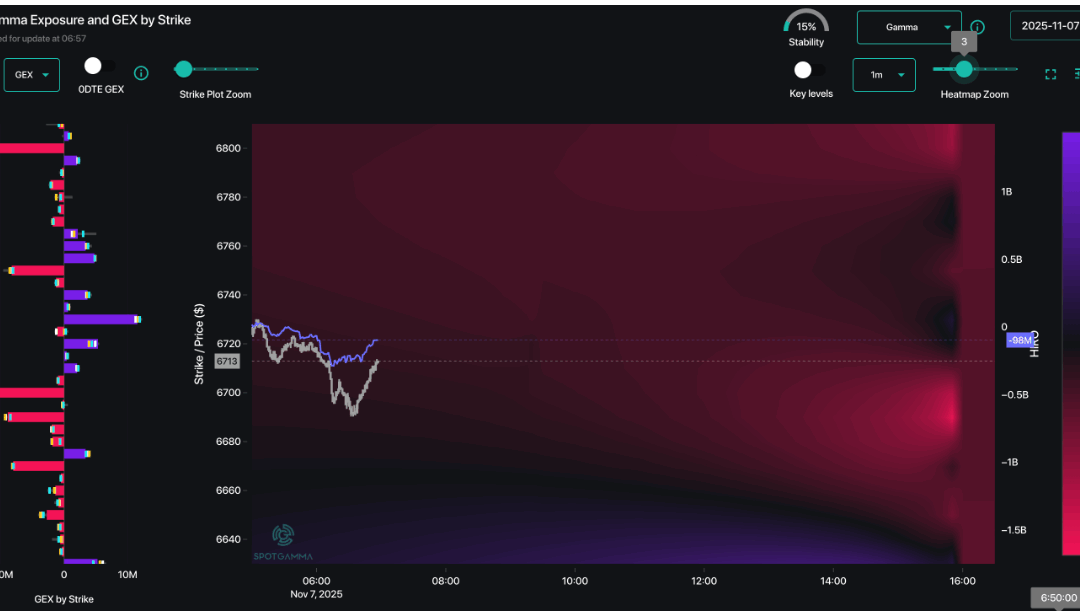

by Melida Montemayor | Nov 7, 2025 | Informe Option Levels

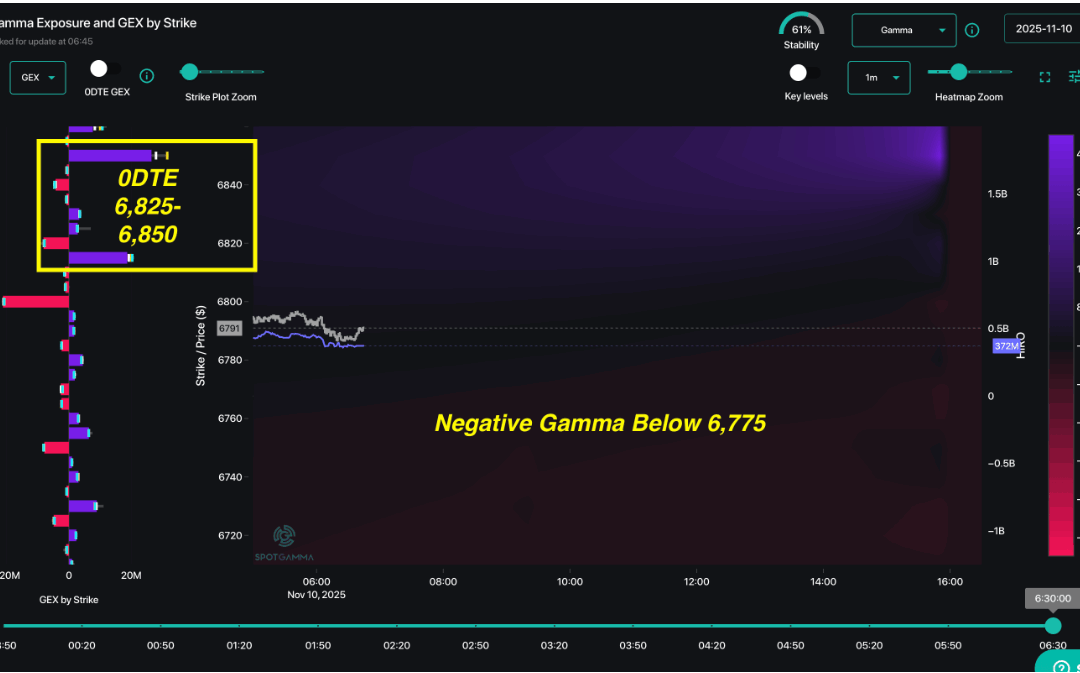

Macro Theme: Key dates ahead: 11/14: PPI 11/19: NVDA ER SG Summary: UPDATE 11/7: We hate being alarmists after a 3% drop, but suddenly there is a sneaky bid to vol, and we see nothing but negative gamma for ±50-100 handles. The difference today is that we suddenly see...

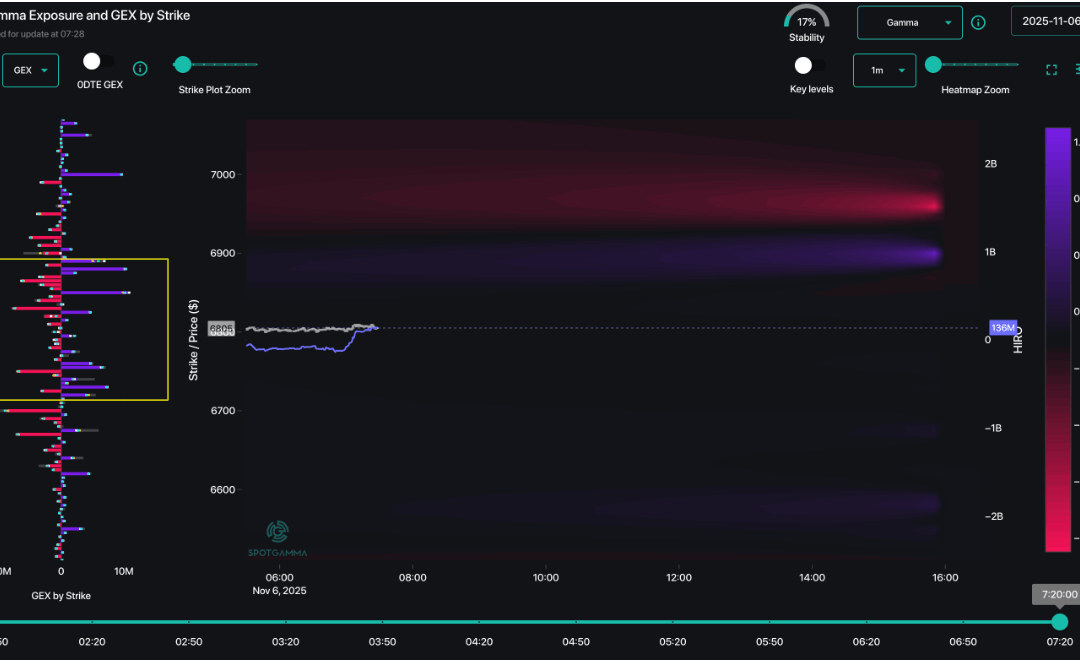

by Melida Montemayor | Nov 6, 2025 | Informe Option Levels

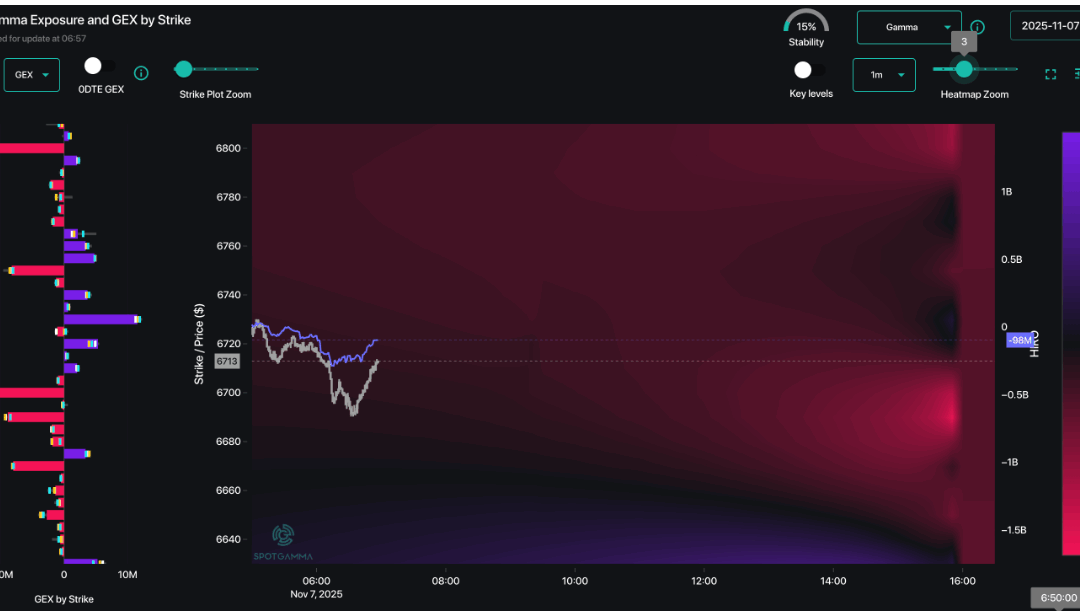

Macro Theme: Key dates ahead: 11/5: ISM 11/6: Jobs 11/14: PPI 11/19: NVDA ER SG Summary: 10/31: Yesterday’s meager 1% decline started to ease the “risk alert” positioning we flagged on 10/29, with call skews shifting to “rich” vs...

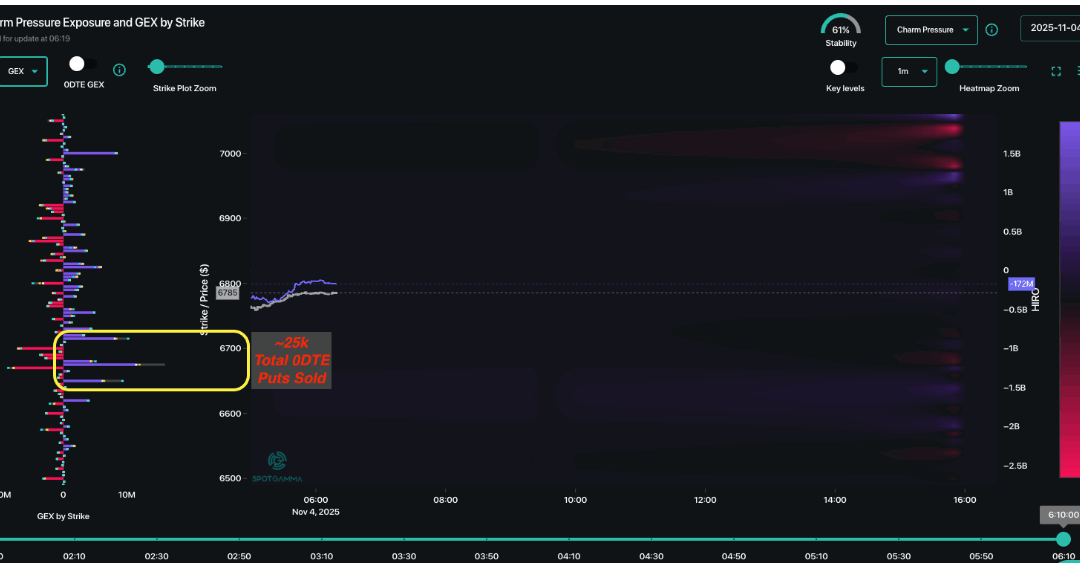

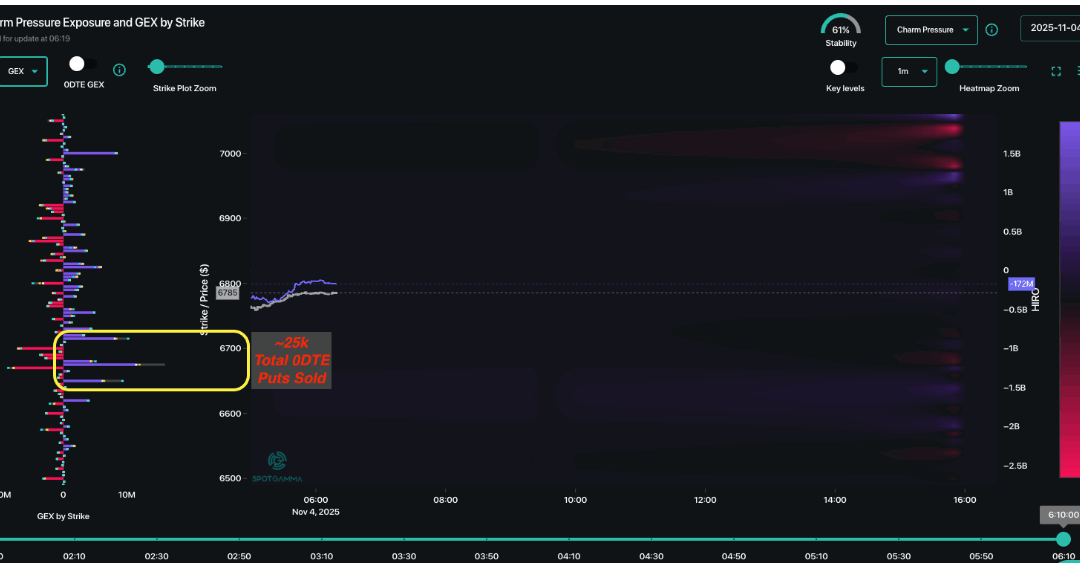

by Melida Montemayor | Nov 4, 2025 | Informe Option Levels

Macro Theme: Key dates ahead: 11/4: JOLTS 11/5: ISM 11/6: Jobs 11/18: NVDA ER SG Summary: 10/31: Yesterday’s meager 1% decline started to ease the “risk alert” positioning we flagged on 10/29, with call skews shifting to “rich” vs...

by Melida Montemayor | Nov 3, 2025 | Informe Option Levels

Macro Theme: SG Summary: Update 10/31: Yesterday’s meager 1% decline started to ease the \”risk alert\” positioning we flagged on 10/29, with call skews shifting to \”rich\” vs \”screaming overbought\”. Thats good news for...