by Melida Montemayor | Oct 30, 2025 | Informe Option Levels

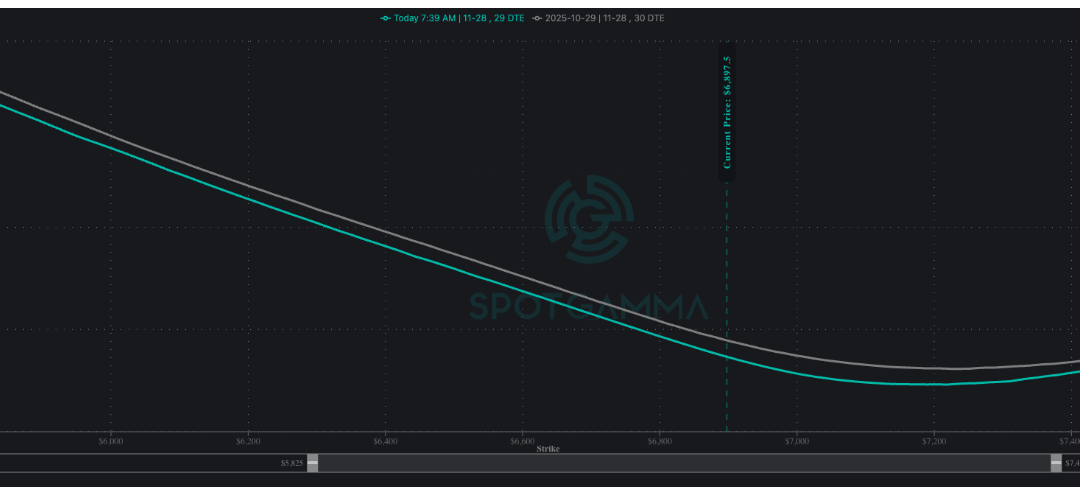

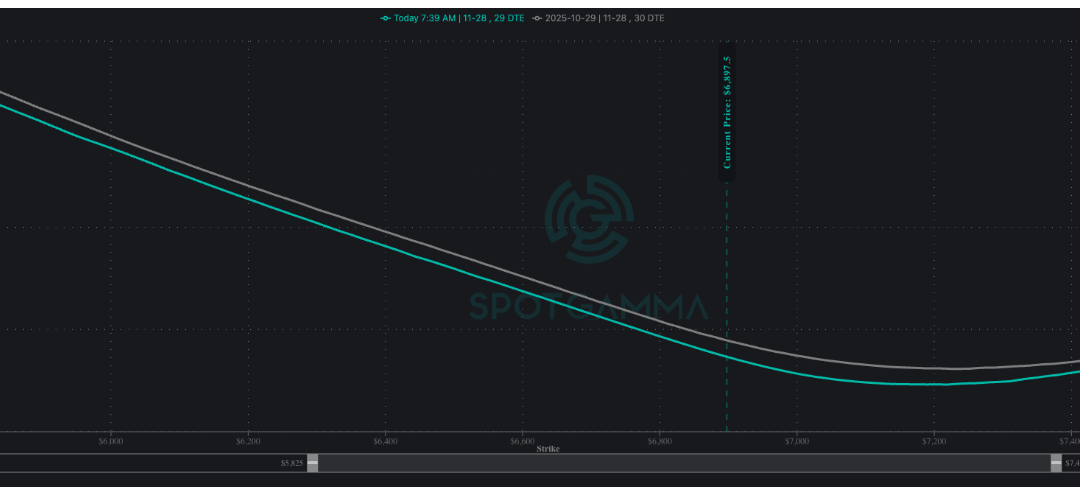

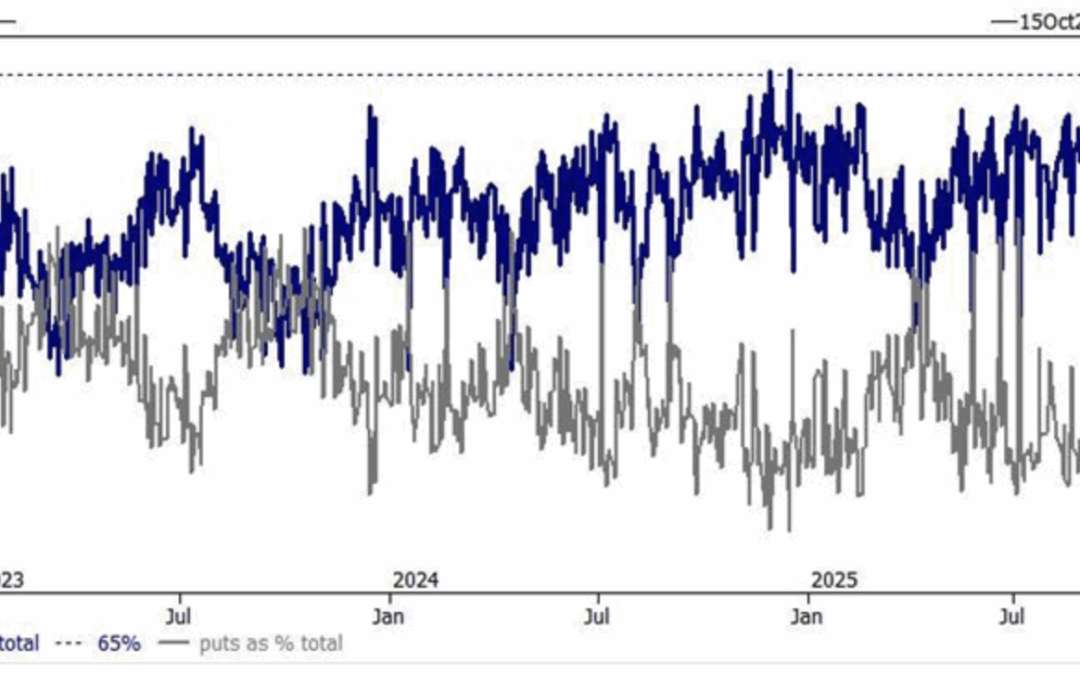

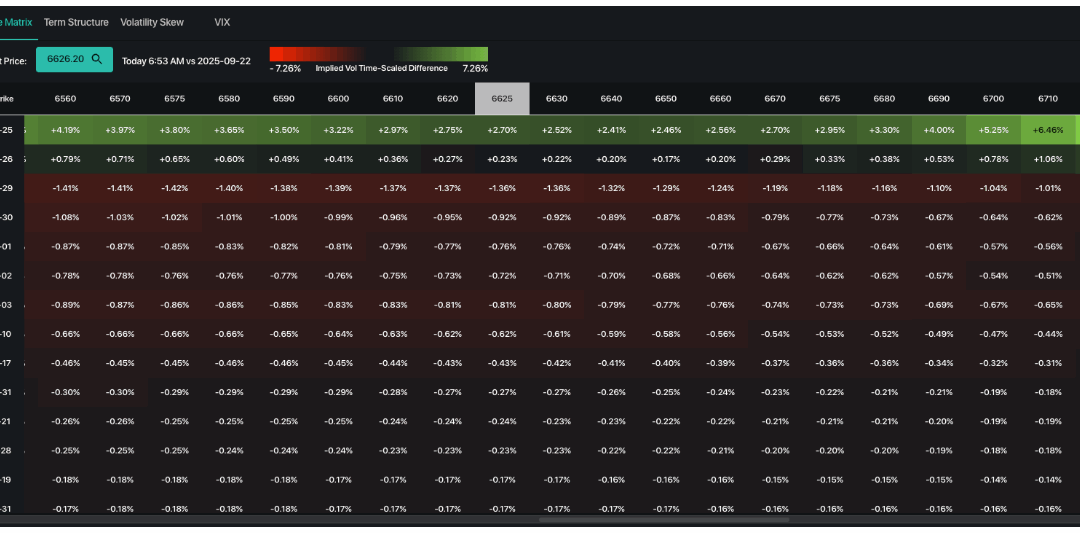

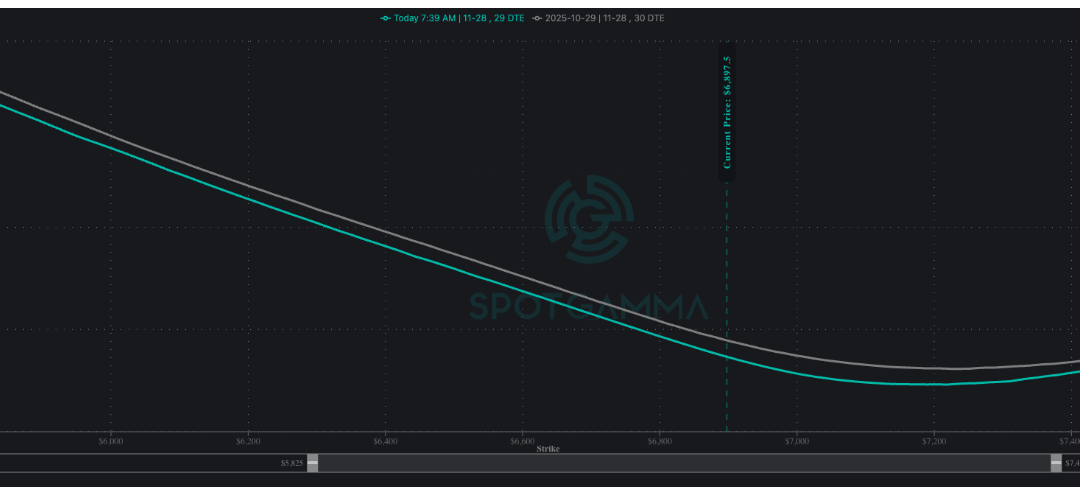

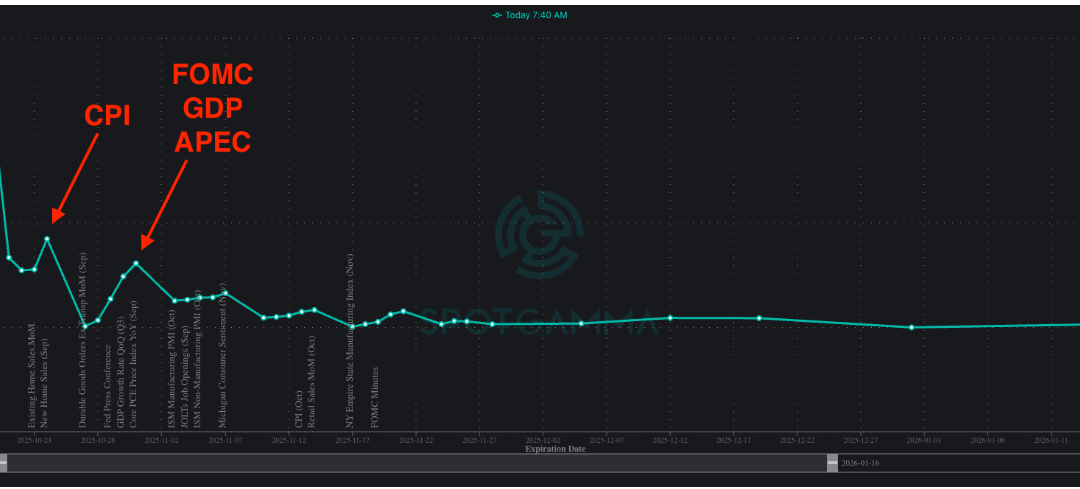

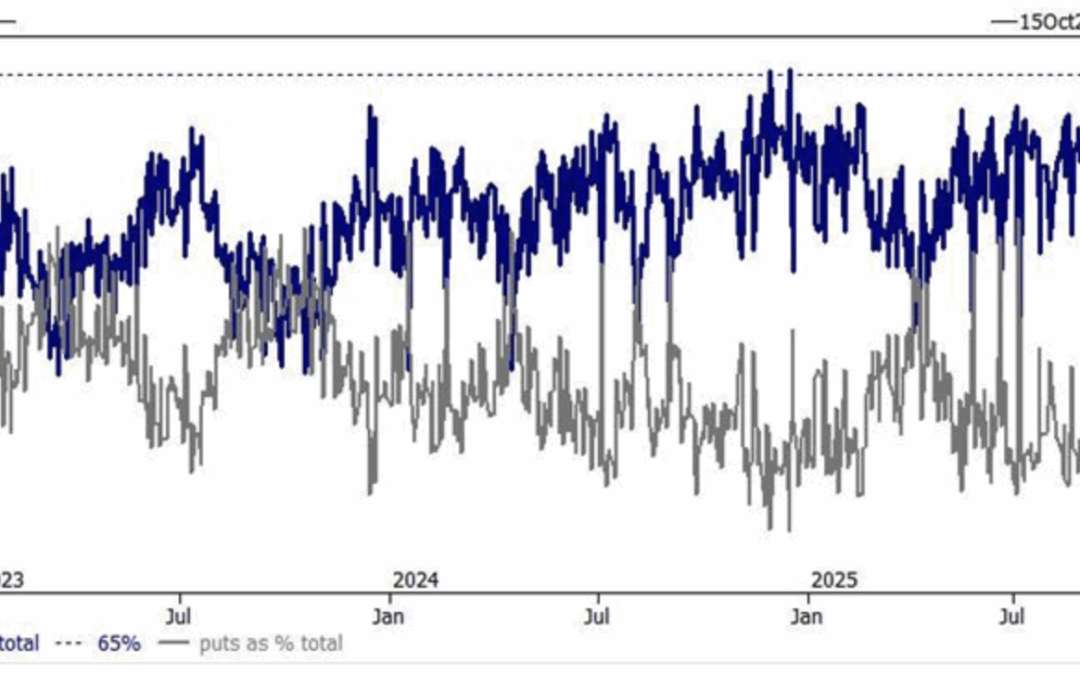

Macro Theme: Key dates ahead: 10/30: AAPL/AMZN ER SG Summary: Update 10/29: RISK ALERT – COR1M and the over-bid Index calls have us quite nervous at these levels. Given that we are going to be rolling up call positions, and adding to downside protection. The...

by Melida Montemayor | Oct 20, 2025 | Informe Option Levels

Macro Theme: Key dates ahead: 10/17: OPEX 10/22: VIX exp 10/24: CPI ~10/29: Trump/XI meeting 10/13: We see relative support in the 6,500’s due to a range of positive gamma (red box), which means we will look to play tactical bounces at major gamma strikes in...

by Melida Montemayor | Oct 6, 2025 | Informe Option Levels

Macro Theme: Key dates ahead: 10/6: OPEN AI dev day Update 10/2: We raise our key risk off level to 6,680 (from 6,600). We prefer remaining long of stocks while above that level, with an short term upside target of 6,750-6,765. If 6,680 breaks, we would look...

by Melida Montemayor | Sep 29, 2025 | Informe Option Levels

Macro Theme: Key dates ahead: 9/26: Core PCE 9/29: Potential Gov Shutdown 9/30: Quarterly OPEX, JOLTS 10/1: ISM PMI 10/2: Jobless Claims Update 9/26: While the much discussed oddities in the vol complex we are concerned that a break <6,500 >=9/30 OPEX...

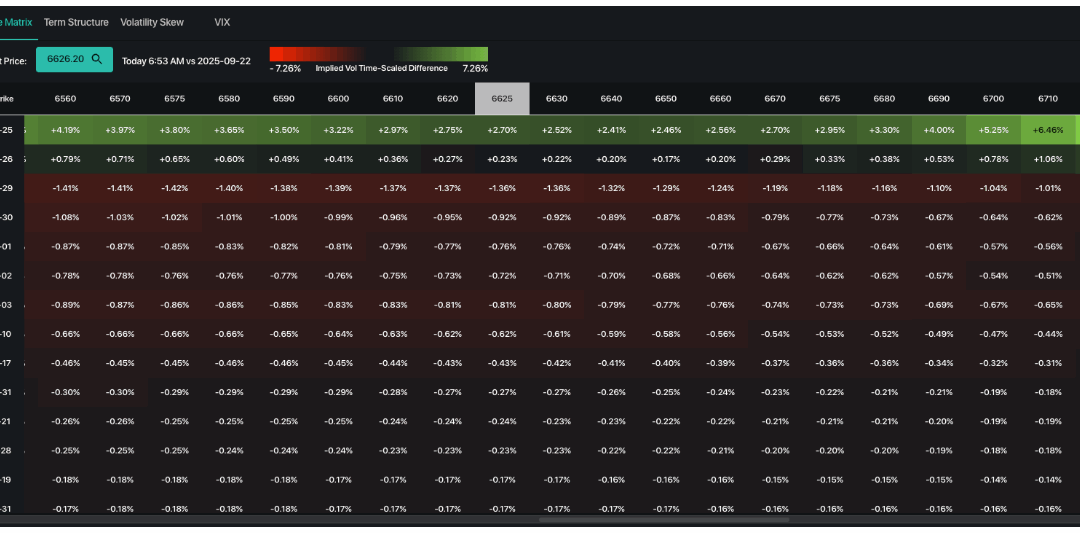

by Melida Montemayor | Sep 25, 2025 | Informe Option Levels

Macro Theme: Key dates ahead: 9/25: Jobless Claims, GDP 9/30: Quarterly OPEX 9/19: We remain bullish with SPX >6,600, but we will be adding put spreads and/or put flies for expirations near 9/30, playing a potential move to the massive 6,505 JPM strike. 9/18: We...